This article is written by Kiranjeet Kaur. This article explores the Tata Mistry case, a significant legal battle in the corporate world. It further explores the relevant provisions of the Companies Act of 2013, shedding light on the evolving landscape of safeguarding minority shareholders’ rights and upholding corporate governance standards within large corporate entities.

Table of Contents

Introduction

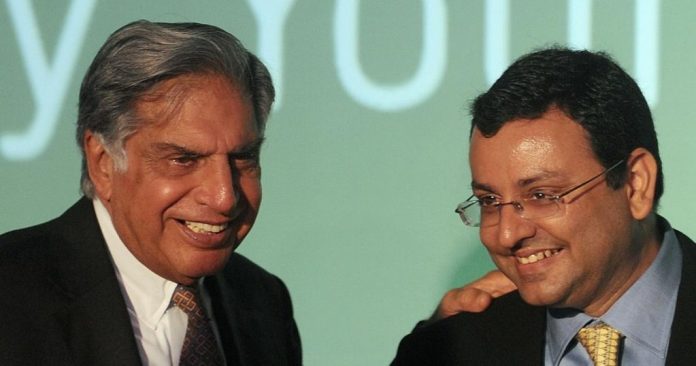

The corporate legal battle that took place between Tata Sons Private Limited (Tata Sons), led by Mr. Ratan Tata, and the Shapoorji Pallonji Group (Tata Consultancy Services Ltd. v. Cyrus Investment Pvt. Ltd., 2021) gained worldwide attention and emerged as a significant ruling on issues related to oppression and mismanagement under the Companies Act, 2013. The feud first came into the limelight when it made its way to the National Company Law Tribunal (NCLT) in Mumbai in November 2017. The Supreme Court passed a comprehensive judgement on the matter, on March 26, 2021. This case attracted a lot of attention globally not only because it involved two major conglomerates but also due to its potential to advance Indian corporate law and legal philosophy. Surprisingly, it turned out to be the first case dealing with shareholder oppression and mismanagement under the Companies Act, 2013, to reach the Apex Court of India. The case also sheds light on various other aspects of the Indian corporate law and specifically the provisions under the Company law, such as the roles and duties of directors, the fiduciary nature of their duties, the allegiance of nominated directors, the nature of affirmative voting rights, and the scope of ‘prejudice’ against specific classes of shareholders.

According to Mr. Mistry, he was deliberately ousted as this would enable Tata Sons in reasserting their authority in the company. This assertion is contingent on the fact that he had always been very open about the low standards of corporate governance maintained within the company. Further smearing Mr. Mistry’s image was a planned move to curtail the Shapoorji Pallonji group’s influence within the company and its prominent subsidiaries. This was done covertly, with the overall aim of weakening the position and the rights of the minority shareholders within the company.

Throughout the legal proceedings, judicial and quasi-judicial bodies, including the NCLT, National Company Law Appellate Tribunal (NCLAT), and the Supreme Court have given their own views on the present matter. The NCLT dismissed all of Mr. Mistry’s allegations of oppression and mismanagement, ruling them baseless. Subsequently, the NCLAT overturned the decision passed by the NCLT, reinstating Mr. Mistry as the Executive Chairman of Tata Sons. However, the Supreme Court ultimately overturned the decision passed by NCLAT, largely supporting the NCLT’s ruling in favour of Tata Sons.

In this article, I’ve delved into the complexities of the Tata-Mistry case, a pivotal legal dispute in the corporate realm. I’ve analysed the case through the lens of corporate governance in India, focusing on the continual pursuit of safeguarding shareholder interests. By examining the relevant provisions of the Companies Act of 2013, I aim to shed light on the evolving landscape of corporate governance standards and the protection of minority shareholders’ rights within prominent corporate entities. Through comprehensive exploration, I seek to provide insight into the challenges and developments surrounding corporate governance practices in India, using the Tata-Mistry case as a compelling example.

Detailed description of the parties

Tata Sons Private Limited: is a private limited company registered under the Companies Act of 1913. It serves as the principal investment holding company as well as the promoter of various Tata Group companies. Mr. Ratan Tata served as the chairman of Tata Sons from 1991 until his retirement on December 28, 2012.

- Tata Trusts: The trusts associated with Tata Sons, including the Sir Dorabji Tata Trust established in the year 1932, the Sir Ratan Tata Trust established in the year 1919, and other affiliated trusts such as (Tata Education and Development Trust (2008), Sarvajanik Seva Trust (1975), Lady Tata Memorial Trust (1932), and the JN Endowment for the Higher Education of Indians Trust (1892) and many more, collectively known as the “Tata Trusts”) hold 66% of the equity share capital of the company. Each of these trusts is determined and engaged in delivering philanthropic services to the society such as facilitating education, economic sustenance, and promoting health, well-being, art and culture. The subsidiary companies under Tata Sons operate autonomously, guided solely by the Board of Directors of the respective subsidiary companies under the Tata Sons Private Limited, the holding company.

- Mr. Cyrus Pallonji Mistry, the son of the former Non-Executive Director, Shri Pallonji S. Mistry, took charge of the company as the chairman, succeeding Mr. Ratan Tata in the year 2012. However, Mr. Mistry was removed from the position of chairman on October 24, 2016, following a collective decision by the Board of Directors (Board) of the company who had lost confidence in Mistry’s leadership as a chairman of Tata Sons.

- Key subsidiaries involved

- Tata Consultancy Services Limited (TCS), founded in 1968, is a subsidiary company of Tata Sons dedicated towards fostering mutual collaborations with IT services, digital and enterprise solution providers to enhance and bolster the enterprises owned by their clientele worldwide.

- Tata Teleservices Limited (TSL), founded in 1868, is also a subsidiary company of Tata Sons, initiating the company’s engagement in the Telecom industry. The company is involved in providing services like cellular connectivity and related services.

- Tata Industries Limited (TIL), another subsidiary company of the Tata Sons founded in 1868, has been established with the motive of expanding the enterprises of Tata Sons into numerous sectors.

- Cyrus Investments Private Limited and Sterling Investment Corporation Private Limited are both investment companies held by the Shapoorji Pallonji Group. Both of these companies held a significant number of shares in Tata Sons, as aforementioned. Mr. Cyrus Mistry held a substantial stake in both of these investment companies.

Facts of Tata Consultancy Services Ltd v. Cyrus Investment Pvt. Ltd. (2021)

- In the middle of this corporate dispute, the significant event was the removal of Mr. Cyrus Pallonji Mistry, the Executive Chairman of Tata Sons Private Limited, from his position, accompanied by his removal from the position of director roles in other prominent companies within the Tata Group. As minority shareholders holding 18% of the paid up share capital of Tata Sons, the Shapoorji Pallonji Group, represented by Cyrus Investments Private Limited and Sterling Investment Corporation Private Limited, found themselves at odds with the unfolding events. These companies, part of the Shapoorji Pallonji Group, initially owned 48 preference shares and 40 equity shares respectively of Tata Sons, a stake that has since increased substantially, as highlighted above. Mr. Mistry, who was removed from his position, holds a controlling interest in these companies. His removal in 2016 resulted from growing concerns regarding his leadership and management style. Factors contributing towards his removal included his engagement with the Income Tax Authorities and the unauthorised disclosure of confidential emails.

- According to Mr. Mistry, he was deliberately ousted as this would enable Tata Sons in reasserting their authority in the company. This assertion is contingent on the fact that he had always been very open about the low standards of corporate governance maintained within the company. Further smearing Mr. Mistry’s image was a planned move to curtail the Shapoorji Pallonji group’s influence within the company and its prominent subsidiaries. This was done covertly, with the overall aim of weakening the position and the rights of the minority shareholders within the company.

- On March 16, 2012, Mr. Cyrus Pallonji Mistry was appointed as the Executive Deputy Chairman of Tata Sons for a period of five years, pending shareholder approval. Following the shareholders’ endorsement in a general meeting, Mr. Mistry’s appointment was confirmed. Subsequently, on December 29, 2012, he was repositioned to serve as the Executive Chairman of the company from 2012 to 2016, while Mr. Ratan Tata remained the Chair Emeritus of Tata Sons.

- Initially, things went well between the two, with Mr. Ratan Tata strongly supporting the candidature of Mr. Mistry for the position of chairman. However, their relationship soured over time due to differences in management styles. Mr. Mistry was accused of being too autocratic in his approach which eventually led to his removal in the year 2016. Mr. Ratan Tata was subsequently appointed as interim Non-Executive Chairman of Tata Sons.

- Specific provisions of the company’s Articles of Association, such as Article 75 (Power of the company to transfer ordinary shares by way of passing a special resolution without serving any prior notice), were subjected to scrutiny. Mistry raised concerns regarding the ethical implications of the Tata Trusts’ influence on the Board, suggesting potential lapses in corporate governance. Various transactions and business dealings, including those involving Air Asia India (P) Ltd. (a deal worth twenty-two crores), and the acquisition of Corus Steel (Corus) at an alleged outsize payment, were also highly criticised by Mistry.

- Mistry’s confidential communication to the directors of the company, regarding their inability to exercise their fiduciary duties, and other emails highlighting ethical concerns, became public knowledge after being leaked to the media, sparking considerable sensation.

- Following these events, Tata Sons issued a clarificatory press statement, emphasising a drop in returns during Mr. Mistry’s tenure. This statement aimed to shed light on the company’s performance under his leadership.

- Shortly thereafter, from December 12 to December 14, 2016, shareholders of TIL, TCS, and TSL voted to remove Mr. Mistry as a director.

- On December 19, 2016, Mr. Mistry preemptively resigned as director from the board of Indian Hotels Company Limited, Tata Chemicals Limited, and Tata Power Company Limited. Tata Motors, and Tata Steel Limited, anticipating resolutions for his removal.

- The corporate dispute further unfolded as tensions between the two major conglomerates escalated, eventually reaching the courtrooms. Cyrus Mistry’s conflict with Tata Sons became public when he approached the NCLT on December 20, 2016, following his removal as Executive Chairman, for reasons stated above. His petition, filed under Section 241 (the provision encourages filing of the applications to the Tribunal by the members of the company for the purposes of obtaining relief for matters pertaining to oppression and mismanagement) and Section 242 (the provision talks about the suo-motu powers of the Tribunal in matters related to oppression and mismanagement in a company) of the Companies Act, accused majority shareholders, including Rata Tata, Noshir Soonawala (former Vice Chairman at Tata Sons and trustee of the Sir Dorabji Tata Trust and Sir Ratan Tata Trust), and others, of engaging in practices detrimental to the company, its stakeholders and the public. Mistry questioned the circumstances of his removal, contesting the decision’s arbitrariness.

- Subsequently, on January 17, 2017, Mr. Chandrasekaran was appointed as Chief Executive Officer and Managing Director of TCS and Chairman of Tata Sons, marking a transition in leadership.

- Finally, on February 6, 2017, Mr. Mistry was officially removed as a director from the board of Tata Sons, marking a significant event in the ongoing dispute between Cyrus Mistry and the Tata Group.

Key provisions related to oppression and mismanagement under the Companies Act, 2013

Section 244 of the Companies Act, 2013 empowers a certain class of members of a company with the right to file an application to the NCLT as provided under Section 241 of the Act. This is applicable only when the members of a company are of the view that the business operations of the company are being carried out in a way that is oppressive and prejudicial to the interests of its members, the company itself and the general public at large. One of the most important prerequisites for a member of a company to file an application to the NCLT depends on whether the company, against which such an application is filed has a share capital or not.

For companies having a share capital, the right to file such an application is granted to either at least one hundred members of the company or not less than one tenth of the total number of its members, whichever is less. Alternatively, an application can be filed by any member or member holding not less than one-tenth of the issued share capital of the company, provided that they have paid all calls and other sums due on their shares.

For companies not having a share capital, the right to file an application is granted to not less than one-fifth of the total number of its members.

However, the proviso to Section 244 allows the NCLT to waive off all or any of these requirements upon application. This particular waiver empowers the members to file an application to the NCLT under Section 241, even if they fail to meet any of the criterias outlined in Section 244 of the Companies Act, 2013 for matters related to oppression and mismanagement of minority shareholders in a company. This provision aims to ensure that minority shareholders can seek redressal for oppressive and prejudicial acts committed by the

company’s management, even if they cannot meet the strict quantitative criteria outlined in the provision.

The challenged Articles within the Article of Association of Tata Sons

| Article | Provision |

| Article 75 | Allows the transfer of ordinary shares by special resolution without prior notice. |

| Article 86 | Requires the presence of a Tata Trusts representative at general meetings if Tata Trusts collectively hold at least 40% of the company’s paid-up capital |

| Article 104 | Grants Tata Trust the right to nominate three ‘Trustee Nominated Directors.’ |

| Article 118 | Establishes a Selection Committee to recommend the appointment of the Chairman if Tata Trusts hold at least 40% of the paid-up equity capital. |

| Article 121 | Mandates that decisions of the Board require affirmative consent from a majority of ‘Trustee Nominated Directors’. |

| Article 121-A | Requires the decisions to be brought before the Board, where ‘Trustee Nominated Directors’ hold the majority. |

Issues

- Whether Mr. Mistry’s removal as Executive Chairman and subsequently as director of the company was oppressive or prejudicial to the interests of the company?

- Whether the Articles of Association of Tata Sons are in itself repressive as they enable the Tata Trusts especially Sir Ratan Tata Trust and Sir Dorabji Tata Trust to maintain their dominance over the affairs of the company, and if they have been misused by Mr. Ratan Tata?

- Whether the constant intervention by Mr. Ratan Tata and Mr. Noshir Soonawala in the affairs of the company, was prejudicial to the interests of the company?

- Whether the manufacturing of the Tata Nano, a failed project carried out by Tata Motors at the behest of Mr. Ratan Tata detrimental to the interests of the company?

- Whether Tata Steel’s acquisition of Corus Group in 2006, negatively impacted the company or the petitioners’ interests?

- Whether the business deals made with Siva Group Companies by Mr. Tata proved detrimental to the interests of Tata Sons and its business operations?

- Whether the acts occurring in Air Asia India (P) Ltd constituted a prejudicial conduct against the interests of the company and the public?

- Whether the Company’s actions regarding a special resolution for conversion from public to private under Section 14, without altering relevant articles in the Articles of Association, were oppressive or prejudicial to the petitioner’s interests?

Contentions of the petitioner (Cyrus Investments Private Limited)

- The ousting of Mr. Mistry from the position of chairman of Tata Sons was challenged on the grounds of being unlawful, posing serious questions on the company’s principles of governance, accountability, fairness, and integrity.

- Mr. Mistry contended that certain Articles within the Articles of Association of Tata Sons, (especially Article 75), are inherently oppressive in nature as they confer excessive authority upon the Tata Trusts (Sir Ratan Tata Trust and Sir Dorabji Tata Trust), resulting in the Trusts having substantial control over the company’s affairs and business operations.

- Mr. Mistry also alleged that Mr. Ratan Tata and Mr. Noshir Soonawala were extremely intrusive, interfering and dominant in every affair of the company.

- The continuation of the failed Nano Car Project, undertaken by Tata Motors at the behest of Mr. Ratan Tata, was strongly criticised by the petitioners. The Petitioners argued that the Nano project, which has incurred losses exceeding 1000 crores, should be terminated. However, emotional ties related to Mr. Tata’s involvement in the project, have prevented the decision to shut it down.

- The acquisition of Corus by Tata Steel Limited at an alleged outsize payment was also questioned by the petitioners. Tata Steel Limited acquired Corus for over USD 12 billion, an amount exceeding its original offer price by 33%.

- The ultra vires usage of Tata Sons shareholding in certain subsidiary companies of the Tata Group to call for an extraordinary general meeting for the removal of Mr. Cyrus Mistry from the position of Director on the company’s Board was also challenged.

- The petitioners argued that the partnership with Air Asia was established before Mr. Mistry assumed the role of Executive Chairman, suggesting it was imposed upon him. They further alleged that Mr. Venkataramanan (former managing trustee of Tata Trusts), influenced by Mr. Tata, engaged in diverting funds from Air Asia. Additionally, the Petitioners claimed that a forensic investigation by Deloitte revealed fraudulent transactions totalling up to Rs. 22 crores through non-existent parties in India and Singapore via hawala transactions. They accused Mr. Tata of indirectly financing terrorism and tarnishing the Tata Group’s image.

- Various actions undertaken by Tata Sons significantly impaired the position and status of independent directors across the listed companies of the group, including attempts to remove Mr. Nusli Wadia, the chairperson of Bombay Dyeing, due to his consistent support and endorsement of Mr. Mistry’s decisions, which was also criticised by the petitioner in their pleadings.

- The petitioner also submitted that the regular sharing of board meeting agendas and other sensitive information with Mr. Ratan Tata, who held no full-time position in the Tata group listed companies, was violative of the Securities and Exchange Board of India (Prohibition of Insider Trading) Regulations, 2015.

- The petitioners also blamed Mr. Ratan Tata for having close affiliations with Siva and Sterling group of companies, which they believed was the sole reason behind the company’s confidential Board meeting decisions being frequently exposed to the public.

- Lastly, the petitioners blamed Mr. Ratan Tata for bestowing excessive confidence upon Mr. Mistry and entrusting him with major contracts of the company, empowering him while compromising with the interests of the company.

Contentions of the respondent (Tata Sons)

- The Company’s response to the allegations was that the petitioner’s pleadings are wholly centric on Mr. Mistry’s removal and the present company petition filed before the NCLT solely depicts Mr. Mistry’s outrage against his removal from the position of chairman of the company hidden under the veil of oppression and mismanagement. Therefore, the company negated all the allegations, stating that the petition merely reflected Mr. Mistry’s dissatisfaction with his removal and that Mr. Mistry was using it as a tool to tarnish the company’s reputation.

- Further, the other members of the company and major stakeholders highlighted the unwavering confidence in Mr. Ratan Tata’s leadership during his tenure as Chairman of the company for the past 21 years (1991-2012), which saw a significant increase in the valuation of the company for up to 500 times.

- It was also submitted that the Board had already clarified that although Mr. Tata was no longer a board member, he would be invited to board meetings as a special permanent guest, and it was solely left to his discretion to be part of meetings which he felt were necessary to attend. Further, the directors of the company, if needed, could always reach out to him for any kind of assistance and guidance with respect to the conduct of affairs of the company.

- Addressing Mr. Mistry’s allegations pertaining to certain articles in the company’s Articles of Association being arbitrary. Tata Sons stated that the shareholders of the company had consensually passed a resolution authorising the Tata Trusts to collectively nominate one-third of the directors on the Board while maintaining the Trust’s 40% shareholding within the company. Further, the resolution thus passed also made it mandatory for matters requiring a majority vote of directors to be supported by the affirmative vote of all the directors appointed under Article 140B of the company’s Articles of Association. However such requirements were altered later making the procedure of varying attendance at the board meetings more flexible, convenient and effective. Such an amendment proposed that instead of seeking the mutual acceptance of all the directors appointed under Article 140B, a decision could be taken if a majority of these directors present at board meetings supported it. Furthermore, the company clarified that during the general meeting, where such amendments were proposed Mr. Mistry was present and had also expressed his support towards such alterations in the disputed article, which he was now claiming to be obliterated.

- It was further submitted that many of Mr. Mistry’s decisions, such as capital distribution, depicted his little enthusiasm in addressing the issues reported by the company and its management. There was a lack of precision in strategies pertaining to business, along with a deficiency of vigour and vitality needed for developing the business to achieve greater goals. His failure to respect the articles outlined in the Articles of Association of the company further made his leadership questionable to the company and contributed to the Board losing confidence in him and his leadership.

- The company blamed Mr. Mistry of strategically decreasing the Tata Son’s representation on the boards of its other prominent subsidiary companies. With the passage of time many of the directors serving on the board of different companies under the Tata Group had retired. According to the company, Mr. Mistry deviated from the traditional practices of the company as he failed to appoint any of the retired directors to the boards of other subsidiary companies under the Tata Group which has been a common practice for the company in the past. The company further contended that the actions undertaken by Mr. Mistry towards strategic reduction resulted in a potential departure from the cohesive organisational culture and strategic alignment that Tata Group historically aimed to maintain. It was further claimed that Mr. Mistry ensured that each and every piece of communication, information, directives and strategies passed through him and such concentration of communication channels really hampered the company’s functioning and coordination with its other subsidiary companies.

- The company through its submissions countered Mr. Mistry’s imprudent decision of permitting Tata Power Renewable Energy Limited which is a subsidiary company of Tata Power to acquire Welspun Renewables Energy Ltd. for a consideration exceeding USD 1 billion. The decision was highly criticised by the company as Mr. Mistry neglected the fact that the company was already in huge debt of around 40,000 crores and the tariff issues faced by the company at their Mundra project, still remained unresolved and the major issue lied in the fact that he did not feel that it was necessary to consult any of the directors from the company before permitting such acquisition by Tata Power Renewable Energy Limited.

- In response to the petitioners raising concerns about the Articles of Association of the company, the respondents claimed that the Articles of Association were previously endorsed by Mr. Pallonji Mistry, father of Cyrus Mistry and Mr. Mistry himself, and so far as the amendments were concerned such amendments had been made a long time ago which was not an issue to the petitioners and the same were not contested until Mr. Mistry’s removal.

- Regarding the acquisition of Corus Group by Tata Steel, the company defended its decision as the largest cross-border acquisition by an Indian conglomerate, positioning Tata Steel as the sixth-largest producer of steel worldwide. The Nano Project undertaken by Tata Motors aimed at transforming the passenger car market in India. Addressing the company’s engagement with Siva Group, the company clarified that the group is a consultant to Tata Teleservices Limited (TTSL), serving as an equity investor. The company also added that its decision of entering into a joint venture with two of Asia’s preeminent airline carriers, targeting both low-cost and premium full-service segments had paved its way for reengaging itself in the aviation market.

- Regarding allegations pertaining to Mr. Mehli Mistry, the company also pointed out that nowhere in the petition it had been mentioned that Mr. Mistry served as a director on the Board of Tata Power since 2002. All business deals entered between Tata Power and Mr. Mehli Mistry had been ratified by Mr. Mistry himself. Therefore, the company argued that all the allegations made in the petition were not maintainable due to significant delays in addressing them, as most of the instances had taken place between 1993 and 2008. These matters, the company contended, could not be brought before the NCLT solely because Mr. Mistry was removed as chairman.

- The company submitted that the current company petition filed by Mr. Mistry has solely emerged out of his disdain towards Mr. Ratan Tata and Mr. Soonawala, aiming to stain Tata Sons’ image. It is alleged to be a planned move by Mr. Mistry to demonstrate his vengeance towards the company following his removal.

- Additionally, the company through its submissions proposed that the accusations in the petition do not qualify as organisational affairs of the company instead the entire petition is inclined towards challenging the operations of Tata and its allied trusts which is not admissible under the law. Moreover, allegations brought against the company pertaining to infringement of insider trading regulations and the Foreign Exchange Management Act, 1999, fall beyond the subject matter jurisdiction of the bench before which the current petition is filed.

- The company strictly denied the purported allegations of Tata Trusts operations being prejudicial to the company’s functioning and interest because if that was the scenario it would be the Trusts who would be highly affected as it would directly hamper the investments held by these Trusts within the company.

- Further, the respondents contested that the petitioners have primarily highlighted some of the failed business endeavours undertaken by Tata Sons Private Limited at the behest of its ex-chairman Mr. Ratan Tata labelling the decisions to be thoughtless and unwise, however, the respondents highlighted that some of the most successful business dealings made by Mr. Tata during his tenure as the chairman of the company including the acquisition of Tetley and most importantly the acquisition of Jaguar Land Rover and commendable success of TCS which have been cornered by the petitioners in their submissions.

- The respondents also countered the petitioners’ argument with respect to the alleged fraudulent acts occurring in Air Asia, asserting that Mr. Mistry’s involvement in the decision-making process of entering into a joint venture was evident from his presence and approval in the board meetings. They highlighted Mr. Mistry’s active participation in key decisions, including the establishment of Vistara Airlines and the allocation of funds to Air Asia. Regarding the alleged fraudulent transactions worth Rs. 22 crores, they emphasised that the forensic investigation implicated the ex-CEO of Air Asia, not the directors. Further, the respondents asserted that the decision to increase investment in Air Asia was made during Mr. Mistry’s tenure as Executive Chairman.

- In response to the allegations pertaining to Mr. Noshir Soonawala’s intervention in the company’s affairs, the respondents submitted that Mr. Soonawala has always held prominent positions in the company. He served the company as Finance Director from 1988-89 and later as Vice Chairman and Finance Advisor for a period of eleven years. The Board and key persons in the company, including Mr. Mistry, collectively decided that Mr. Soonawala would serve as an advisor, providing necessary assistance and guidance in the financial matters of the company. The company also mentioned in its submissions that there have been instances where Mr. Mistry himself had consulted Mr. Soonawala for his guidance and advice on various affairs of the company.

- Finally, the company denied all allegations made by Mr. Mistry against Tata Sons and submitted that Mr. Mistry’s removal was done in accordance with the law following the provisions of the Companies Act, 2013, and argued that ousting Mistry from the position of chairman is legitimate and intra vires. The company also denied the allegations of oppression and mismanagement within the company.

NCLT’s Order

In November 2017, Mr. Mistry filed a company petition against Tata Sons Private Limited in NCLT, Mumbai regarding the company’s conversion from a Public Limited Company to a Private Limited Company. However on July 9, 2018, the NCLT, Mumbai rejected Mr. Mistry’s contentions, including his removal as chairman of the company, and dismissed his accusations of constant misconduct being meted out at the hands Mr. Tata and the Board. According to NCLT, the present matter was not maintainable as the allegations brought by Mr. Mistry against the company pertaining to mismanagement and oppression were solely unsubstantiated and baseless and the NCLT also clarified that there was nothing wrong on the part of the company going private from a Public limited company. The NCLT made the following observations in the present matter:

- The NCLT ruled that Mr. Mistry’s removal was solely made on grounds of a growing trust deficit in his leadership as chairman of the company and rejected his allegations of deliberate action by Mr. Ratan Tata and Mr. Noshir Soonawala who saw it as an opportunity to show their dissatisfaction and disdain towards Mr. Mistry. The NCLT clarified that the approval of the selection committee was not necessary for the purpose of removal of Mr. Mistry as executive chairman.

- Further, the NCLT ruled that Mr. Mistry’s removal was attributed to various issues, including his discussions with Income Tax Authorities, failure to maintain secrecy and confidentiality as most of the confidential information was shared and made public by him to the media houses in India, and expressing discontentment with the company and its allied trusts.

- According to the NCLT, the removal of Mr. Mistry from the directorship of the company as a subject matter did not fall under Section 241 of the Companies Act, 2013.

- The NCLT found no substance in the petitioner’s argument regarding proportionate representation on the board. The contention was that board representation should align with the number of shares held by the petitioners, which was deemed achievable unless the Articles of Association specify otherwise, as per Section 163 of the Companies Act, 2013.

- The purported allegations of enriching certain individuals known to be close to Mr. Tata at the cost of the company for instance Mr. Mehli Mistry, and allegations pertaining to the Siva Group, TTSL, Air Asia, Corus acquisition, and the failed Nano Car project were all rendered baseless by the NCLT under Sections 241 and 242 as envisaged under the Companies Act of 2013.

- The NCLT also rejected all allegations regarding Mr. Tata and Mr. Noshir Soonawala’s interference in the affairs of the company and that of them being prejudicial further acting as de facto directors of the company always trying to influence the decisions of the company by imposing their wishes. The Tribunal found these claims lacked substantial and evidentiary support.

- Furthermore, the Tribunal rejected all the allegations challenging the legitimacy of various articles outlined within the Articles of Association of Tata Sons Private Limited, including Articles such as 75, 104B, 118, and 121, on grounds of being oppressive and detrimental to the interests of the petitioners.

- The NCLT ruled that the application under Section 14 of the Companies Act, for the conversion from a public to a private company, does not fall within the scope of Sections 241 and 242. According to the NCLT, there is no provision incompatible with Section 43A (1A) and (2A) of the Companies Act, 1956, and the company retains the right to inform the Registrar of Companies (ROC) to change its status to private. This action cannot be deemed oppressive to the petitioners because the law itself mandates the company to become private under Section 43A(2A) of the 1956 Act. The NCLT noted an interface between the provisions of the Companies Act, 1956, and the Companies Act, 2013, highlighting that the repeal provision under Section 465 of the 2013 Act, has been notified concerning Section 43A. It emphasised that the absence of any other definition of a ‘private company’ under the Companies Act, 2013, does not automatically classify the company as public. By examining Tata Sons’ Articles of Association, the NCLT affirmed its classification as a ‘private company’ under the new regime.

- Mr. Mistry’s contention related to the majority rule not being valued much in companies and their corporate setting, with the concept of corporate governance introduced in the Companies Act, 2013, was also dismissed by the NCLT. The Tribunal emphasised that “corporate democracy is the genesis, and corporate governance is a species, and both are inseparable and can never be in dispute with each other.”

NCLAT’S Order

Not satisfied with the NCLT’s order, Mr. Mistry decided to approach the NCLAT in his own capacity. The NCLAT accepted Mr. Mistry’s petition along with the main petitions filed by the two investment firms, namely Cyrus Investments Private Limited and Sterling Investment Corporation Private Limited. On August 6, 2018, Tata Sons got approval from the ROC to change its legal status from a Public company to a Private Limited company. On December 18, 2019, the NCLAT passed its order in favour of the petitioners and revoked the order passed by the NCLT. In addition, the Appellate Tribunal reappointed Mr. Mistry as the Executive Chairperson of the Tata Sons for his remaining term and the company’s decision of electing Mr. Natarajan Chandrasekaran as the executive chairman of Tata Sons was held illegal and highly condemned by the Appellate Tribunal. However, the NCLAT did not bring its order into effect immediately, waiting for 4 weeks in order to provide some time for the respondents (Tata Sons) to appeal the order passed by the NCLAT. The NCLAT also went ahead and revoked the order passed by the NCLT, permitting the company’s conversion from a public company to a private company. The NCLAT questioned the ROC and ordered the ROC to provide the tribunal with appropriate reasons behind permitting Tata Son’s conversion from a public company to a private one and also sought in depth details of the procedure for the approval and conversion. After examining the petitioner’s submissions, the NCLAT also addressed two specific issues: the oppressive nature of certain Articles of the company and the removal of Mr. Mistry as executive chairman.

- The NCLAT stated that Tata Trusts didn’t control Tata Sons directly. Their power came from specific Articles, giving them certain rights. For instance, a quorum at the company’s general shareholder meetings requires the presence of Tata Trusts’ authorised representatives, given their substantial ownership stake of 40%. Article 121 mandated that for major decisions, the Board needed majority votes, including affirmative votes from Trust-nominated Directors, highlighting their significant influence over the Board. Additionally, Tata Trusts had the authority to transfer the ordinary shares of any shareholder within the company, including those owned by Mr. Mistry, without serving him any prior notice regarding the same. However, certain important prerequisites need to be fulfilled, such as passing a special resolution in the general meeting and ensuring that the nominated directors of the Tata Trusts possessing affirmative voting rights are present if the ordinary shares are to be transferred without serving any prior notice.

- The NCLAT further observed that the courts lack a juridical competence and it is beyond their power to declare the Articles of a company to be invalid and whimsical if it had been agreed by the shareholders in the first place. However, the NCLT is empowered to examine the situations where actions undertaken by a company are prejudicial, oppressive, or detrimental to the interests of the company, its members or the general public at large. Even if these actions are in accordance with the law, the NCLT has the authority to scrutinise if such actions are critical enough to warrant shutting down the company.

- NCLAT in its decision also mentioned that Mr. Mistry along with other minority shareholders were persistently facing oppression because of instances of maladministration and misgovernance taking place in the company. The Appellate Tribunal questioned the nominated directors who did not exercise their rights by casting affirmative votes over the majority decisions of the Board and letting the company carry out business transactions that ended up in losses. According to the Appellate tribunal such negligence in itself was an unfair abuse of powers on the part of Tata Sons Private Limited and most importantly the entire blame could not be shifted alone on Mr. Mistry.

- Addressing Mr. Mistry’s removal, which was made solely on grounds of his track record in the company, was held to be arbitrary by the Appellate Tribunal. The NCLAT clarified that a business operates because of the collective efforts of every individual involved in that business and so far as Tata Sons is considered, failure of some of its ventures is the collective responsibility of Tata Sons, the Tata Trusts and the Board of Directors, mostly when the nominee directors of the Tata Trusts have pre-eminent powers such as that of affirmative voting rights which could be exercised to overturn any majority decision at any time when they feel the same would not prove beneficial for the company. Therefore Mr. Mistry alone cannot be made responsible for the company’s failed businesses and hence his removal is illegal.

- The NCLAT examined the minutes of the meeting conducted by the Nomination and Remuneration Committee on June 28, 2016, and observed that this meeting was held a few months prior to Mr. Mistry’s removal. During the meeting, Mr. Mistry’s work and eminent contributions to the company and its significant growth to various Tata Group companies had been acknowledged and applauded by the members of the committee. The committee also appreciated various measures undertaken by him to retain the unified operation of the Tata Group while sticking to the core values and principles of the company.

- Further, the NCLAT ruled that the decision to remove Mr. Mistry was premeditated and the subject matter upon which the meeting was about to be held was also not notified to the Board before removing Mr. Mistry and the reasons behind his removal were recorded and minutes were maintained in the meeting when the Board took the decision to remove him.

- Finally, the NCLAT, while examining the matter, came to the realisation that out of nine directors present at the Board meeting that called for Mr. Mistry’s removal, three of them who had voted in favour of Mr. Mistry’s removal, were introduced to the Board of Tata Sons only two months prior to the meeting in which the decision to remove Mr. Mistry was enforced. The Appellate Tribunal noted that the other two out of the three directors were inducted just four months before his removal.

Appeal to the Supreme Court

In January 2020, Tata Sons appealed to the Supreme Court to set aside the order passed by the NCLAT, which reinstated Mr. Mistry as the chairman of Tata Sons. According to Tata Sons, the NCLAT’s order undermined the principles of democracy in a corporate setting and was detrimental to the rights of the Board of Directors.

Reasons for Appeal

- Reinstating Mr. Mistry to the position of chairman is violative of the principles of democracy in a corporate setting since he was removed only after a majority in the Board had voted against him.

- Mr, Mistry never expressed his will for reinstatement after the end of his tenure.

- The NCLAT compelled Tata Sons to engage in advisory discussions with its minority shareholders, the Shapoorji Pallonji group, before appointing the executive chairman, which was deemed unnecessary.

- Additionally, Tata Sons appealed the NCLAT decision to limit the power of Mr. Ratan Tata and the nominees of Tata and its allied trusts in making decisions, especially those requiring a majority decision of the Board in the Annual General Meeting.

Supreme Court’s judgement

The Supreme Court deliberated on several key questions of law raised in the appeals. These questions centred around whether the NCLAT’s findings aligned with established legal principles, considering that the NCLT’s findings were not explicitly overturned. Additionally, the Court examined whether the relief granted by the NCLAT, such as Mr. Mistry’s reinstatement and other directions issued, were within the scope of the powers under Section 242(2) of the Companies Act, 2013. Furthermore, the Court examined if NCLAT could have limited the rights granted under Article 75 without invalidating the Article and if its ruling of affirmative voting rights under Article 121 as oppressive was reasonable. The Court also looked into whether Tata Sons’ reconversion from a public into a private one needed approval under the Companies Act, 2013.

The Supreme Court of India made the following observations:

- After thoroughly examining the legislative background of Section 43A of the Companies Act, 1956, the Supreme Court came to the conclusion that the concept of a ‘deemed public company’ no longer exists under the new Companies Act of 2013. Instead, the definition of a ‘private company’ has been reverted to its position prior to 2000.

- The determination of whether a company qualifies as a private company or not shall be guided by the definition provided for a ‘private company’ under Section 2(68) of the Companies Act, 2013. In the current matter, the Articles of Tata Sons have fulfilled all the necessary requisites outlined within Section 2(68) of the Companies Act, 2013.

- The Supreme Court made the following observations while addressing the petitioner’s allegations challenging the legality of the conversion of the company from a public entity to a private one:

- Tata Sons remained a private company until January 31, 1975;

- From February 1st, 1975, until December 12th, 2000, Tata Sons was a deemed public company as envisaged under Section 43A of the Act, 1956;

- Tata Sons continued to be a deemed a public company from December 13, 2000- September 11, 2013, by virtue of Section 3(1)(iii) of the Companies Act, 1956, as amended by Act 53 of 2000 with effect from December 13, 2000; and

- Tata Sons to date remains to be a private company with effect from September 12, 2013, as envisaged under Section 2(68) of the Companies Act, 2013.

- Furthermore, the Supreme Court criticised the NCLAT’s decision, stating that Tata Sons should have acted in accordance with the procedure outlined under Section 14(1)(b) of the Companies Act, 2013. This procedure should be read along with sub-sections (2) and (3) of Section 14 in order to obtain a modified and revised certificate of incorporation when Tata Sons became a public company.

- The NCLAT confused Tata Sons’ effort to change the Certificate of Incorporation with its effort to change the Articles. All the requisites outlined under Section 2(68) of the Companies Act, 2013 had been fulfilled by Tata Sons, which had simply demanded the Registrar of Companies to amend the certificate, requesting acknowledgement of the company’s status rather than aiming to create a totally new status for the company.

- According to the NCLAT, Tata Sons had been sluggish in their approach, as there was a considerable delay in seeking the Central Government’s permission to convert itself to a private company from a public one under Section 43A (4) of the Companies Act, 1956. The Appellate Tribunal’s decision proposed a speculated time span for the company’s action, between 2000 and 2013. However, the Supreme Court condemned the Appellate Tribunal’s decision stating that Section 43A (11), inserted in the Companies (Amendment) Act, 2000 (Act 53 of 2000), made all the subsections of Section 43(A), except sub-section 2(A), inapplicable after the commencement of the Act. The requirement under Section 43A(4) ceased to exist from December 13, 2000. Therefore, the speculated deadline proposed by the NCLAT for the company to seek approval from the government stands baseless.

The Supreme Court decided the appeal in favour of the Tata Group and upheld that the action of ousting an individual from the position of chairman was not maintainable under Section 241 of the Companies Act, 2013 unless such removal was made in a way which was prejudicial, oppressive and detrimental to the interest of the company, its members or the general public at large. The Supreme Court also clarified that the NCLT or the NCLAT did not have the right to intervene in matters pertaining to the dismissal of a person as a chairman of a company in a petition filed under Section 241 of the Companies Act, 2013. Finally, the Court ruled that Sections 241 and 242 of the Companies Act, 2013, do not empower the tribunals to reappoint individuals.

Important Case Laws

The Indian judiciary, in examining the present matter, explored various cases to get an in-depth knowledge about the concepts of oppression and mismanagement provided in the legislation for companies in 2013. The following cases are essential in understanding the concepts of oppression and mismanagement under the Companies Act of 2013.

In Loch v. John Blackwood, (1924), it was upheld that the winding up of a company shall only be permitted when it is strongly backed and supported by valid reasons based on grounds of growing trust deficit in the company’s operations and management. However, it shall be noted that such lack of confidence shall not emanate from any personal grudges pertaining to instances of being outnumbered in the business affairs of the company and its operating internal policies. Instead, applications for the winding up of the company shall stem from deep rooted concerns related to the lack of transparency and uprightness leading to a trust deficit in the operation and management style of the company. If there are genuine apprehensions regarding the transparency and uprightness maintained by the company and its management leading to a trust deficit in the company’s ability to lead and to carry out the daily business operations, then in such cases, the winding up of such company shall stand valid and justified under the under definition of “lack of confidence”.

In the case of Rajahmundry Electric Supply Corpn. Ltd. v. Nageshwara Rao, (1955). It was held that in order for the “just and equitable clause” as provided under Section 242, to be applicable under the legislation, the reasons alleging the lack of confidence in a director’s leadership must be valid and reasonable. It was further observed in this case that minor disagreements or disputes pertaining to the trust deficit between majority shareholders and minority shareholders of the company are significant for the clause to operate.

In Needle Industries (India) Ltd. and Ors. v. Needle Industries Newey (India) Ltd. and Ors.,(1981) the court elucidated on Section 397 of the Companies Act of 1956. It was upheld in this case that in order to seek redress under section 397 of the Companies Act 1956, allegations based solely on grounds such as ineptness, incompetence, or negligence in a director’s performance are not sufficient as they lack factual and evidentiary support and backing. For the purposes of seeking redress under Section 397, the petitioners have to prove that such allegations have stemmed from consistent acts of injustice, dishonesty, and discrimination meted out by the petitioners, hampering their legal and ownership rights as shareholders. In essence, the petitioners in their submissions need to address the actions of the directors that are ethically dubious and lack fairness, supported by strong evidence, restricting the shareholders from exercising their rights freely. In this scenario only can a complainant seek relief under Section 397 of the Companies Act 1956.

Conclusion

The Tata-Mistry dispute has played a huge role in shaping the landscape of corporate governance in India, shedding light on the issues of shareholder oppression and mismanagement under the Companies Act, 2013. It stands as the first ever case adjudicated by the Apex Court of India addressing oppression and mismanagement in a corporate setting, with special reference to provisions such as Sections 241 and 242 of the Companies Act, 2013. This case also draws the reader’s attention towards the issues faced by big corporations in relation to their ownership composition and power dynamics highlighting how asymmetrical power relationships can limit the rights upheld by the minority shareholders, especially when they do not align with the interests of the promoters. There is a prevailing tendency to prioritise the interests of the promoters of the company, over those of the company, which can be detrimental to the long-term durability of the corporates in the relevant business sectors. Therefore, it is crucial for corporate entities to understand the vitality of structuring their governance policies in a way that safeguards the rights of the shareholders and to restrain themselves from designing policies that work one way or are lopsided, benefitting only the promoters and overlooking the policies that actually benefit each and every stakeholder that is involved and has contributed towards the growth and development of the corporation.

The present matter, which went on for five long years from the Boardroom to the Courtrooms, acts as a cornerstone in the legal sphere, providing insights into previously unexplored areas of the 2013 Companies Act. It marks a significant advancement in corporate dynamics in India, particularly in the interpretation and applicability of Section 241 of the Companies Act, 2013, as determined by the Indian justice system. Moreover, this case provides the corporate enthusiasts and law practitioners with an in depth knowledge about the subject matter jurisdiction of the company law tribunals, clarifying that a company petition filed under Section 241 concerning the removal of an individual as chairman of a company is not triable and maintainable unless such removal is a direct outcome of oppression and mismanagement detrimental to the petitioner, the company, and the public.

Moreover, the present matter is a perfect example of a constant struggle between two strong personalities, escalating to pride issues. In essence, there never existed a case, to begin with, and the only dispute worth gaining attention to was Mr. Mistry’s removal as the chairman of Tata Sons Private Limited, which was rooted in the growing trust deficit in his leadership as a rather than personal grudges held by Mr. Tata.

Frequently Asked Questions (FAQs)

Who is a minority shareholder?

A minority shareholder can be defined as a member or group of members holding less than 50% stake in a company. The minority shareholders in a company do possess voting rights; however, these rights are limited. This limitation is evident from the fact that minority shareholders do not have the power to alter or hinder any decision passed by a majority vote in resolutions, whether they are ordinary or special. Therefore there are chances that their opinions might not get enough attention when important decisions pertaining to the affairs of the company are being made.

What are articles of association of a company?

Articles of Association of a company refers to the internal bylaws of a company. It is like a constitution of a company wherein all the rules, regulations and objectives have been extensively laid out to be followed by each and every one who is associated with the company. The internal bylaws of a company typically address rules and compliance concerning various aspects related to the company’s functioning, including organisational structure, decision-making processes, shareholders’ rights and responsibilities, corporate governance practices, and amendment procedures.

Who can approach the Tribunal against oppression and mismanagement in a company?

Section 244 of the Companies Act, 2013 outlines the criteria and prerequisites that must be fulfilled to file an application to the Tribunal regarding oppression and mismanagement within a company. This provision allows either the company itself or an individual member acting on behalf of other members to submit an application to the Tribunal. The presence or absence of a share capital in the company is a crucial factor in determining eligibility to file such an application. For companies with a share capital, the right to file depends on either the number of shares held or their value. If the criterion is based on the number of shares, the member seeking to file an application must possess at least 100 shares of the company or represent 1/10th of the total membership. Alternatively, if it’s based on the value of shares, the member should hold at least 1/10th of the total share capital value. In the case of companies without a share capital, the requirement is that 1/5th of the total members of the company may apply.

If someone is filing on behalf of other members, they must obtain consent from those members before submitting the application.

The Tribunal may also receive such an application from the Central Government.

What is the meaning of oppression and mismanagement?

The Companies Act of 2013 does not provide an explicit definition for “oppression”. However, the courts have tried reiterating the definition of oppression through a plethora of cases and have interpreted oppression to be a practice that departs from the ethical standards referring to a conduct which deliberately infringes the minority shareholder’s rights in a corporate entity and is violative of principles of fairness which needs to be strictly adhered by all the corporate entities. Similarly, the legislation remains silent on the definition of mismanagement but in common parlance mismanagement refers to dealing with the operations of the company in an unfair and prejudicial manner.

What are the roles and duties of a director under the Companies Act of 2013?

Section 166 of the Companies Act of 2013 broadly discusses the duties and responsibilities of directors in a company. Some common roles and responsibilities of a director include the duty of good faith, due diligence, proficiency, and vigilance. They are required to ensure strict compliance with the provisions of the Companies Act of 2013, attend board meetings, maintain confidentiality, prohibit insider trading, and prevent fraud.

What are the fiduciary duties of directors?

A fiduciary relationship refers to a relationship built on faith, confidence, and certainty between two parties. Examples include relationships such as that between a principal and his agent, business partners and their co-partners, and a trustee and his beneficiary. Similarly, directors have a fiduciary relationship with the companies in which they have been appointed. The ways in which a director can exercise his fiduciary duties towards a corporate entity include performing duties of loyalty, due diligence, and vigilance, as well as the obligation to disclose relevant information all of which are considered vital fiduciary duties of a director in any company.

What do we mean by affirmative voting rights?

Affirmative voting rights refer to the rights delineated in the articles of the shareholders’ contractual agreements. These rights are possessed by specific investors or shareholders to prohibit the company from making decisions pertaining to the affairs of the company that might influence their interests on certain identified matters. Affirmative voting rights empower investors with the right to vote and express their dissatisfaction in matters that they feel might be detrimental to their interests in the company. Matters such as the issuance of new shares and issues related to mergers and acquisitions could fall under such matters.

References

- https://www.tata.com/business/tata-sons

- https://www.tatatrusts.org/

- https://www.mondaq.com/india/shareholders/1133782/tata-mistry-conflict-the-continuing-corporate-schism

- https://www.nishithdesai.com/ArticleContent/47/4813/MA-Lab.html

- https://www.icsi.edu/media/webmodules/NCLAT_ORDER_CYRUS

- https://books-library.net/files/books-library.net-12091504Uz1N9.pdf

- https://www.mangalamjobs.com/wp-content/uploads/2021/05/TATA-v-CYRUS-MISTRY.pdf

- https://www.legalmantra.net/blog-detail/TATA-CYRUS-MISTRY-CASE-STUDY#:~:text=Cyrus%20Mistry%20filed%20a%20petition,the%20post%20of%20Chairman%20of

- https://www.scconline.com/blog/post/2021/05/15/tata-v-mistry-a-case-for-greater-protection-of-minority-shareholders-rights/

- https://www.moneycontrol.com/news/business/cyrus-mistry-tata-group-spat-a-throwback-to-the-boardroom-battle-9129181.html

- https://www.iimb.ac.in/sites/default/files/2022-03/tata-mistry.pdf

- https://www.livemint.com/news/india/tatamistry-case-ratan-tata-appreciates-supreme-court-ruling-read-here-11652949510648.html

Students of Lawsikho courses regularly produce writing assignments and work on practical exercises as a part of their coursework and develop themselves in real-life practical skills.

LawSikho has created a telegram group for exchanging legal knowledge, referrals, and various opportunities. You can click on this link and join:

Follow us on Instagram and subscribe to our YouTube channel for more amazing legal content.

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Allow notifications

Allow notifications