This article has been written by Aparajita Balaji and is updated by Dilpreet Kaur Kharbanda. It is an effort to delve into the concept of wakf under Muslim law. The focus is upon the creation of wakfs, their types, and their management. The appointment, powers, and duties of the Mutawalli have also been dealt with. Both the Wakf Act, 1913, and 1995 have been discussed to look into the legislative aspect of the subject. Furthermore, the important precedents have also been discussed to see the evolution of the concept of wakf in India.

Table of Contents

Introduction

The concept of wakf, also termed as waqf, developed under Islamic law. There was no concept of wakfs in Arabia before the advent of Islam. Although there is no mention of wakf as such in the Quran, such Quranic injunctions that deal with charity are at the root of the development and extension of wakfs. Ameer Ali describes the law of wakf as “the most important branch of Muslim law, for it is interwoven with the entire religious life and social economy of Muslims. Wakf, in its literal sense, means detention or stoppage”.

The definition of wakf according to the accepted doctrine of the Hanafi school is the extinction of the proprietor’s ownership in the thing dedicated and its detention in the implied ownership of God in such a manner that the profits may revert to and be applied for the benefit of mankind. One of the Hadiths of Prophet Mohammad reads, a person went to the Prophet and said that he has property; what should he do with that? The Prophet said, give it in the name of Allah and let its receipts go to charity.

According to Muslim law, wakf originates from the principles established by the Prophet. It involves dedicating property to the ownership of God. Almighty, and the devotion of the profits for the benefit of human beings.

Meaning of wakf

If we look at the word ‘wakf’, in its literal sense it is referred to as ‘detention’, ‘stoppage’ or ‘tying up’. According to the legal definition, it means a dedication of some property for a pious purpose in perpetuity. The property so alienated should be available for religious or charitable purposes. Such a property is tied up forever and becomes non-transferable.

It has been observed in the case of M Kazim vs. A Asghar Ali, AIR 1932 11 Patna 238, that wakf in its legal sense means the creation of some specific property for the fulfilment of some pious purpose or religious purpose.

A lot of eminent Muslim jurists have defined wakf in their own way. According to Abu Hanifa, “Wakf is the detention of a specific thing that is in the ownership of the Wakif or appropriator and the devotion of its profits or usufructs to charity, the poor, or other good objects to accommodate loan”.

Further, as defined by Abu Yusuf, wakf has three main elements:

- Ownership of God,

- Extinction of the founder’s right and

- Benefit of the mankind

Section 2 of the Mussalman Wakf Validating Act, 1913, defines wakf as “the permanent dedication by a person professing the Mussalam faith of any property for any purpose recognised by Musalman Law as religious, pious, or charitable.”

The Wakf Act, 1954, Section 3(l) defines wakf as the permanent dedication by a person professing Islam of any movable or immovable property for any purpose recognized by Muslim law as religious, pious, or charitable”.

A wakf can be either in writing or can be made by an oral presentation. In the case of an oral agreement, the presence of words emphasising the intention of the parties is a prerequisite.

Purpose and objective of a wakf

There can be mixed purposes of a wakf; some may be lawful, and some of them may be unlawful. If a wakf is created for a lawful purpose, it would be a valid wakf, and an unlawful purpose would lead to an invalid wakf. The honourable Allahabad High Court in the case of Mazhar Husain Khan vs. Abdul Hadi Khan (1911) held that the unlawful part of the wakf must return back to wakif.

If a wakf is created for a particular purpose, that purpose should be served. But if that purpose somehow, because of some genuine reasons, cannot be fulfilled, then the second best purpose should be completed.

Here comes the doctrine of cypress into action. The basic meaning of the doctrine is ‘as nearly as possible’. If the wishes of the donor cannot be carried out literally, they can be carried out as nearly as possible. Hence, if a wakf was created for the purpose of establishing a university, if that was not possible and a college was opened instead, that would mean fulfilling the purpose of wakf under the said doctrine. The doctrine is discussed further in the article.

The objective of a wakf should be religious, charitable, or pious. The basic yardstick is what is deemed to be religious, charitable, or pious. All these three words may seem synonymous, but they are not. Religious means purely based on religion, whereas charitable means a kind act, and pious means moralistic or something that is approved by Allah.

Parties to a wakf

There are majorly three parties to a wakf:

- The founder of a waqf is known as ‘wakif’.

- The beneficiary for whom the wakf is created is known as the ‘Mawquf ‘alayh’. A beneficiary must be legally capable of owning a property.

- The person appointed for the administration of the wakf is known as ‘Mutawalli’. Mutawalli has been discussed in detail further in the article.

Essentials of a valid wakf

Wakf under Sunni Law

The essential conditions of a valid wakf, according to the Hanafi Law (Sunni Law), are:

Formalities

There are no formalities as such for the creation of a wakf. It can be created orally or by a deed. However, the intention to give property in wakf should be proved. The Privy Council in the case of Beli Ram & Brothers and others vs. Chaudari Mohammad Afzal and others (1948) observed that the validity of the wakf completely depends upon the intention with which the wakif creates that wakf. The court held that if there is a situation where the wakif does not put the wakf-nama into action, then it can be clearly presumed by the court that the dedication of the property was not the intention of the wakif and there was some other malafide intention of the wakif to retain the said property.

Wakf must be unconditional

The wakf created must not be contingent. The giving away of the property must be immediate and complete and should not be based on any condition. Contingent wakfs are invalid. The Allahabad High Court, in the case of Khalil Uddin vs. Sir Ram and Ors. (1933), held that there is only one situation where a condition is allowed and that does not make a wakf invalid, that is, payment of debts before giving away the property to wakf.

Wakf must be irrevocable

Hidaya provides that once the property is given for the purpose of wakf, it becomes inalienable, that is, it cannot be further sold, leased, or mortgaged. The property thereafter vests with God or Allah.

Permanent dedication of the property

The most important essential of a valid wakf is that it should be a permanent dedication of the property. It has the following prerequisites:

- There must be a dedication,

- The dedication must be permanent and

- The dedication must be of any property.

The wakif himself has the right to donate such property and give it for any purpose recognized under the Muslim Law. If the wakf is made for a limited period, it cannot be considered as a valid wakf.

In the case of The Karnataka Board of Wakfs vs. Mohd. Nazeer Ahmed (1982), it was held that “if a Muslim man provides his house to the travellers irrespective of their religion and status for their stay, this cannot be considered as a valid wakf on the ground that under Muslim law a wakf has a religious motive and that it should be created for the benefit of the Muslim community. When a wakf is constituted, it is always a presumption that it is a gift of some property, made in favour of God. This is a legal fiction”.

Further, in the case of Mst. Peeran vs. Hafiz Mohd. Ishaq (1966), the honourable Allahabad High Court, while dealing with a leased property and whether that leased property can be converted into a wakf, held that a leased property cannot be given for a wakf, if given, would be invalid because it would not be a dedication of permanent character.

Competence of wakif

- Wakif must be a Muslim

- He must be of a sound mind, meaning he should be able to understand the repercussions of his act.

- He should be a major (18 years or above) as per the Indian Majority Act, 1875.

A person may profess the capacity but may not have any right to constitute a wakf. Such a person cannot constitute a valid wakf. The subject matter of wakf should be owned by the wakif at the same time when wakf is being constituted. Whether a wakf can be created by a particular person depends upon whether there exists a legal right for the dedicator to transfer ownership of the property or not.

Let’s take a few situations:

A property held by a widow in lieu of her unpaid dower cannot be given by her for the purpose of dower because she is not an absolute owner of that property.

Further, in case a wakif is a pardanashin woman. She may give away property for the purpose of wakf, but it becomes the duty of the beneficiaries and the Mutawalli to prove that the woman had exercised her mind independently for constituting the wakf after fully understanding the nature of the transaction.

Wakif must be the owner of the property

Wakif must be the owner of the property; thereby, the property must belong to the dedicator completely. A leased or any mortgaged property cannot be given for the purpose of wakf. However, an anticipated property can be allowed for the purpose of wakf, provided the sale of the property is eventually completed.

Wakf under Shia law

The essential conditions for creating a valid wakf according to Shia law are:

- It must be perpetual,

- It must be absolute and unconditional,

- Possession of the thing appropriated must be given and

- The wakf property should be entirely taken out of wakif.

Doctrine of cypress

The word cypress means ‘as nearly as possible.’ The doctrine of cypress is a principle of the English law of trusts. Under this doctrine, a trust is executed, or carried out as nearly as possible, according to the objects laid down in it.

Where a settlor has specified any lawful object that has already been completed or the object cannot be executed further, the trust is not allowed to fail. In such cases, the doctrine of cypress is applied, and the income of the property is utilised for such objects that are as nearly as possible to the object already given.

The doctrine of cypress is also applicable to wakfs. Where it is not possible to continue any wakf because of

- lapse of time,

- changed circumstances,

- some legal difficulty or

- where the specified object has already been completed

The wakf may be allowed to continue further by applying the doctrine of cypress.

The Supreme Court in the case of Ratilal Panachand Gandhi vs. State of Bombay (1954) held that when a particular purpose for which wakf is created and due to any reason that particular purpose cannot be given effect, then the courts can step in and allow the trust to be executed in cypress, that is, in a way as nearly as possible to that which the author of the trust intended.

Modes of creation of wakf

Wakf can be created in the following ways:

Inter-vivos

This type of wakf is created between living persons, constituted during the lifetime of the wakif, and takes effect from that very moment. Hanafi law provides the creation of a wakf through unilateral declaration.

Revocation: A wakf created inter-vivos cannot be revoked.

By will

A wakf created by will is contradictory to a wakf created by an act inter-vivos. It takes effect after the death of the wakif and is also known as ‘testamentary waqf’. Such a wakf cannot operate upon more than one-third of the net assets without the consent of the heirs. The Allahabad High Court, in the case of Mohd. Yasin vs. Rahmat Ilahi (1947), held that a wakif can create a testament himself and continue as a manager or trustee of that property.

Revocation: A testamentary wakf can be revoked by the testator at any time before his death.

During death or illness (marz-ul-maut)

Similar to gifts made while the donor is on the deathbed, a wakf created under these circumstances can apply to up to one-third of the property without the consent of the heirs.

Revocation: A wakf created during illness can be revoked only in the circumstance where the wakif recovers from the illness.

By immemorial use

Limitation of time also applies to the creation of wakf property, but wakf property can be established by way of immemorial use.

Completion of wakf

A wakf can be completed by the following modes:

- Where a third person is appointed as the first Mutawalli. In such a case, the wakf gets completed only when the possession of the endowed property is delivered to the appointed Mutawalli.

- Where the founder appoints himself as the first Mutawalli. In this case, there is no need for either the physical transfer of the property or the transfer of property from the name of the owner to the name of the Mutawalli.

Kinds of wakf

There are broadly two kinds of wakf:

Public wakf

Public wakf

It is created for the public, religious, or charitable purposes. The end benefit goes directly to the people at large, and the descendants and children of the wakif cannot take its benefit.

Private wakf

This type of wakf is created for the settler’s own family and his descendants and is also known as ‘wakf-alal-Aulad’. It is a kind of family settlement in the form of a wakf. In the words of the Prophet, “the most excellent sadaqua that a man can bestow upon his family is wakf-alal -aulad”. Till the heirs are alive, the property remains with them. On extinction of the family, the residue goes to the poor; that is, the ultimate benefit goes to charity.

Ijma gave existence to wakf-alal-aulad. Under Muslim law, there is a duty to maintain one’s wife, children, parents, and those relatives who are unable to take care of themselves. As per the Prophet, “when a Muslim bestows on his family, it becomes alms; though he is not giving to charity or poor people, it is a pious obligation”.

In the case of Abul Fata Mahomed Ishak and others vs. Rasamaya Dhur Chowdhuri and others (1891), two Muslim brothers executed a deed that purported to be a wakf of immovable property for their children and descendants from generation to generation. If there was a complete extinction of defendants, then the property would go for the benefit of orphans, poor, widows, et cetera. The honourable Privy Council held that the extinction of all the defendants seems illusionary and too remote and uncertain, as the family may not be extinct for ‘n’ number of years, and within that time, the property may completely vanish. It was held that such a creation of wakf is nothing but hood winking of the law. Hence, such a wakf cannot be accepted.

After this judgement of the privy council, there was an uproar among Muslims. The judgement was not in consonance with the ancient Muslim law. To reverse the above judgement, the Mussalman Wakf Validating Act, 1913, was passed. The act is discussed in detail further in the article.

Kinds of wakf from the view of their purpose

Wakf Ahli

This wakf is basically created to cater to the needs of the wakf’s founder’s children and their descendants. But the nominees do not have a right to sell or dispose of the property, which is the subject matter of wakf.

Wakf Khayri

This kind of wakf is established for charitable and philanthropic purposes. The beneficiaries in such a kind of wakf may include people belonging to the upper economic sections of society. It is used as an investment for building mosques, shelter homes, schools, madrasas, colleges, and universities. All of this is built to help and uplift the economically challenged individuals.

Wakf al-Sabil

The beneficiaries of such a wakf are the general public. Although similar to wakf Khyari, this type of wakf is generally used for the establishment and construction of public utilities (mosques, power plants, water supplies, graveyards, schools, etc).

Wakf al-Awaridh

In such a kind of wakf, the yield is held in reserve so that it can be used in case of emergency or any unexpected events that affect the livelihood and well-being of a particular community in a negative manner. For example, wakf may be assigned to cater to the specific needs of society, like providing medication to sick people who cannot afford expensive medicines.

Wakf al-awaridh may also be used to finance the maintenance of the utility services of a particular village or a neighbourhood.

Kinds of wakfs from the view of its output nature

Wakf-Istithmar

Such a kind of wakf is created for using the assets for investment purposes. The said assets are managed in such a way that the income is applied for constructing and reconstructing wakf properties.

Wakf-Mubashar

The assets of such a wakf are used to generate services that would be of some benefit to some charity recipients or other beneficiaries. Examples of such assets include schools, utilities, etc.

Administration of wakf

Mussalman Wakf Validating Act, 1913

This Act of 1913 legalised and recognised wakf-alal-aulad. The objective of the Act was to declare the rights of Muslims to make settlements of their property in favour of their family, children, or descendants. Furthermore, the term ‘family’ has been given a wider interpretation and also includes daughter-in-laws or other people connected with the other Muslim family members.

As per Section 3 of the Act, wakf-alal-aulad would be deemed to be a wakf for religious purposes. However, the ultimate benefit is to expressly or impliedly help the poor, give the usufruct in charity, or fulfil the pious or religious obligations.

Hanafis can create a wakf for their own maintenance or support during their lifetime or for payment of debt out of such property, of which the wakf has been created.

Section 4 of the Act further clarifies that by mere remoteness or uncertainty of benefit, the wakf does not become invalid in the eyes of law. However, as per Section 5 of the Act, if any custom or usage of any sect is contrary to the provisions of the Act, the same will override the Act.

In the case of Radhakanta Deb & Anr. vs. Commissioner of Hindu Religious Endowments, Orissa (1981), the Hon’ble Supreme Court observed that in wakf-alal-aulad, the ultimate benefit is reserved for God, but the property vests in the beneficiaries, and the income from the property is used for the maintenance and support of the family of the founder and his descendants.

The changes brought by the Mussalman Wakf Validating Act, 1913, can be summarised as follows:

- The 1913 Act validates the wakf in the favour of wakifs, children, family, and descendants. However, the ultimate benefit has to be reserved for charitable purposes.

- There was a doubt whether a Muslim could eat out of his own wakf because of the dichotomy of views between Sunnis and Shias, especially Hanafis. The 1913 Act clarifies that the Hanafis can have a life interest or pay their debts out of the wakf property.

- The Act also validates the payment of debts of wakifs out of rent and profits, which accrue from the property of wakf.

- Confusion over whether the property in wakf could be movable or immovable was settled by the 1913 Act. The term ‘any property’ is used in the definition of wakf under the Act.

- Religious, pious, and charitable purposes have to be understood as per Muslim law and not English law.

The chronology of the Wakf Acts and the amendments made to them can be understood through the following flow chart:

Wakf Act, 1995

The most prima facie amendment made by the Wakf (Amendment) Act, 2013 to the Wakf Act, 1995, is the replacement of the word ‘wakf’ with ‘auqaf’. The Preamble of the Act reads as “an Act to provide for the better administration of Auqaf and for matters connected therewith or incidental thereto”.

The Act provides for the constitution and establishment of a Central Wakf Council (under Section 9) and the State Wakf Board (under Section 14).

Central Wakf Council

The Central Wakf Council is established by the Central Government. The main role of a Central Wakf Council is to advise the wakf boards of the States and take care of the administration of the waqf. The council consists of:

Ex-Officio chairperson

The Union Minister responsible for waqf is the ex-officio chairperson of the Central Wakf Council.

Appointment by the central government from the Muslim Community

- Representatives of Muslim Organisations

Three individuals from organisations with a pan-India presence and national importance are appointed.

- Eminent Individuals

- Four distinguished figures, each recognized in the following fields, are appointed

- Administration or management

- Financial management

- Engineering or architecture

- Medicine

- Parliamentary Representation

Three Members of Parliament, including:

- Two from the House of the People (Lok Sabha)

- One from the Council of States (Rajya Sabha)

- Judicial and Legal Expertise

- Two former judges, either from the Supreme Court or a High Court.

- One advocate with national recognition.

- Board Chairpersons and Scholars

- Chairpersons of three boards, selected on a rotational basis.

- Three eminent scholars specialising in Muslim law.

- Mutawalli Representation

One representative of mutawallis manages waqf properties with an annual income of ₹5 lakhs or more.

Women representation

At least two of the members selected from all the categories must be women.

The term of office of the members of the council, the procedures for carrying out their functions, and the process for filling casual vacancies are determined by rules set by the Central Government.

Further, the State Government or the Board must provide the Council with information on Waqf Boards’ performance, including:

- Financial performance,

- Survey results,

- Maintenance of waqf deeds,

- Revenue records,

- Encroachment issues and

- Annual and audit reports

The Council may also request specific information on issues where there is apparent evidence of irregularity or violation of the Act.

If any dispute arises from the directives issued by the Council, the same is referred to a Board of Adjudication. The Board is chaired by a retired Supreme Court Judge or a retired Chief Justice of a High Court.

State Wakf Board

The State Wakf Board and its members are appointed by the State Government. A state board consists of:

- A chairperson

The board members elect a chairperson from amongst themselves during a meeting convened.

- Members

Electoral Colleges (up to two members from each):

- Muslim Members of Parliament from the State/NCT of Delhi.

- Muslim Members of the State Legislature.

- Muslim members of the Bar Council (or a senior Muslim advocate if no member).

Members from these three categories are elected through proportional representation by single transferable vote.

- Mutawallis of auqaf with an annual income of ₹1 lakh or more.

The state government can directly nominate members if constituting an electoral college seems impractical; however, the reasons must be recorded in writing for doing so. Further, elected members must always outnumber nominated members, except when nominated members are directly appointed due to practical issues.

- Nominated Members

- One Muslim professional with experience in town planning, business management, social work, finance, revenue, agriculture, or development is nominated by the state government.

- One Muslim scholar in Shia Islamic theology and one in Sunni Islamic theology is nominated by the state government.

- One Muslim officer from the state government, not below the rank of Joint Secretary, is nominated.

- In the case of Union Territory

- The Board must have 5-7 members appointed by the Central Government.

- At least two members must be women.

- One mutawalli must be included where the mutawalli system exists.

- Representation of Shia and Sunni Auqaf

The number of Shia and Sunni members should reflect the number and value of Shia and Sunni auqafs.

- Term of Office

As per Section 15 of the Wakf Act, 1995, the members of the Board serve a five-year term from the date of notification in the Official Gazette.

The State Wakf Board consists of three committees:

Further, as provided under Section 13(2) of the Wakf Act, 1995, if Shia auqaf in a state account for over 15% of the total number or income of auqaf, the state government may establish separate boards for Sunni and Shia auqaf. Before doing so, a proper survey of the wakfs in the state is conducted by the survey commissioner. One percent of the net income of a State Wakf Board is given to the Central Wakf Council.

Wakf tribunal

Section 83 of the Wakf Act, 1995, provides for the constitution of the wakf tribunals. Section 83 has been simplified here under:

Constitution of the wakf tribunals

- The state governments notify the constitution of tribunals.

- Tribunals are constituted to determine:

- disputes, questions, or matters related to wakf or wakf property,

- eviction of tenants and

- rights and obligations of lessors and lessees.

Application to the tribunal

- Any Mutawalli interested in a wakf or aggrieved person can apply to the tribunal.

- Applications must be made within the specified time or within the prescribed time if not specified.

Jurisdiction in cases of multiple tribunals

- Where a wakf property lies within multiple tribunal jurisdictions, then the application has to be made where:

- the Mutawalli resides or

- conducts business or

- where he works.

- Other tribunals cannot entertain the same application unless transferred by the concerned state government.

Composition of the tribunal

- State Judicial Service member (chairman) not below District, Sessions, or Civil Judge, Class I Rank.

- One State Civil Services officer equivalent to Additional District Magistrate.

- One person having knowledge of Muslim law and jurisprudence.

Powers and procedures

- A tribunal is a deemed civil court with powers similar to a civil court under the Code of Civil Procedure, 1908.

- Tribunals follow a set prescribed procedure notwithstanding the Code of Civil Procedure, 1908.

Finality and execution of tribunal decisions

- The decisions of a tribunal are final and binding and carry the same force as a civil court decree.

- Decisions of the tribunal are executed by the civil court to which the decision is sent for execution and is done as per the Code of Civil Procedure, 1908.

Appeals

- No appeals lie against the decisions or orders of a tribunal.

- The High Court can review a tribunal’s records to ensure correctness, legality, or propriety, and may confirm, reverse, modify, or pass other orders.

There has been a constant legal battle as to who has the jurisdiction to deal with specific situations, the wakf board or the wakf tribunal. The Honourable Supreme Court in the case of Rashid Wali Beg vs. Farid Pindari (2021), while dealing with the issue as to whether a wakf tribunal has jurisdiction to deal with the wakf property or not, observed, “to say that the tribunal will have jurisdiction only if the subject property is disputed to be a wakf property and not if it is admitted to be a wakf property, is indigestible in the teeth of Section 83(1) of the wakf Act”. Further, the court, by bifurcating Section 83(1) into two parts, observed that a tribunal has jurisdiction with regards to wakf and wakf property both.

Another important recent judgement is S.V. Cheriyakoya Thangal vs. S.V.P. Pookoya & Ors. (2024). The honourable Supreme Court decided on the issue as to whether the wakf board or the wakf tribunal has a jurisdiction to decide on muttawalliship. The honourable court observed that the wakf tribunal acts like a civil court, with an authority similar to that of a civil court under the Code of Civil Procedure, 1908.

According to Section 83(7) of the Wakf Act, 1995, the tribunal’s decisions are final and carry the same weight as a decree from a civil court. The term ‘competent authority’ mentioned in Section 3(i) of the Act clarifies that jurisdiction lies with the wakf board and not the wakf tribunal. The tribunal adjudicates disputes, while the wakf board handles administrative matters. The board’s jurisdiction is not just limited to routine affairs but extends to disputes arising during property management, including decisions about who serves as Mutawalli and the person responsible for administering the wakf. Thus, the court concluded that the jurisdiction regarding appointment or any other matters connected with Mutawalli lies with the wakf board and not the tribunal.

Mutawalli

Property of a wakf is invested with Allah. Under the Indian Trusts Act, 1882, the property is invested with the trustee, but that is not the case of wakf. Even using the word manager would not do complete justice, as a manager is paid remuneration whereas the post of Mutawalli is more of an honorary job. Thus, it can be said to be a combination of two (trustee and manager) in one role. The honorarium given to a Mutawalli is fixed by wakif in the wakf nama. Usually a wakf deed provides that remuneration to be paid, however, where the salary is not fixed or fixed at a lower rate, then the court can fix the said amount. Furthermore, the remuneration paid to a Mutawalli cannot be beyond 1/10th of the total income of the wakf.

The manager or the superintendent of the wakf is known as the ‘Mutawalli’. Such a person appointed has no powers, either to sell or exchange or mortgage the wakf property, without the prior permission of the court, unless he has been empowered by the wakf deed expressly to do so.

Persons eligible to be appointed as a Mutawalli

Any person who has attained the age of majority, is of a sound mind, and is capable of performing the functions to be discharged under a particular wakf can be appointed as a Mutawalli of the wakf. A foreigner cannot be appointed as a trustee of property in India.

Allahabad High Court in the case of Ijaz Ahmed vs. Khatoon Begum (1917) held that where the office of Mutawalli is hereditary, then in that case, even a minor can be appointed as a Mutawalli.

A woman can also be appointed as a Mutawalli. The Privy Council in the case of Shahar Banoo vs. Aga Mohomed Jaffer Bindaneem (1906) held that there is no prohibition against a woman being appointed as a Mutawalli, but the appointment depends completely upon the nature of wakf. For example, if the purpose of wakf is religious activities, then a woman cannot be appointed.

Furthermore, Madras High Court in the case of Munnavaru Begum Sahibu vs. Mir Mahapalli Sahib and two others (1918) and Calcutta High Court in the case of Kassim Hassan vs. Hazra Begum (1920) held that women are allowed to be appointed as Mutawalli. If a woman is appointed and there are certain spiritual or religious functions that a woman cannot perform, then in that case, a deputy should be appointed to fulfil such religious functions. The same was upheld by the Supreme Court in the case of Mohd. Zainulabudeen (Since Deceased) by LRs. vs. Sayed Ahmed Mohindeen and Ors. (1989) that a woman can be appointed a Mutawalli anywhere and a deputy can be appointed to fulfil or perform the spiritual functions of the wakf.

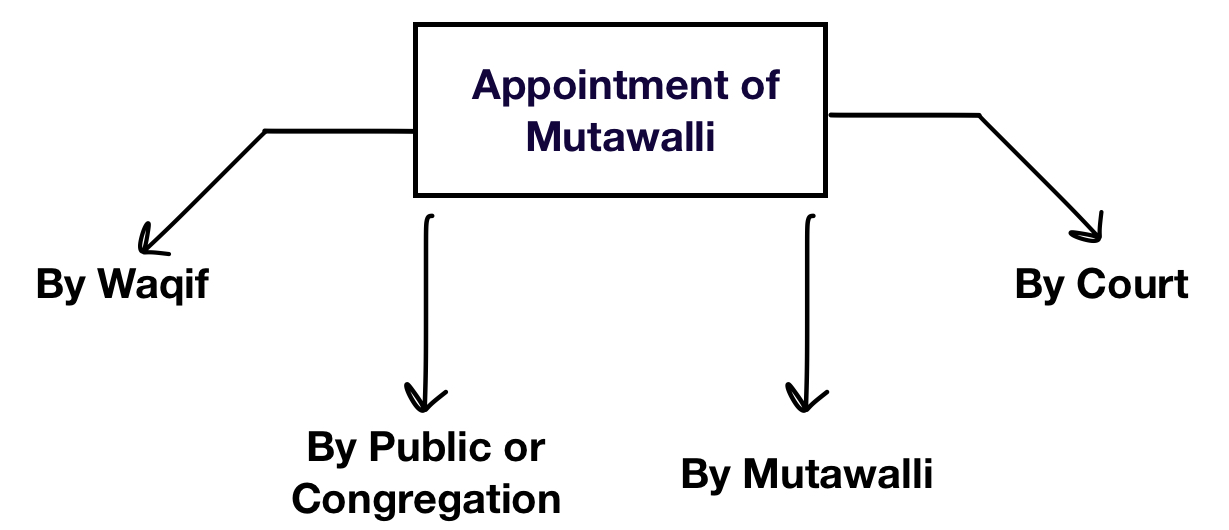

Persons eligible to appoint a Mutawalli

Appointment by wakif

Since the property of the wakf belongs with the wakif, he has complete power to appoint any Mutawalli of his choice. He may even lay down a series of Mutawalli (succession). Wakif may nominate a successor by name or class of persons that he decides. Wakif may further confer this power of appointment to someone else.

Wakif has complete discretion in the appointment of Mutawalli and can even lay down a few set qualification criteria to be met to be appointed as a Mutawalli.

Appointment by the public or congregation

In certain circumstances, even the public or a congregation can appoint a Mutawalli for the wakf property. One such example is where, on the wakf property, a mosque is built or is turned into a graveyard; in that case, Mutawalli can be appointed by the public or a congregation.

Appointment by another Mutawalli

If the wakif is dead and there is no scheme in place regarding the appointments of Mutawallis, then the outgoing Mutawalli can decide as to who should be the next Mutawalli, but only when he is dying. If the wakif decides that the appointment of Mutawalli will not be based on hereditary but the existing custom provides completely opposite, then in that case, custom will prevail over the decision of the wakif.

In case two or more Mutawallis are elected and one dies, then, as per survivorship, the other one will step up to be a Mutawalli. The same was dealt with by the Bombay High Court in the case of Haji Abdul Razaq vs. Sheikh Ali Baksh (1948), where it was held that if there was a provision of joint Mutawalli, then, in the case of death of one of the Mutawallis, the office will pass on to the surviving Mutawalli and not to the hereditary Mutawalli.

Appointment by court

In the case of a public wakf, Mutawalli is appointed by the court. The discretion is completely with the courts, but wakif’s intention should be taken into consideration. The privy council, in the case of Mahomed Ismail Ariff vs. Hajee Ahmed Moola Dawood (1916), held that the courts have the power to amend the management rules of a wakf and new rules can be made in the favour of the public interest.

The courts, while appointing a Mutawalli, must take into consideration the following pointers:

- Direction of wakif

- Appointment must be made by keeping public interest in mind.

Powers and duties of Mutawalli

Being the manager of the wakf, he is in charge of the usufruct of the property. He has the following rights:

- He has the authority to use the usufructs to the best interest of the wakf. He is authorised to take all reasonable actions in good faith to ensure that the end beneficiaries are able to enjoy all the benefits from the wakf. As he is not the owner of the property, therefore he is barred from selling the property. However, he could be bestowed upon such rights by the wakif by the explicit mention of them in wakf nama.

- He can alienate the wakf property by giving genuine reasons and taking prior sanction from the court. If he alienates the property without the permission of the court, it would not be void ab initio; rather, it would be voidable at the instance of any of the parties. If the court retrospectively confirms the alienation, then it would become valid.

- He can take authorisation from the court to sell or borrow money by showing the existence of appropriate grounds or the existence of urgency.

- He can file a civil suit to protect the interests of the wakf. Before the Wakf Act, 1934, a Mutawalli could file a suit at any time. But, after the 1934 Act, wakf board files suits.

- He also has the power to lease the property for the agricultural purpose for less than three years and for the non-agricultural purpose for less than one year. He can get the term extended with due permission from the court. If the wakf nama provides for a longer period of lease, then that would be valid. Otherwise, in the rest of the situations, the permission of the court is a must. Furthermore, if Mutawalli makes an invalid lease, it can be confirmed afterwards by the court and made valid.

- He has complete power with regard to the legal and economic aspects of wakf.

Removal of Mutawalli

By the court

The court’s power to remove Mutawalli is absolute. A suit has to be filed in the district court, and the procedure laid down under the Code of Civil Procedure, 1908 would be applicable to such a suit. Mutawalli can be removed by the Court only on the following grounds:

- He denies the wakf character of the property and sets up an adverse title to it in himself.

- He, although having sufficient funds, neglects to repair the wakf premises and allows them to fall into despair.

- He causes damage or loss to the wakf property or commits a breach of trust knowingly and intentionally.

- He is rendered insolvent.

By the wakf board

According to Section 64 of the Wakf Act, 1995, the Wakf Board has the authority to remove the Mutawalli from his office under the following conditions:

- Of unsound mind

- Convicted of the offence of criminal breach of trust

- Convicted under Section 61 of the Act more than once

- Undischarged insolvent

- Drug addict

- Act against wakf in legal proceedings

- Neglect the duties of wakf

- Misappropriates property of the wakf

By the Wakif

There are different views with regard to the removal of Mutawalli by the wakif. According to Abu Yusuf, even if the wakif has not reserved a right to remove the Mutawalli in the wakf deed, he can nevertheless remove the Mutawalli. However, Imam Mohammed differs on this and believes that unless there is a reservation, wakif cannot do so.

However, the general rule applicable is that if the wakif is alive, Mutawalli can be removed at any time, but if the wakif is dead, then Mutawalli cannot be removed until and unless the wakf nama clearly provides for the same.

Wakf (Amendment) Bill, 2024

As per the ruling government, the proposed amendments by the Wakf (Amendment) Bill, 2024, to the Wakf Act, 1995 are done with an aim to address the gaps in the Wakf Act, 1995, and to prevent the alleged capture of the wakf boards, which, as per the reports referred to by the government, come across as being controlled by the mafias in some places.

One discernible amendment proposed is to rename Wakf as “Unified Waqf Management Empowerment Efficiency Development” or “UMEED”. The acronym UMEED is symbolic of the government’s intention to reform the system for better justice and welfare for the Muslim community.

The Bill’s Statement of Objects and Reasons puts forth that despite amendments made in the year 2013, the Wakf Act, 1995, has not significantly improved the management of Wakf properties. The proposed changes are based on the recommendations from the Sachar Committee, the Joint Parliamentary Committee on wakf, and the Central Wakf Council.

Key Amendments Proposed by the Wakf (Amendment) Bill, 2024

Alterations in the definitions

- The term “Wakf” under Section 3(r) is re-defined to mean the permanent dedication of property, whether movable or immovable, by any individual who has practised Islam for at least five years and owns the property for purposes recognized by Muslim law as pious, religious, or charitable.

- The concept of Wakf-alal-aulad under Section 3(r)(iv) is clarified, stating that if the line of succession ends, the waqf’s income should be directed towards education, development, and welfare, including the maintenance of widows, divorced women, and orphans as prescribed by the Central Government, along with other purposes recognized by Muslim law.

- Section 3(da) has introduced the role of a collector, who will assume some of the powers previously held by the Auqaf Board.

New provisions added for regulating the wakf properties

Section 3A

Section 3A sets out two conditions for creating a wakf.

- Only individuals who are lawful owners of the property and have the competence to transfer or dedicate the property shall establish a wakf.

- The creation of wakf-alal-aulad shall not infringe upon the inheritance rights of heirs, including female heirs.

Section 3B

Section 3B mandates that the details of all the wakfs that were registered before the Wakf (Amendment) Act, 2024, must be submitted on an online portal and database within a period of 6 months. This includes details like the name and address of the wakif, the wakf deed, annual income from the properties, pending court cases, mutawalli’s salary, taxes, and other information prescribed by the Central Government.

Section 3C

Section 3C specifies that any government property, whether identified or declared as wakf before or after the amendment, will not automatically be considered wakf property. In the event of a dispute regarding the ownership of such property, a collector will conduct an inquiry and report to the state government. The property will remain unclassified as wakf until the report is submitted.

Survey Commissioner’s role transferred to collector

Section 4

The Wakf Act, 1995, requires the state government to appoint a survey commissioner to conduct a survey of auqaf. The proposed amendment replaces this role with that of the Collector, who will now oversee jurisdiction.

Further, the classification of wakf has been broadened to include ‘Aghakhani waqf’ or ‘Bohra waqf’ in addition to Shia or Sunni waqf.

Section 5

Section 5 provides for the publication of a list of auqaf. The report prepared by the Survey Commissioner under Section 4 of the Act is examined by the wakf board, and within 6 months, the wakf board forwards the report to the state government for publication, and accordingly, the revenue authorities update the land records. Now, as per the proposed amendment, prior to updating land records to include waqf properties, revenue authorities must issue a 90-day public notice in two daily newspapers, with one notice in a regional language, to ensure affected parties have the opportunity to raise objections.

Legal disputes and challenges

As per Section 6 of the Wakf Act, 1995, the disputes over whether a property listed as a wakf is indeed a wakf or not and whether it is Shia or Sunni wakf are resolved by a Tribunal, whose decision is final. The proposed amendments allow for the Tribunal’s decisions to be challenged within two years of the list’s publication. An application can even be filed after the two-year period if a valid reason for the delay is provided.

Section 40 of the Wakf Act, 1995, which allows the Board to gather information about any property suspected to be waqf, is proposed to be removed.

Change in constitution of wakf council and auqaf board

The composition of the Central Wakf Council as provided under Section 9 has been left mostly unchanged, but it has proposed two requirements:

- Inclusion of two non-Muslim members and

- Inclusion of two women members among those appointed by the Central Government.

The composition of the Board of Auqaf under Section 14 of the Wakf Act, 1995, is proposed to be revised to include:

- Two non-Muslim members

- Two women members

- At least one representative each from Shia, Sunni, and other backward classes within Muslim communities.

- A member from the Bohra or Aghakhani communities shall also be nominated if they have functional auqaf in the state.

Registration and audit of wakf properties

As per the proposed changes under Section 36, no waqf shall be established without an official waqf deed. The registration process, previously regulated by the Auqaf Board, will now be handled via an online portal. The collector must verify the legitimacy of the application, and if the property is disputed or government-owned, registration will be suspended until a court resolves the dispute.

As per proposed changes under Section 47, the audit process will be modified and will require that the auditors appointed by the Auqaf Board should be selected from a panel prepared by the State Government. Additionally, the Central Government can order audits by the Comptroller and Auditor-General of India and may require the publication of audit reports as it sees fit.

Criticisms of the Bill

The proposed bill has sparked significant debate, raising several concerns that highlight the potential flaws. Some of them are mentioned below:

Violation of constitutional rights

Several opposition members have criticised the bill as undermining the secular fabric of the Constitution. It was argued that the bill violates Articles 25 and 26 of the Indian Constitution, which protect religious freedom and the right of religious communities to manage their own affairs. It was pointed out that the inclusion of non-Muslim members in the Wakf Council and Auqaf Board comprises religious autonomy.

Further, it was claimed by the opposition members in the Parliament that the bill violates Article 30, which grants minorities the right to manage their institutions.

Federalism and state rights

It was argued by the opposition that the bill encroaches upon the rights of state governments, as the management of wakf properties falls under the State List in the Constitution. The central government lacks the authority to make rules for wakf properties, which should remain under state jurisdiction.

Another point of criticism was with regard to the fact that managing wakf properties is an essential religious practice for Muslims. Any interference by the state could lead to religious discrimination, thereby violating Articles 14 and 15(1), which protect the right to equality and prohibit discrimination.

Lack of consultation

Another point of criticism concerns the fact that the bill has been introduced without adequate consultation with stakeholders. The provision allowing the decisions of Wakf Tribunals to be appealed undermines cooperative federalism by giving the Central Government more regulatory control over wakf.

The points of criticism were countered by the government by citing the Wakf Inquiry Report, 1976, which puts forth the significant mismanagement of wakf properties by Mutawallis, resulting in unequal distribution of benefits. The report has recommended abolishing Wakf Tribunals due to their ineffectiveness.

Further, the point of legislative competence of the centre government was countered by outlining the powers bestowed under Entry 10 (Trust and Trustees) and Entry 28 (Charities and charitable institutions, charitable and religious endowments, and religious institutions) of the Concurrent List (List III).

Due to the criticisms faced by the bill presented in the monsoon session of the Parliament, the same has been referred to the Joint Parliamentary Standing Committee to look into the concerns raised by the opposition regarding the bill.

Difference between Sadaqah and Wakf

| Sr. No. | Basis | Sadaqah | Wakf |

| 1. | Meaning | Sadaqah is voluntary charity given in the name of Allah. | Wakf is an endowment of property for religious or charitable purposes. |

| 2. | Extent of Transfer | The legal estate and not merely the beneficial interest pass to the charity to be held by the trustees appointed by the donor. | The legal estate or the ownership is not vested in the trustee or the Mutawalli but is transferred to God. |

| 3. | Power to Alienate | Both the corpus and the usufruct are given away. Therefore, the trustee has the right to sell away the property itself. | The trustees of a wakf cannot alienate the corpus of the property, except in the case of necessity with the prior permission of the Court or when authorised by the settlor to do so. |

| 4. | Nature | It is in the form of a donation or a gift. | It is an endowment. |

| 5. | Management | There is no management involved. The donor can directly give away sadaqah. | There is a proper formal setup for the administration and management of wakf. Mutawalli was disappointed to manage the wakf property. |

| 6. | Legal Aspect | Sadaqah is governed by the general principles of charity in Islam. There is no specific act or provision that codifies sadaqah. | Wakf is governed by the Wakf Act, 1995 and the Wakf (Amendment) Act, 2013. |

Difference between Hiba and Wakf

| Sr. No. | Basis | Hiba | Wakf |

| 1. | Right of the owner | The dominion over the object passes from one human being to another. | The right of wakif is extinguished and passes in favour of the Almighty. |

| 2. | Possession | Delivery of possession is essential. | In a wakf inter-vivos, no delivery of possession is essential. It is created by the mere declaration of endowment by the owner. |

| 3. | Purpose | There is no limitation with regard to the object for which it has been created. | It is contracted only for religious, charitable, or pious purposes. A wakf for family purposes should also be charity. |

| 4. | Ownership Transfer | The property passes from one person to another, and the absolute right is transferred. The recipient of the gift can use, sell, or dispose of the property as they wish. | The right of wakif is absolutely extinguished and passes in favour of the Almighty, and a Mutawalli is appointed to administer the wakf. The property cannot be sold, inherited, or alienated in any way. |

Difference between Trust and Wakf

| Sr. No. | Basis | Trust | Wakf |

| 1. | Religious motive | The existence of a religious motive is not necessary for trust. | There should exist a religious motive behind creating a wakf. |

| 2. | Beneficiary | A trustee may be a beneficiary. | A settlor, except under Hanafi law, is not entitled to keep aside any benefit for himself. |

| 3. | Object | There has to be a lawful object. | The object has to be one that is charitable, pious, or religious according to the Muslim faith. |

| 4. | Ownership | Involves double ownership, equitable, and legal ownership. The property vests in the trustee. | The ownership of the wakf is extinguished, and the ownership is vested in God. |

| 5. | Power of alienation | The trustee has superior powers of alienation because he is the legal owner. | Mutawalli is a mere receiver and manager and cannot alienate the property. |

| 6. | Remuneration | A trustee does not have the power to demand remuneration. | Mutawalli has the power to demand remuneration. |

| 7. | Duration | It is not necessary that a trust should be perpetual, irrevocable, or inalienable. | Property is inalienable, irrevocable, and perpetual. |

| 8. | Governed by | Trusts are governed by the Indian Trusts Act, 1882. | Wakfs are governed by the Wakf Act, 1995 and the Wakf (Amendment) Act, 2013. |

Relevant case laws

Nawab Zain Yar Jung and Others vs. the Director of Endowments and Others (1962)

In this case, the court held that for a dedication to be a wakf, it does not need to benefit only Muslims or a specific community. As long as the dedication is for a charitable purpose under Muslim law and the property or asset is permanently dedicated, it qualifies as a wakf.

The court also went a step ahead and discussed the difference between the concept of trust in English law and wakf in Muslim law. The court referred to the judgement of Vidya Varuthi Thirtha vs. Balusami Ayyar (1921), where the court held that a trust and a wakf are completely different. In the case of a trust, an obligation is put on the shoulders of the trustee to manage the property, whereas in the case of a wakf, the property is permanently dedicated in the name of the almighty, and the wakif is left with no ownership powers over the property, and further, a mutawaali is appointed to manage Tehelka wakf property.

Ramjas Foundation & Ors. vs. Union of India & Ors. (2010)

The honourable Supreme Court, while dealing with this case, discussed the issue as to whether a non-Muslim can create a wakf and observed that once a property is declared as wakf, or if it is clear from the document that it is meant for a religious or charitable purpose, the original owner’s rights are gone and ownership is transferred to the Almighty. The court took into consideration the book on Mohammedan Law, written by Ameer Ali, which states that anyone, regardless of their religion, can create a wakf, but the purpose of the dedication must be lawful according to both their own religion and Islamic law. The court further observed that since divine approval is crucial for a wakf, it won’t be valid if the purpose is considered sinful by either Islamic law or the creator’s religion. This means that a non-Muslim can create a Wakf for a religious purpose, but it must also be lawful according to their own beliefs.

Faseela M. vs. Munnerul Islam Madrasa Committee & Anr. (2014)

In this case, the honourable Supreme Court dealt with the issue of whether the suit for eviction against the tenant is triable by the Civil Court or the wakf tribunal where the matter relates to a wakf property. The honourable court observed that Sections 83, 85, 6, and 7 of the Wakf Act, 1995, need to be read together to get a clear picture of the legislative intent. The court held that Section 6 and Section 7 of the Act confer exclusive jurisdiction upon the tribunal for determination of certain disputes regarding auqaf and, at the same time, take away the jurisdiction of the Civil Court away in respect of such disputes.

Further, the court referred to the judgement of Ramesh Gobindram (Dead) through LRS. vs. Sugra Humayun Mirza Wakf (2010), where the honourable Supreme Court dissected the Wakf Act, 1995, and explained the jurisdiction of the wakf tribunal as well as that of the Civil Court. The court held that the suit for eviction of the tenant from the wakf property falls within the jurisdiction of the civil court as it does not fall under Section 6 or Section 7 of the Act. Further, the honourable court held, “the crucial question that shall have to be answered in every case where a plea regarding exclusion of the jurisdiction of the Civil Court is raised is whether the tribunal is under the Act or the Rules required to deal with the matter sought to be brought before a Civil Court. If it is not, the jurisdiction of the Civil Court is not excluded. But if the Tribunal is required to decide the matter, the jurisdiction of the Civil Court would stand excluded”.

Maharashtra State Board of Wakfs vs. Shaikh Yusuf Bhai Chawla & Ors. (2012)

The Supreme Court in this case observed that there is a need to draw a line between Muslim public trusts and wakfs. The court clearly pointed out that painting all the Muslim public trusts with the same brush and gleaning them as wakfs is completely against the law.

Furthermore, determining whether an institution is a wakf or a public trust involves both facts and law. A Muslim can create either a public trust or a wakf, and it will remain valid. The key feature of a trust is that the property is managed by a trustee according to the terms of the trust document. If the document does not allow the sale or transfer of the property, this might indicate the institution is a wakf, especially if other essential features are also present. The Wakf (Amendment) Act, 1964 clarified that the benefits of a wakf are not limited to the Muslim community alone, emphasising that if the purpose is public utility, the difference between a trust and a wakf becomes less significant.

Salem Muslim Burial Ground Protection Committee vs. State of Tamil Nadu and Ors. (2023)

In this case, the Hon’ble Supreme Court dealt with an issue of whether a particular land that is used as a burial ground should be converted into wakf without fulfilling the requirement of Section 5 of the Wakf Act, 1995, or not. The Hon’ble Court pointed out that the conjunctive reading of Sections 4 and 5 of the Wakf Act, 1995, provides that a notification under Section 5 (Declaration of lists of wakfs) shall be published only after the completion of surveys and submission of reports under Section 4 of the Act. The court clearly pointed out that conducting surveys as per Section 4 of the Act is sine qua non for declaring a property to be a wakf.

The court observed that skipping the step of conducting surveys and merely issuing the notification under Section 5 of the Act would not constitute a valid wakf in respect of the suit land.

Conclusion

The concept of wakf goes way back to the 9th and 10th centuries, and still wakfs remain a cornerstone of Islamic charitable practice, with a sincere focus on social welfare and community development. All the concepts revolving around wakf, its types, its administration by Mutawalli, and the disputes to be resolved by the wakf boards and tribunals have been discussed in detail above. We have also seen a series of changes brought by the legislature in the Acts dealing with wakfs.

On 8th December, 2023, The Wakf Repeal Bill, 2022, was introduced in Rajya Sabha. In the statement of objects and reasons, it was outlined that the Wakf Act, 1995, has given extensive powers to Wakf Boards. These boards are the third largest owners of the land in the country, and this often leads to disputes over ownership and encroachment on personal property rights of the general public. The Act mandates that the Wakf Board’s Chairperson should be a State Government officer, and the board members should include professionals and recognized scholars, but on the other hand, the membership to Muslims has been limited over time.

The Act has been criticised for granting unchecked autonomy to Wakf Boards, leading to potential abuse, and for overriding state autonomy (Sections 28 and 29 of the Wakf Act, 1995). It has been pointed out that there is a need for reform to protect citizens’ rights and ensure fair management of wakf properties.

The bill is yet to be passed. If the problems and loopholes mentioned in the bill do actually exist on the ground, then, there is definitely a need to bring legislative changes, so that the true objective and essence of wakf can be safeguarded.

Looking into the situation at hand, the Wakf (Amendment) Bill, 2024 was introduced in the Lok Sabha on 8th August, 2024 and the amendments proposed are discussed above. The decision of the Joint Parliamentary Committee is something to be looked forward to as there are some significant changes that might come into place if the bill gets passed.

Frequently Asked Questions (FAQs)

Can there be a presumption of a wakf?

Yes, in certain circumstances, a wakf can be presumed to exist. One such example can be immemorial usage of the property. Let’s say a land is a burial ground for over 100 years. It can be presumed that that land is a wakf property.

Can Mutawalli take debt against a wakf property?

No, a Mutawalli cannot take debt against the wakf property. The main reason behind the same is that in general circumstances, the wakf property cannot be alienated. Even if Mutawalli takes debt against a wakf property, he would still be personally liable to pay the amount of debt. Furthermore. A decree against Mutawalli cannot be executed against the wakf property.

Can mushaa (undivided interest in a property) form part of wakf?

Yes, mushaa can form the subject of a wakf. It is irrelevant whether the property is capable of division or not. The same has been held by the Calcutta High Court in the case of Mohammed Ayub Ali vs. Amir Khan (1939). However, there is an exception to this. A mushaa cannot be dedicated by way of wakf for a mosque or a burial ground. Such a wakf would be invalid as the continual participation in the property of wakf is repugnant to the basic essential of the property dedicated to God, as Allah has the exclusive right over such property.

Is it necessary to get the wakf registered on the wakf board?

Yes, it is necessary to get every wakf/auqaf registered at the office of the wakf board. The same has been provided under Section 36 of the Wakf Act, 1995. It provides that an application for the registration of a wakf has to be moved by the Mutawalli generally, but it can also be filed by the wakif, his descendants, a beneficiary, or any Muslim of the same sect to which the wakf belongs. Along with the application, certain particulars are also to be supplied to the board. The board, before registering the wakf makes necessary enquiries as to the genuineness and validity of the application submitted and the particulars provided along with it. If such a situation appears, where the wakf board does not exist at the time of the creation of the wakf, then, in that case, the application for registration of the wakf has to be filed within three months of the establishment of the wakf board.

Does waqf-nama need to be registered under the Indian Registration Act, 1908?

If a waqf-nama dedicates a wakf of an immovable property, having a value of ₹100 or upwards, then it needs to be registered under the Registration Act, 1908. Moreover, a wakf nama, while creating a wakf, extinguishes the ownership of the wakif in the property, and thus it should be registered under Section 17(1)(b) of the Act.

References

- Manzar Saeed, Commentary on Muslim Law in India, (Orient Publishing Company, 2011, New Delhi).

- I.B. Mulla, Commentary on Mohammedan Law, (2nd Ed, Dwivedi Law Agency, 2009, Allahabad).

- Prof. I.A. Kan, Mohammedan Law, (23rd Ed, Central law agency, 2010 Allahabad).

- Dr. Paras Diwan, Muslim Law in Modern Indian, (Allahabad Law Agency, 2021, New Delhi).

- https://www.scconline.com/blog/post/2021/11/05/explained-jurisdiction-under-wakf-act-1995-civil-court-versus-tribunal/

- https://www.livelaw.in/top-stories/waqf-amendment-bill-2024-central-government-to-exercise-major-powers-266119?fromIpLogin=6348.567521094727

- https://www.business-standard.com/india-news/parliament-session-govt-introduces-the-waqf-amendment-bill-in-lok-sabha-124080801834_1.html

Students of Lawsikho courses regularly produce writing assignments and work on practical exercises as a part of their coursework and develop themselves in real-life practical skills.

LawSikho has created a telegram group for exchanging legal knowledge, referrals, and various opportunities. You can click on this link and join:

Follow us on Instagram and subscribe to our YouTube channel for more amazing legal content.

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Allow notifications

Allow notifications