This article is written by Anmol Garg, who is pursuing a Diploma in International Business Law from LawSikho.

Table of Contents

Introduction

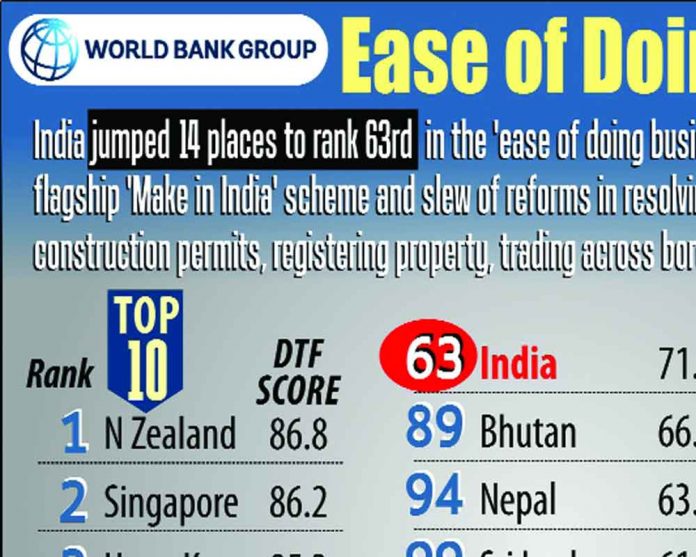

In the Ease of Doing Business (EODB), a report published by World Bank, India currently ranks 63rd and moved up 14 places as against its 77th rank in 2019. Not only this, but India also improved its ranking in 7 out of 10 indicators. All these achievements have been a result of continuous efforts of the government’s policies and the policy with the most positive results is the ‘Make in India’ policy which has attracted a lot of foreign investment. Over the last couple of years, India has tried to improve the business environment in order to make it more welcoming and appealing for not only the entrepreneurs but also for investors(both national and international) who are looking to invest in projects in India and the stakeholders. The Indian Government has the vision to be one of the Top 50 countries which are most preferred in terms of doing business. For this, the government has taken various initiatives, launched a number of schemes and reforms, made amendments in the Company Act, and issued rules simplifying the process of incorporation. These steps and the main aim behind them will be discussed in detail in this article.

What does the ease of doing business represent?

The Ease of Doing Business Report is a kind of index that is released by the World Bank annually. It depicts the ranking on the basis of difficulties and easiness in starting a business in the country. A higher rank on this index means that the laws, procedures, and legislation of that country are easier, simpler, transparent, faster, and more cohesive for incorporating a new business in that country as compared to a lower-ranked country. There are a total of 190 countries that are judged across 12 categories and the overall rank is decided on the basis of the aggregate of the scores in all these categories. The categories are as follows-

- Starting a business,

- Construction permits,

- Ease in getting electricity,

- Registration of property,

- Credit facility/policy,

- Protection of minority investors,

- Taxes to be paid,

- Cross-border trading regulations,

- Enforcement of contracts,

- Insolvency resolutions,

- Availability and employment of workers,

- Government interference and mandatory practices.

The final rank is decided by the World Bank on the basis of their ranks in each of these categories and the weights of these categories in the overall ranking. The higher the ranking of the country means higher is the attractiveness of the regulatory environment in terms of the policies of that country.

As discussed above, India currently ranks 63rd but has moved up 14 places as compared to its previous ranking report. India is also the only country in the world that has been making substantial progress and jumping up the ranks by huge margins consecutively for three years. As per the latest reports, New Zealand is ranked No.1 in the Ease of Doing Business Index.

Steps were taken by the government to promote Ease of Doing Business in India

In pursuance of its objective to provide more ease of doing business, the government has taken various steps to simplify the process, reduce the paperwork and formalities and infuse greater transparency to achieve more compliance. Today, the process for acquiring registration of a new company has been simplified so that a company can get registered within 7days without visiting any government offices for approvals in India. Most of the forms are available online and can be filled out in a day if all the required papers are ready. Following are some of the steps taken up by the government in relation to the incorporation of a company to promote ease of doing business-

- SPICe+(SPICe Plus)form – The latest and the most reformative initiative taken by the Ministry of Corporate Affairs (MCA) has been replacing the SPICe-form with the SPICe+ form. The SPICe+ form is an integrated e-form providing more than 10 services by three Central Government Ministries and Departments, namely, Ministry of Corporate Affair, Ministry of Labour, and Department Revenue in the Ministry of Finance; three State Governments, namely, Maharashtra, Karnataka, West Bengal, and NCT – Delhi. Thus, it not only saves time, money, and effort but also results in a smaller and compact procedure and reduces the overall time taken in the incorporation procedure. The SPICe+ form came into effect on 7th June 2021 and is applicable to all the new companies applying for incorporation.

The SPICe_ form can be divided into parts.

- Part A for name registration

- Part B for other services like-

- Incorporation,

- DIN allotment,

- Issue of PAN,

- Issue of TAN,

- Issue of EPFO registration (Employees Provident Fund),

- Issue of ESIC registration (Employees State Insurance),

- Issue of Profession Tax registration for the states of Maharashtra, Karnataka and West Bengal,

- Opening of a Bank Account in the name of the company,

- Allotment of GSTIN (if applied for),

- Registration of shops and establishments in New Delhi.

SPICe+ form is an integrated form where a person can first apply to reserve a name for their company and then proceed to apply for the mandatory licenses and registration numbers required for it or it can just proceed with Part B applications directly. This form provides all the necessary registrations which are usually required to be taken by a new company in one e-form and the person does not have to juggle between different websites for filling out different forms for registration.

Before the SPICe+ form, when the SPICe form was introduced, it had relaxed the rules in terms of affidavit i.e. people were no longer required to submit a declaration on affidavit separately. Additionally, no fee is to be paid for all the incorporations whose authorized capital is less than 15lakh rupees which substantially reduced the cost of incorporation. All these benefits and changes are still carried on under SPICe+ as well.

2. AGILE-PRO-S form– The Fourth Amendment to the Companies (Incorporation) Rules, 2014 released in 2021 issued a new set of rules, and amongst it the AGILE-PRO-S form was released which replaces the earlier AGILE-PRO form. AGILE-PRO-S form or INC-35 form is the form that is to be compulsorily filed along with the SPICe+ form at the time of incorporation of the company. Before the Amendment, this form was used to apply for the following services-

- Goods and Services Tax Identification Number (GSTIN),

- Employees State Insurance Corporation Registration (ESIC),

- Employees Provident Fund organization registration (EPFO),

- Profession tax registration,

- Opening of bank accounts,

Now, after the Amendment, this form also allows applying for a-

f. Shop and Establishment Registration.

All the new businesses falling under this category will have to mandatorily apply for a Shop and Establishment Registration through this form only. With this Amendment, the companies will not have to apply for this registration separately and wait for a long while to receive this as the Shop and Establishment registration could be applied through this e-form at the time of filing all initial registrations along with the SPICe+ form. This reduced the hassle, time taken in getting a business registered and also saved on cost for the companies as no separate fee for this has to be paid and one single fee for the whole AGILE-PRO-S form is enough.

- RUN Facility- The Ministry of Corporate Affairs had also launched the RUN Services (Reserve Unique Name) which came into effect from 23rd February 2020. The RUN facility is an e-form that needs to be filled out in order to reserve a name for the company at the time of its incorporation or when changing the name of an existing company. Before applying to reserve a name through RUN, a person shall have an MCA Account, Corporate Identity Number (CIN), and the documents related to the proposed name (if any are required to be produced). The name (if approved) is valid for only 20days from the date of approval and all the other formalities like filing off the SPICe+ form, etc. need to be completed within this time span, or else the name approval will get canceled. In one RUN application, two names at the max can be proposed and after that, a new form will need to be filled.

The RUN facility has replaced the INC-1 which was to be filed and has instead provided a kick-start to the process of incorporation. It has also eased the whole process and provided a way for the company to apply for the approval of the names and continue with the other formalities at the same time. With the introduction of this RUN facility, there was more transparency and clarity among the people regarding the whole process and as a result, there was also a significant fall in the rejection rate of the names. The RUN also allowed people to apply for name approval without a Digital Signature Certificate (DSC) which was a relaxation for all.

Through the Amendment, 2018, MCA made certain changes in the rules regarding Limited Liability Partnerships (LLP). With this Amendment, MCA introduced the RUN-LLP form and the FiLLip form. Both these are e-forms. The RUN-LLP form replaced both the LLP-1 and LLP-2 forms which were to be filed with the respective ROC, thereby reducing the time period of receiving registration and FiLLip can be understood simply as the SPICe+ form in respect of LLP registration. Just as SPICe+ and RUN services facilitated the process of incorporation of a company, these two forms eased the process of incorporation of an LLP.

4. Central Registration Centre (CRC) – In order to promote ease of doing business in India, the Ministry of Corporate Affairs under the Government Process Re-engineering (GPR) took an initiative and established the Central Registration Centre in 2016 under Section 396 of the Companies Act, 2013. The CRC was established with the main objective of providing speedy incorporation services which are in line with the global standards and practices. GPR basically includes a three-step approach to increase the efficiency of the approval process which involves using advanced software, making necessary changes to the existing rules, and appointing those professionals who are good at their job as so to reduce the manual work time taken. The CRC is the body that was constituted to make sure that the application of the companies who have applied for their incorporation is cleared within D or D+1days where D stands for the date of the payment. This has resulted in a faster clearing period of the application and because of these efforts, the whole process at the maximum takes 4-5days.

5. Incorporation of Section 8 companies – All the companies which are non-profit organisations are to be registered under Section 8 of the Company Act. The Ministry of Corporate Affairs in 2019 notified rules and simplified the registration process for them as well. Before 2019, such organizations were required to fill INC-12 in addition to all the other forms. INC-12 was an e-form that is to be filled out to acquire a license to function as a non-profit organisation, however, with the amendment now, this form has been merged and consolidated into the SPICe form and all the registrations and licenses can be acquired by the Section 8 companies through just one form. This amendment resulted in less cost and time for these companies which further promoted the ease of doing business.

6. Exemption to private companies – As per the Companies Act, 2013, all private companies were required to maintain a minimum paid-up capital of 1 lakh. This meant that to get a company registered as a private company, shares of the value of 1 lakh rupees shall be invested in by the shareholders. To promote ease of doing business and simplify the process of their registration, the Ministry of Corporate Affairs removed the requirement of minimum paid-up capital through the Companies (Amendment) Act, 2015.

7. Major amendments to the Companies Act, 2013 – The Companies Act has been amended a number of times in order to change or issue new rules which are in pursuance of increasing the ease of doing business in India. MCA removed the requirement by private companies to have the minimum paid-up capital. It also amended the Act in order to do away with the requirement of a common company seal. The background/field check before allotting the shop and establishment registration was also removed. No registration fee is charged from companies having an authorised capital less than 15 lakhs.

Issues that arose

Till now, around 48 initiatives have been taken by the government to promote the ease of doing business. Though India has made commendable progress and has tried to implement policies that are beneficial to all but these policies have also had their drawbacks. These rankings highlight our strong points which can help us to attract more FDI but at the same time, it also highlights our weaknesses which can sometimes even overpower our strengths. Though India ranks 63rd in the overall EODB ranking, it ranks 165th in the ‘Enforcement of Contracts’ category. This is alarming for all the investors who are looking to invest in India. To understand the drawback more, if we compare the contract enforcement mechanism in Singapore, on average it takes only about 165 days to enforce a contract, however, it takes almost 4 years in India. This can be one of the reasons why Singapore will be more attractive to an investor or an entrepreneur as it provides them with more security and assurance.

Recently, in view of the pandemic, the government made changes to the Insolvency and Bankruptcy Code to promote ease of doing business and suspended the initiation of insolvency proceedings for a period of 1 year. Even though it is beneficial for the promoters as they do not lose control over the company for another year, it is disadvantageous for the creditors of that company as they will not be able to recover their debts from the company in any manner and their money would be stuck in that company for a while now.

India is moving forward towards infusing technology in its legal system with online hearing of the courts but it needs to make a lot of changes in it like the drafts of policies lie before it for a long time before they are finalized and the businessmen suffer in anticipation. Amendments and rules take a lot of time to be notified and even being implemented after their notification in the official gazette. There are a high number of backlog cases before the judiciary along with a shortage of officers. India shall try to recruit more officers and maybe create more specialized courts and conduct hearings in a fast track manner so that at least our enforcement mechanism can improve which will, in turn, impact the working of the judiciary and also promote the ease of doing business as it can lead to more assurance in the minds of investors.

Conclusion

In order to cope with its vision of being in the top 50 countries that are preferred for doing business, the government has undertaken a number of policies, reforms, issued notifications, rules and amendments and all these have shown positive results as India has been able to jump up its position consecutively for 3 years. India has its best ranking at 13th rank in the availability of credit category. Various policies have been launched apart from amending the companies act like the Make in India, Atmanirbhar Bharat, etc. The hopes of the government are high but it still needs to implement more changes to the system as the whole process in India still takes almost 7 days whereas, in other countries, it is just a matter of hours. India has managed to reach 63rd place from 130th place but it still has a long way to go.

References

- https://www.mca.gov.in/MinistryV2/easeofdoingbusiness.html

- https://www.icsi.edu/media/webmodules/Reforms_under_CompaniesAct2013_Ease_of_Doing_Business.pdf

- https://www.doingbusiness.org/en/rankings

Students of Lawsikho courses regularly produce writing assignments and work on practical exercises as a part of their coursework and develop themselves in real-life practical skills.

LawSikho has created a telegram group for exchanging legal knowledge, referrals, and various opportunities. You can click on this link and join:

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Allow notifications

Allow notifications