This article is written by Ruchita Sharma who is pursuing Diploma in M&A, Institutional Finance and Investment Laws (PE and VC transactions) from Lawsikho.

Table of Contents

Introduction to the EdTech Industry

One of the few industries for which the effect of ‘corona positive’ has brought a lot of positivity is the EdTech industry. This slowly growing industry is witnessing an impressive growth spurt. Not only is its present scenario progressing, but it also seems like its future is really brightening up with new avenues opening for the pioneers in this industry.

Along with a crazy increase in demand for the existing market leaders, it can also be seen that a lot of new players are entering the market and seem likely to stay in the competition.

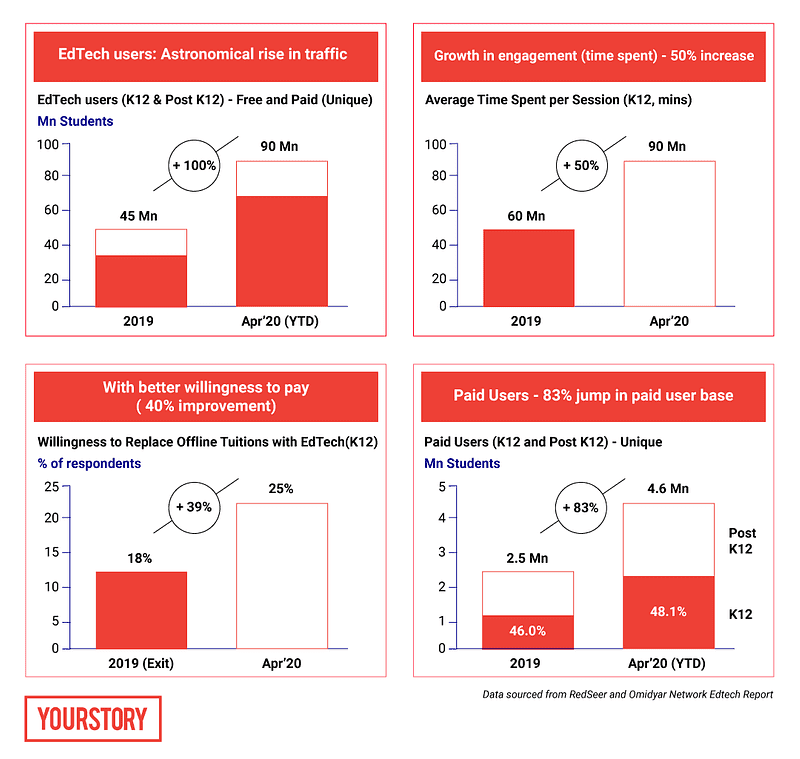

The following is an excerpt from a report by RedSeer and Omidyar Network India –

This just goes on to show the growth of the industry in the span of one year.

This industry was already on a rise due to changes in education trends when the coronavirus hit and the lockdowns all over the world were a nitro-boost for the gradually ascending charts.

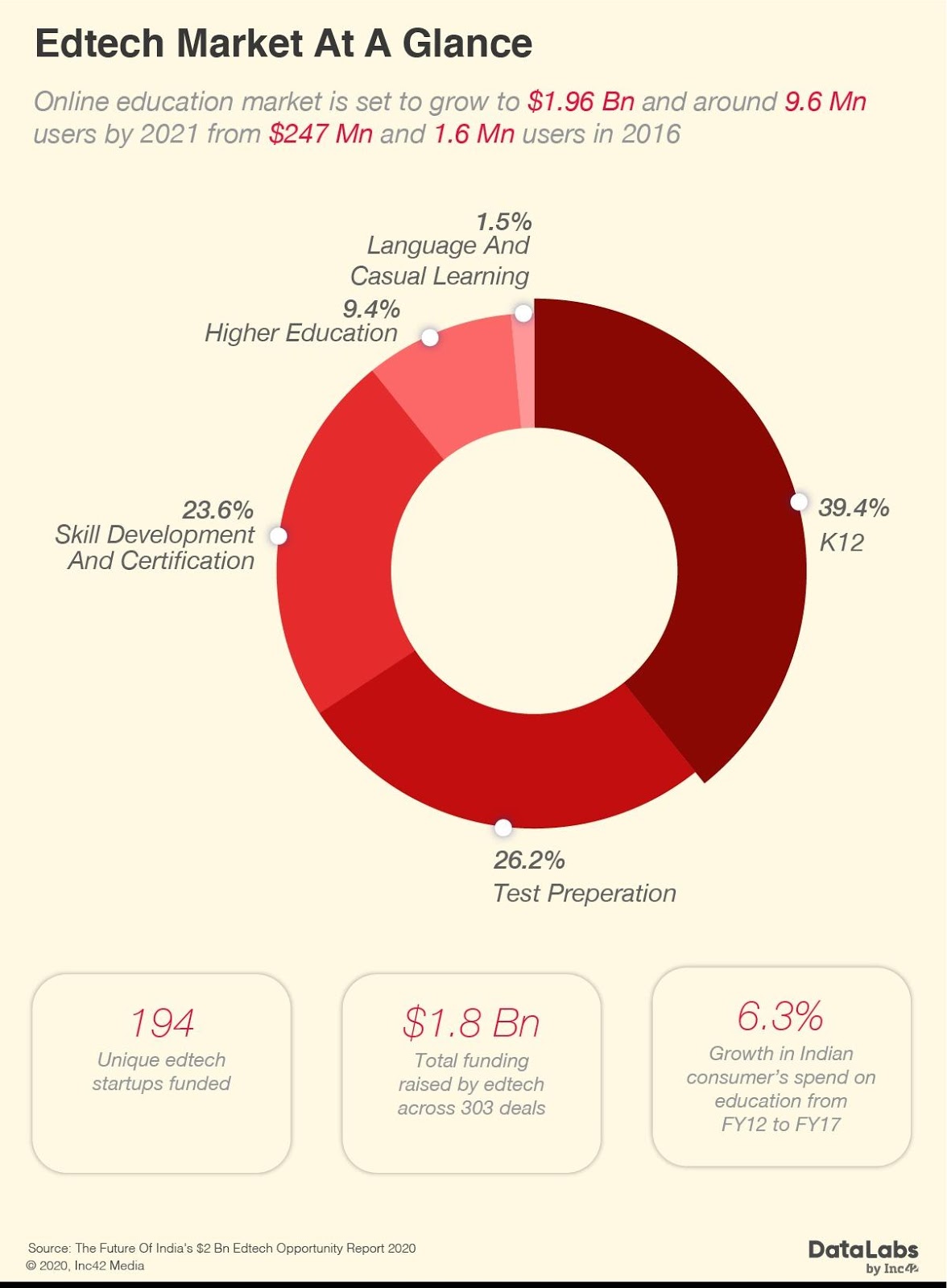

The trends in the educational sector are making shifts due to the attention that Indians pay to education. On an average, an Indian is more likely to make compromises in the health-related areas than they would in any issue related to education. The education system is also shifting from rote learning to concept-based knowledge gain. Considering the hiring trends of various other sectors, it can be noted that there is a great void in the skills required for various job profiles. The educational institutions are lacking in providing practical knowledge and skills to their students that they would need to be job ready. The online education systems and the new era of education are more equipped and contrate on providing the job-related skills to students.

Also, the wide-spread presence of internet and smartphones has made it practically possible for students to access education easily and fair better than those restricted to government-funded institutions. The students are also more interested in ways that can provide them easy and continuous test preps for major competitive examinations. These are covered and provided for by the online education systems for which the students don’t need to travel to cities and can access preparation material from the comfort of their homes. Another reason why EdTech is in popular demand is their offer to carry out certificate programs and award students with certificates for accomplishing the learning of a new skill or a course during their available time.

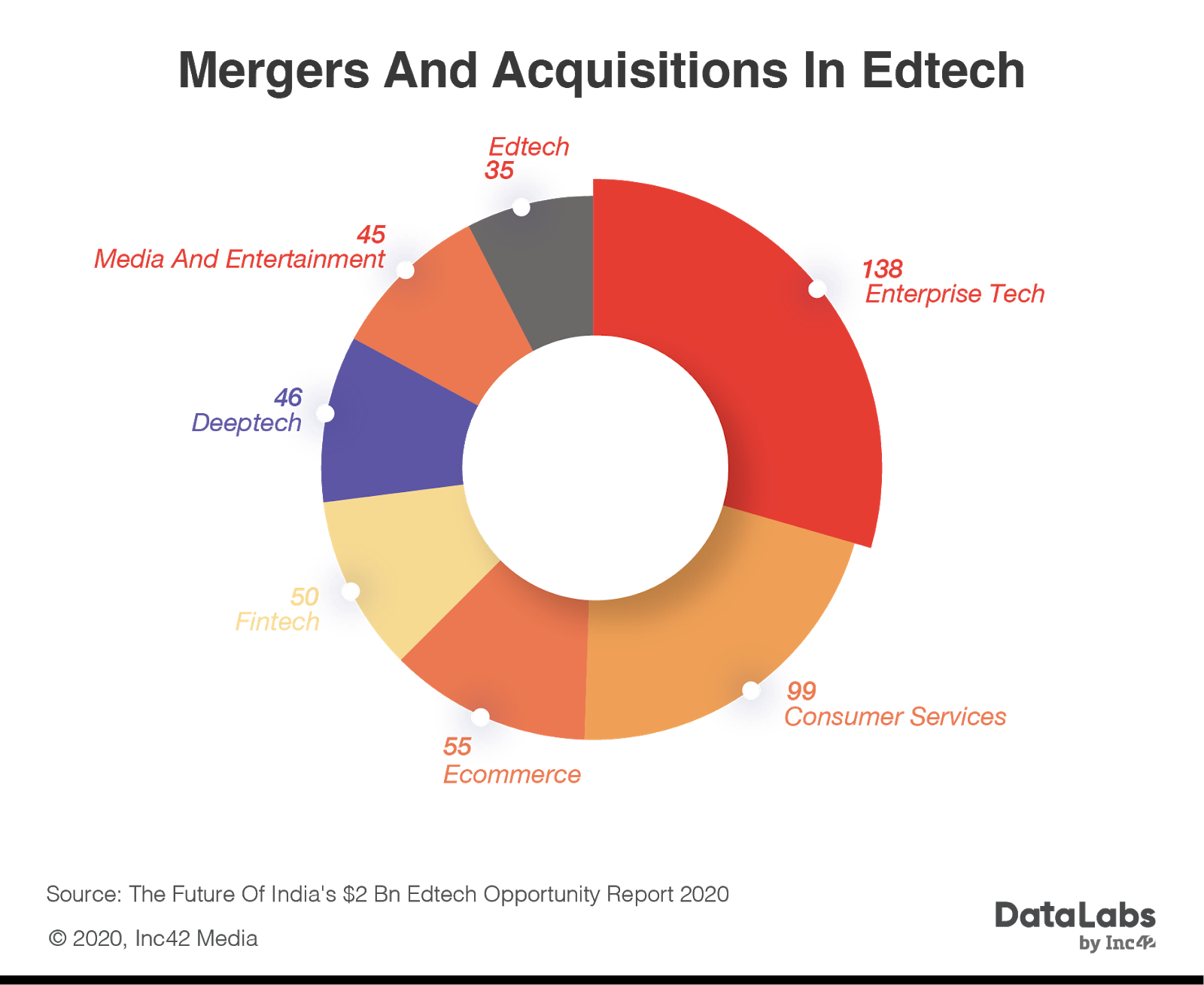

The sudden advent of the industry has resulted in making the EdTech market extremely conducive for all kinds of deals such as mergers, acquisitions, joint ventures, new start-ups etc. It has also resulted in increased recruitment of personnel since this industry is currently penetrating the market beyond the big cities and into the suburbs and other sections too. There can be seen a major jump in the investments made in the EdTech industry by major players such as google etc. The presence of multiple players offering unique propositions opens doors of possibilities for collaborative synergies. The companies resort to mergers or acquisitions to gain an advantage over competitors and strengthen their game by creating a dominant position in the market. Due to an exaggerated rise in the number of players entering the EdTech market, the trends of the market are shifting to include the mergers and acquisitions in this industry.

Rajeev Tiwari, founder and director of STEMROBO Technologies that offers an integrated science, technology, engineering, arts and math (STEAM) learning programme based on the design thinking approach for K-12 segment told Inc42, “Mergers and acquisitions in the EdTech space is generally focussed on either acquiring start-ups with good intellectual property in the form of content, pedagogy, integrated hardware, and software or by acquiring start-ups having a proven business model, market penetration and good reach.”

Basically, initial public offerings (IPO), mergers and acquisitions are the main exit strategies for the competitors in a market. These can be used to strengthen position in competition, as mentioned earlier or the companies can resort to these options to exit the competition.

Let’s look at some major acquisition deals to understand how the EdTech industry has taken advantage of this strategy and how it has affected the industry during the time that can be referred to as the golden era for the EdTech industry.

Major recent acquisitions in the EdTech industry

Deal 1: Byju’s acquires WhiteHat Jr

About Byju’s:

Byju’s, the brand name for Think and Learn Private Limited, is an online learning platform for school students of classes 4th to 12th. It also offers preparation training for competitive exams such JEE, NEET, CAT etc. It is a leader in the EdTech industry and is the second most valued start up after Paytm. It is has now become a decacorn since it is currently valued at a whopping $ 10.5 bn. Cofounder Divya Gokulnath has said that Byju’s revenue for FY20 stood at INR 2,800 Crores.

About WhiteHat Jr:

WhiteHat Jr is a Mumbai-based EdTech start up that aims at teaching coding to young school-going kids in India and U.S . It is made for kids of ages 6 to 18 to learn programming and then create commercial-ready apps, games, animation. It provides students with live classes and unlike other platforms, each teacher is assigned with only 1 student. This start up is less than 20 months old and still has a annual revenue run rate of $ 150 mn. It is valued at $ 11 mn.

Valuation of the deal:

Byju’s acquired WhiteHat Jr for $ 300 million in an all cash deal.

Impact of acquisition on acquiree:

WhiteHat Jr is the leader in the EdTech space as far as coding is considered. It has recently announced its plans to expand to countries like Canada, UK, Australia and New Zealand. Its USP is that it has a 1:1 teacher-student ratio. After this acquisition, Byju’s will help WhiteHat Jr by major investments and providing for teachers that will be required for the declared expansion. WhiteHat Jr, after acquisition, has been left to operate separately under the leadership of Karan Bajaj who has brought the company to this threshold within a span of less than 20 months. The investors of WhiteHat Jr have also received a multi-bagger exit.

Impact of acquisition on acquirer:

Byju’s got an entry into the coding world as a leader after this acquisition. It is a gradually advancing sector with an increasing demand. Plus the model of WhiteHat Jr and leadership of Karan Bajaj will bring great opportunities for Byju’s. It had also been trying to penetrate the markets of other countries. It had acquired U.S.-based start-up Osmo that develops interactive play apps that tie into custom hardware in a $120 million deal early last year with the same intent. Byju’s also aims to penetrate smaller cities and boasts about 65% of their students being from outside major cities. Also, WhiteHat Jr boasts of some three million students, 20,000 classes a day, and 5,000 teachers working with them. And also a not-insignificant annual run rate of $150 million. Its current unit economics are attractive as well, translating to a high take-rate of over 50%, a rarity as far as marketplaces are concerned. Rarer still, this high take-rate has enabled it to grow at a nose-bleed rate without sacrificing profitability—the company claims to have been profitable for the last five months.

Deal 2: Byju’s to acquire Doubtnut

About Doubtnut:

Doubtnut is an Indian learning application that offers services to students from class 6th all the way up to those giving competitive exams. It is basically a doubt clearing app that mainly answers the doubts of the students in as many as 11 languages. The user base of Doubtnut has recently expanded a great deal.

Valuation of the deal:

Byju’s is in late stage talks to acquire Doubtnut in an all-cash deal, with a valuation at just north of $100 million.

Impact of acquisition on the acquiree:

Doubtnut has seen a recent surge in the number of its users but has no way to monetise the user base of millions of its new users. It also faces a major issue that the students do not prefer to buy expensive Doubtnut courses only to get their doubts resolved.

Impact of acquisition on acquirer:

Byju’s would gain an advantageous position after this buy since it would get access to Doubtnut’s as many as 13 million users which would have otherwise cost Byju’s a ton load of money. It would also be able to fulfill its goal to penetrate the markets since Doubtnut teaches in 11 languages and boasts of majority of its students from tier II and tier III cities. With this acquisition, Byju’s is closer to its goal of becoming an EdTech superstructure that sprawls across age groups, exam types, and income categories.

Deal 3: Byju’s acquires LabInApp

About LabInApp:

The LabInApp is an EdTech start up funded by Unitus Ventures. It provides licensed-based programmes that includes experiments in maths and science for class 9th till 12th using 3D simulation. It is basically like a laboratory but online. It lets students access games, experiments etc. that would help them virtually conduct experiments.

Valuation of the deal:

The LabInApp has been acquired by Byju’s for an undisclosed amount.

Impact of the acquisition on the acquiree:

LabInApp boasts of associations with more than 5,000 schools and upto 550 simulations, with more in various stages of development. It helps students carry out experiments virtually that are a part of their school syllabus. This acquisition will help LabInApp to access the gigantic database of Byju’s in the K-12 segment and will widen its reach. The main investor, Unitus Ventures, has completely exited from the LabInApp after this acquisition.

Impact of the acquisition on the acquirer:

Byju’s is on a spree to acquire start ups and solidify its leadership in the market and further expand into areas and segment that are yet to be conquered. This acquisition is another way that will re-establish Byju’s position in the K-12 segment since it will bring in a lot of associations with various schools and lure students with outstanding services of providing a virtual laboratory.

Deal 4: Unacademy acquires Mastree

About Mastree:

Mastree is a new-age learning app that effectively recognised the gaps in school education and has come up with an efficient STEAM preparation for students. It provides lessons in science, technology, engineering, arts and mathematics for students of classes 5th to 8th since its basic aim is to smoothen the transition from elementary school to middle school. It also caters to teaching soft skills to its students. The lessons are conceptual, and each teacher has only about 3-5 students under them. It clears the doubts of the students through doubt classes, live quizzes, personalized practice sessions etc.

About Unacademy:

Unacademy is a leading player in the EdTech industry. It originally started as a YouTube channel. Its target were students aspiring to crack civil services exams, bank exams and other competitive exams. It is in its way to become a unicorn in the EdTech with the COVID-19 being a major boost to its user base. Unacademy has recently been rapidly expanding into the K-12 segment having already established its standing in the area of competitive exams’ preparation.

Valuation of the deal:

Unacademy has acquired majority stake in online learning platform Mastree for $5 million.

Impact of the acquisition on the acquiree:

Mastree had been aiming to come up with better courses and services and become a one-stop solution for all STEAM related study. This acquisition will help Mastree expand its operations and access Unacademy funds to venture out into providing better and more courses, options and services. Its major investor, Blume Investors has been provided a full exit by Unacademy after the acquisition.

Impact of the acquisition on the acquirer:

Unacademy will be able to strengthen its position in the K-12 segment owing to this deal and venture beyond the competitive examination preparation. It will also be in a better place to rival Byju’s who is clearly the industry leader currently. It will also help Unacademy with its aim to make education accessible and affordable. This acquisition has clearly bolstered Unacademy’s position in the industry.

Deal 5: Unacademy acquires PrepLadder

About PrepLadder:

PrepLadder is an extremely in-demand app for students trying to crack medical entrances. It is an online application that offers lectures and live classes. It also is efficient in clearing the doubts of the students. It lets students customize their tests and constantly monitors performance to give regular feedback to students. It also boasts of employing the best teachers. It also allows users to make efficient, attractive and easy to study notes.

Valuation of the deal:

Unacademy has acquired PrepLadder for $50 million in a cash and stock deal.

Impact of the acquisition on the acquiree:

PrepLadder has been a tremendously profitable venture from its inception. It has been making profits from the start with low marketing expenditure. It has created a data base of users for a stream that is niche but still is a premium sector. It has successfully made itself known as the leader in medical preparation stream. After this acquisition, PrepLadder will have access to a lot more funding and become a part of a huge user base too. It will also become a leader in the EdTech industry under the umbrella of Unacademy who has been on a spree to make acquisitions in order to fairly compete with Byju’s who is an EdTech leader.

Impact of the acquisition on the acquirer:

Unacademy, through this acquisition, has gained a smooth entry into the medical PG examinations preparation, NEET PG and FMGE

sector. This move will also help Unacademy expand its annual revenues by as much as 15 percent.

Bonus Deal 6: Unacademy acquired CodeChef

About CodeChef:

CodeChef is an app that helps its programmers in enhancing their coding skills and facilitates problem solving. It also hosts training sessions and discussions related to algorithms, binary search, technicalities like array size and the likes. Apart from providing a platform for programming competitions, CodeChef also has various algorithm tutorials and forum discussions to help those who are new to the world of computer programming. It is an app that has made programming uncomplicated and easy to understand and then execute.

Valuation of the deal:

Unacademy has acquired CodeChef for an undisclosed amount. It is being referred to as transfer of custodianship rather than an acquisition by the parties involved.

Impact of the acquisition on the acquiree:

CodeChef, which already has an impressive amount of users, after this acquisition, will have access to greater resources, teams, technology, platforms and capital. Under Unacademy, it will be able to expand its user base and operations and offer new courses. It will also be able to offer some free courses dus to this acquisition.

Impact of the acquisition on the acquirer:

Unacademy, just like Byju’s acquired Whitehat Jr, has acquired a coding app. This acquisition will prove tremendously serviceable to Unacademy. It will bring under its umbrella, the users of CodeChef. It will also add to Unacademy the amazing management team of CodeChef to their personnel teams. This will also help Unacademy run faster in the race to lead the EdTech industry. These acquisitions by Unacademy will help facilitate its aim to provide affordable courses to students and expand into unchartered territories of new courses and unexplored target segments of the market.

These are some major acquisitions that have recently happened in the EdTech space. Let’s be assured that there are more to come.

Current state of the EdTech industry

The EdTech industry is one of the very few components of the economy that have profited from the impacts of COVID-19. All other industries have been awfully hit and have gone into deep losses during this time. But the EdTech industry has grown exponentially. Every student, deprived of classroom education has tried to resort to online education to improve their knowledge systems and make up for the lost time. Because of the Indian mentality regarding education, parents have been keen on not letting their children miss out on studies due to the lockdowns. The Indian parent would easily spend extra on education even if it would mean compromising expenditure on health or on any other thing. This industry is seeing growth like never.

Some companies have emerged as clear leaders. The online apps like Byju’s and Unacademy are on top of the leader charts. The startups in this industry are rigorously raising funds and investing them in acquiring smaller startups and making strategic investments. All this to stay on top of the competition and lead the market. The scope for expansion has majorly grown in this sector and all firms are willing to invest in EdTech since the pandemic has led us to realize that this is obviously the way things will be in the future.

Issues the EdTech industry is faced with

Even though this sector is exceptionally growing, there are a few restraints that hinder its growth in India. The government regulations on the education sector are a roadblock in this country. The state of network and internet in rural areas has made it difficult for even the decacorn, Byju’s to penetrate deeper into the markets and add users from such areas to their network. Then there is the perception about conventional education that stops the students and parents from relying on online education and understand that this is how things will work in the future. The parents believe that the online system is good for now, till the pandemic settles and the lockdowns lift but then it should be back to school education for their kids because that is the best. Even though the apps are evolving and expanding to accommodate the ideas of conventional education and these applications actually are better than the school education that we are used to, still the parents are hesitant to be completely reliable on these apps.

Conclusion

Despite such issues, the EdTech players are constantly coming up with new and revolutionary concepts to better the education systems. The schools and boards too are continuously promoting online education. There is originality in the content and services that these applications are offering.

More such predictions can be found in the latest report released by DataLabs — The Future Of India’s $2 Bn Edtech Opportunity Report 2020.

This report states that there will be a demand for upskilling to meet the requirements of the industry that would have revolutionized in its operations by 2022. In those times, the EdTech would see an increase in demand since these start ups are well equipped and relied upon for certified courses and learning new skills by the students and individuals. These apps are also venturing out to accommodate the various languages spoken in our country. This would help the students who aren’t well-versed in English to depend upon and make use of these applications to learn new skills and courses and also prepare for competitive examinations.

The education sector is also forecast to spend more than $6 Bn annually on augmented and virtual reality technologies by 2023.

According to another report, “Augmented and Virtual Reality in Education,” the market for augmented reality in education will hit $5.3 Bn in 2023, with the market for virtual reality head-mounted displays trailing at $640 Mn.

Rest assured, we can definitely expect to see this sector riding the corona-led boom for a long time, with a lot more funding, investment, mergers and acquisitions happening in this industry.

Students of Lawsikho courses regularly produce writing assignments and work on practical exercises as a part of their coursework and develop themselves in real-life practical skill.

LawSikho has created a telegram group for exchanging legal knowledge, referrals and various opportunities. You can click on this link and join:

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Allow notifications

Allow notifications