In this blog post, Sourabh Makhija, a Law Aspirant pursuing a B.A. LL.B (Hons.) from RDVV, Jabalpur and having a Diploma in Cyber Law from Asian School of Cyber Laws, Mumbai analyses BHIM an initiative undertaken by our current Prime Minister Narendra Modi.

Introduction

Can you imagine that a country like India where the majority of people are unaware of the use of ATM cards can become a digital country? This question was asked by many people after Prime Minister Modi tried to push the country towards the cashless economy. But nothing stopped PM Modi from doing what he dreamt for, and as a result, many measures have been taken in the last 50 days to ensure that the country moves towards the digital world.

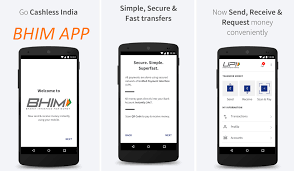

BHIM – Bharat Interface For Money

Prime Minister Narendra Modi came forward on 30th December 2016, to answer the critics on how India can become a digital country. Speaking at the Digi Dhan Mela in the national capital, Prime Minister Modi answered every criticism following his way and also announced the launch of BHIMapplication which can be used to make cashless monetary transactions. BHIM stands for ‘Bharat Interface for Money’. He further said, “I am giving the nation my gift for the new year in the form of BHIM.”

Whether one received Christmas and New Year’s gifts from your family or not, but Modi uncle never let us down. He gifted the nation with “Lucky Grahak Yojana” and “Digidhan Vyapar Yojana” as a Christmas gift & the usage of biometric technology for bank related works and an application named BHIM as the New Year’s gift. Has anyone ever seen such a caring Prime Minister before? Obviously not!

To encourage the poor and backwards section of the society, PM Modi stated that illiterate people could use their thumb to access their banks. “Ek zamana tha anpad ko ‘angutha chhap’ kaha jata tha, waqt badal chuka hai, aap hi ka angutha aapki bank, aapki pehchaan hai (There was a time once when people used to call you ‘angutha chhap’ but now your angutha (thumb) is your bank, your identity),” he said. This biometric technology of using thumb impression for securing one’s identity in the banks will boost the confidence of the poor people as they will be able to do transactions without filling various forms at the bank. Moreover, this will eradicate the identity theft.

What makes BHIM Application different from other Applications?

There are many applications which help to do the online transaction, for example, PayTm, MobiKwik, etc. so what makes BHIM different from these applications is a question to be answered.

The great thing about the BHIM application is its simplicity and how, with one touch, it makes the cashless transactions very easy. The account holder does not need to have mobile banking activated as the Application automatically fetches user data, but the user’s mobile number must be registered with the bank.

In applications like Paytm and MobiKwik, you have to recharge your e-wallet to use them. There is no such thing in BHIM. It directly connects to your bank account — one account that you can specify — and then you can use it to make payments, receive money and make transfers. Other applications need mobile data or Wi-Fi to use them, while BHIM does not require any data to use as in the absence of mobile data or Wi-Fi one can transfer money using *99#.

It uses United Payment Interface (UPI) through which all the major banks in India are now connected. The application still needs some scrutiny, but if it all works as intended, BHIM is going to be big. Like colossal for India.

How to get registered in BHIM Application?

It’s not a rocket science which we can’t understand; it’s pretty easy to use BHIM as any other application. Even WhatsApp was once a big thing for us, but now we use it 24/7. So, nothing to be worried.

7 simple steps which will help you use the newly launched Application

Step 1 – Download the BHIM app from play store if you are an Android user and from Appstore if you are using iOS.

Step 2 – Hold back and wait until the application is installed. Open the application once it is installed on your phone.

Step 3 – Verify your mobile number. It is preferable to use the same mobile number as linked in your bank account.

Step 4 – Once the verification is done, secure your profile with a pin. Remember the pin is your password for the account, and it should be secured with you only.

Step 5 – A list of all the banks will appear on your screen, choose your bank from there.

Step 6 – If you had entered the same mobile number as linked on your bank account, then the application will fetch the data from your bank account automatically. And in case your mobile number is not linked to your bank account then you have to get your mobile number linked with the bank account.

Step 7 – A QR code, as well as UPI ID, will be generated for your ID. Using which transactions can be done.

How to make transactions through BHIM Application

On the home screen, the application has three options. Send money, request money and scan and pay.

- Send money: The option is simple to use. Tap on it, enter the phone number of the person who is going to receive the money. The number will be verified and if a UPI/BHIM account has been set up for that number, the application will accept the number and will take you to the next screen where you can put in the money and send it. If there is no number or UPI ID, you can also send the money using Bank Account + IFSC code. To access this option, click on three dots (settings) on the send money page.

- Request money: Again, tap on the request button. Put in the number, let the application verify it. Once the verification is done, you can request the money.

- Scan and pay: This is the place where QR codes come into the picture. The application generates a QR for every user, which can then be shared or printed and pasted. To make a payment to the QR code owner, just scan it and pay.

Benefits of BHIM

- All payments are done using secure networks of United Payment Interface (UPI).

- All money goes directly into bank account.

- You can transact business 24/7.

- The application has two languages (English and Hindi) which enable larger section to access it.

- One can transfer money even in the absence of the mobile data or Wi-Fi by dialling *99#.

To promote and push digital payments method such as BHIM, PM Modi said that prizes will be given to those who make transactions of more than Rs 50 and less than Rs 3000 using digital payment methods. “Over the 100 day period, several families will be given the prizes. These schemes were launched to benefit poor.” He also announced that mega draw will take place on April 14, the birth anniversary of Dr Babasaheb Ambedkar. This announcement was considered same as giving a lollipop to a small child to make him do some work. Nevertheless, it’s better for the whole nation if people take these prizes seriously and start making digital payments as this will boost up the number of people transacting digitally which will further help the country to become corruption free.

Criticism

- The application has a lot of bugs: The server takes it pretty long to respond, sometimes it’s also difficult to generate OTP. As of now, the Maestro cards are not supported in this application.

- Fixed limit of transactions: The application permits you to transfer only 10,000 at a time and only 20,000 in a day. So if you are someone who needs no limit on transactions, then this application is not for you.

- Hard for Indians to adopt such drastic changes in such a short time: Indians are not that flexible; they take a bit more time to understand the need and advantages of anything. Hence, to say that the country will become cashless economy suddenly is not correct. Take, for example, someone who has a habit of paying in cash only will restrain from using his mobile to make e-payments, he will consider it to be time-consuming because it’s his habit of using cash for payments. As a matter of fact, Indians don’t change their habits quickly.

- New security breaches could be developed, regarding which we might not have any penal punishments, so is it worth taking that risk? How many of us are aware of the laws which govern the online transactions? Lawyers, law students, and some intelligent people only will raise their hands. What about the other peoples? Moreover, The pendency of crimes is not handled by our courts, imagine having extra cyber crimes, what it be like then? Less technical knowledge will lead to even more pendency of cases.

- The poor are neglected: The poor doesn’t have to do anything with the Digital India initiative neither are they going to benefit in any way, what they really need is ROTI, KAPDA and MAKAN. What is the use of a money transferring application for the poor who don’t even have money? It is clear that the interest of the poor neglected by the government.

Conclusion

BHIM is a gift for the whole country from the Prime Minister. We all have learnt during our childhood that a gift is a gift, doesn’t matter expensive or not. The same law should apply to this gift also, and people must come forward with suggestions and criticisms to guide the government to improve the application. “The best student in the class is the one who learns from his mistakes,” so let us give our government a chance to learn. One needs courage and power even to think what he has done for the nation; surely there will be shortcomings, but that can be rectified sooner or later. It’s a great achievement for the government of India to launch its own mobile application for money transferring which in the long run will reflect our capability to the world. Being digital is the need of the hour, it’s up to us whether we want to be modern or want to live in the traditional way only.

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Allow notifications

Allow notifications