This article has been written by Kingshuk Saha, pursuing a Diploma in M&A, Institutional Finance and Investment Laws (PE and VC transactions) from LawSikho.

Introduction

When David Nussbaum, an investment banker with a psychology undergraduate degree, and his lawyer friend David Miller “invented” a form of investment vehicle which they called a ‘SPAC’ way back in 1993 (click here), little could they have predicted that their invention would become the hottest topic in finance almost three decades later amidst a global pandemic. Mr Nussbaum’s investment bank EarlyBirdCapital filed an S-1 in 2003 (a form required by US companies to be filed with the US Securities Exchange Commission (SEC) to register securities they already hold or would most likely acquire) for Millstream Acquisition Company.

It was to ensure that Millstream raises over 20 million USD in the stock market to acquire NationsHealth, a Delaware based company that specialized in retail drug stores, in 20041, in what is perhaps the first recorded SPAC deal in history. However, SPAC as an investment vehicle failed to ignite the imagination of the contemporary financial world at the turn of the millennia when it was first introduced but made an astonishing comeback in 2020 – a situation which Mr Nussbaum aptly described as something that had taken him “27 years to become an overnight sensation”. (click here)

Table of Contents

SPAC: What is it and how does it work?

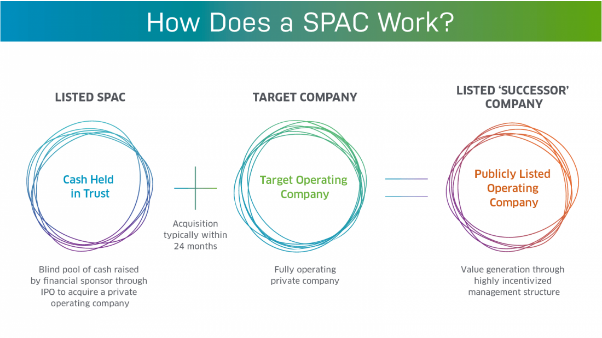

SPAC stands for Special Purpose Acquisition Company. It is essentially a blank cheque company founded by investment experts (called sponsors) and managed by personnel skilled in the field which raises money by seeking investment from the public like in a traditional IPO in the hope that it would acquire a company within a limited time-frame and reverse merge with the acquired company. The acquired company survives the transaction.

The process can be broken down into the following stages:

Stage 1: Formation of a SPAC

A SPAC is formed when an experienced investor or a group of experienced investors come together to become sponsors of the SPAC. The company is a shell company with no operations, assets, turnovers or any other form of business activity whatsoever. It is generally established in jurisdictions with favourable tax treatments, ideally in tax havens like the Cayman Islands. Experienced investors with a proven track record of success are crucial to the success of a SPAC, the reason for which will be explained in the next stage.

Stage 2: Seeking Investment from Institutional Investors

Once the SPAC is formed, the sponsor/s will approach the institutional investors like established banks seeking investment in the SPAC in a manner similar to the IPO. This is where the ‘reputation’ of the sponsor/s becomes extremely important as the institutional investors are aware that they are investing in a shell company and are not told the acquisition targets that the SPAC plans to acquire. Therefore, the institutional investor is essentially betting on the promise of the sponsor/s to deliver.

Stage 3: The SPAC IPO

Once the sponsor/s is able to secure adequate investment from the institutional investors, then he will list the SPAC for an IPO. In preparation for the same, the legal and financial advisors would work together in order to draft a SPAC prospectus and applies to the regulatory body for listing. Once the requisite forms (like the S-1 form in the US context discussed above) are filed and approved by the regulatory body, the SPAC becomes a public listed company.

In the US context, the shares of a SPAC are bundled into units containing a share and a warranty with a fixed uniform exercise price which gives the public investor an investment incentive in the form of a right to purchase more shares of the SPAC (and ultimately the acquired company) at a fixed price. The USA also ensures investor protection and prevention of misappropriation of funds by mandating that the funds raised by the SPAC in the IPO are held in a trust and invested in Treasury (US government) Notes. Only at the next stage can the funds be utilized.

Stage 4: Identification of Acquisition Targets

A primary reason why SPACs have become an attractive investment opportunity is that the SPAC is required to identify an acquisition target within twelve to twenty-four months (one to two years) following the IPO. If the SPAC is unable to do so, then the SPAC must be liquidated and the funds raised is returned to the investors. Otherwise, the SPAC, after identifying the target company, approaches the target with an acquisition offer armed by the funds raised from the IPO. From the investors’ perspective, it is important to note that if they are unhappy with the acquisition target, they are provided with an exit option.

It is sometimes possible that the public funds raised through the IPO may not always be sufficient to complete the deal. In such cases, the sponsor/s generally seeks private investment in public equity (PIPE) commitment from private parties like hedge funds to augment the SPAC’s capital pool. For a detailed understanding of PIPE transactions, click here.

Stage 5: Deal Approval

After the offer is accepted and the deal is agreed upon, the same deal needs to be approved by the regulatory authorities before the deal is announced to the public.

Stage 6: De-SPACing

Once the acquisition is completed and approved, the SPAC is dissolved as a result of a reverse merger with the acquired company, popularly dubbed as de-SPACing. This ultimately leads to the acquired company surviving the deal. It is beneficial from the acquired company’s perspective because the acquired company now becomes a public listed company whose securities are traded in the stock market without the acquired company ever having to go through the hassle of an IPO process (as a backdoor entry).

The concept simply can be illustrated thus:

The SPAC buzz and why India should care

With companies struggling to raise capital via the traditional initial public offerings (IPO) route in uncertain times forced by the global pandemic, SPAC soon emerged as everyone’s favourite investment mechanism, with household names like Buzzfeed, Vice Media, Vox and Group Nine in the digital media industry (click here), fintech giants like eToro (click here) and sporting information industry leaders like Sportradar (click here) all already securing or seeking to secure financing via the SPAC route.

SPACs have raised a record 170 billion USD this year alone so far, leaving behind last year’s total of 157 billion USD and now account for more than 70% of all initial public offerings, up from 20% two years ago and a negligible total for much of the past 20 years.2 Suddenly everyone wanted a piece of this old pie served in a new hot way, with celebrity investors like basketball legend Shaquille O’Neal and tennis legend Serena Williams already investing in the SPAC space (click here). Indian companies and regulatory bodies, though slower to ride on the SPAC wave when compared to their US counterparts, are starting to show signs of catching up.

In late February 2021, India’s green energy industry giant ReNew Power became the latest company to jump on the SPAC wagon after agreeing to a SPAC deal with the SPAC, RMG Acquisition Corporation II, backed by leading global banks like Goldman Sachs and Bank of America at an 8 billion USD valuation. Post completion of the deal, ReNew Power would be traded on the NASDAQ (click here). This should give impetus to other Indian industry giants contemplating foreign listing through SPACs like Grofers (which is seeking a valuation of around 1 billion USD) (click here) and Flipkart (which is seeking a valuation of around 35 billion USD) (click here).

SPACs offer an exciting route and opportunity for Indian technology start-ups looking to list in the USA. On 19 March 2021, prominent Indian venture capital investors, Ravi Adusumalli of Elevation Capital and Shashin Shah of Think Investments (who partnered to develop a SPAC called Think Elevation Capital Growth Opportunities) filed for the registration of the same with the SEC (click here). It seeks to raise 225 million USD with an offer of 22.5 million units at 10 USD each. Each unit is to consist of one share of common stock and one-fourth of a warrant, exercisable at USD 11.50 (click here). Think Elevation Capital Growth Opportunities is however a unique SPAC with an aim to aid only Indian technology start-ups looking to list on US exchanges. But this indicates the growing trend of acceptance of SPACs in India because SPACs offer unique opportunities for cash-strapped Indian start-ups looking for an urgent injection of capital in times when capital is a dearth commodity for most business.

Advantages of choosing the SPAC route for Indian companies over the traditional IPO route

-

Less cumbersome: Undoubtedly the biggest reason why SPACs have become popular in recent times is that it is easier for a private company to become a public listed company than through the traditional IPO process. As explained above, an acquired company can gain a backdoor entry into foreign stock markets via the SPAC route. This would make it easier for Indian companies to gain access to foreign markets.

-

Less expensive: For a traditional IPO, the fees are generally 7% of the capital raised through the IPO while for the SPAC, the costs are around 5.5% of the capital raised (broken down as 2% in underwriting fees paid by the SPAC at the inception of the IPO and 3.5% in underwriting fees paid by the final combined entity after completion of the acquisition) (click here). The cost structure for the SPAC would therefore be more favourable for Indian companies.

-

Less time taken to go public: It would typically take the acquired company around 6 months to be a publicly-traded concern via the SPAC route, as opposed to 18 months in the traditional IPO process. For Indian companies seeking to secure investments quickly, this short timeframe could become a survival necessity.

Key challenges to implementing a SPAC regime in India

While Indian companies could look to become public listed companies in foreign stock exchanges via the SPAC route, it is necessary that a proper SPAC regime is implemented in India. This should benefit Indian start-ups as it would not necessitate them to seek investment from foreign stock markets if they are unable to fulfil the profitability criteria mandated by the Securities and Exchange Board of India (SEBI) for listing for an IPO in the Indian stock exchanges and provide them with an alternative method to secure the necessary investment required to prevent them from failing. However, implementing such a regime has a number of legal and regulatory challenges:

-

SPACs are not defined under the Companies Act: The Companies Act, 2013 does not define blank cheque companies or SPACs. Under the crackdown of shell companies post demonetization in India, it has become difficult for such blank cheque companies to exist in India. Perhaps the most pressing challenge to the existence of SPACs in India comes from Section 248 of the Companies Act, 2013 which requires the Registrar of Companies to strike off the name of a company from its register if a company is found to have not entered into business within a year of his incorporation. As explained above, SPACs can stay non-operational until two years (twenty-four months), which raises immediate conflict.

-

SPACs will conflict with the SEBI’s disclosure requirements: Section 26 of the SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2009 (last amended on 31 May 2017) inter alia mandates that any company making a public offer in an IPO requires to have a net worth of minimum 1 crore INR3 and net tangible assets worth minimum 3 crores INR4 in each of the three years preceding the offer along with pre-tax consolidated profits of minimum 15 crores INR5 in three of the most profitable of the five years preceding the offer. SPACs, by virtue of not having any operations or business before the acquisition, simply cannot fulfil these requirements. Moreover, the deal completion period through the SPAC route will be delayed by the SEBI’s Takeover Code, 2011 (last amended 18 April 2017) as it is applicable only for listed companies.

-

SPACs will be unable to fulfil the requirements of the Indian listing exchanges: India’s most prominent stock exchanges are the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE). Both of these stock exchanges require compliance with the aforementioned SEBI guidelines, which, in their present form, immediately disqualifies SPACs. Additionally, the NSE requires companies seeking to be listed on its exchange to maintain positive operational cash accruals for two years preceding the offer, which again the SPACs cannot show.

These provisions would require substantial revisions and amendments in order to facilitate the implementation of a SPAC regime in India. However, there is still hope yet for SPACs in India. To adequately address these challenges, the SEBI has announced on 11 March 2021, the formation of an expert group under its Primary Markets Advisory Committee (PMAC) to discuss the feasibility of implementing a SPAC regime in India with adequate checks and balances (click here) which should delve extensively into the legal and regulatory hindrances faced by the SPACs.

Conclusion

As per reports by Mckinsey & Co. (click here), India’s capital markets, if developed, could inject as much as 100 billion USD worth fresh funding annually. With the global pandemic giving an impetus to alternative modes of investments like SPACs, India needs to explore the possibilities of developing its capital markets to boost industrial and economic growth which has taken significant hits because of the global pandemic. With the SEBI showing open-mindedness towards the issue, one can be hopeful of a SPAC regime in India soon.

References

1 Patrick A. Gaughan, Mergers, Acquisitions and Corporate Restructurings, 7th Edn (Hoboken, Wiley 2017) 36

2 Supra note 2

3 Section 26 (c), SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2009

4 Section 26 (a), ibid

5 Section 26 (b), ibid

LawSikho has created a telegram group for exchanging legal knowledge, referrals and various opportunities. You can click on this link and join:

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Allow notifications

Allow notifications