This article is written by Prashant, pursuing a Diploma in M&A, Institutional Finance and Investment Laws (PE and VC transactions) from lawsikho.com.

Table of Contents

Mergers and amalgamation

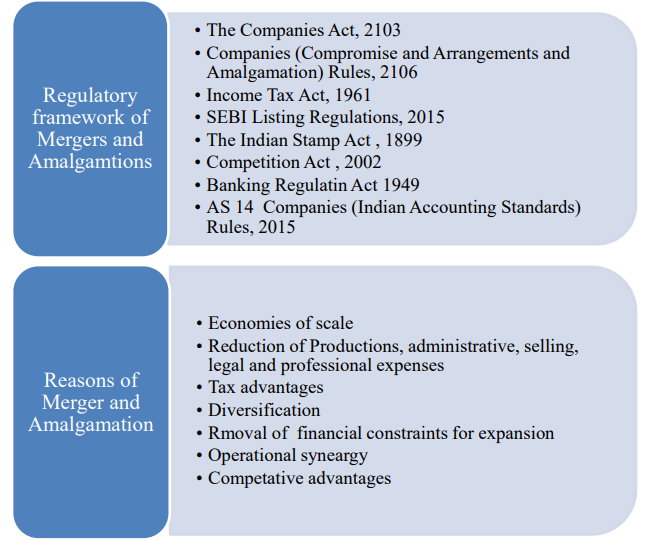

Merger and amalgamation are the tools of Corporate Restructuring, through which the organization changes its structure in order to achieve its strategic goals. In other words it can be stated as restructuring or reorganizing a company or its business or its financial structure in such a way as to make it operate more effectively and increases its efficiency and profitability.

As Indian Economy is getting to be worldwide, activity in mergers and amalgamation is booming. Fast and liberal laws are required to help Merger and amalgamation bargains in Indian corporate sector. Smooth Corporate Restructuring is one of the primary reason a 60 year old Companies Act, (‘1956 Act’) was replaced by new Companies Act, 2013. The new Companies Act, 2013 gives a chance to make up for lost time and make our corporate directions more contemporary, as likewise possibly to make our corporate administrative structure a model to imitate for different economies with comparable qualities and practices.

The new Act has been lauded by corporate organizations for its business-friendly corporate regulations, enhanced disclosure norms and providing protection to investors and minorities, among other factors, thereby making M&A smooth and efficient.

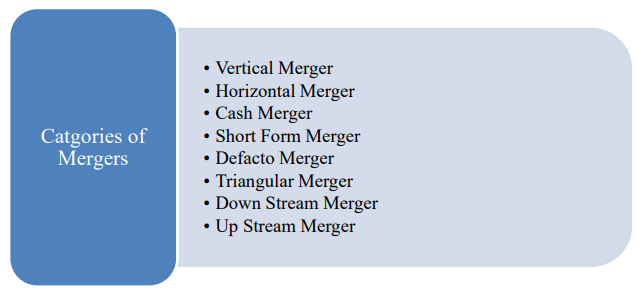

Merger: It can be define as fusion or absorption of one company by another. It may also be understood as an agreement whereby the assets of two (or more) companies get transferred to or come under the control of one company.

Amalgamation: It is a legal process by which two or more companies are joined to form a new entity, or one or more companies are absorbed or blended with another and as a consequence the amalgamating company losses its existence and its shareholders become the shareholders of new company or the amalgamated company.

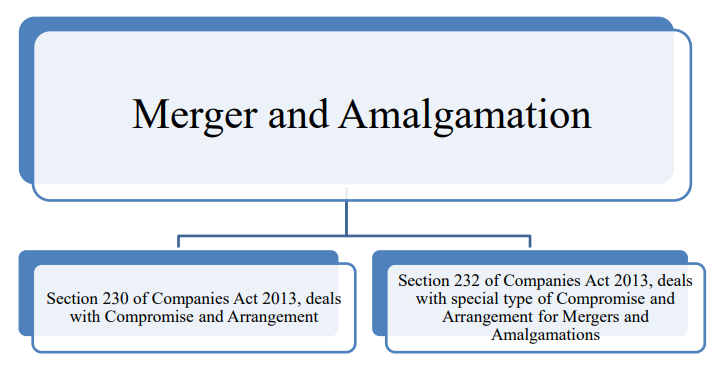

Section 230 to 240 of the Companies Act, 2013 cover the statutory provisions governing M&A including arrangements involving companies, their members and creditors. Apart from the substantive provisions mentioned in Section 230-240, guidance on procedural aspects is covered in Companies (Compromises, Arrangements and Amalgamations) Rules, 2016 (‘CAA Rules’).

The provisions relating to section 230 to 240 are different from erstwhile section 391 to 394 of the Companies Act, 1956 (‘1956-Act’) on account of various aspects. Some of them are as below:

- Mandate of the National Company Law Tribunal (‘NCLT’)

- Introduction of Fast-Track merger process

- Two-way cross-border amalgamations

- Quantified threshold for objecting to the scheme

- Certification from statutory auditors

- Representation by other professionals

An application for Merger & Amalgamation can be file with Tribunal (NCLT). Both the transferor and the transferee company shall make an application in the form of petition to the Tribunal under section 230-232 of the Companies Act, 2013 for the purpose of sanctioning the scheme of amalgamation.

Where more than one company is involved in a scheme, such application may, at the discretion of such companies, be filed as a joint application, However, where the registered office of the Companies are in different states, there will be two Tribunals having the jurisdiction over those companies, hence separate petition will have to be filed.

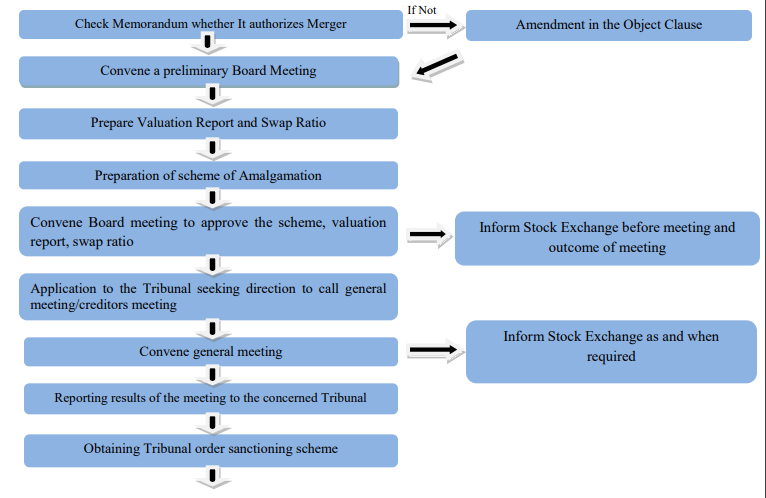

Process of merger and amalgamation

So it can be concluded that Mergers and Amalgamations is one of the best mode for expansion of business operations by a corporate to either leverage the full potential of a specific line of business or to venture into any unexplored line of business.

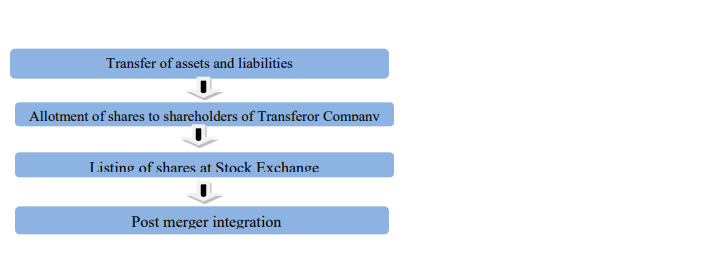

Private equity buyouts

It can be define as an investment transaction where the acquirer acquires control of a company by obtaining a controlling equity interest i.e. at least 51% of companies voting shares. A private equity investment is generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investors has its own set of goals, preferences and investment strategies.

This private equity transaction usually takes place in situations where the acquirer Considers the target company to be undervalued or underperforming but have the potential for improving operationally and financially under new ownership and control.

In this process the interested acquirer formally makes a buyout offer to the board of director of the target company. Several negotiation and due diligence will be done for the valuation. The funds to be used in buyouts transaction is usually supplied by private individuals, companies, private equity firms, pension funds and other institutional investors.

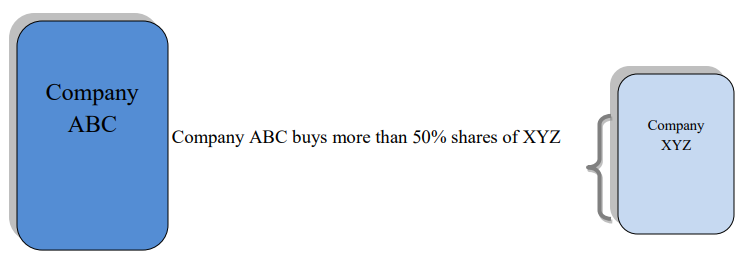

Management Buyout (MBO): It is a buyout when the existing management team

of company acquires all the significant stake of the company from the owners. It is

very attractive deal for managers since they can expect greater potential rewards by

being the owners of the business instead of employees.

Leveraged Buyout (LBO): This transaction occurs when the acquirer deployed huge loan to gain the control of the target company. Generally the assets of Target Company used as collateral for the loan. Through these buyouts acquirer can acquire large company without infusing huge amount of capital.

Advantages of buyouts

- Enhanced Efficiency: It can reduce operational expenses which can leads to enhance the bottom line. It may rid of areas of services or products duplication in businesses.

- Reduce Competition: Acquirer can reduce its competition by purchasing its competitor. It can offer the newly formed company increased economies of scale, as well as eliminate the need to get into a price war with a competitor.

- New Products and Services: Usually large companies purchases smaller companies so as to acquire there innovation and technology, this move will benefit both the companies. Smaller companies get access to better financial resources and large customer base on the other hand larger companies benefits by incorporating new technologies and products.

Disadvantages of buyouts

- Debt Enhancement: As acquirer company needs to borrow funds for acquiring Target Company the debt structure of the acquirer leads to increase in loan repayment on its books. Sometimes due to this several necessary expenditures have to be cut down.

- Dropping Employees: Sometimes key personal quit or retire in the time of buyouts, so it becomes a challenge to find new personnel’s with equal knowledge and experience as that of previous employees.

- Cultural Integration: Integration of personnel and procedures of two companies takes time. There are different corporate culture and operational methods which needs to be integrated. This is time a consuming phase which reduces the productivity.

There are several things that need to be taken into consideration to make the transaction successful. The agreement should ensure that the needs of both parties are met. It is, however, unrealistic for both sides to achieve everything they desired. The pros and cons of the buyout need to be considered wisely on both sides.

Difference between merger & amalgamation (M&A) and private equity buyouts

Operating logic and Business models: The amalgamated or merged enterprise and private equity firms operates in different business models.

- An amalgamated or merged company provides products or services to benefit the ultimate consumers. In this transaction, acquisition is done to expand into related or new product or to reach new geographic areas. This acquisition offer routes to Economies of scale, Reduction of production, administrative, selling, legal and professional expenses, Tax advantages, Diversification of their existing business portfolio.

- Private equity firms are professional’s investors, they acquire the company and enhance its value over a decided time frame and secure a financially sound exit. They are short to medium term business developers or transformers.

Major Objective: The ultimate intentions of both the transaction were different.

- The private equity players revolves around purchasing and selling of target company, making right firm purchase and made exit in right time is of paramount importance.

- The objective of merger or amalgamation is operational synergy. The restructured company makes efforts to achieve its ultimate goal of expansion or diversification by enhancing its top and bottom line.

Post deal Execution: The post deal execution between both is different.

- In case of merger and amalgamation the acquirer needs to execute the post deal integration. Business executives and managers are responsible to integrate the teams of previous separate organization strategically, culturally, organizationally and technologically.

- In private equity buyout transaction the post transaction phase is focused on governance ownership of private equity owned firm. As an owner the private equity firm is proactive, intense and demanding. The board and management of acquired company have to make full cooperation and are fully accountable for all the operations of the acquired firm.

Students of Lawsikho courses regularly produce writing assignments and work on practical exercises as a part of their coursework and develop themselves in real-life practical skill.

LawSikho has created a telegram group for exchanging legal knowledge, referrals and various opportunities. You can click on this link and join:

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Allow notifications

Allow notifications