This article is written by Molika Garg, pursuing a Certificate Course in Insolvency and Bankruptcy Code from Lawsikho.com.

Table of Contents

Abstract

A company is an artificial person it is created & dissolved by a set of rules & laws. Liquidation is the legal procedure by which the company come to an end. The decision of liquidation is taken when a company’s chances of revival are almost negligible. The process to revive the company through internal and external restructuring is not falling in place and the legal procedure needs to be adopted. Delaying the whole process of liquidation when it’s a no return point the beating around the bush will only cause good money going against bad money. Liquidation can be voluntary or compulsorily by order of court. As the concept of liquidation is a very detailed subject we have only tried to focus on the compulsory liquidation wherein the facet is on defining liquidation, liquidation process and the key man – liquidator.

What is liquidation

In India we believe in the going concern concept, we believe in reconstruction of the company, our business structures are so that we design/perceive them for generations and we feel trust where the business is transferred from one hand to another through tradition. This makes the whole Entry and Exit for a business very difficult and business houses keep on borrowing funds just to keep the sustenance as they fear the taboo of Insolvency and Bankruptcy attached to it.

This whole situation of keeping the business operationally functional without understanding the depth of gaps in cash-flow and accumulated debts/losses causes the defaults at the stage where there is no return point. This not only causes loss of jobs and creditability of corporate debtor, but it also causes loss of public money and spiral effect on the operational and financial creditors.

To safeguard the interest of Creditors and Employees (partly or wholly) the law is prescribed which has been more simplified by Insolvency and Bankruptcy Code, 2016. Wherein Liquidation is a Legal Procedure, with step by step prescribed structure under this Code. The compulsory liquidation under this code is guided and monitored by NCLT with appeal Tribunal being NCLAT and final authority being the Supreme Court of India.

Winding Up is not Liquidation, It’s the beginning point of Liquidation. Whereas the ending point is Dissolution.

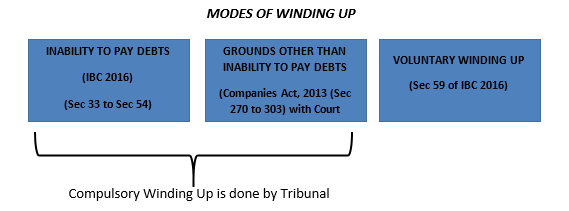

Grounds of compulsory winding-up other than inability to pay debts

Compulsory winding up is done by Tribunal.

- Company Passes a Special Resolution and wants to be liquidated by Tribunal.

- Company is acting Anti-National or Has conducted Fraudulent Activities.

- Defaults in Filing Financial Statements and Annual Returns for a Period of 5 Yrs. (Consecutively)

- Winding up is the Equitable ground in the eyes of the Tribunal.

Eligible for filling petition to Tribunal

- The Company – Director/ Director’s or Authorised Representative on Behalf of the Company through Special Resolution.

- The Contributory – He is the Person or Group of Person’s Liable to pay at the Liquidation.

- The Registrar of the Companies.

- Person Authorised By Central Government.

- Central Government or State Government.

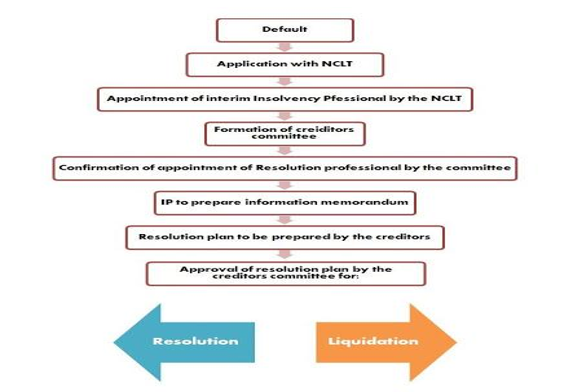

Step towards liquidation

When can liquidation order be passed by the tribunal

- NCLT does not receive a resolution plan under sub section(6) of Section 30 before the expiry of 180 days or extended time (if any) extension is permitted u/s 33(1)(a).

- NCLT rejects the Resolution Plan u/s 31 on Non-Compliance of the requirements u/s 33(1)(b).

- When Resolution Professional intimates the Tribunal, anytime during the CIRP before the confirmation of the Resolution Plan, on the decision by CoC for Liquidation of the Corporate Debtor. Amendment dated 16th Aug 2019 u/s 33(2).

- Where the Resolution Plan approved by the NCLT is contravened by the concerned corporate debtor, or any person other than the corporate debtor, whose interest are prejudicially are affected by such contravention, may make an application to NCLT for Liquidation Order u/s 33 (3); on receipt of such an application, if NCLT feels that the corporate debtor has contravened the Resolution Plan then it can order Liquidation.

Rationale of Amendment that Anytime Liquidation Resolution can be passed:

- There are No Business Prospects for the Company.

- There is no point spending good money to make efforts to recover bad money, where the situation is grim and non-reconstructive with any amount of effort.

- There is no substance in chasing legal suits or cases for recovery due to clear bankruptcy situation.

- The gap between the Assets of the company and the Liability payable is huge and not sufficient.

- The assets in form of immovable or securities are also not easily recoverable.

- There is lack of business feasibility or revival of opportunities.

- Even recovering the cost of CIRP and other expenses are negligible.

- No constructive resolution plan seems possible for revival.

We can refer case laws:

- VIP Finvest Consultancy Pvt Ltd v/s Bhupen Electronics – company has to go for liquidation as the company is not operation for a decade and no employee is on payroll.

- Esskay Motors Pvt Ltd – contended that the Resolution Professional did not invite the bid for interested parties, whereas the CoC recommended that inviting of bids would have prolonged the process and as the firm was not a going concern thus the liquidation needs to be ordered.

Steps of Liquidations Process:

The steps defined here are generally followed after the liquidation process is imitated by NCLT:

- Appointment of Liquidator;

- Public Announcement of Liquidation and Calling for Submission of claims;

- Appointment of atleast 2 Valuers as per Regulation 35;

- (a) Verification and Acceptance/ Rejection of Claims;

(b) Preparation of Assets Memorandum and Other Specified Reports;

- Formation of Liquidation Estate (with Inclusions and exclusions);

- Sale of Assets;

- Distribution of Assets;

- Dissolution of Corporate Debtor(to be completed in 2 yrs).

Liquidator

Once the Liquidation Process is initiated the first step done by NCLT is the appointment of the Liquidator, he is the person who independently is authorized and accountable for all the responsibilities under the liquidation process. He needs to deal with the creditors and organize meetings as and when necessary, he takes the control of the business and sell’s off the assets and distribute the proceeds amongst the creditor. He also investigates the conduct of the directors and as and when needed reports the same to the Tribunal.

Who is the liquidator?

- The Resolution Professional appointed by the CIRP under Chapter II, subject to the written consent to the NCLT, act as the Liquidator for the purposes of Liquidation unless replaced by the NCLT u/s 34(4).

- For the purpose of clauses u/s 34(4)(a) & (c) the NCLT may direct IBBI to propose a name for another insolvency professional as a liquidator and IBBI may propose the name with 10 days along with written consent of the RP.

- The NCLT by Order may replace the resolution professional if any –

- The resolution plan submitted by the resolution professional u/s 30 was rejected for failure to meet the mandatory requirement under the given sub section (2) of section 30.

- If IBBI proposes the replacement and gives another resolution professional for the same.

- The resolution professional fails to submit the written consent.

Can COC appoint a Liquidator other than RP? – The Answer is Yes

Cases that can be referred when a Committee of Creditors appointed a Liquidator Other than the Resolution Professional of Corporate Resolution Insolvency Process:

- Sandeep Kr. Gupta (RP) V/S Stewarts & Llyods of (I) Ltd and An NCLT

- Devender Padamchand Jain(RP) v/s SBI & Ors NCLT

- Punjab National Bank V/S Mr. Kiran Shah Liquidator of ORG Informatics Ltd

Eligibility of a Liquidator: (Regulation 3)

- Eligible only if IP or every partner or director of his IPE is independent of the CD.

Explanation: A person can be considered independent of the CD

- If he is eligible to be appointed as an independent director on the board of CD u/s 149 of the Companies Act, 2013

Where the Corporate Debtor (CD) is a company;

- If he is not related party of the CD or

- Has not been an employee or proprietor or a partner:

- Of a Firm of Auditors or Secretarial Auditors or Cost Auditors of the CD or ;

- Of a legal or a consulting firm, that has or had any transaction with the CD contributing 10% or more of the gross turnover of such firms, in the last three financial years.

- A liquidator shall disclose the existence of any pecuniary or personal relationship with the concerned CD or any of its stakeholders as soon as he become aware of it, to the IBBI and AA.

- An IP shall not continue as a liquidator if the IPE of which he is a director or partner, or any other director or partner of which IPE represents any other stakeholder in the liquidation process.

- The fees of the liquidator is paid from the proceeds of the liquidating estate as per section 53 of IBC and Regulation 4.

Filing claims by stakeholders

- Claim is defined u/s 3(6) it means –

- A right to payment, whether or not such right is reduced to judgement , fixed , disputed, undisputed, legal, equitable, secured or unsecured.

- Right to remedy for breach of contract under any law for the time being in force, if such breach gives rise to a right to payment, whether or not such right is reduced to judgment, fixed, matured, unmatured, disputed, undisputed, secured or unsecured.

- Under Section 18 (b) the duties of IRP or Liquidator to receive and collate all the claims submitted by the creditors to him, as per the public announcement. Further the duties of liquidator or RP to maintain and update the list of claims is explained u/s 25(2)(e).

- Powers and duties of liquidator for verifying claims (section 35(1)(a)) and to invite, settle and distribute the claims (sec 35(1)(j) are well defined under the code.

- Powers of Liquidator to access information for the purpose of admission and proof of claims u/s 37(1).

- Verification of claims by Liquidator u/s 39 and Reg 30.

- Submission of claims and proof of existence of debt:

- By Financial Creditors – as per Reg 18 – Form D of Schedule II by electronic means only.

- By Operational Creditors – as per Reg 17 – Form C of Schedule II by post or electronic means or in person.

- By Workmen & Employees – as per Reg 19 – Form E of Schedule II by post or electronic means or in person.

- By Other Stakeholders – as per Reg 20 – Form G of Schedule II by post or electronic means or in person.

Rejection of claims

- The claim is admitted after verification, usually the liquidator mentions the deficiencies if the provisional claim is submitted.

- The liquidator has to give and record a detailed reasoning for the rejection of the claim and also explain the process followed for verification.

- The rejection of the claim has to be prudent and reasonable course of action.

Preparation of asset memorandum

Under section 36 the liquidator shall prepare Asset Memorandum within 75 days from the Liquidation commencement date. The asset memorandum provides a detailed report on the realizable assets under the liquidation process it will constitute the following:

- Value of Assets as per Regulation 35;

- Value of Business as per Regulation 35 and Regulation 32(b) to (f), if intended to be sold under those clauses;

- Intended manner of sale;

- Mode and Reasons of Intended Sale;

- Expected realization Amount from such Sale;

- Any other information relevant to the sale of assets.

The liquidator will file the preliminary report to the Adjucating Authority in complete confidentiality.

Formation of liquidation estate

Section 36 states that the liquidator will form an estate of the assets mentioned in asset memorandum as per sub section (3). Further the sub section (4) elaborates the inclusions and exclusions of the Liquidation assets and ensures that all the tangible and intangible assets that hold a realizable value shall be comprised under the Liquidation Estate those were vested in by the corporate debtor at the Insolvency Commencement date.

Distribution of assets

The Liquidator u/s 53 shall not commence the distribution of assets till the list of stakeholders and asset memorandum is filled with the Adjucating Authority. The Liquidator has to follow the timeline and distribute the proceeds within 90 days of realization. The CIRP cost (if any) and the Liquidation Cost have to be deducted before the distribution of the proceeds to the approved stakeholders.

Priority of Distribution:

- CIRP and Liquidation Cost;

- Workmen dues (for 24 months), and secured creditors, if the interest has been relinquished;

- Employee dues (for 12 months);

- Unsecured Financial Creditors;

- Government dues and unpaid dues of Secured Creditors;

- Preference Shareholders;

- Equity Shareholders;

Dissolution of the corporate debtor

The Liquidator under section 54 initiates the dissolution of the corporate debtor when the assets are completely liquidated. The Adjucating Authority under sub section (1) orders dissolution from the date of order. Copy of the order under sub section (2) is forwarded within 7 days to the authority where the corporate debtor is registered.

Conclusion

The first and foremost objective of IBC is to Revive, if that doesn’t happen then Realize Maximum Value of the Assets and the third but not the least is to give Business Friendly Ecosystem where the Entrepreneurship can grow and balance the availability of Credit and Interest of all.

“Success is not build on Success, It builds on failures, it builds on frustrations, and sometimes its build on Catastrophe”. So, if the business situation is at the end of the road then it’s better to stop beating around the bush – close and move on.

References

- U/s 33(2) of IBC Amendment dated 16th Aug 2019

- https://www.dissolve.com.au/blog/top-9-business-insolvency/

- Insolvency and Bankruptcy Board of India (Liquidation Process) (Amendment) Regulations, 2020

- Model Timeline for Liquidation Process as per extraordinary part III, u/s 4 published on 25th July, of Insolvency and Bankruptcy Board of India (Liquidation Process) (Amendment) Regulations,2019

- https://ca2013.com/2-5-34insolvency-bankruptcy-board-india-liquidation-process-regulations-2016/

- https://ibclaw.in/section-36-liquidation-estate/

- http://www.legalserviceindia.com/legal/article-1059-liquidation-process-and-asset-distribution-under-ibc.html

- Swiss Ribbons Pvt Ltd V/S Union of India and Ors

Students of Lawsikho courses regularly produce writing assignments and work on practical exercises as a part of their coursework and develop themselves in real-life practical skill.

LawSikho has created a telegram group for exchanging legal knowledge, referrals and various opportunities. You can click on this link and join:

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Allow notifications

Allow notifications