This article is a discussion about cancelled Cheque and the various questions surrounding the issue. Kashish Khattar is a 4th Year B.A.LL.B. (Hons.) student at Amity Law School in New Delhi.

What is a cancelled Cheque?

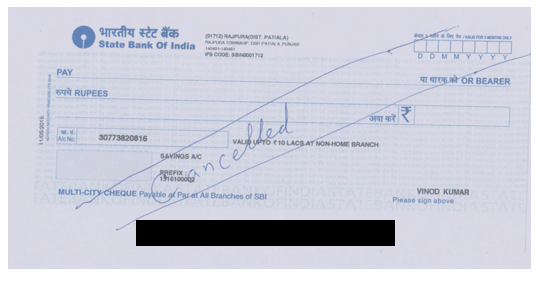

A cancelled cheque is a cheque bearing the account holder’s name, account number and has CANCELLED inscribed across it.

A lot of times employers, banks or various establishments may have asked you for a cancelled cheque.

Why do they ask for it? What’s the purpose?

If you are a curious fellow like me you must have wondered about this at some point. Let’s address this.

Should you sign a cancelled cheque?

You just have to cancel cheque by drawing two parallel lines over it and writing “cancelled” in between the lines. You should NEVER sign on a cancelled cheque. You should ABSOLUTELY make sure that the person or institution to whom you are handing over this cancelled cheque of yours is highly reliable.

Details given out by such a Cheque

- MICR CODE – MICR or Magnetic ink character recognition, it is a 9 digit code which has the name of the bank, the specific branch and the area code it is situated in.

- IFSC CODE – Indian financial system code, better known as IFSC, is 11 characters alphanumeric code mentioned on the cheque which assists the bank in providing services like the NEFT or RTGS.

- The name of the Account Holder, Account Number and the Name of the Bank.

Where is it needed?

Following are some areas in our life where the cancelled cheque would be needed:

- Bank account opening – When you open a savings or current account with a bank, you would have to submit a cancelled cheque to complete the account opening process.

- KYC – Know your customer (KYC) is very essential for a lot of investments these days. KYC is needed for mutual funds, stock investments, etc.

- ECS – Electronic clearing service (ECS), which is used for deducting money from your accounts every month also require a cancelled cheque.

- EMIs – Different types of loans have EMI (Easy Monthly Installments) payments. EMIs are also applicable to purchase of mobiles, televisions, or any kind of tangible property for that matter. To complete the process of assigning EMIs, the bank or the company financing the EMI likes to ask for a cancelled cheque.

- EPF withdrawal – Withdrawal from Employee Provident Fund (EPF) account would require a form and a cancelled cheque. These need to be submitted to the EPFO or the organisation you are currently you are employed in. This basically helps in validating your account details.

- Insurance policy – When you purchase an insurance policy like term, endowment, money back, health, etc, you need to submit a cancelled cheque to the organization or agent.

- Demat account – A demat account is needed for any person who wants to trade or invest in stocks. A cancelled cheque needs to be submitted to the stock brokerage along with the account opening form, ID proof, address proof, etc.

These are the alternatives to cancelled blank cheques for confirming MICR and IFSC for an account

- Photocopy of the first page of the Passbook.

- Copy of your account statement.

- Many organization accept the photocopy of a cheque. Alternatively, you can scan a copy of one cancelled cheque and use it again and again whenever the need arises.

When should you refuse to give a cancelled cheque?

It depends upon the policy of the organisation, as to accept the cancelled cheque in what form. You should always ask for a letter or an email of their demand for this cancelled cheque. This is done for your own safety as this letter or email can be used as evidence in the court of law if such need arises.

In what ways could your cancelled cheque be misused?

A cancelled cheque has no monetary value, there have been reports of its misuse. Therefore, before handing over a cancelled cheque you should inquire if a photocopy or scanned copy of the cheque, or the first page of the passbook is acceptable as it is only required for your verification.

Does the picture of a cancelled cheque suffice for KYC in some cases?

It mainly depends upon the policy of the respective organisation you are submitting and can only be answered by them. Most of them should agree to accept a picture of a cancelled cheque because after all it is just needed for the purpose of verification.

Conclusion

A cancelled cheque does not require your signature at any point. Fraud relating to these cancelled cheques are not unheard of. Hence, the authority you are handing over this cheque should be extremely trustworthy and it should make sure that it would not fall into the wrong hands.

Cancelled Cheque

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Allow notifications

Allow notifications

Cheque is a legal instrument supplied by bank for withdrawal only. The requirement by third parties to provide original cheque leaf is misuse to satisfy the third parties.self attested Photocopy should serve their purpose instead wasting a legal instrument agreed between bank and it’s customer. Law should prevent such use.

Good educative article on cancelled cheque. Further precautions: Don’t hand over a cancelled cheque to a representative on visit to your residence for verification. Deposit it at the office to an authorised officer against acknowledgement. Mention the purpose for which it is given.

EMI means Equated Monthly Instalment, as it is an equal monthly payment amount that contains a part of loan and interest.

Thanks.