This article on legal requisites for starting the import or export of pearls, precious and semi-precious stones is written by Lavanya Verma from RDVV, Jabalpur.

From ancient times, India has played a crucial role in major trade flows. India being situated between the mainland Asia, South East Asia and the Middle East, has served a gateway to global markets. Presently, India’s geostrategic position continues to impart a benefit to importers and exporters, nevertheless, low operating costs and friendly business ambience by the government is have helped tradesmen to expand their business interests in later years. Importers and exporters are more likely to find a stable business environment in India. The country’s massive unified market is accompanied by well-established trade market flows and steady government policies. Traders that master the present trade conditions are well- placed to reap lucrative rewards as nation’s investment climate continues to advance.

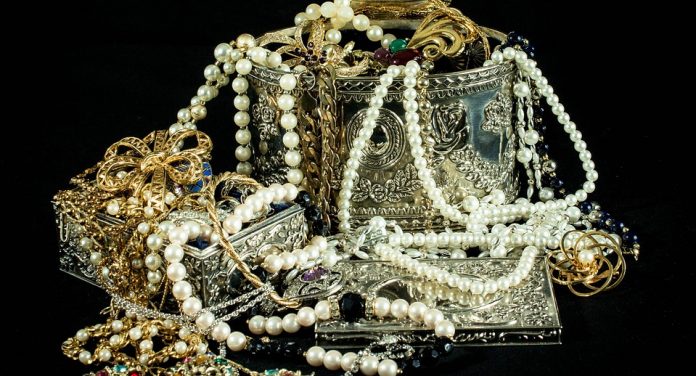

India’s second and third largest import is gold and other precious and semi-precious stones. Collectively, they account for nearly US $57 and $59.6 billion worth of imported goods in the fiscal year 2015 and 2016, respectively. The domestic consumer demand for gold is steered by cultural and economic factors. Mostly, Indians purchase gold for various occasions, like marriage ceremonies or festivals because it is regarded auspicious. Erstwhile, many Indians consider gold as one of the safest investment options. Likewise, India also imports major quantities of pearls, precious and semi- precious stones for the same reason as that of gold. The gem and jewellery sector exports US $24.6 billion per year, as of the latest data. The Indian government has subsequently identified the jewellery sector for export production.

In India, Import Export Code Number (IEC) is mandatory to act as an importer or exporter. It is obtained from the office of Director General of Foreign Trade office to operate as an importer and exporter. Registration procedure to act as an importer is a one-time process, but renewal may be required according to the terms and conditions of such foreign trade office of a country. In most of the countries, the information on such registration for import– export trader is linked with customs location and reserve bank, as the process of imports and exports are now online digitalized. So the importer of Pearls, precious and semi-precious stones is also required to contact solicitous government agencies of their importing country to verify whether such one-time registration is required or not.

Any importer or exporter of imitation jewellery, pearls, precious metals, coin etc. should know HTS code ﴾HS code﴿ of their product, the Harmonized System codes ﴾Harmonized Tariff System‐ HTS﴿ help exporters and importer all over the world to identify product classification code fixed differently in each country like Schedule B, ITC, HS, HTS, Tariff Code etc. Imitation jewellery, pearls, precious metals, coin etc. falls under HS code ﴾HTS code﴿ chapter 71. These HS codes help exporters and importers of pearls, stones, precious metals, imitation jewellery, coins etc to identify their product for use in customs department and other government and non-government agencies.

The Indian Trade Classification ﴾ITC﴿ code assists exporters and importers in India to discern product classification code to use various government and non-government agencies in India. ITC is an 8 digit product classification code specified in India only which is a modification of 6 digit HS code used all over the world. In India imitation jewellery, pearls, precious metals, coin etc. classified under ITC code ﴾Indian Tariff Code﴿ chapter 71. HS code is the first six digit of ITC code.

The export- import traders must follow Conditions in accordance with Hazardous Wastes management, handling and Transboundary movement rules while trading imitation jewellery, pearls, precious metals, coin etc. The movement of goods falling under the category of hazardous wastes management, handling and tans boundary has to be along with form 9. Almost every country has environment department to regulate importation, consumption and usage of materials which effect the environment. Permission to import some of the items under Pearls, precious and semi-precious stones is essential from such environment department of importing country. Ministry of Environment and Forest ﴾MOEF﴿ in India is the authorised government agency to regulate such materials including importation.

Test report of analysis from Laboratory also may be required if applicable to export or for the purpose of importing, authorised or governed by importing (or exporting)country of imitation jewellery, pearls, precious metals, coin etc. A requisite sample of imported or exported Pearls, precious and semi-precious stones is drawn as per the procedures and rules of importing country and renders with such authorised laboratory and obtains analysis report. Usually, three sets of samples of importing Pearls, precious and semi-precious stones are made and sent to laboratory apprised by environment and forest department. Test report retains for minimum two years to confirm on obligation accomplishment by the importer on the importation of Pearls, precious and semi-precious stones. If non-fulfilment of obligation such by the importation then the importer should re‐export the hazardous waste within 90 days from the date of arrival into importing country according to hazardous waste management, handling and trans boundary rules.

Kimberly Process Certificate ﴾KP certificate﴿ to export rough diamonds is a must to obtain for export of imitation jewellery, pearls, precious metals, coin etc. The KPC is issued mainly to prevent conflict diamonds by ensuring that the purchase of diamonds was not financing violence by rebel movements and their allies seeking to sabotage legitimate governments. So, the illicit international trade in rough diamonds and armed conflict are monitored, hence maintaining security, peace and sustainable development in affected countries. As a part of various key commitments, Kimberly Process Certificate Scheme includes a mandate that all imported and exported rough diamonds be certified. GJEPC ﴾Gem and Jeweller Export Promotion Council﴿ of India is the government agency to issue Kimberly Process Certificate.

Certificate from Pollution control board also may be required if applicable to export imitation jewellery, pearls, precious metals, coin etc under chapter 71 of HS code ﴾HTS code﴿. Incumbent certificate from pollution board has to be attached along with other documents, as a part of documentation methods to import rough diamonds.

Another special requirement to export imitation jewellery, pearls, precious metals, coin etc. is Pre-shipment inspection Certificate. Needful pre-shipment inspection certificate furnished by the inspection agency certified by the exporting country or approved by other government agency of exporting country must be arranged for the importation of items under diamond materials.

If any hazardous material found when importing Pearls, precious and semi-precious stones, Penalization by re‐ exporting is demanded by importing country. These non-compliant imported Pearls, precious and semi-precious stones may be also fined by imposing penal charges, apart from destruction or return to origin country.

Unilateral, multilateral or bilateral trade agreement amidst countries simplifies documentation and other formalities and process for export of imitation jewellery, pearls, precious metals, coin etc. The importers have to collect precise information from appropriate government agencies before import of Pearls, precious and semi-precious stones.

Few materials are prohibited to import in some countries as per their foreign trade policy on imports. Certificate of Origin to import Pearls, precious and semi-precious stones is required in almost every country. It helps to determine the origin of imported goods to avail exemption on import duties and taxes. Such a certificate of origin issued by necessary sanction authorities at exporting country is required to import Pearls, precious and semi-precious stones. Different unilateral, multilateral and bilateral agreement between countries also allows import- export trade with the exemption of import duties where in Certificate of Origin is the primary proof regarding country of origin of these importing goods.

This article aims to explain the documentation, process and formalities to import Pearls, precious and semi-precious stones. As mentioned above, this information is generally applicable for all countries to import Pearls, precious and semi-precious stones. Specific requisites for each importing country need to be followed by the importers and the exporters of Pearls, precious and semi-precious stones.

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Allow notifications

Allow notifications