This article is written by Varalika Mendiratta, pursuing a Diploma in M&A, Institutional Finance and Investment Laws (including PE and VC transactions) from LawSikho.

Table of Contents

Introduction

In these times hovering with looming unemployment and economic distress, the business sector was largely affected by changing the dynamics as well. Mergers and Acquisitions form a pertinent part of the growth and expansion of the companies. With deals like Reliance and Future Group, Zomato and Uber Eats, etc., this domain has become a well-known topic heard by even a layman. Before moving towards the critical M&A deals of 2020, let us first understand Mergers and Acquisitions’ meaning.

What are mergers and acquisitions

Although many a time both these terms, i.e., ‘Merger’ and ‘Acquisition’ are used interchangeably, the legal meaning of both these terms slightly differ. On the one hand, Merger is when two or more separate companies (often of similar size) combine to form a new single entity. On the other hand, Acquisition is when one company takes over or acquires stake in another entity by absorbing such entity’s business. In this case, usually, a larger company acquires a smaller entity. The situations wherein there is a hostile takeover of one company by another are always regarded as acquisitions.

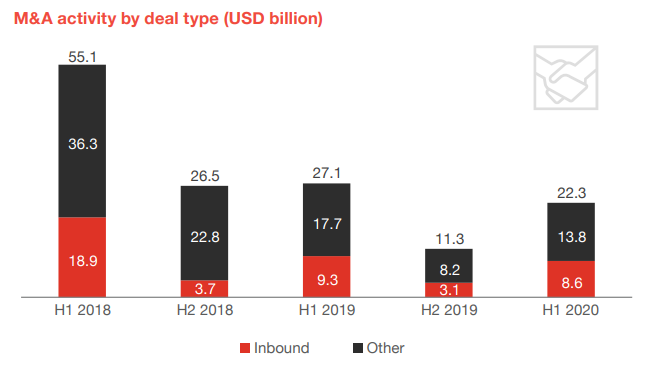

Since the second half of 2018, M&A deals in India have been witnessing a decline with a significant decrease towards the end of 2019 due to various global and domestic concerns. The pandemic also brought to halt many economic activities. Despite the hardships, in the first half of 2020 India saw a 19% increase in the value of investment activity compared to the second half of 2019. However, compared to the first half of 2019, there was a 14% decline in the value of investment activity. Inbound activity, i.e., when a foreign company acquires or merges with a domestic company, amounted to USD 9 billion in the first half of 2020. The data showing a decline of M&A deals since 2018 is as follows[1]:

Source: VCCEdge and PwC Analysis

M&A Deals which were most critical in 2020

The year 2020, despite a significant slowdown of the economy due to COVID-19, has brought forth some remarkable and critical M&A deals. These deals don’t only impact the business world but also have a major impact on the competition in the market. It is also essential to keep such deals in check so that they do not hinder the market competition and lead to a monopoly or even oligopoly. The deals mentioned as follows involve companies that already secure significant stake in their respective markets. These Mergers and Acquisitions have the power to penetrate and establish even more control.

-

Reliance and Future Group

Reliance’s Acquisition of Future Group’s retail business remains one of the most celebrated M&A transactions of the year. The main reason for this was the intrusion in the deal by Amazon (which can be accessed here). However, the deal has now been finally approved by the Competition Commission of India (CCI).

Reliance acquired Future Group’s business for a purchase consideration of around Rs 24,713 crore. This deal will indeed strengthen Reliance’s position as the largest organised retail in India. As a part of the deal, the separately listed subsidiaries of the Group including apparel, supply chain and grocery business will be merged into Future Enterprises Ltd. (FEL) and then will be acquired by Reliance Industries Ltd. (RIL). Future Group has around 1800 stores all over India spread across 420 cities. This deal will give an even more powerful position to Reliance in the retail market which would inevitably be stronger than any of the competitors.

-

ITC and Sunrise Foods

The well-known diversified business brand ITC (India Tobacco Brand), with an aim to boost its spice business, acquires the Kolkata based spices manufacturer Sunrise Foods Pvt. Ltd. (SFPL). ITC acquired 100% of the equity share capital of SFPL for an all-cash deal valued at Rs 2,150 crore through the deal.

With this Acquisition, ITC is all set to expand and grow its fast-moving consumer goods (FMCG) in India. SFPL, with its strong consumer connect and sound distribution system, will facilitate ITC to scale up and rapidly expand its spice business across India. ITC already sells its spices under the brand name of ‘Ashirvaad’ which has a strong base in Andhra Pradesh and Telangana. ITC already sells a large variety of products under various brand names in India. It has a stronghold over the market, and you can find its products in every Indian household. This deal will enable ITC to strengthen its position in the spice market as well. With good results and continuous growth, it might give intense competition to the major Indian spice brands like MDH, Everest, etc.

-

Reliance Jio and Facebook

The largest M&A deal in the first half of 2020 was Facebook’s investment in Jio Platforms worth USD 5.7 billion. With Facebook’s WhatsApp having more than 400 million users in India and Reliance Jio’s user base of 388 million, this fusion of the strong market forces is bound to establish significant market control. This Merger will also help Reliance on boosting Jio Mart. This amalgamation is likely to increase Facebook’s access to the Indian markets as well. According to Mukesh Ambani, Chairman and Managing Director of RIL, this partnership will immensely contribute to the ‘Digital India’ Mission. He affirmed that RIL and Facebook’s alliance would effectively work in realising the Mission and help bring about a significant transformation. It is yet to be seen how the effects of this Merger turns out for the millions of users of these two platforms.

-

Zomato Uber Eats

The Online food delivery major Zomato, acquired Uber’s food delivery business, ‘Uber-Eats’ for a deal value of around USD 350 million. In this all-stock deal, Uber acquired 9.99% ownership in Zomato to transfer the entire Uber Eats’ business. However, this deal’s crucial hardship is to the future of the employees of Uber Eats. The reason being that, Zomato made it reasonably clear that it won’t be absorbing Uber Eats’ team, which implies that they would either be absorbed in Uber’s Indian business or laid off.

The success of Uber Eats was always seen as a rough road since it entered the market late in 2017. Moreover, it consistently failed to differentiate its services from the rising competitors and thus failed. Uber has been trying to exit the food delivery market in India since 2019, which also involved a potential deal with Swiggy, which, however, couldn’t eventually transpire. With Zomato acquiring Uber Eats, two major competitors who thrive in the online food-delivery business are Zomato and Swiggy. Each of them is providing differential services and maintaining their user base.[2] With the online food delivery business continuing to bloom in the pandemic, it would be intriguing to see what strategies these two have in hold for beating the other.

-

Reliance Retail and Netmeds

RIL acquired controlling equity stake ownership in Vitalic Health Pvt. Ltd. and its subsidiaries (which are collectively known as ‘Netmeds’) through its wholly-owned subsidiary Reliance Retail Ventures Limited. The deal value was around Rs. 60 crores. As part of the investment deal, RIL acquired 60% equity shareholding of Vitalic Health and 100% direct ownership of its subsidiaries’ equity share capital, including Dadha Pharma Pvt. Ltd., Tresara Health Pvt. Ltd., and Netmeds Market Place Limited.

This deal becomes extremely germane pertaining to the current COVID-19 crises. By entering the online pharmacy business, there are not many business areas left where Reliance does not have a strapping presence. Another noticeable feature of this deal is its timing. This deal happened within a week of Amazon rolling out its online pharmacy services in Bengaluru. With the rapidly increasing demand for e-pharmacies, it would be tough for both the competitors to lay their stronghold in the market.

-

HUL and GSK

Hindustan Unilever Limited (HUL), one of India’s leading consumer goods companies, has successfully merged with GlaxoSmithKline (GSK) Consumer Limited for a deal of Rs. 31,700 crore. HUL is a subsidiary of Unilever (a British Company). HUL will also additionally pay GSK a sum of Rs 3,045 crore as part of the deal to acquire Horlick’s brand rights for India. The deal enables brands like Horlicks, Maltova, and Boost to be part of the company’s food and refreshment business.

The deal gave HUL the rights to distribute GSK’s brands, the prominent ones being Crocin, Eno, Sensodyne, etc. in India. As a result of the Merger, GSk’s 3,500 employees joined HUL. After the completion of the deal, GSk will own a 5.7% stake in the merged company. Post the Merger, Unilever’s stake in the merged entity shall be 61.9%.

HUL is one of the most reputed consumer goods brands in India. This deal will highly impact the market and affect the other major competitors like Nestle. It will help HUL strengthen its Nutrition business (which covers food and refreshment) and establish a dominative position in the sector compared to the competitors.

-

Reliance and Urban Ladder

This was RIL’s second deal in the e-commerce industry in 2020 after major stake acquisition in Netmeds. RIL acquired Urban Ladder Home Decor Solutions Pvt. Ltd for Rs. 182.12 crore marking its presence in the online furniture business as well. After this deal, the retail unit of RIL, i.e., Reliance Retail Ventures Ltd. (RRVL) owns 96% stake in Urban Ladder. RRVL has further proposed to buy the remaining 4% stake in Urban Ladder by the year 2023.

Urban Ladder had an online furniture selling business for eight years, but the company was facing some significant challenges for the past two years and was going in loss. It was also facing major competition from Pepperfry, which is on its continuous growth rate. With the Acquisition of Urban Ladder, Reliance would compete mainly against Pepperfry, Amazon, and Flipkart to set deeper roots in the online furniture market.

Analysis and conclusion

All these critical deals sure have one thing in common, the establishment of further control and the capability to be even more dominant in their respective markets as already holding major players’ positions. These companies have significant shares of consumers in the market to manipulate it with major acquisitions and mergers and further hamper the competition. One eye-catching highlight of all these deals is the shopping spree of Reliance by penetrating in every sector it finds an opportunity to grow further and expand. As RIL enters the e-commerce industry, the competition it will face will be harsher compared to its win in the telecom sector by providing free services in the beginning to consumers and now holding a major share in the telecom market by defeating mostly the homegrown players.

RIL is facing major competition from the American giant Amazon. It is pretty evident that both these companies have developed a rivalry against each other and are competing to establish more control in the Indian market. Mukesh Ambani is Asia’s richest man with a net worth of $78 billion, and Reliance is India’s biggest company with a market capitalisation equal to 6.6% GDP of India. Reliance’s position seems to get stronger and stronger with every passing year and 2020 being a Golden Year for the company’s deals.

From oil to telecom, and now with the establishment of Jio Mart and numerous acquisitions in the year 2020, the moot question is, whether Reliance is disrupting the healthy competition in the market? It is undeniable that with Reliance’s strategy to enter the telecom industry by offering free services, Acquisition of every possible company that would help it establish itself in that particular market, its control is expanding. Especially collaborating with companies like Facebook for using its services to efficiently exploit the digital market for further promotion of its products and companies, Reliance is moving gradually to establish control in the Indian market as no other company can. One can easily interpret that by establishing such power, it indeed is hampering the competition in the Indian economy in one way or another making the growth of small companies extremely arduous.

In conclusion, it is very pertinent to keep a proper check on all these companies to maintain healthy competition in the market and further protect the consumers’ interest. If every time a small company or start-up tries to grow but is pushed down by major players compelling it to either sell or ultimately be worn out by losses, it is highly likely that soon there would be only a few players managing and manipulating the market. It is the government’s and CCI’s duty to be even more alert in these times and not to let few giant companies (or especially one company) control the Indian market.

References

[1] https://www.pwc.in/assets/pdfs/services/dels/deals-in-india-mid-year-review-and-outlook-for-2020-pause-and-consolidation.pdf [2] https://www.mondaq.com/india/consumer-law/891314/acquisition-of-uber-eats-by-zomato-the-flaw-in-the-plan-with-deep-discountingStudents of Lawsikho courses regularly produce writing assignments and work on practical exercises as a part of their coursework and develop themselves in real-life practical skill.

LawSikho has created a telegram group for exchanging legal knowledge, referrals and various opportunities. You can click on this link and join:

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Allow notifications

Allow notifications