This article is written by Shalini Shrivastav, from Amity University, Kolkata who is pursuing a Diploma in Advanced Contract Drafting, Negotiation and Dispute Resolution from LawSikho.

Table of Contents

Introduction

Mudarabah (profit sharing) was used by the pre-Arabs for trade activities and it is also among one of the ancient business forms. The term “mudarabah (profit sharing)” originated from al-darb al-ard which means “traveling through the land”. The literal meaning of this partnership is that, in the past this contract required the parties involved to make a journey to run their business.

Mudarabah contract is used by modern Islamic banks basically as a profit-sharing contract. As a representation of a growing market segment, presently, mudarabah including musharakah covers less than 10% of all global transactions of Islamic banking and finance. The usage of mudarabah is still considered to be enormously risky even after making copious efforts to increase the practice of mudarabah in Islamic banking and finance. The successful application of mudarabah needs to be coupled with efforts from various quarters, together with regulators, bankers, advisors and the society at large.[1]

Mudarabah is also known as “silent partnership” (Al-Zuhayli, 2007) whereby it involves a financier (rabbulmal), who acts as a business agent or trustee, providing a specific amount of capital and acts as an entrepreneur (mudarib) and a sleeping or dormant partner. In order to generate optimal profits for the mudarabah (profit sharing) investment, in adherence with the Shariah laws, a mudarib manages and utilizes the capital in a good way. He does not put in any property in the business venture except for his knowledge and skills and he is not entitled to claim any wage for carrying on the business venture. If any profit is generated, it must be shared in a mutually agreed ratio between them. But, in case of loss, the fund provider (rabbul maal) will bear it completely and the mudarib will only lose the efforts he put into the business.

Mudarabah contract

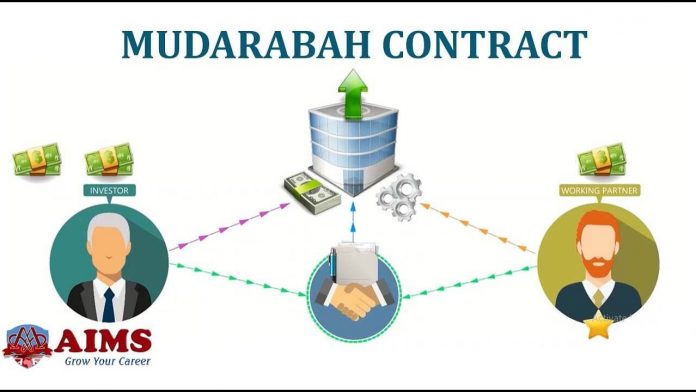

Mudarabah which is widely called a profit-sharing contract is nothing but a type of Islamic equity-based partnership contract. Basically, it is a partnership contract in which the capital provider provides the money and the manager offers his managerial skills to manage the money of Mudarabah. These Mudarabah arrangements could be one-tier or multi-tiered. In such contracts, the contracting parties share the profit amongst themselves. The parties involved in a Mudarabah contract share the profit amongst themselves. But, in the case, when there isn’t any misconduct or negligence or breach of the partnership terms and conditions by the manager, the capital provider will bear the loss. Therefore, trust which is based on the fiduciary relationship amongst the parties is the basis of this mudarabah contract.

Only in the combination of financial and managerial resources between the parties, a noteworthy application of a Mudarabah contract could be attained. It works well in the investment which is both general or specific in nature, as well as in project financing, bridge financing, working capital and SME financing, inter-bank investment, structured products, investment deposits, etc. The capital delegated as wealth to the manager encourages shared goodwill between the partners and channels wealth to productive use. To accomplish the desired aim of the capital provider who has spent his capital without having any control in the management of the venture, the manager should act in full integrity to perform in the best manner

The Mudarabah contract can be classified into:

- Unrestricted Mudarabah: It is a type of mudarabah in which the capital is handed over to the mudarib without determination of the type of work that is to be done by him, including the place, time, or payment mode from the client, the quality of work and the person with whom the mudarib have to do the trade. Here, the investor gives approval to the agent to entirely act at the discretion of the letter in all business matters. This authorization is communicated by the statement of the investor to the agent which is to act with the investment as he deems suitable (Sarakhsi).

- Restricted Mudarabah: It is considered to be restricted when the liberty of the mudarib in managing the venture is restricted in terms of a kind, time and place. The AAIOFI standard describes it as “A contract in which the capital provider restricts the actions of the mudarib to a particular location or a particular type of investments as the capital provider considers appropriate, but not in a manner that would unduly constrain the mudarib in his operations” (INCEIF).

The fundamental components of this contract are:

- Sighah (Ijab and Qabul): Basically, the condition related to the sighah of mudarabah (profit sharing) is similar to those other contracts which constitute an offer and acceptance. Mudarabah (profit sharing) is concluded when the parties use words that indicate the contract of mudarabah (profit sharing) in their offer and acceptance.

- The Contracting Parties: The contracting parties consist of fund providers (rabbul maal) and entrepreneurs (mudarib) that have a sound mind and can take responsibilities. They offer capital for investing in a business to the entrepreneur who will in return apply his skills and efforts.[2]

- Mudarabah capital: It should be in the form of money because, if the capital is in the form of commodities and assets, then there would be a possibility of uncertainty and dispute in their value. But, the majority of contemporary scholars are of the outlook that the capital in mudarabah may be in the form of commodities and illiquid assets. But in such instances, it is essential to decide the value of those assets in terms of cash. Hence, there should be any uncertainty about the value of capital. Moreover, the capital must be present after the contract. The capital in mudarabah cannot be substituted by the debt or receivables.

- Work for the mudarabah venture: The capital provider is restricted from participating in mudarabah business. If he puts the condition that he has a right to participate in mudarabah business and is involved in buying and selling activities, then the mudarabah contract becomes void. The manager (mudarib) has to perform his duties within the agreed terms and conditions of the contract. However, the capital provider has a right to oversee the mudarabah business to make sure that manager fulfils his duties honestly and efficiently.

- Profit & loss sharing in mudarabah: It is necessary for mudarabah that both parties agree on the profit sharing ratio at the time the contract is concluded. The distribution of the profit must be based on the percentage of profit. It is not allowed to decide the profit based on a lump sum or percentage of capital. Nevertheless, the parties have the right to agree on equivalent profit sharing or allocate different proportions. The capital provider only bears a loss if it happens, because the manager doesn’t invest anything. Hence, whenever the mudarabah business faces a loss, at the first given chance the profit is used to counterbalance the loss and if the loss is greater than profit accrued at the time of liquidation, then it is taken away from the capital.[3]

Legitimacy under the Islamic Law

Mudarabah is not authenticated by the explicit text of the Qur’an. But, it has been established by Sunnah (prophetic practice) and scholarly consensus (ijma’) and as well as on the practical grounds of its economic function in society. It is from the traditional practice of the Prophet (PBUH), the jurists have unanimously agreed on the legal validity of the mudarabah contract. There are numerous traditions which attribute its practice to the Prophet (PBUH), before his prophethood, and to his leading companions.

- The Quran: The following Quranic verses imply the general permissibility of commercial ventures including Mudarabah –

- “…others travelling through the land, seeking Allah’s bounty…” (Al-Muzammil:20)

- “And when the Prayer is finished, then may ye disperse through the land, and seek the Bounty of Allah; and celebrate the Praises of Allah often (and without stint): that ye may prosper.” (Al-Jumu`ah:10) These verses speak about the acceptability of Mudarabah but it also implies to the people who have traveled for trading purposes and for seeking suitable income including the people who have undertaken labour with someone else’s capital in exchange for part of the profit.

- The Sunnah of the Prophet Muhammad (SAW):

- The Narration of Ibn Ishaq: The Prophet himself, prior to his prophethood had acted as a mudarabah contract’s agent manager with an investment provided by Khadijah Bt. Khuwaylid. He took her goods and traded with them in Syria. By selling them, he made a profit which was almost double the amount of the goods. So, it can be stated that this is a type of commercial association which was widely used in pre-Islamic trade among the Quraysh and other tribes, and continued to be practiced throughout the early centuries of the Islamic era as the ministry of caravan and long-distance trade (Ibn Hazm).

- The Narration of Ibnu Abbas: Ibnu Abbas r.a. accounted that: “When our leader Abbas Ibn Abd al-Mutallib gives his property to someone for Mudarabah, he stipulated conditions for his partner not to bring the capital throughout the sea; and not to bring with him the capital crossing a valley; and not to buy livestock with the capital; and if his partner violates the conditions, he should guarantee the loss occurred. These conditions have been brought to the attention of Prophet Muhammad (SAW) and he approved them.” (Mu’jam Al-Awsat; Al-Tabrani).

- The Narration of Suhayb: Suhayb r.a. accounted that the Prophet Muhammad (SAW) said: “Three matters that have the blessing (of Allah): A deferred sale, Muqaradah (Mudarabah), mixing the wheat with barley for domestic use and not for sale.” (Sunan Ibn Majah).

- The Tacit Approval of the Prophet Muhammad (SAW): Mudarabah venture has been practised before the Prophet’s (SAW) first revelation and he did not raise or show any objections against the practice. This is regarded as an implicit approval by the Prophet Muhammad (SAW).

- Ijma’: These traditions attributed to Prophet Muhammad (PBUH) are an unequivocal endorsement and approval of those engaging in trade through Mudarabah. It was during the era of Prophet Muhammad (PBUH) when people were using mudarabah is their dealing and he also agreed to this practice. Aishah and ‘Abd Allah B. Umar are accounted to have invested the money of orphans and other money left in their safekeeping in mudarabah contracts. ‘Abd Allah B. Mas’ud and al-Abbas B. ‘Abd al-Mutalib, engaged in Mudarabah contracts, the latter having acquired the consent of the prophet (PBUH) for the provisions he imposed upon his agent-manager to whom he entrusted his money. On the basis of these recitations, Islamist jurists have collectively agreed that Mudarabah is allowed. Ibn al Munzir stated that there is an agreement among the jurists concerning the legitimacy of mudarabah in his book al-ijma. According to the renowned Hanafi jurist al-Kasani, mudarabah was carried out by the companions, and no condemnation was ever stated by the prophet (Kasani). The above traditions indicate that the Prophet (PBUH) approved of engagement in trade in the form of mudarabah, and this approval amounts to his acknowledgement of the legality of mudarabah. The Mudarabah contract also comprises one of the prevalent tools of viable activity from the pre-Islamic Arabian caravan trade to the early centuries of the Islamic era.[4]

Analysis

In the modern times, the concept of mudarabah has changed. In this type of contract, the bank is responsible for providing the capital to the working-partner and the bank will have to bear all the financial losses solely. The bank will choose its working partner and forward the capital, which has already been deposited by the bank’s clients as “investment account‟. The manager will spend the funds in money-making ventures.

From the legal viewpoint, the legal owner of the capital is the bank and invests in the mudarabah investment throughout its duration, in spite of not taking part in the management.

But the bank has to ensure that the capital provided by them to the working-partner is used in a proper way to avert losses by their mismanagement. The bank seeks the services of an investment expert to figure out the best possible investment. The bank will not involve itself in the day to day transaction of the business in which it has invested its funds. At the time of making a contract, some issues like the nature, size, and the power of the entrepreneurs may be settled with discussion with the entrepreneurs. If in the contract it has been stated that the capital invested by the bank will be used in a particular trade then the entrepreneur will not be permitted to invest that capital in any other trade.

From the outlook of the Mudarabah agreement, the Islamic bank will be authorized to avert the entrepreneurs from taking steps which may result in a loss due to lack of planning. Hence, the most appropriate procedure for the mudarabah agreement between the Islamic bank and the entrepreneur would be to afford the fullest freedom of working in principle. The Islamic bank needs to ensure that it would not charge any fixed rate of return when offering investment. As a substitute, the depositor would be a shareholder in the bank and will be eligible for a profit share made by the bank (Sadr).

The bank will only take the profit after the mudarabah is completed as per the rule of Islamist Jurisprudence. But, it is not possible to make and complete a contract of mudarabah might within the same financial year. Thus, the bank will add individual mudarabah. But, whenever there is a profit, then it will be distributed according to their capital proportionately among the depositors after the bank has deducted its percentage. But, in the case of the loss, only the bank will take care of it. (Bedewai)[5]

Customarily, Mudarabah is applied to commercial activities for a short time period. The profit percentage taken by the bank varies from one mudarabah transaction to another after taking into account the skills and efforts of each entrepreneur (Kiran). Generally, the bank does not involve itself with the management but can ask for an audit from time to time. If the bank takes a practical part in the management of the business, when it provides the part of the capital, this form will be musharakah participation (Nawawi, 2009).

Conclusion

Since its practice in the pre-Islamic era, Mudarabah has undergone various evolutionary changes and modernizations The improvement of existing mudarabah (profit sharing) conditions in modern mudarabah (profit sharing) is acceptable given that it does not challenge the provisions in the al-Quran and Sunnah. This development intends to fulfil the needs of the modern communities and the fast-growing Islamic financial market. But, in actuality, it is less favoured as compared to Islamic debt financing instruments. This is due to the existence of imperfect information that is inherent in mudarabah (profit sharing) contracts and creates problems of adverse selection and moral hazard, also known as agency problems. As an outcome of it, mudarabah has declined in importance as a financing vehicle.

To overcome the agency problem, screening, monitoring and supervision of the mudarib by the capital provider have been suggested as the best tool to mitigate this problem. From the Islamic viewpoint, in the meantime, the principle of amanah (trusteeship), fairness and shura (mutual consultation) have also been highlighted as a part of trustable solutions to reduce the problem of agency in mudarabah (profit sharing) contracts. As a faithful Muslim, the entrepreneur needs to work in a trustworthy manner and carry out his responsibility truthfully to obtain Allah’s blessings and not for his self-interest.

Mudarabah is an exclusively shariah based transaction. But, in the modern era, the traditional application of the contract of mudarabah has been extended to cover various businesses. However, full potential mudarabah technique of financing has not yet been realized. In general, the successful implementation of PLS contracts and mudarabah in particular have been obstructed by various hindrances. Additionally, committing to mudarabah is harder as compared to musharakah and so on because mudarabah bank does not have any involvement in ventures and the management will be left solely to the mudarib. Consequently, high confidence in the ability of the mudarib to manage the business is extremely needed.

References

[1] Md. Habibur Rahman, Mudarabah and Its Applications in Islamic Finance, https://www.researchgate.net/publication/328630287_Mudarabah_and_Its_Applications_in_Islamic_Finance (accessed Dec 1 2020)

[2] Noraina Mazuin Sapuan, An Evolution of Mudarabah Contract: A Viewpoint From Classical and Contemporary Islamic Scholars, https://core.ac.uk/downlo ad/pdf/8232 949 9 .pdf (accessed on December 7, 2020)

[3] Muhammad Abu Bakar, Basic Rules of Mudarabah (Partnership) Contracts (16 of 28), https://blossomfinance.com/press/basic-rules-of-mudarabah-16-of-28, (accessed on December 10, 2020)

[4] Md. Habibur Rahman, Mudarabah and Its Applications in Islamic Finance, https://www.researchgate.net/publication/328630287_Mudarabah_and_Its_Applications_in_Islamic_Finance (accessed Dec 12, 2020)

[5] D. Rahman, Mudarabah and its Applications in Islamic Finance: An Analysis, https://www.academia.edu/37678436/Mudarabah_and_its_Applications_in_Islamic_Finance_An_Analysis (accessed on December 16, 2020)

Students of Lawsikho courses regularly produce writing assignments and work on practical exercises as a part of their coursework and develop themselves in real-life practical skill.

LawSikho has created a telegram group for exchanging legal knowledge, referrals and various opportunities. You can click on this link and join:

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Allow notifications

Allow notifications