In this blog post, Abhishek Kumar, a student of law at Delhi University, who is currently also pursuing a Diploma in Entrepreneurship Administration and Business Laws from NUJS, Kolkata, writes about the procedure for filing an application for rectification of Income Tax.

Section-154 of Income Tax Act provides for the remedy of rectifying the assessment of income tax.

What kind of errors can be rectified?

Under Section-154(1), errors which can be rectified are:

an error of fact

2. an arithmetic mistake, or

3. a small clerical error, or

4. error due to overlooking compulsory provisions of law.

Who are empowered to rectify?

A rectification can be filed by a Taxpayer (assessee) bringing the mistake to the notice of the authority concerned, or, an Income Tax Authority. The authorities concerned are:

- Income Tax Assessing Officer (under Section-143(1))

2. Commissioner (Section-23 or Section-264)

3. Commissioner (Appeals) (Section-250)

4. Other Income Tax Authorities (Section-116) - The Appellate Tribunal (under Section-254(2) but not Section154 as it is not an income tax authority).

Some Important points regarding filing application for rectification under Section 154(1)

One cannot use this rectification request for changing bank account or address details of one’s Income Tax Return. If upon rectification there is a change in income, in that case, one must file a Revised Income Tax Return. No new deductions or exemptions are allowed to be claimed in the rectification request.

Time limit for rectification under Section 154

Rectification of an order can be made only within four years from the end of the financial year. However, the time limitation shall not be applicable where correction is made under Section 155. If the assessee makes an application for rectification , the authority shall pass an order within a period of 6 months from the end of the month in which the application is received by it making the amendment or refusing to allow the claim. The opportunity of being heard is given to assessee if rectification results in enhancement or reduction or increase in liability of the assessee. Moreover, the authority concerned must give notice to the assessee. Even when Returns are already processed in Central Processing Centre (CPC) Bangalore, a rectification request can be filed. When the income tax return was filed online, only online rectification is allowed.

How to file a rectification request under Section 154(1) online

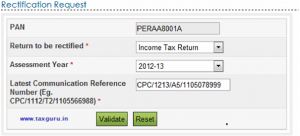

Step 1 – Login to the e-Filing application and go to > My Account > Rectification Request.

Step 2 – Select Return to be rectified as “Income Tax Return” from the drop down available.

Step 3 – Select the Assessment Year for which Rectification is to be e-Filed. Enter the Latest Communication Reference Number (as mentioned in the CPC Order)

Step 4 – Click “Validate”.

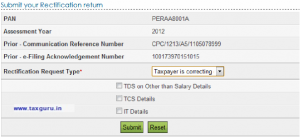

Step 5 – Select the ‘Rectification Request type.’

Step 6 – On selecting the option “Taxpayer is correcting data for Tax Credit mismatch only”, three check boxes TCS, TDS, IT are displayed. You may select the checkbox for which data needs to be corrected. Details regarding these fields will be prefilled from the ITR filed. The user can add a maximum of 10 entries for each of the selections. No upload of any ITR is required.

These Three fields are as follows:

‘Taxpayer Correcting Data for Tax Credit mismatch only’ − on selecting this option, three check boxes, TCS, TDS, IT, are displayed. You may select the checkbox for which data needs to be corrected. You can add a maximum of 10 entries for each of the selections. No upload of an Income Tax Return is required.

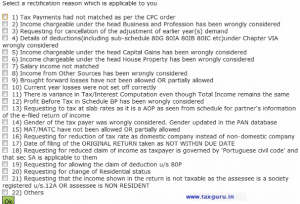

‘Taxpayer is correcting the Data in Rectification’ − select the reason for seeking rectification, Schedules being changed, Donation and Capital gain details (if applicable), upload XML and Digital Signature Certificate (DSC), if available and applicable. You can select a maximum of 4 reasons

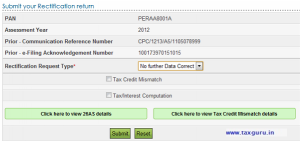

‘No further Data Correction required. Reprocess the case’ − On selecting this option, three check-boxes, Tax Credit mismatch, Gender mismatch, Tax/ Interest mismatch are displayed. You may select the checkbox for which reprocessing is required. No upload of an Income Tax Return is required.

Step 7 – Click the ‘Submit’ button.

Step 8 – On selecting the option “Taxpayer is correcting Data in Rectification”, select the reason for seeking rectification. Schedules being changed, Donation and Capital gain details (if applicable), upload XML and Digital Signature Certificate (DSC), if available and applicable. You can select a maximum of 4 reasons.

Select a Rectification Reason

Step 9 – On selecting the option “No further Data Correction Required. Reprocess the case”, checkboxes to select are: Tax Credit Mismatch, Gender Mismatch (Only for Individuals), Tax / Interest Mismatch are displayed. The user can select the checkbox for which reprocessing is required. The user can view their 26 AS details by clicking on ” Click here to view 26AS details” button and view their Tax Credit Mismatch details by clicking on “Click here to view Tax Credit Mismatch details” button.

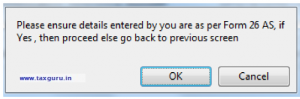

Step 10 – Click the “Submit” button. A popup appears.

Step 11 – Click on “OK” button to submit the rectification.

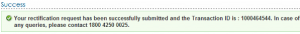

Step 12 – On successful submission, following message is displayed.

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Allow notifications

Allow notifications