This article is written by Aditi Lahiri, pursuing a Diploma in Business Laws for In-House Counsels from LawSikho.

Table of Contents

Bookkeeping – an introduction

Accurate bookkeeping is the backbone of any successful small business. In every business, every financial transaction of the firm needs to be classified and recorded, which forms the basis of the firm’s accounting system. This recording of every effect pertaining to financial transactions of the firm is called bookkeeping. Proper bookkeeping is critical to sustaining and expanding a business by conducting official business analysis and allowing tax agencies to evaluate the business venture. It tracks the profitability of the company and maintains and improves financial management and cash flow.

Small business owners may set their own bookkeeping system or hire someone to maintain the books. Neglecting this process has a direct adverse effect on the business as it makes it nearly impossible to get loans from the bank or justify their income tax liability without proper books of account and revenue projections. Hence, to fulfil tax and legal obligations (Section 44AA of the Income Tax Act), maintain proper price fixation, preparation of financial statements, and better financial management of the business, it is imperative for even small businesses to maintain books of account.

Manual bookkeeping

Manual bookkeeping typically includes maintaining non-digital (without using a computer system) journals and ledgers (like Sales Book, Cash Book and Purchase Book) by hand, to keep track of receivable and payable accounts. For this purpose, the bookkeeper will need to retain certain physical documents in order to keep a track of its financial affairs, like quotations, delivery notes, purchase orders, credit notes, sales invoices, remittance advices, bank statements, paying in slips, cheque books, purchases and expenses from suppliers and statements of bank account. This is commonly found in small businesses and enterprises with limited transactions where the owner of the business himself performs the functions of the bookkeeper. While initially such manual bookkeeping systems spare the business significant costs in appointing a professional or buying a computer system and software, these systems are prone to human error and often have a very high error rate. Hence, such systems cannot be sustained as the business grows and the number of transactions substantially increase.

Proper bookkeeping

A proper bookkeeping system is easy to use and understand and records all the financial transactions and data in a regularised manner. The extent of detail of such bookkeeping will vary depending on the size and complexity of the business. While bigger organisations may maintain all records like cost and market valuation of the business, smaller businesses may not have the same. However, it is advisable for businesses of all sizes to maintain some basic documentation like receipts, invoices, tax returns, payroll records, bank statements, accounts payable and accounts receivable. For the purpose of good record keeping, at least the following books should be maintained:

- Cash Book – a record of all the money that comes in and goes out.

- Purchase Book – a record of all the items purchased by the business from suppliers at any time.

- Sales Book – a record of all the sales made by the business to customers at any point.

- Inventory Record – a record of physical goods that your business has at any point in time.

- Credit Book – a record of all the money the customers that owe the business to repay for goods and services purchased on credit.

- Debtor Book – a record of all whom the business owes cash as they have supplied goods and services to the business on credit.

- Labour Book – a record of who had worked for the business, how long they have worked (number of hours, days or quantity of work done), when and how much they were paid.

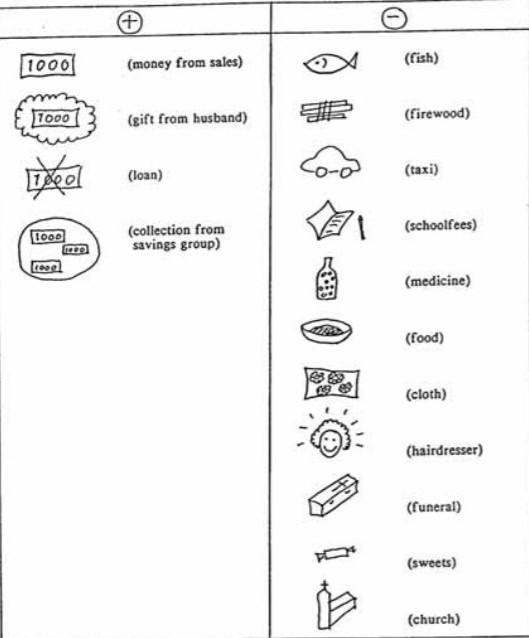

Use of symbols in bookkeeping

All the owners of very small businesses in rural areas may not be educated. Hence, they struggle to maintain proper books as they do not know how to read and write proper words. However, they are all capable of drawing symbols to indicate certain things, which help them in classifying and recording the financial transactions in a clear manner. They can use simple symbols like the ‘+’ or ‘-’ sign to indicate credits and debits respectively in the cash book. Under the income and expenses, they may use any symbols that they choose of the different transactions like buying cloth, taking loan, paying rent, as long as they remember the meaning of each symbol.

Single or double entry bookkeeping

Depending on the size of the business, a business owner may opt for one of two methods of bookkeeping – the ‘Single Entry Method’ or the ‘Double Entry Method’. In case of a very small company with limited transactions, the single-entry method may be opted for, which is similar to keeping a check register where the transactions are recorded as bills are paid and deposits are made into the company account. This method is most commonly used by the manual bookkeepers.

However, for companies of any size, the double-entry method is preferable. Under this method, the two aspects of every aspect, i.e. the credit and debit must always tally and hence, at least two entries are to be made for each transaction. This tally makes it extremely useful in minimizing recording errors.

Cash or accrual accounting

Another important choice to be made while setting up the bookkeeping system is whether to opt for a cash or accrual accounting system. In case of a very small business or a sole proprietorship firm, cash accounting might be more appropriate where transactions are recorded whenever cash (actual money or electronic funds transfer) changes hands. On the other hand, in case of more complex business models operating on requesting credit from suppliers or offering credit to their customers, they will need to opt for an accrual accounting system, where purchase or sale transactions are recorded immediately in the form of Accounts Payable or Accounts Receivable irrespective of whether the cash exchange happens immediately or in the future. A business can also start off with cash accounting and transition to accrual accounting as they grow.

Basics of accounting

Before setting up the bookkeeping system, three basic terms that are there in the format of a balance sheet, need to be understood.

- Assets: Asset accounts enlist the cash account, the marketable securities account, inventory accounts receivable, fixed assets such as land, buildings, and equipment and even intangible assets such as customer goodwill.

- Liabilities: Liability accounts include both current liabilities like accounts payable (what the business owes to its suppliers, credit cards, and bank loans) and accruals (taxes owed to the State) as well as long-term liabilities.

- Equity: Equity accounts include the claims the owners have against the company in the form of their investment in the firm.

The key bookkeeping formula is called the accounting equation: Assets=Liabilities+Equity. It means that the assets (what is owned by the business) has to be balanced out against the liabilities and equity (claims against the business).

Difference between bookkeeping and accounting

While bookkeeping and accounting may be done by the same professional in a business and may hence appear to be the same, they are two different stages of handling financial data of a business. Bookkeeping refers to the identifying and recording of financial transactions in the prescribed form in journals and preparing a ledger account and trial balance whereas accounting refers to the summarising, classifying, interpreting, analysing and reporting the financial data.

Bookkeeping alone isn’t enough for assessment and yearly comparison of the financial situation of a business as well as payment of taxes. Accounting is hence necessary for the proper interpretation and compilation of the raw financial data into financial statements (like balance sheet, profit and loss account and cash flow statement) that can provide a clear view of the financial status of the business to the employees, creditors, investors, and the government. In small businesses the bookkeeping is often done by the owner himself. However, an accountant with the proper skill set is almost always required for the second stage of processing the financial data.

Basic accounting statements

- Balance Sheet – It provides a summary of the value of the business, its assets and liabilities, and its capacity to pay back its debts, depicting that the total assets and total liabilities always balance out.

- Cash flow statement – It tracks the payments and receipts of cash by recording receipts and outgoings such as capital influx, salaries and wages, revenue from sales, interest payments etc. and helps in indicating the excess or lack of cash in the business.

- Profit and loss account – It is an annual statement that shows the after profit or loss of the company after the deduction of annual costs and other expenses incurred by it from the annual sales income of the business.

Basic steps in an accounting cycle

In every financial cycle, combining bookkeeping and accounting, there are eight basic steps, which are as follows:

- Identify financial transactions including debits and credits.

- Record each transaction in a journal entry at such time depending on whether the cash or accrual system is followed.

- Post the transaction to an account in the general ledger, which provides a breakdown of all financial activities by account, including how much cash is available.

- Calculate the trail balance, which identifies its unadjusted balances in each account.

- Create and analyse a worksheet to identify the adjusting entries for the previously unadjusted balances to ensure that debits and credits are equal.

- Record the adjusted entries as journal entries where necessary.

- Generate financial statements including a balance sheet, an income statement and cash flow statement.

- End the accounting cycle by closing the books at the end of the day on the specified closing date, and the closing statements provide a report for performance analysis of the business over the said period.

Advantages and disadvantages of manual bookkeeping

Manual bookkeeping has some definite advantages like being a cheaper method of bookkeeping and brings the ease of accessing all records easily to businesses of all sizes and types, even the ones owned by uneducated people or in remote locations without access to electricity. However, it also has some glaring disadvantages in the long term:

- Data Entry Errors: Manual labour is inefficient, laborious and highly prone to data entry errors.

- Potential Loss of Physical Copies: While digital data doesn’t get lost as easily and is highly recoverable, loss, theft or destroying of physical copies of manual bookkeeping can cause huge gaps and errors in accounting and lead to financial vulnerabilities.

- Knowledge of Accounting Procedures: It requires knowledge of accounting procedures and has to be set up from scratch instead of a computer software which is already set up for use.

- Investment of time: It also ends up taking up significant time of the business owner which could otherwise be directed towards the running and growth of the company.

Hence, it is always advisable that even the small business owners who cannot afford to hire someone for bookkeeping, at least work with a bookkeeping software optimised for efficiency and ease of use instead of the manual procedure of maintaining ledgers and journals.

Bookkeeping tips for small business owners

- Increase the frequency of bookkeeping: As small business owners usually do the bookkeeping themselves, while managing the operations of the business, bookkeeping tends to end up taking a lower priority on their to-do list. To ensure efficient and accurate bookkeeping and avoid piling up and forgetting or misplacing important data, update your books daily or at least weekly.

- Accounting Checklist: Even if the task of bookkeeping has been delegated to an employee, an owner should have their accountants sit down with him and have them explain the basics of accounting to him so that the owner is familiar with the essential concepts and numbers. This will help him develop a checklist that he can always keep in mind while running the business.

- Review Your Accounts Regularly: The owner should review the accounts periodically to get an overview of the finances of the business and be well-informed about its financial state.

- Annual and Seasonal Cash Flow: Have a good grasp over the cash flow of the business both annually and seasonally as the knowledge and awareness of your cash flow cycle will give you a better understanding of the needs of your business.

- Tax Details: Even a business owners delegates the task of handling of taxation matters to an employee or consultant, it is imperative that they are well aware of the details of the taxes being paid by the business so as to understand how to file your taxes and how much of your resources need to be set aside for the taxes.

Conclusion

The owner needs to have eyes in all areas of the business and a very close eye and hold over the financial bookkeeping and accounting of a new small business. Hence, especially in a small business where bookkeeping is done mutually, ensuring the accuracy and efficiency of the bookkeeping is highly important for the sustenance and future expansion of the business.

Students of Lawsikho courses regularly produce writing assignments and work on practical exercises as a part of their coursework and develop themselves in real-life practical skill.

LawSikho has created a telegram group for exchanging legal knowledge, referrals and various opportunities. You can click on this link and join:

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Allow notifications

Allow notifications