In this article, Venkateswaran T, pursuing Diploma in Advanced Contract Drafting, Negotiation and Dispute Resolution from LawSikho , discusses Top Contracts that an SEZ developer executes while building and running an SEZ.

The background – when it all began!

Amongst the many topics debated in public domain and highlighted in the positive as well as negative news cycles over the past 20 years, Special Economic Zones, popularly known as SEZ, would certainly qualify as one of those much-reviewed concepts.

Prior to getting into the definition of an SEZ and the main legal contracts involved, it would be imperative to go through the background of how the concept came into being in at the outset; and as to what would it take to build and run an SEZ in terms of its business model, players and regulatory process. This would provide the requisite context for contracts.

-

Overall Background

- The need for balancing payments by increasing Exports share…

India has been taking all endeavours to increase its share of exports since liberalisation era of the 1990s in order to better the balance of payments scenario caused due to higher imports. And India’s exports as a share of global trade remained at a meagre 0.6% in the early 1990s and then increased gradually in the range of 1.6% to 1.7% from 2016 onwards[1].

The Department of Commerce and Industries, through the mechanism of EXIM Policy (also known as Foreign Trade Policy) issued over the years, has been implementing and experimenting with various schemes for increasing exports such as Export-Oriented Units (EOUs), Software Technology Parks (STPs), Biotechnology Parks (BTPs) and Electronic Hardware Technology Parks (EHTPs), etc.

In the meanwhile, China has been succeeding in its share of global exports through certain specified, specifically identified, delineated and duty-free geographical regions with special laws, administrative procedures and tax incentives known as Special Economic Zones (SEZs).

-

The fundamental concept of a Special Economic Zone (SEZ)

Basis the success story of SEZs in China, Government of India modelled and introduced the SEZ policy in April 2000 in order to give a further boost to our exports scenario.

During the period from Nov 2000 to February 2006, the SEZs functioned under the provisions of Foreign Trade Policy and availed of various tax benefits accordingly, though with limited success in attracting adequate investor interest, confidence and flow of investments.

In order to provide a stable SEZ policy framework and enhance investments, the Government of India enacted the Special Economic Zones Act 2005 (SEZ Act). Subsequently, the Special Economic Zone Rules 2006 (SEZ Rules) was notified on 10th February 2006, therein leading to SEZ Act coming into operation as a consequence effective this date[2].

- The salient features of the SEZ Policy are as follows[3]

- Simplified procedures for development, operation, and maintenance of the SEZs and for setting up Units and conducting business in SEZs

- Single-window clearance for setting up of SEZ, Units in SEZ, and clearance on matters relating to Central as well as State Governments

- Simplified compliance procedures and documentation with an emphasis on self-certification.

- The principal objectives behind creating Special Economic Zones (SEZs) are

- Creation of incremental economic activity and supporting infrastructure facilities

- Promotion of exports of goods and services and investments from domestic and foreign sources

- Generation of employment opportunities

- SEZ area demarcation as Processing and Non-processing area

- Processing Area – this is the area that gets specifically notified in which the core business activities of the SEZ are undertaken by the approved Units, wherein a minimum of 50% of the SEZ area has to be marked for processing area.

- Non-processing Area – this is the area in which the support infrastructure is created, such as schools, hospital, residential complex, etc. primarily to cater to the needs of the employees working in the SEZ.

-

SEZ Operating Model – the Players [4]

The SEZ Act[5] mentions that any person (as defined by Act) such as individual, proprietorship or company can establish an SEZ. In order to encourage foreign exchange inflow, the individual or entity can be a resident within or outside India. Therefore, a foreign company can also set up an SEZ in India.

Establishment of an SEZ involves the following predominant players –

- Developer(s)

- Co-Developer(s)

- Unit Holder(s)

- Government (Development Commissioner/Board of Approval)

Developer

For the purposes of this article, let us assume that a new company is incorporated for starting an SEZ business. This company, basis availability, and possession of the land can apply to the Board of Approval and become a Developer as per the provisions of the SEZ Act. A Developer, in a nutshell, is therefore the one who envisions, creates, develops and maintains the land and associated infrastructure into a meaningful commercial venture to satisfy the above mentioned principal objectives of an SEZ.

Co-Developer

The Developer can agree and establish a contract with Co-Developer (another company) to partner/assist with the creation of support infrastructure in the non-processing zone. Appointment of a Co-Developer is normally done through a tendering process involving Expression of Interest (EOI) and/or Request for Proposal (RFP) and Bidding/selection stages.

Unit Holder

The Company that establishes the facility for manufacturing goods or service purposes in a specific plot of land of a negotiated area and location, within the processing zone, contracted on a leasehold basis with the Developer. The Unit will have the responsibility to achieve positive Net Foreign Exchange (NFE)[6] requirements enabled by exports of goods or services.

The Development Commissioner (DC) and Board of Approval (BOA)

The DC and BOA are Government stakeholders ensure that the overall framework, objectives and other governance requirements of the SEZ framework are facilitated and administered in a seamless manner.

The diagram provided in Annexure at the end of this article illustrates the overall SEZ layout.

-

The Contracts that an SEZ Developer executes with the Players

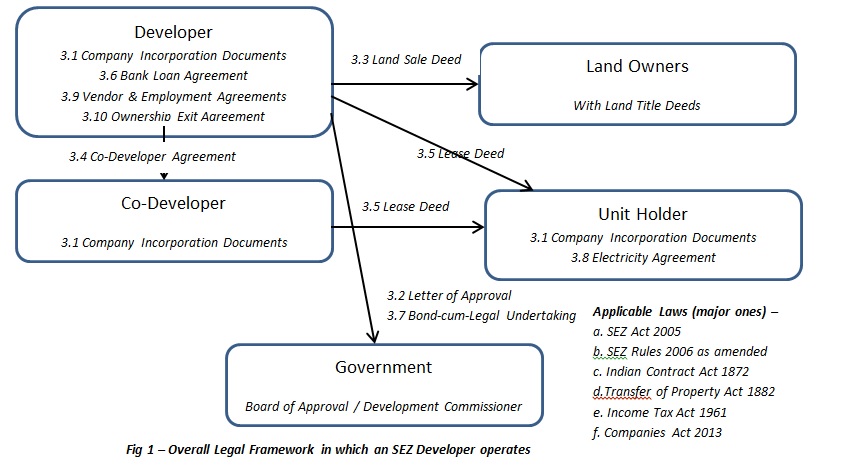

Basis the background and structural context provided in the above sections, following figure 1 illustrates the overall legal framework, applicable laws, players and associated main contracts that are involved in establishing and running an SEZ –

- Company Incorporation Documents[7] (by the Developer)

The Developer shall execute the Memorandum and Articles of Association as well as Shareholders Agreement of the company incorporated specifically for the purpose of SEZ establishment as a business model. As there are lock-in clauses wherein the notified SEZ land cannot be bought and sold to avoid speculative purposes; therefore the Developer, as a normal practice, is an entity set-up as a company to enable transfer of ownership of the SEZ to another entity/Developer providing an exit option to the original Developer.

- Letter of Approval (LOA)[8] (Between Government and Developer)

The Developer has to obtain a Letter of Approval from the Ministry of Commerce and Industry which provides the following details –

- Name of Developer

- Type, Area, and Location of SEZ

- General terms and conditions

The Developer needs to accept all the terms and conditions listed out in the LOA and convey such acceptance in return within 30 days from the date of issue of the LOA. This LOA in a way also forms a contract that the Developer forms with the Ministry of Commerce and Industry.

- Land Sale and Purchase Agreement / Sale Deed (Between Developer and Land Owners)

First and foremost, in order to establish an SEZ, depending on whether it’s single or multi-product in nature[9], anywhere between 10 hectares (for say an IT/ITES SEZ) to 1000 hectares (for a multi-sector SEZ) of unencumbered and contiguous land need to be in possession of the Developer. The activity of land acquisition has been a sensitive subject[10] all along and even the State Governments have been restricted from making a compulsory acquisition of land for setting up SEZs effective April 2007[11]. In cases of certain regions in the country with own regulations of land ownership, the developmental agencies can own the land and lease out same to SEZ Developers, which shall be considered to be in possession of the SEZ for all practical purposes[12].

It is also worth noting that stamp duty, incurred by the Developer during registration of such Land Sale and Purchase Deed, is either exempted or refunded to the Developer depending on whether the acquisition is being made after or prior Board of Approval in-principal approval[13].

- Co-Developer Agreement (Between Developer and Co-Developer)

The Developer through a tendering/bidding process selects and appoints a Co-Developer for further development of infrastructures such as Buildings and common utilities, on the specified land plots allotted for the purpose.

There are many variations to this aspect depending on the type of SEZ. In the case of IT/ITES SEZ, the Co-Developer’s scope could be the creation of a master plan, office buildings, canteens and other supporting infrastructure works. In case of multi-sectoral SEZ, the Co-Developer could be brought in for developing infrastructure in non-processing zones such as schools, hospitals, etc. whereas the Unit Holders would create their factory setup within the processing zone.

There could be two contracts here – a Construction contract and a Lease Deed. The construction contract could be awarded basis the lump sum amount benchmarked to a reserve price with a period of say 4 years, known as construction period starting from the signing of the Co-Developer agreement.

The Lease Deed would be basis an Annual Lease Rental on, say a Sq.M per annum basis, as agreed between the Developer and Co-Developer for a certain time period, say 99 years as lease period from the date Lease Deed gets executed[14].

This is one of the most important legal contracts that a Developer shall execute being the main revenue generation in the SEZ business model. The Unit Holder subsequent to obtaining LOA from the Development Commissioner approaches the Developer and signs a Memorandum of Understanding (MOU) capturing the initial business requirements such as area of the plot, lease rental, and other general terms. Subsequent to initial commercial advance payment to Developer and permission from District Collector for the lease of land, a final Lease Deed is agreed and signed.

- Bank Loan Agreement (Between Bank and Developer)

The Developer/Co-Developer/Unit Holder can obtain term and working capital loans[17] for which necessary Loan Agreements are executed.

- Bond-cum-Legal Undertaking (Between Government and Developer)

As part of infrastructure development, the Developer would require goods/materials that would be either imported or procured from overseas or domestic tariff area respectively. The Developer would need to, therefore, provide a Bond-Cum-Legal Undertaking to Government of India wherein the Developer commits to keeping records of movement, storage and consumption of such goods/materials for the intended purpose.

- Electricity Agreement (Between Unit Holder and Developer, if it distributes power)

The Developer may either approach the State Electricity Distribution Company or set up his own or through the Co-Developer a captive power plant in SEZ. The Unit Holder, as an end user, signs the Electricity Purchase Agreement with the Electricity Company (owned by Developer / Co-Developer / State Electricity Company as the case may be).

- Vendors / Sub-contractors Agreement and Employment Agreement

The Developer as part of the infrastructure development may need to engage consultants for creating master business plans[18], EPC contractors, legal teams, auditors and company secretaries for structuring contracts and compliance and various other vendors for office administration. As also, the Developer Company shall need to execute Employment Agreements for the staff employed and engaged to undertake the SEZ development.

- Exit Agreements related to SEZ and Unit Ownership

As mentioned earlier in the article, the Developer for various reasons may want to exit the SEZ business but cannot sell the SEZ land as the law restricts one from doing so. However, the Developer can sell his ownership stake in the company that owns the SEZ to other investor basis prior approvals from the Board of Approval. The SEZ Act and Rules provide various guidelines on the communication of change of ownership and equity[19]. The same rules apply for Unit Holders as well with an additional payment of Transfer fee[20] (which would be a percentage of the deal value) to the Developer depending on the status of the Unit development.

-

Conclusion

The above mentioned are some of the main agreements that an SEZ Developer would come across. The detailing and paperwork are certainly much more than mentioned in this article, the depth of which shall be visible once the practitioner proceeds to work on an SEZ development project.

Annexure – SEZ Plan[21]

The below layout illustrates an SEZ with processing area (showing the Units as Plots) and non-processing area (showing the supporting infrastructure) with a separate electrical sub-station. The Developer would create and market the overall SEZ facility, with the Co-Developer building the social infrastructure and the Unit Holders taking up the Plots for setting up the manufacturing facilities.

Source : ELCOT Hosur SEZ

[1] https://www.eximbankindia.in/blog

[2] http://www.mondaq.com/india/

[3] http://www.mondaq.com/india/

[4] SEZ Act 2005 and SEZ Rules 2006 and its amendments

[5] http://sezindia.nic.in/cms/sez-act.php

[6] FOB Exports minus CIF Imports (https://taxguru.in/corporate-law)

[7] http://www.advocatekhoj.com/library/lawareas/

[8] http://www.mepz.gov.in/Form-B.pdf

[9] http://sezindia.nic.in/cms/how-to-apply.php

[10] https://landmatrix.org/media/uploads/indiaenvironmentportalorginfilessez_sampdf.pdf

[11] http://sezindia.nic.in/upload/uploadfiles/files/17InstructionsNo_29.pdf

[12] http://sezindia.nic.in/upload/uploadfiles/files/17InstructionsNo_29.pdf

[13] http://sezindia.nic.in/upload/uploadfiles/files/2InstructionNo_18.pdf

[14] http://www.mpakvnindore.com/images/tender/20170117150202RFPCrystalITPark.pdf

[15] Lease shall have meaning as per Section 105 of Transfer of Property Act, 1882.

[16] http://www.dishmaninfra.com/files/applicaion/Lease%20Deed.pdf

[17] http://sezindia.nic.in/upload/uploadfiles/files/5sez%20operational%20guidelines%202.pdf

[18] https://ic.gujarat.gov.in/documents/SEZ/sez_guideline.pdf

[19] https://www.sursez.com/exit_route.html

[20] https://www.business-standard.com/article/opinion/intervening-on-sez-exit-rules-113102800014_1.html

[21] https://elcot.in/betaversion/special-economic-zone/hosur-sez

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Clikc here

Clikc here

Allow notifications

Allow notifications