In this article, Shital Darak Mandhana pursuing M.A, in Business Law from NUJS, Kolkata discusses Legal recourses to corporate governance lapses and mismanagement.

What is Corporate Governance?

Institute of Company Secretaries of India defines Corporate Governance as-

“Corporate Governance is the application of best Management Practices, Compliance of Laws in true letter and spirit and adherence to ethical standards for effective management and distribution of wealth and discharge of social responsibility for sustainable development of all stakeholders.”

Standard and Poor define Corporate Governance as: – “Corporate Governance is the way a company is organized and managed to ensure that all financial stakeholders receive a fair share of the company’s earnings and assets.”

Corporate administration is intended to run organizations morally in a way to such an extent that all partners counting loan bosses, wholesalers, clients, representatives, the general public everywhere, governments and even contenders are managed in a reasonable way. Great corporate administration should take a gander at all partners what’s more, not quite recently the investors alone. Corporate administration is not something which controllers need to force on an administration, it ought to originate from inside.

A business association needs to go after an offer in the worldwide market without anyone else inside quality, in specific on the quality of its human asset, and on the goodwill of its different partners. While its detail of-the-workmanship advances and abnormal state administrative skills could be of assistance in meeting the quality, cost, volume, speed and breakeven necessities of the exceedingly aggressive worldwide market, it is the esteem based administration and morals that the association needs to use in its administration. This would empower the association to build up beneficial association with its inside clients and enduring business association with its outside clients.

Why is Corporate Governance mechanism needed?

Notwithstanding, the inquiry arises that if the supervisors and the Board of directors are designated by the investors, and esteemed to act in light of a legitimate concern for the investors, at that point why might CG be required. This is because of the way that there is a contrast amongst control and ownership. While the administration controls the business by taking day-to-day choices and managing arrangement issues, the investors are the substance in whose name the business is conveyed and subsequently, the genuine proprietors. As indicated by the lawful hypothesis, the investor is a definitive and last specialist inside the corporate enterprise. Another reason that a sound corporate governance mechanism requirement is because of the way that investors, the majority of them owning shares in various corporate elements, are recipients of portfolio broadening which can lessen dangers engaged with putting resources into unsafe securities by building an arrangement of interests in which those securities are adjusted by others which are generally safe yet which offer a lower return, and along these lines don’t feel the need or step up with regards to focus on their interests in any one organization. And still, at the end of the day it would be in fact outlandish for a solitary investor to watch out for every one of the exercises of a cutting-edge organization inferable from the data lacks that he endures with. What’s more, regardless of the possibility that investors need to control the course an organization diagrams, the court may not permit them since they would perceive the way that a director ought to have freedom to complete his obligations, and investors can’t stop or strip an activity of the executives’ of its legitimacy since the demonstration of the director is the demonstration of the organization. Furthermore, the investors are appropriately estopped from arguing that the demonstration conferred is void. Regardless of the possibility that the energy of the investors from controlling the organization in an outright way is remembered, it may offer use to the greater part to manhandle it against minority later on.

Objectives of Corporate Governance

Corporate Governance is gone for making an association which boosts the abundance of investors. It conceives an association in which accentuation is laid on satisfying the social obligations towards the partners notwithstanding the procuring of benefits. The goals of Corporate Governance is to guarantee the accompanying:

- Properly constituted Board fit for taking autonomous and target choices.

- Board is autonomous regarding Non-Executive and Independent Directors.

- Board embraces straightforward techniques and practices.

- Board has a viable apparatus to serve the worries of the Stakeholders.

- Board to screen the working of the Management Team.

- Properly constituted Board fit for taking autonomous and target choices.

- Board is autonomous regarding Non-Executive and Independent Directors.

- Board embraces straightforward systems and practices.

- Board has a viable hardware to serve the worries of the Stakeholders.

- Board to screen the working of the Management Team.

- Board stays in viable control of the undertakings of the Company.

Components of Good Corporate Governance

- Check Role and Powers of the Board.

- Follow proper legislation applicable to the company

- Transparent Management Environment

- Efficient Board Skills

- Transparent Board Appointments

- Regular Board Induction and Training

- Board Independence

- Regular Board Meetings

- Clear Policy on Board Resources

- Application of Code of Conduct across the Company

- Regular Strategy setting

- Financial and Operational Reporting

- Monitoring the Board Performance

- Clear Roles and Responsibilities of Audit Committee

- Updated Risk Management

- Framing of Whistle-Blowing Policies

Corporate Governance and Companies Act 2013

The Companies Act, 2013 enacted on August 30, 2013 envisages radical changes in the sphere of Corporate Governance in India. It is set to provide a major overhaul in Corporate Governance norms and have far-reaching implications on the manner in which corporate operates in India.

Some of the Provisions of Companies Act, 2013 related to Corporate Governance are:

- Appointment and maximum tenure of Independent Directors;

- Appointment of Woman Director;

- Appointment of Whole time Key Managerial Personnel;

- Performance Evaluation of the Directors and Board as a whole;

- Enhanced disclosures and assertions in Board Report, Annual Return and Directors’ Report with regard to Managerial Remuneration, risk management, internal control for financial reporting, legal compliance, Related Party Transactions, Corporate Social Responsibility, shareholding pattern, public money lying unutilised, etc.

- Stricter yet forward-looking procedural requirements for Secretarial compliances and ICSI Secretarial Standards made mandatory;

- Enhanced compliances of Related Party Transactions and introduction of concept of arm’s length pricing;

- Enhanced restrictions on appointment of Auditors and mandatory rotation of Auditors;

- Separation of role of Chairperson and Chief Executive Officer;

- Mandatory provisions regarding vigil mechanism;

- Constitution of Nomination and Remuneration Committee;

- Constitution of CSR Committee with minimum one Independent Director and formulation of CSR policy to spend 2% of average Net Profits during the three immediately preceding financial years in pursuance of CSR policy;

- Secretarial Audit for the bigger companies.

Corporate Governance and SEBI (LODR)

| Corporate Governance under SEBI (LODR) and Companies Act 2013 | |||

| Sr. No | Particulars | Companies Act 2013 | LODR |

| 1 | Size of the Board | Section 149 (1) states that the minimum number of director as three in case of public company, two in case of private company and one in case of One Person Company. The maximum number of directors should be 15 | Regulation 17(1)(a) The board of directors shall have an optimum combination of executive and non-executive directors. |

| 2 | Board Composition | Section 149(4) provides that every public listed Company shall have at-least one third of total number of directors as independent directors and Central Government may further prescribe minimum number of independent directors in any class or classes of company. Rule 4 of the Companies (Appointment and Qualification of Directors) Rules, 2014 states that the following class or classes of companies shall have at least two independent directors: • Public Companies having paid-up share capital of 10 crore rupees or more; or • Public Companies having turnover of 100 crore rupees or more; or • Public Companies which have, in aggregate, outstanding loans, debentures and deposits, exceeding 50 crore rupees. | Regulation 17: • At least 50% of the board of directors shall comprise of nonexecutive directors. • If the chairperson of the board of directors is a non-executive director, at least 1/3rd of the board of directors shall comprise of independent directors. • If the chairperson of the board of directors is not a non-executive director, at least 50% of the board of directors shall comprise of independent directors. • If the regular non-executive chairperson is a promoter of the listed entity or is related to any promoter or person occupying management positions at the level of board of director or at one level below the board of directors, at least 50% of the board of directors of the listed entity shall consist of independent directors. |

| 3 | Appointment of Woman Director | Section 149(1) and Companies (Appointment and Qualification of Directors) Rules, 2014 Rule (3) read with Section 149(1) provides that (i) every listed company; (ii) every other public company having – 1. paid–up share capital of Rs.100 crores or more; or 2. turnover of Rs.300 crore or more shall appoint at least one woman director. A company shall comply with provisions within a period of six months from the date of its incorporation. | Regulation 17(1)(a) The Board of Directors of the Listed Entity shall have at least one woman director. |

| 4 | Maximum No. of directorship of IDs. | Section 165 A person shall not hold office as a director, including any alternate directorship in more than 20 companies at the same time. The max no. of public companies in which a person can be appointed as a director shall not exceed 10. |

Regulation 25(1) A person shall not serve as an independent director in more than seven listed Entities. Any person who is serving as a whole time director in any listed Entity shall serve as an independent director in not more than three listed Entities. |

| 5 | Maximum tenure of IDs | Section 149(10) & (11) Subject to the provisions of Section 152(2), an independent director shall hold office for a term up to five consecutive years on the Board of a company, but shall be eligible for reappointment on passing of a special resolution by the company and disclosure of such appointment in the Board’s report. No independent director shall hold office for more than two consecutive terms, but such independent director shall be eligible for appointment after the expiration of three years of ceasing to become an independent director. |

Regulation 25(2) It shall be in accordance with the Companies Act 2013 and rules made there under, in this regard, from time to time. |

| 6 | Separate meeting of IDs | Section 149 read with Schedule IV IDs of the company shall hold at least one meeting in a year, without the attendance of non independent directors and members of management. All the independent directors of the company shall strive to be present at such meeting. Here, “Year” means Calender year as referred in SS-I. | Regulation 25(3) The IDs of shall hold at least one meeting in a year, without the attendance of non independent directors and members of management. All the independent directors of the Listed Entity shall strive to be present at such meeting. |

| 7 | Familiarisation Programme for Independent Director | Schedule IV specifies that the Independent Directors shall undertake appropriate induction and regularly update and refresh their skills, knowledge and familiarity with the company. |

Regulation 25(7) The Listed Entity shall familiarise the independent directors with the Listed Entity, their roles, rights, responsibilities in the Listed Entity, nature of the industry in which the Listed Entity operates, business model of the Listed Entity, etc. The points of interest of such acquaintance program might be unveiled on Listed Entity site and a web interface thereto should likewise be given in the Annual Report. |

| 8 | Code of Conduct of Board of Directors & Senior Management | Section 149(8) provides that the company and the independent directors shall abide by the provisions specified in Schedule IV. |

Regulation17(5) The board shall lay down a code of conduct for all Board members and seniors management of the Listed Entity. The code of conduct shall be posted on the website of the Listed Entity. All Board individuals and senior administration faculty should insist consistency with the code on a yearly premise. The Annual Report of the Listed Entity might contain a statement to this impact marked by the CEO. The Code of Conduct should appropriately consolidate the obligations of Independent Directors as set down in the Companies Act, 2013. |

| 9 | Liability of ID’s | Section 149(12) An independent director; a NED not being promoter or KMP, shall be held obligated, just in regard of such demonstrations of oversight or commission by an organization which had happened with his insight, inferable through Board forms, and with his assent or conspiracy or where he had not acted persistently. | Regulation25(5) An independent director shall be held liable, just in regard of such demonstrations of oversight or commission by a Listed Entity which had happened with his insight, inferable through Board forms, and with his assent or conspiracy or where he had not acted persistently with deference of the arrangements contained in the Listing Agreement. Control 17(5)(b) states that the Code of Conduct should appropriately join the obligations of free executives as set down in the Companies Act, 2013. |

| 11 | Constitution of Audit Committee | Section 177 read with Rule 6 of Companies (Meeting of Board and Its Powers) Rules, 2014 states that the Board of directors of every listed company and such class of companies as prescribed under Rule 6, shall establish an Audit Committee. The Audit Committee shall consist of a minimum three directors with independent directors forming a majority provided that majority of members of Audit Committee including its chairperson shall be person with ability to read and understand the financial statement. |

Regulation 18 A listed Entity shall set up a qualified and independent audit committee, giving the terms of reference subject to the accompanying: 1. The review BOD should have least three Chiefs as individuals. 66% of the individuals from review panel should be ID’s. 2. All individuals from review BOD might be fiscally educated and no less than one part should have bookkeeping or related budgetary administration ability. 3. The administrator of the Audit Committee might be an Independent Director. |

| 13 | Risk management | Section 134(3)(n) The Board’s report as prescribed under Section 134(3) required to incorporate its Board’s Report, an announcement showing improvement and usage of a hazard administration strategy for the organization including ID in that of components of hazard, assuming any, this in the sentiment of the Board may debilitate the presence of the organization. | Regulation 21 |

| 14 | Disclosure of Related Party Transaction’s | Section 134(3)(h) mandates that Board‘s Report shall contain particulars of agreements or game plans with related gathering as alluded in segment 188 of the Companies Act, 2013 in Form AOC-2[Rule 8 of Companies (Accounts) Rules, 2014] | Regulation27(2)(a) Points of interest of every single material exchange with related gatherings should be unveiled quarterly alongside the consistence write about corporate administration. The Listed Entity might uncover the approach on managing RPTs on its site and a web interface thereto should be given in the Annual Report. |

| 15 | Disclosure of different Accounting standard | Section 129(5) Where the money related explanations of an organization don’t conform to the bookkeeping principles, the organization should unveil in its monetary articulations, the deviation from the bookkeeping models, the purposes behind such deviation and the budgetary impacts, assuming any, emerging out of such deviation. | Regulation 34(3) read with Schedule V Where in the planning of money related articulations, a treatment not the same as that endorsed in an Accounting Standard has been taken after, the reality should be uncovered in the budgetary proclamations, together with the administration’s clarification in the matter of why it accepts such option treatment is more illustrative of the genuine and reasonable perspective of the hidden business exchange in the Corporate Governance Report. |

Legal Recourses For non-compliance of necessary requirements and disclosures as mentioned in Listing Agreement and Companies Act 2013

Legal Recourse 1: Special Courts

Establishment of Special Courts under Section 435 to 438 and Section 440 of Companies Act 2013:

To give rapid transfer of offenses culpable under the Companies Act, 2013, which are culpable with detainment of 2 years or more, the Ministry of Corporate Affairs has advised the arrangements managing ‘Exceptional Courts’ with impact from 18 May 2016. The aim behind setting up these courts is to let officer courts attempt minor infringement, and those graver offenses ought to be managed by Special Courts.

Appeals/Revisions from Special Courts

Remarkably, for the reasons for engaging interest and update, the High Court have been allowed purview, as though the Special Court inside the nearby furthest reaches of the ward of the High Court were a Court of Session attempting cases inside the neighbourhood furthest reaches of the locale of the High Court.

| Sr. No | Offence | Punishable Personnel | Section |

| 1 | False declaration of solvency by a Director during voluntary winding up | Director | 305(4) |

| 2 | Intentionally and fraudulently concealing material information about the company, relating to properties, debts, creditors, financial statements from the Company Liquidator during winding up or Fraudulently misrepresenting material information about the company to the Company Liquidator during winding up | Officer (including any person in accordance with whose directions or instructions the directors of the company have been accustomed to act) | 336(1) |

| 3 | Taking in pawn or pledge or otherwise receipt of the property, knowing it to be pawned, pledged, or disposed of wherein such property was pawned, pledged or disposed off (in 12 months preceding the commencement of the winding up) on credit and not been paid for and was not in the ordinary course of business | Any person who does such act knowingly | 336(2) |

| 4 | Commitment of fraud provided fraud in question involves public interest | Any person found guilty of such fraud | 447 |

| 5 | Intentionally giving false evidence upon any examination on oath or solemn affirmation, authorised under the Companies Act, 2013 or Intentionally giving false evidence in any affidavit, deposition or solemn affirmation, in or about the winding up of any company under the Companies Act, 2013, or otherwise in or about any matter arising under the Companies Act, 2013 | Any person giving such false evidence | 449 |

Legal Recourse 2 – Compounding

Compounding of Certain Offences under Companies Act 2013:

Section 441 provides for compounding of offences punishable under the Act i.e payment of money in lieu of prosecution. The compounding provisions in an Act reflect the leniency in the administration of the Act.

Offences that can be compounded

An offence under Companies Act, 2013 can be compounded if it is punishable with-

- Fine; or

- Imprisonment or fine; or

- Imprisonment or fine or both

Following offences cannot be compounded

- Offences punishable with imprisonment

- Offences punishable with imprisonment and fine

An offence punishable with imprisonment or fine, or both may be compounded only with the permission of the special court.

Who can apply for compounding?

Application for compounding to be made to Registrar by –

- The Company, where offence is committed by the Company

- Any officer of the Company, where the offence is committed by such officer

While compounding the offence, the Tribunal or the Regional Director or the officer authorized by Central Government may direct any officer of the Company to file a return or other document in question within such time, as may be specified in the order. Non-compliance of such order shall be punishable with imprisonment for term which may extend to 6 months, or with fine not exceeding Rs. One lakh, or with both.

When is Compounding not permissible?

- If investigation against such company has been commenced or is pending under this Act

- If an offence compoundable has been committed within 3 years from the date on which similar offence was earlier compounded.

Effect of Compounding

- No prosecution shall be initiated in relation to that offence

- Where an offence is compounded after the institution of any prosecution, the fact of compounding shall be brought by the Registrar in writing, to the notice of the Court in which the prosecution is pending, and on receipt of such notice of compounding, the Company or the officer concerned shall be discharged.

- Compounding of offences does not amount to conviction by the Court.

Legal Recourse 3 – Filing applications/petition/appeals with NCLT or NCLAT

National Company Law Tribunal and National Company Law Appellate Tribunal (NCLT and NCLAT):

As per Companies Act 2013, Company law Board, Board of Industrial and Financial Reconstruction and its appellate authority has been dissolved and new mechanism in the form of NCLT and NCLAT has been established under section 407 to 434 of Companies Act 2013.

Following are few of many offences that NCLT has jurisdiction over

- Legal action for false or incorrect information at the time of Incorporation

- Conversion of Public to Private Limited

- Changes in voting rights by Consolidation or sub-division of share Capital

- Action against Company by defrauding Depositors by non-payment

- Power to call for AGM in case of failure by the Company

- Power to call for meetings other than AGM

- Punishment for failure to comply with Tribunal Direction regarding Meetings

- Removal of Directors – representation and relaxation of provisions in certain cases

- Removal or change of Auditor before due Date and Suo Moto action by Tribunal for removal

- Action against Prevention and Oppression and Mismanagement

- Order for production of documents by Registrar

Corporate Governance and Foreign Exchange Management Act 1999

Following are few mandatory compliance under FEMA, 1999:

- Foreign Liabilities and Assets (FLA) Return is required to be submitted compulsorily by every one of the India occupant organizations which have gotten FDI as well as made ODI in any of the past year(s), including current year i.e. who holds remote resources or liabilities in their money related explanations as on 31 March

- An Indian Party (IP)/Resident Individual (RI) which has made an Overseas Direct Investment (ODI) needs to present an Annual Performance Report (APR) in Form ODI Part II to the AD bank by 31 December consistently in regard of each Joint Venture (JV)/Wholly Owned Subsidiary (WOS) outside India.

The due date for recording of APR has been reached out from 30 June to 31 December consistently. Further, the APR is required to be confirmed by the statutory examiner of the Indian party. Affirmation of APRs by the Statutory Auditor or Chartered Accountant might not be demanded on account of Resident Individuals and self-confirmation can be acknowledged in such case.

Non-recording of FLA Return and/or APR (as might be pertinent) prior to due date will be dealt with as an infringement of FEMA and aggravating procedures might be started for infringement of FEMA.

Penalties – (prescribed under Sec.13):

- Up to thrice the aggregate associated with such repudiation where such sum is quantifiable.

- Or up to two lakh rupees where the sum is no quantifiable.

- And where such repudiation is a proceeding with one, facilitate punishment which may reach out to five thousand rupees for consistently after the main day amid which the negation proceeds.

Legal Recourses

- Compounding

Compounding alludes to the procedure of deliberately conceding the negation, confessing and looking for redressal. The Reserve Bank is enabled to exacerbate any negations as characterized under section 13(i) of FEMA, 1999 with the exception of the contradiction under segment 3(a)ii in the same place, for a predetermined total in the wake of offering a chance of individual hearing to the contravener. It is a deliberate procedure in which an individual or a corporate looks for exacerbating of a conceded negation. It gives solace to any individual who contradicts any arrangements of FEMA, 1999 [except segment 3(a) of the Act] by limiting exchange costs. Resolute, malafide and deceitful exchanges are, nonetheless, seen truly, which won’t be aggravated by the Reserve Bank.

Who and When can one apply for compounding?

Any individual who contradicts any arrangement of the FEMA, 1999 [except area 3(a)] or repudiates any administer, control, warning, course or request issued in exercise of the forces under this Act or negates any condition subject to which an approval is issued by the Reserve Bank, can apply for intensifying to the Reserve Bank. Applications looking for aggravating of repudiations under segment 3(a) of FEMA, 1999 might be submitted to the Directorate of Enforcement. At the point when a man is made mindful of the repudiation of the arrangements of FEMA, 1999 by the Reserve Bank or the Foreign Investment Promotion Board (FIPB) or whatever other statutory expert or the evaluators or by some other means, she/he may apply for exacerbating. One can likewise make an application for intensifying, suo moto, on getting to be noticeably mindful of the negation.

-

Adjudication

Section 13(1) of the Foreign Exchange Management Act, 1999 (‘FEMA’ for short) accommodates forcing punishments by Adjudicating Authority. The said Section gives that if any individual repudiates any arrangement of this Act, or contradicts any administer, control, notice, course or request issued in exercise of the forces under this Act, or negates any conditions subject to which an approval is issued by the Reserve Bank, he should upon mediation, be obligated to a punishment up to thrice the whole engaged with such repudiation where such sum is quantifiable, or up to ₹ 200000/ – where the sum is not quantifiable and where such contradiction is a proceeding with one, facilitate punishment which may stretch out to ₹ 5,000/ – for consistently after the main day amid which the repudiation proceeds.

-

Appeals

Section 17 states about documenting advance against the request of Adjudicating Authority to Special Director. The Central Government might designate at least one Special Directors (Appeals) to hear offers by methods for Notification in which the Central Government additionally to demonstrate the issue and places in connection to which the Special Director (Appeals) may practice purview.

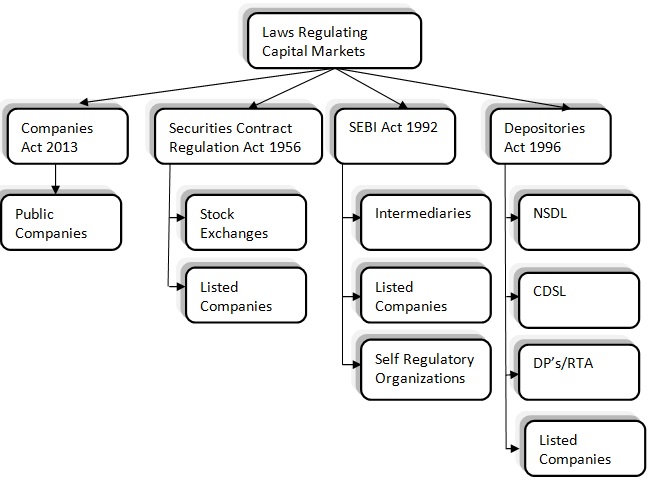

Corporate Governance and Capital Market

Powers and Functions of SEBI

General Powers:

- Promoting / Development / Regulating Securities Market;

- Regulating the working of Stock Exchange

- Registering & Regulating Intermediaries;

- Promoting & Regulating Self-Regulatory Organizations;

- Prohibiting Fraudulent and Unfair Trade Practices relating to securities;

- Prohibiting Insider Trading in securities;

- Regulating substantial acquisition of shares and takeover of the Companies;

- Power to make orders for :

- Suspension of trading in any security;

- Restraining to access the market & prohibit any person to sell, buy, deal in securities;

- Suspend any office bearer of a Stock Exchange and Self Regulatory Organization from holding such position;

- Impound and retain the proceeds and securities in respect of any transaction under investigation.

Relating to issue of securities and protection of investors

- Matters relating to issue of capital, transfer of securities and other incidental matters;

- Manner how the disclosures have to be made by companies;

- Prohibit any company from issuing prospectus, any offer document or advertisement soliciting money from public for issue of securities. specify the conditions based on which the prospectus may be issued

- Specify the requirements of listing, transfer of securities and other matters incidental thereto.

- To issue directions:

- If after making or causing to be made an enquiry, the board is satisfied that it is necessary-

- In the interest of investors, or orderly development of securities market; or

- To prevent the affairs which are detrimental to the interest of investors or securities market.

- To secure the proper management of such intermediary or person.

- It may issue such directions which are in the interest of the investors and securities market-

- To any Intermediary, person or class of persons associated with the securities market;

- To any company in respect of matter specified in section 11A.

Powers to investigate

Where the Board has reasonable ground to believe that:

- Any transaction that are dealt in a manner detrimental to the investors or securities market;

- Intermediary violates any provision of the Act, rules, regulations made under it or any order passed by the chairman.

It may Direct any person to investigate the affairs of such intermediaries or any other person concerned and to report thereon to the Board.

Power to Cease and Desist the proceedings

The board may pass cease & desist order in the following case:

- Where any provision of the Act, rules and regulations has been violated or is likely to be violated.

- In case of insider trading or market manipulation.

Adjudication Powers

For the purpose of adjudging under sections 15A – 15HB,

- The Board appoints any of its officer not below the rank of Divisional Chief to be an adjudicating officer for holding an inquiry,

- After giving any person concerned a reasonable opportunity of being heard for the purpose of imposing any penalty.

- Governed by SEBI (Procedure of Holding Enquiry & Imposing Penalty by Adjudicating Officer) Rules, 1995

Types of Enforcement Actions by SEBI

- Administrative Proceedings

- Monetary Penalty Proceedings

- Disciplinary Proceedings

- Prosecution

- Civil Litigation

Compliances to be followed by listed Companies/intermediaries under various SEBI Regulations

- Furnish any document, return or report to the Board

- File any return or furnish any information, books or other documents within the time specified therefore in the regulations

- To maintain books of account or records

- Failure to enter into an agreement with his client in case of intermediaries

- to redress the grievances of investors, after having been called upon by the Board in writing to redress the grievances of investors.

- Following provisions of Insider Trading Regulations and Takeover Code Regulations.

- Not to indulge in any Fraudulent and Unfair Trade Practices.

Legal Recourse 1: Appeals to SAT

Appeals to Securities Appellate Tribunal can be made in following cases:

- Orders passed by SEBI (after Securities Laws Amendment Act, 1999)

OR

- Orders passed by an adjudicating officer

OR

- Refusal, Omission or failure of Stock Exchange to list the securities

Time Limit for filing appeal

- In case of orders of SEBI or adjudicating officer, within 45 days from the date on which copy of order is received.

AND

- In case of Stock Exchange refusal, failure or omission within 15 days of specified date of section 73(1A) of the Companies Act, 1956

Appeals to Supreme Court

- Aggrieved by the decision of or order of SAT or for determining any question of law arising out of the order,

- Appeal can be filed to Supreme Court within 60 days of the date of communication of the decision or order of SAT.

Legal Recourse 2 – Compounding

Offences can be compounded subject to following conditions :

- The offence must not be punishable with Imprisonment only or with imprisonment and fine under SEBI Act,

- The offences can be compounded either before or after the institution of proceedings,

- The offence can be compounded by SAT or by the Court under which the proceedings are pending,

- The provision of SEBI Act shall be applicable notwithstanding anything stated in Criminal Procedure Code.

Legal Recourse 3 – Granting of Immunity

Special Powers to grant immunity from penalty lies with Central Government

- Can be granted by Central Government

- Where the alleged person gives a full and true disclosure in respect of the alleged violation

- Central government imposes such conditions as it may think fit.

- No immunity granted where the prosecution has already been instituted.

- Immunity once granted can be withdrawn on non compliance of any condition imposed or giving of false evidence.

Conclusion

Corporate governance has been defined as “a set of systems, processes and principles, which ensure that a company is governed in the best interest of all stakeholders.” Its objective is to ensure commitment to values and ethical conduct of business, transparency in business transactions; statutory and legal compliances, adequate disclosures and effective decision making to achieve corporate objectives. Good governance is simply good business, but, the moot question is as to whether the Indian companies are really, in spirit, committed to corporate governance or it is only a superficial compliance in letter and cost. The regulators are forcing the corporate governance regulations on the Indian Companies without measuring its benefits and advantages commensurate the cost in terms of resources of money, man hour and paper consumption. Importance, necessity and quality of corporate governance that Indian Companies needs cannot be undermined. Indian Companies are very intelligent and comply with all requirements of corporate governance in full, in letter, without meaning it in most cases. Ministry of Corporate Affairs, SEBI or stock exchanges have not yet put any mechanism in place to weigh and measure the effectiveness, usefulness or benefits of compliance of corporate governance commensurate with cost spent on its compliance. Following few examples will support the observations:

There was a lot of hue and cry on appointment of woman directors before 31st March, 2015 in listed companies and the defaulting companies were fined very promptly and very heavily.

Listed and certain other specified companies were asked to broad base their Board of directors and appoint independent directors before the year-end.

In most cases, audit committee and nomination and remuneration committee meetings are held minutes before the Board meeting to make their affirmative recommendation on the already circulated relevant items of the Board meeting agenda, e.g. financial results, appointment of directors, etc. In some cases, Board and Committee meetings are also held simultaneously and concurrently and just the minutes are recorded separately as per mandatory requirements.

A report on corporate governance on mandatory 10 main and about 50 sub items became part of the annual report running into 10-15 printed pages.

Has any study been subsequently made as to –

- How many of the Woman and Independent directors appointed aforesaid are worth their appointment and fulfil the spirit of Corporate Governance?

- Are Board constituted Committees are doing meaningful desired work?

- Do the stakeholders really need, use and become wiser with the voluminous information provided in the Corporate Governance Reports?

At least, nothing is available in public domain.

Curb on malpractices by the independent directors

Recently, Daily Financial newspaper ‘Mint’ of 7th October, 2015 published, under the caption ‘MR INDEPENDENT’, the list of 15 longest serving (for 35-52 years) independent directors on 20 companies, most of whom are also serving as advisers to and have, as such, become insiders of their respective companies. Mint questioned can such directors “really be independent”? Further, Hindustan Times of 8th October also printed similar write up on independent directors with observations, namely, ‘Prolonged association of directors with companies dilutes the spirit of the law, experts say’, and ‘Sabarad said some independent directors even have business links with companies on whose boards they serve’. Even the deterrent that a person cannot be appointed as an independent director if he or his relative “is a material supplier, service provider or customer or a lessor or lessee of the company” has not worked.

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Allow notifications

Allow notifications