This article has been written by Shreya Ganapathy, pursuing a Certificate Course in Advance Corporate Taxation from LawSikho.

Table of Contents

Introduction

Tax revenue is the income of the government from direct and indirect taxes. Tax revenue forms the primary source of government income. Indirect Taxes account for 48.7% of total revenue in 2016-17 and the rest came from direct Taxes. With the introduction of GST from July 2017, all indirect taxes (with the exception of customs duties) are now decided by the GST Council and not the Government of India.

An indirect tax is a tax that can be shifted by the taxpayer to someone else. These taxes are levied on goods and services on the basis of sale, production or purchase of goods or during provision of services, in the form of Goods and Services Tax (GST), excise, import and export duty, sales tax, Value Added Tax (VAT), electricity duty, tax on passenger fares and freights, entertainment tax etc. Its incidence is born by the consumers who ultimately consume the product or service while the immediate liability to pay the tax may fall upon another person such as a manufacturer or provider of service or seller of goods. In this article, we will be understanding the meaning of indirect taxes and the various types of indirect taxes that are applicable for a corporate taxpayer. We will also be exploring how indirect taxes are being regulated in India and how Corporate taxpayers could handle compliances related to indirect taxes better.

Corporate taxes are defined as the income-tax paid by domestic companies, and foreign companies on their income in India is corporate income-tax (CIT). The CIT is at a specific rate as prescribed by the income tax act subject to the changes in the rates in the union budget every year. The compliance burden for the Corporate Taxpayer has increased. Indirect taxes have assumed a very important role in strategic planning within the tax function. Businesses need to monitor developments in the field of indirect tax developments closely and should be ready to adapt their transactions, accounting policies, as well as the technology they use to pay the correct amount of tax.

The financial crisis in 2008 which led to a global recession also led to a major decline in corporate profits and the tax revenues raised by the government. During the period of recovery from the crisis, indirect taxes proved to be a very important tool for governments who were fighting the effects of the financial crisis. Countries began increasing their VAT/ GST rates to raise more revenue. Soon VAT/ GST was adopted by other countries as well. India did away with its former tax system to adopt the Goods and Services Tax Act in 2017.

Meaning of indirect taxes

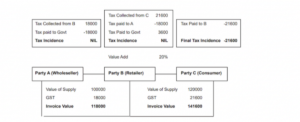

If a taxpayer is just a conduit and at every stage, the tax incidence is passed on till it reaches the consumer who really bears the brunt of it, such tax is an indirect tax. Unlike direct taxes, it is not imposed on the revenue of a person. A numerical example of the working of GST will help in understanding the concept better:

It is vital to note here that:

- There is no tax liability on any of the interim parties, i.e., neither the wholesaler nor the retailer is liable to pay GST

- The reason for this is fairly simple- the tax paid by the interim parties can be set off against their output tax liabilities. This concept is known as ‘Input Tax Credit’

- The final incidence of GST is solely on the end consumer.

What are indirect taxes for corporate taxpayers?

Previously, there were multiple indirect taxes levied in India. With the introduction of GST on 1st July 2017, a lot of Indirect Taxes have been subsumed. Other indirect taxes include the following:

- Customs duty/cess: This is levied on goods imported to India

- Excise duty: This is levied on alcoholic liquor and specified petroleum products

- Electricity duty and tax on the sale of electricity

- Stamp duty: This is generally levied on the transfer of immovable property by the State Government. It is even applicable to the registration of legal documents.

- Entertainment Tax: This tax is levied on products or transactions related to entertainment. It is levied by the State Government.

- Securities Transaction Tax: This is levied on the trade of securities in the Stock Exchanges of India.

- Other local levies (like municipal tax, property tax, etc.)

Out of these, the indirect tax that is most prominently dealt with by the corporate taxpayer is GST. GST has a ‘Dual structure’ i.e., intrastate or intra union territory supplies are liable to Central GST as well as State/ Union Territory GST and inter-state supplies and imports are liable to integrated GST. Occasionally, corporate taxpayers might also engage in transactions wherein the other types of indirect taxes like customs duty, stamp duty, local levies etc could be levied. For the purpose of this article, we will be focusing primarily on GST as it is the mirror of all the indirect taxes in India.

Generally, all forms of supplies of goods and/ or services that are in furtherance of a business for consideration are liable to a standard rate of GST. The standard rate of GST is 18% but certain goods or services are eligible for a lower rate of GST. Some forms of supply are exempt from the purview of GST. A higher rate of 28% applies to certain luxury/ sin goods. Additionally, such goods also attract a GST Compensation cess. The GST rate applicable to a specific good or service is based on the classification as per the GST rate schedule.

The corporate taxpayer would pay indirect taxes to the government but the liability is transferred to the final consumer. Corporate taxpayers receive credit for the tax paid by them. With the implementation of GST, it has become difficult to evade taxes because they are being levied directly through products and services. It has also removed the cascading effect of taxes that was proving extremely burdensome to corporate taxpayers during earlier tax regimes.

How are these taxes regulated or governed in India?

Prime Minister Atal Bihari Vajpayee envisioned a single tax for the entire nation i.e., GST in 1999. A committee headed by Asim Dasgupta designed the GST model for the country. A task force under Vijay Kelkar was set up in 2002. After a long period of study and deliberation, The Constitution (One hundred and first amendment) Act, 2016 was passed by both Houses. It was approved by the President of India laying the foundation for the implementation of GST in the country.

For the implementation of GST, four GST Legislations were passed by the houses. These are:

- Central Goods and Services Tax Act, 2017

- Integrated Goods and Services Tax Act, 2017

- Union Territory Goods and Services Tax Act, 2017

- Goods and Services Tax (Compensation to the States) Act, 2017

India is a federal system. It adopted a dual model of GST which not only empowered the centre to levy taxes but also gave the states and union territories of India the power to levy taxes as opposed to the Union collecting taxes and later distributing it to the states. Therefore, the states and union territories passed their own respective State goods and services tax bills. Under the dual GST structure in India, there are 3 main applicable taxes:

- CGST: This is levied by the Union intra-state sales i.e. when sale and consumption of goods and/or services are both in the same state/ union territory

- SGST: This is levied by the State Government in addition to CGST on an intra-state sale; and

- IGST: This is levied by the Union on inter-state sales i.e. when the point of origin and point of consumption of goods and/or services are in two different states.

Under the Constitution (One Hundred and First Amendment) Act, 2016 a GST council was set up. This was done to ensure smooth functioning between the centre and one or more states since GST is collected by both centres as well as states and there are chances that disputes could arise. The GST Council is vested with the power to adjudicate any dispute that arises either between two or more states or between the centre and one or more states shall be adjudicated by the GST council. The council arrives at a decision through a three-fourths majority where the centre has a one-third vote and each state has one vote. The procedure of functioning is determined by the council itself. The GST council currently has 33 members with The Union Finance Minister Nirmala Sitharaman is the Chairman of the GST Council. The Council has 33 members.

How will corporate taxpayers deal with these taxes and issues related to them?

Currently, it is doubtful that Indirect tax rates will increase anymore. However, with the growth of digital economies, there are very high chances that the government could introduce new indirect tax measures to deal with the provision of online services or the sale of goods online. These measures could be both favourable to provide a boost to the economy and could be designed in a way that plugs loopholes in the existing system that are allowing corporate taxpayers to get away without paying taxes.

Indirect taxes are also being used as a tool for influencing the behaviour of consumers or to reduce the consumption of ‘bad/ sin goods’ in society. Such tax policies also help in stimulating innovation. A higher rate of taxes on goods would naturally drive the prices of the goods higher, which could be a blow for the industries dealing in such goods as the price, demand and even the profitability of the business would be affected. Such corporate taxpayers might be forced to innovate or diversify to stay profitable.

Tax authorities have digitised their indirect tax systems to reduce errors during filing and to increase transparency and efficiency. This also helps in the easier handling of indirect tax revenue. Corporate taxpayers should invest in technology and try to move to standardised and automated processes instead of relying on outdated or manual methods. This will help them handle and analyse large amounts of data easily while working on their indirect tax related compliances. This also reduces costs for the corporate taxpayer that was arising because of sticking to manual or outdated methods. This also helps them gain better visibility of their indirect tax obligations, risks, outstanding compliances, refunds due etc.

Conclusion

The digitalisation of systems can prove immensely beneficial for corporate taxpayers. Digitalised Tax administrations are gradually moving towards a system where they will be able to easily differentiate between compliant organisations and non-compliant organisations. They will be able to easily identify and certify the compliant taxpayers as ‘good’ taxpayers. Good taxpayers would obviously face lesser scrutiny and audits. During these times, where the indirect tax is becoming more and more popular as a tool for regulating not only consumers but businesses as well, it would prove extremely beneficial for corporate taxpayers to pay greater attention to the government’s favourite ‘child’ i.e., Indirect Taxes.

References

Students of Lawsikho courses regularly produce writing assignments and work on practical exercises as a part of their coursework and develop themselves in real-life practical skills.

LawSikho has created a telegram group for exchanging legal knowledge, referrals, and various opportunities. You can click on this link and join:

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Allow notifications

Allow notifications