This article has been written by Shreya Mazumdar, pursuing a Diploma Programme in Cyber Law, FinTech Regulations, and Technology Contracts from LawSikho.

Table of Contents

Introduction

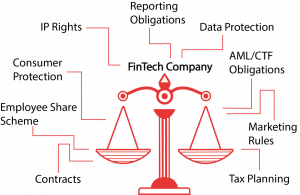

When it comes to fintech (financial services technology) do you feel it is a collaboration of finance and technology that you do not understand? If yes, then this article might help you figure out certain aspects of your investment in the FinTech industry. It is true that technology is reshaping the world and along with it technology is reshaping the financial sector. Finance has been a complicated chapter for a lot of us and so is technology. The combination of the two may promise a fast growth of the economy but the struggle to understand FinTech is real. The emerging Fin-Tech has brought in a radical change in the existing banking industry (think Paytm, PayPal, FreeCharge). Although FinTech can have a lot of exciting offers and cashback, contractually engaging with them can be complicated. The pictorial depiction as had been put forth below, shows the areas that FinTech is involved in:

Inclusion of start-ups and well-established companies

The FinTech companies contain both start-ups and also well-established companies. Therefore, there are a variety of contracts. The spectrum behind engaging with a FinTech company spans over a large side, which begins with a licence agreement to a joint marketing agreement where the profit earned is divided between two or more parties. FinTech has its claws around the diverse demographic base and therefore it has its dealings with sensitive information. The crux of the matter is that the regulatory landscape is still in a very nascent state and in some jurisdictions, such laws are overly strict in bringing in the question of preparation for a new contract. There are myriads of legal obligations that are involved while drafting the contracts and these should be addressed properly. For a better understanding of the areas, one may consider the below-represented points in the diagram:

The five inevitable contract clauses to mitigate risk in a financial transaction

This article talks about the five inevitable contract clauses to mitigate risk in a financial transaction by the Fintech Company involving a few of the above-mentioned points. The article also helps the investor to better understand and interpret the clauses which may help them better negotiate their deal. Considering the B2B investment in FinTech, it can be a valuable investment opportunity. In order to provide better clarity with respect to a new FinTech agreement, this article mentions the five clauses that need interpretation while negotiating a new FinTech agreement. There may be others that require your undivided attention but these are the five clauses that are believed to have carried a great impact. In order for risk mitigation which can be used in fintech technology must include the following:

- Indemnity

- Limitation of liability

- Representation and warranties

- Liquidated damages

- Confidentiality

Indemnity

Indemnity is a promise that makes one party liable to compensate if a loss is incurred to the other party as a result of the acts of the indemnitor or any other party. There may be many points that could be covered under the indemnity clause but this paper focuses on certain points:

Intellectual Property infringement

FinTech with its developing technology may tend to release new technologies which may give rise to Intellectual Property infringement lawsuits. These lawsuits are extremely pricy and definitely impact the ROI (Return of Investment). If a company is contracting directly for marketing the solution, then they may find themselves getting involved in the pending lawsuit. Also, in the cases where the party is just licensing the technology, then such a contract with FinTech must ensure that they indemnify for an infringement-related action that might be brought in due to your relationship with FinTech.

- The drafted clause can be mentioned as follows:

FinTech shall indemnify and defend its customers against any claims which include but do not limit to third party claim, suit, or proceeding arising out of, related to, or alleging:

- Infringement of any patent, copyright, trade secrets, or other Intellectual Property Rights.

- Replace or modify the deliverable to make it non-infringing, provided such modification or replacement will not materially degrade any functionality of the service.

- Refund __% of the license fee that is paid for the deliverable for each month that is remaining in ______, in which case the FinTech may terminate any or all customer licenses to the deliverables that are granted in this Agreement and require return or destruction of copies thereof.

- The FinTech company should have certain exclusion from the IP indemnity on certain grounds:

FinTech obligations that are mentioned in Section ___ (IP Indemnity) does not apply to the extent that indemnity claims regarding intellectual property infringement arising out of:

- If the breach is on the customer’s part.

- If there is any failure by the Customer to incorporate Software updates or upgrades that would have circumvented the alleged infringement.

- Fin Tech’s modification of the Software is not at par with the specifications provided by the Customer.

- The use of this Software in collaboration with the hardware or software that is not provided by the Vendor.

Limitation of liability

When it comes to the pragmatic part of implementing an indemnity clause, one must definitely negotiate the limitation cap for the liability that may fall on due. The limitation of the liability clause determines the total amount of damages that the parties are responsible for.

- This can be drafted as:

FinTech’s liability that shall arise from or relates to this Agreement shall not exceed $___ each time such liability arises.

This clause can help in putting a cap on the number of damages that are recoverable as well as the type of damages that can be claimed. Consequential damages are also referring to special and indirect damages which are said to have indirectly occurred due to the breach by another party. For instance, it could be indirect losses caused because the party could not get other clients as the defaulting party could not make the payment and the other party could not buy raw materials for its next client. Incidental damages are the ones where the damages are caused because of the actual breach of the agreement that the parties entered into. The Black’s Law Dictionary mentioned ‘punitive/exemplary damages’ as damages that are awarded in addition to the actual so that the wrongdoer does not repeat the offence again.

- This clause can be drafted as:

At no point in time shall any Party be liable for any consequential or punitive damages that shall arise out of or relates to this Agreement.

This clause can also point out where the limitation of liability may not apply and this can include payment of liquidated damages, claims for indemnity, and lawyer’s fee. The clause may not cover payment of fees, infringement of Intellectual Property, and/or breach of confidentiality provisions.

Representation and warranties

Representation means a collection of facts or a set of facts in a manner to persuade someone either by words or by action to enter into a contract. Whereas warranty is a set of provisions which is a promise to the other party mentioning the quality of goods or services that will be provided as a consequence of the agreement. In the representations clause, the appropriate standard of liability shall be properly expressed. If it is from the side of the party who is making the representation then the number of representations should be minimum and precise, maintaining any potential liability. If this representation is from both the side of the party then, in that case, the clause should be broad and loose ended so that it is easier to bring a claim of representation. Few of the common representation and warranties clauses include:

- Warranty of function: This is supposed to mention the products will work as it should be for a specific period of time or in some cases. It is stated that the software is provided as it is without any warranties as to its working functionality.

- IP warranty: It mentions that the IP belongs to the party that gives the warranty.

- Professional service quality: It mentions that the services that are provided are in a professional and workmanlike manner.

- Authority to enter into an agreement: This states that the party has the legal authority to enter into and bind the parties.

- Warranty disclaimer: It is a matter of essence to have a disclaimer to warranty. It prevents the business/client from any implied warranty.

Liquidated damages

It is very difficult to calculate liquidated damages as in the claim for liquidated damages, there has to be evidence that has to be led in support of the same be granted on consideration of the basic principle for grant of liquidated damages. If an agreement has a specific clause on liquidated damages, then in that case the injured party need not have to prove the actual damages, it is sufficient to prove that the injured party has suffered some loss. Although as mentioned before, there should be a cap on the maximum liability in order to minimise the risk on one of the parties. Indian courts have from time to time decided that the parties are not at liberty to charge exorbitant sums as a breach of contract. If this sum is exorbitant and has no resemblance to the losses suffered or is too excessive then no prudent person would consider the same as reasonable assessment of damages that arises out of the breach and shall be termed as penalty. Therefore, in a FinTech agreement, the clause cannot pose a loss to be like a penalty (which is exorbitant) but it has to be a reasonable assessment of the damages that are claimed in the agreement. The court, in this case, might consider the penalty clause to be void and unenforceable.

Confidentiality

There are bundles of financial data that are stored online and there are many FinTech which views this as a chance to examine that data in order to identify new markets and products. If you are a company that has any customer data then you must ensure that a confidentiality clause protects the privacy and security of any customer sensitive information which must extend to the privacy and security of any customer sensitive information. It should be drafted that exposure of any of the sensitive customer information without consumer consent is a violation of the applicable laws. The FinTech company must always ensure that they define the confidential information in the agreement as accurately as possible depending upon the sort of information that is supposed to be shared with the contracting party over the course of the business deal. The template contracts may be a convenient resource, it is definitely essential to review these templates and modify them in order to make sure that it is custom made as per the deal and nothing is missed out. The language used in the agreement should guarantee the return of sensitive information or certify the destruction of data that survives the initial term of the agreement.

Conclusion

The FinTech agreements are very important but it is also very complex. It is very essential to understand how this impacts the liability for FinTech as a company and also its users and its investors. When it is the question of risk management there are three important steps- identity, assess, and mitigate. This article analyses ways to mitigate contract risk and how to look into the points from both sides of the party. In order to have a win in these situations and making the maximum of the investments depends heavily on the investor’s ability to negotiate these five clauses.

References

- Altug Ozgun et al., 5 Inevitable Contract Clauses That Mitigate Third-Party Risk (Nov. 19, 2020), https://www.cetinkaya.com/insights/5-inevitable-contract-clauses-mitigate-third-party-risk?utm_source=Mondaq&utm_medium=syndication&utm_campaign=LinkedIn-integration.

- Andy Atkins, The ‘FinTech Five’- Mitigate risk by Focusing on Five Clauses, (Jan. 3, 2019), https://journal.iaccm.com/contracting-excellence-journal/the-fintech-five-mitigate-risk-by-focusing-on-five-clause.

- Content Team, Incidental Damages (Dec. 31, 2014), https://legaldictionary.net/incidental-damages/.

- David Parks, 7 Ways to Mitigate Contract Risk, (May 03, 2021) https://www.contractlogix.com/contract-management/7-ways-mitigate-contract-risk/.

- Finwin Technologies, Fintech vs. Traditional Banks: Cooperation or Competition? (Oct 2, 2020) https://medium.com/finwintech/fintech-vs-traditional-banks-cooperation-or-competition-93852e6a7d31.

- Law Sikho Cyber Law, Fintech & Technology Contracts (Dec. 2020) (unpublished manuscript).

- Lisa Farrah Ho, The FinTech Series: Part1 Contracts, (Aug. 22, 2019), https://zegal.com/blog/post/the-fintech-series-part-1-contracts/.

- Mitigating Risk in Contracts, https://generainc.com/mitigating-risk-in-contracts/, (last visited May 03, 2021).

- Pankaj Agarwal et al., Exemplary/Punitive Damages (Feb. 14, 2020), https://www.mondaq.com/india/libel-defamation/893708/exemplary-punitive-damages.

- PSP Lab, FinTech Legal Services, https://psplab.com/services/fintech-legal-services/ (last visited May 03, 2021).

- Punitive/Exemplary Damages, Black’s Law Dictionary https://www.latestlaws.com/wp-content/uploads/2015/04/Blacks-Law-Dictionery.pdf.

- Shweta Sahu et al., A Liquidated Damages Clause Does Not Oust the Need to Prove the Loss: Bombay HC, (Nov. 07, 2016), https://www.mondaq.com/india/contracts-and-commercial-law/541398/a-liquidated-damages-clause-does-not-oust-the-need-to-prove-the-loss-bombay-hc.

Students of Lawsikho courses regularly produce writing assignments and work on practical exercises as a part of their coursework and develop themselves in real-life practical skills.

LawSikho has created a telegram group for exchanging legal knowledge, referrals, and various opportunities. You can click on this link and join:

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Allow notifications

Allow notifications