This article is written by Anand Gopal, pursuing a Diploma in Advanced Contract Drafting, Negotiation and Dispute Resolution from Lawsikho.com.

Table of Contents

Introduction

India is expected to reach US$1 trillion by 2030. After 2025 the country’s GDP will rise by 13 %. The reason for growth in the real estate sector is not just limited to residential but also includes commercial and retail segment[i]. The real estate sector has been growing rapidly and the government has been supporting the same. In the year 2015, the Union Cabinet had approved 100 Smart City Projects in India. The FDI limits have been raised by the government for townships, land rehabilitation projects, and special economic zones up to 100 %. Moreover, the government is planning to provide Housing for All by 2025 and wish to bring approx.1.3 trillion US dollar investments. Under the Pradhan Mantri Awas Yojana (PMAY) Urban, 6,028,608 houses had been sanctioned up to September 2018. The scheme wishes to provide affordable housing and construction in the country to give a boost to the real estate sector. It has also issued various guidelines for investments like Real Estate Investment Treaty (REIT)[ii].

The REIT and InVits have been very catchy for the investors of many mutual fund companies and they have invested a huge amount (around Rs 12,000 Cr) in such units. According to SEBI, the fund managers infused (Rs 670 crores) in real estate investment trust (REITs) and ((Rs 11,347 crore) in InVit. Over the past few years, investment of Mutual Fund companies in REIT has increased to a great extent[iii].

Now we are going to discuss the concept of REIT.

Concept

The REIT is a trust registered under the Indian Trust Act which owns, finances, or operates income-producing real estate. It provides all investors a chance to own valuable real estate, access to dividend-based income and it also helps communities to grow and thrive.

In a REIT Trust (Equity REIT/ Mortgage REIT) the trust usually pools the capital of various investors and then purchases and manages the income-generating property of these REITs. REIT assists many individuals who wish to own a property but are having insufficient purchasing power to own real estate. Other stakeholders in REIT apart from Unit Holders/Investors are the other primary players in REITs which consist of Trustee, Sponsors, Managers, and Principal Valuer[iv].

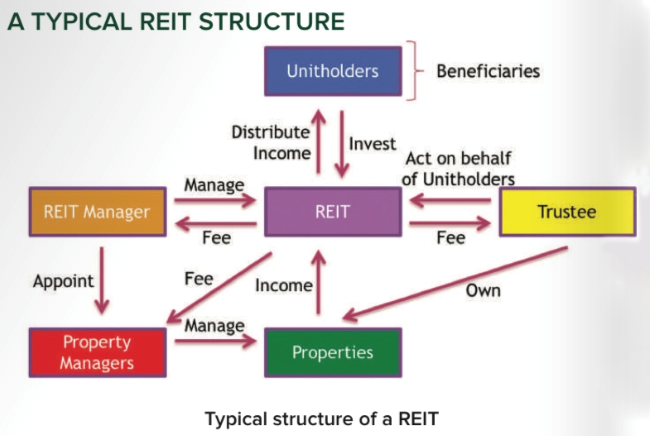

Let us decode the chart above.

REIT Managers: are the manager of REIT trusts who shall appoint the property managers and they also tap potential business opportunities with respect to any particular property which they feel could generate income generating.

The property managers consult for some of the information from REIT managers and they also take care of renting of properties or selling of the properties. The income of these properties is transferred to REIT trust.

Trustee: The trustee owns the properties of REIT. They have the decision-making power of the entire REIT structure. They act on behalf of the unit holders. They also decide with respect to dividend or major decisions which might affect the Business of the REIT. The trustee charges some fees out of the REIT for managing the same.

Unit Holders: The Unit Holders are the ultimate beneficiaries. They invest in the RIET structure and the income is distributed as per the amount invested in Trust. The Unit Holders could be any investor like Retail Investors, Mutual Fund Companies, Qualified Institutional Investor, Foreign Portfolio Investor or any other investor which is permitted to invest in such a type of structure as amended by SEBI from time to time.

Now let us discuss the requirements of REIT ISSUE from IPO’s perspective and registration requirement for listed REIT.

Eligibility requirement for REIT

The primary requirement is to create a trust which is to be registered as per the Indian Trust Act and registered under SEBI REIT regulations. The registered deed of trust shall give the main objective and what activities shall undertake in REIT accompanied by the responsibilities of the Trustee. There should not be any disciplinary decision taken by SEBI or any regulatory body like Income Tax Authorities. The associated stakeholders with REIT should be fit and proper persons as per SEBI Intermediary Regulations 2008 as mentioned in Schedule II and if there is any related party, it shall disclose open offer documents[v].

Investments through an SPV

These trusts may invest directly or through a Special Purpose Vehicle. The holding and controlling interest under REIT shall not be less than 50% equity SPV and it shall hold 80% equity in the REIT assets[vi].

Foreign Investments in REITs

The RBI regulations permitted Non-resident Indians and Foreign Portfolio investors to invest in REIT units without any approval requirements. The circular further provides downstream investments by REIT and will be regarded as foreign investments as either the sponsor or the Manager is not Indian ‘owned and controlled’ as defined in Regulation 14 of the FEMA (TISPRO regulations 2000). SEBI will have the powers to determine whether the sponsor or the manager or investment manager is foreign-owned and controlled. It further allows investing in two-level. SPV structure through holding Trust, subject to sufficient holding in the holding Trust and the underlying SPV and other safeguards including (i) the right to appoint majority Directors in the SPV; and (ii) the requirement by the holding Trust to distribute 100% cash.[vii]

Valuation requirements

The REIT regulations prescribe mandatory compliance for the valuation of REIT assets on a year to year basis. The net asset value is required to be declared within 15 days from the date of the valuation of assets to the stock exchange and the computation and the declaration of the same shall not be less than 6 months. If there is any acquisition/transfer of REIT assets then it has to be met as per the prescribed valuation guidelines[viii].

Now let us discuss the applicable regulations for Companies that manage REITs.

Applicable regulations for REIT Company who manages the trust

- Indian Trust Act 1882

The REIT or InVit is registered under India Trust Act 1828 which gives a brief guideline about the functioning of trust.

SEBI REIT or InVit Regulations are brief regulations with respect to the listing of trust and associated disclosure which the trust has to make to respective investors.

- Rent Control Act of respective states wherever the property is situated has to be complied and some of states covered as follows:

The Trust has to comply with the respective Rent Control Regulations of different states wherever the trust purchases the property and collects rent from those properties.

- Indian Stamp Act or Respective State Stamp Act

The respective state stamp act needs to be complied with payment of stamp duty. If respective state stamp act is not available then Indian Stamp Act which is central law needs to be complied

The Trust has to comply with Indian Stamp Act and respective state regulations with respect to stamp duty and registration if the property is purchased or sold.

The Company needs to comply with Insider Trading Regulations with respect to related party disclosure. If the income generating property is sold to a related party of the Company then such related party disclosure needs to be done.

The Company needs to pay capital gains with respect to sale of property, income earned through property in the form of rent and it also needs to pay tax if the dividends are distributed to the Unit Holders of the Company. Any income generated from any sources the applicable rates shall be paid to the Income Tax Authority.

Now let us discuss the various taxes which the company has to keep in mind while operating as trust:

Taxation perspective

There are various taxes which REIT has to undertake while operating as a Company and applicable taxes are mentioned below:

- Dividend Distribution Tax (DDT):The Dividend distribution tax is applicable whenever the company or trust distributes a portion of Income to unitholders or shareholders. The Dividend Distribution Tax will apply to all even if the income is distributed through a Special Purpose Vehicle.

- Capital Gains Tax

If property or shares is sold to any person then capital gains tax will be applicable on such a transaction. If the Unitholders of the trust sell the shares of Special Purpose Vehicle of REIT, capital gains tax shall apply to the Unitholders of trust. There are two types of capital gains 1. Short term capital gain which is less than 1 year 2. Long Term Capital Gain which is more than 1 year.

- Interest from SPV: If the Unitholders earns any interest under Special Purpose Vehicle it shall also attract income earned through special purpose vehicles.

- Other income or Rental Income: If income is earned through rental income of House or property then it shall have to pay tax with respect to the income earned through rent.

It is important to look at the recent developments in the taxation aspect of REITs that came into being from April 1, 2020 with respect to companies operating on a trust model.

Recent Changes in tax perspective with respect to REIT

The Finance Act 2020 proposes various things, for taxability and exemptions available to business trusts in India:

The proposed changes in the Act, are given below:

Definition of ‘business trusts’

The definition of ‘business trust’ under Section 2(13A) of the Income-tax Act means a trust which is registered as an InvIT Regulations or a REIT under the REIT Regulations. The Business Trust definition only covered the listed REIT or InVIT

The Finance Act 2020 which was passed on April 1, 2020, amended the definition of ‘business trust’, earlier it recognized only listed InvITs and REIT registered with SEBI, but now it further recognizes unlisted InvITs registered with SEBI as well.

The transfer of units of unlisted private InvITs shall be eligible for capital gains at the rate of 10% (plus surcharge and cess) in the hands of a non-resident unitholder and 20%(plus surcharge and cess) for resident unitholders if the units are more than 36 months, or else it shall attract short term capital gains (wherein the units are less than or equal to 36 months) will be taxed at the rate of 30%(which will include surcharge and cess) for residents and 40% (plus surcharge and cess) for non-resident corporates. So, Non-resident Unitholders may claim the beneficial provision under the double tax avoidance agreement (“DTAA”). Non-residents and residents will have to pay long term capital gains if income earned from the sale of listed units at market rate and it shall attract taxed at the rate of 10%(plus applicable surcharge and cess) and if the gains exceed 0.1 million then short terms capital gains will be at the rate of 15%(plus applicable surcharge and cess)[ix]

Dividend distribution tax is being replaced with dividend withholding tax

The Trust shall be subject to dividend distribution tax as per section 115-O of the Income Tax Act in the hands of the trust and the effective rate of 20.56% (including surcharge and cess). These dividends were generally exempted in the hands of the non-resident unitholders in India even if they may have been taxable in the home jurisdiction. The Dividend Distributed by special purpose vehicle (“SPV”) as per section 115-O of the Income-tax Act, where business trust held the entire share capital other than as required by the Govt or any regulatory authority, was exempted from Dividend Distributed Tax. The dividend which was received by the business trust from SPV was distributed to unitholders with any further tax being levied on it.

The Finance Act 2020, has abolished the regime of DDT as applicable to companies and has now shifted the incidence of taxation of dividends on the shareholders or unitholders. The amended provisions, (i) dividend income will be subject to tax in the hands of the investors/shareholders, at the applicable rate (ii) the SPV would be required to withhold tax and the Business trust shall continue to exempt from tax on income earned from dividend by way of SPV.

There is no specific mechanism for an SPV to not withhold tax for the income earned through dividends with respect to business trust but the business trust will have to provide a nil withholding tax certificate to the SPV. So, that no tax is withheld by the SPV while distributing dividends to the business trust.

It also clarifies and adds to the same that, the business trust will be required to withhold tax on the distribution, where the income being distributed is like dividend income received from the SPV, as described below:

Now let us understand the different layers of taxation of dividends:

Taxation of dividends at the trust level

Before the finance act 2020, Section 10(23FC) of the Income-tax Act exempts certain income which is earned through business trust i.e. (i) where the business trust is having controlling and such percentage holding prescribed under REIT or InvIT regulations and business trust distributes interest income from an SPV; and (ii) income earned through dividend by forming SPV in which the business trust held the entire share capital other than as required by the govt.

The Finance Act 2020 does not mention the taxation of interest income of a business trust. Although, it exempts the dividend income received by a business trust from an SPV, in which business trust holds controlling interest or such percentage holding under the InvIT Regulations or REIT Regulations as prescribed. This amendment shall come into effect from April 1, 2020.

The capital gains tax will still be applicable and the total income of a business trust (other than interest and dividend) shall continue to be charged to tax at the maximum marginal rate of 42.7%[x].

Taxation of dividends for unitholders

Before the Finance Act 2020, Section 10(23FC) of the Income Tax Act talks about income which is distributed or received by the unitholder from business trust or any other interest or rental income would be exempt from the total income of the unitholder. The act also suggests income earned interest, rental and dividend distributed the trust to unitholders, would also be subject to taxation in the hands of the unitholders from April 1, 2020.

It further proposes that dividend income received by the residents and non-residents unitholders would be subject to a tax rate of 10%. In the case of non-residents, any lower rate as may be provided in the Double Tax Avoidance Agreement between India and the country of residence of non-resident unitholder may be applicable[xi].

The Finance Act provides some concessions to the unitholders. The amended provisions under Income tax act provides that dividend distributed by the trust shall be exempted in the hands of unitholders, provided that the special Purpose Vehicle distributing dividends has not exercised the option to pay corporate tax under 22% corporate tax regime available as per section 115BAA of Income Tax act[xii].

Now we are going see what changes it will bring in interest and rental income on unitholders of Trust

Taxation of interest and rental income on unitholders of a business trust

The income earned through interest and rental income and distributed in the hands of resident investors is subject to deduction of tax at the rate of 10% as per section 194(LBA) (1) of the Income Tax Act. Any distributable income earned through interest and rental income in the hands of a non-resident is subject to deduction of tax at the rate of 5% as per section 14(LBA) (2) of the Income Tax Act.

There is no change in the proposed Act concerning taxation of unitholders with respect to interest and rental income received from the business trust[xiii].

Let us look at the various examples of REIT where money was generated through an IPO

Examples of RIET ISSUE

- EMBASSY PARK was the first REIT to raise money through IPO for an amount worth RS 4,750 crore in the year 2019.

- Mindspace Business park to raise money through IPO for an amount worth Rs 4,500 crore in the year 2020.

Conclusion

REIT or InVit is a new form of securities that is in the form of trust and trust invested in income-generating assets. The mandatory disclosures under REIT are mentioned in schedule III of REIT regulation before making a draft offer document with SEBI. There are many significant changes that have evolved REIT as a source of investment and the regulatory changes have evolved REIT at par with the United States and other developed nations. Unlisted REIT will have less compliance in relation to SEBI but if the REIT is listed in the market it has to comply with SEBI REIT regulations.

References

[i] https://economictimes.indiatimes.com/wealth/real-estate/indian-realty-market-to-touch-1-trillion-by-2030-survey/articleshow/65978364.cms

[ii] https://www.ibef.org/archives/industry/indian-real-estate-industry-analysis-reports/indian-real-estate-industry-analysis-january-2019

[iii] https://economictimes.indiatimes.com/markets/stocks/news/reits-invits-pick-up-steam-mutual-funds-pour-in-rs-12000-crore-in%202019/articleshow/73211059.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

[iv] https://www.mondaq.com/india/fund-management-reits/489236/setting-up-of-real-estate-investment-trusts-reits-in-india-regulatory-and-taxation-aspects

[v] https://www.mondaq.com/india/fund-management-reits/489236/setting-up-of-real-estate-investment-trusts-reits-in-india-regulatory-and-taxation-aspects

[vi] https://www.mondaq.com/india/fund-management-reits/489236/setting-up-of-real-estate-investment-trusts-reits-in-india-regulatory-and-taxation-aspects

[vii] https://www.rbi.org.in/scripts/FS_Notification.aspx?Id=10358

[viii] https://www.mondaq.com/india/fund-management-reits/489236/setting-up-of-real-estate-investment-trusts-reits-in-india-regulatory-and-taxation-aspects

[ix] https://corporate.cyrilamarchandblogs.com/2020/04/update-tax-implications-on-invits-reits-and-its-unitholders-under-finance-act-2020/

[x] https://corporate.cyrilamarchandblogs.com/2020/04/update-tax-implications-on-invits-reits-and-its-unitholders-under-finance-act-2020/

[xi] https://corporate.cyrilamarchandblogs.com/2020/04/update-tax-implications-on-invits-reits-and-its-unitholders-under-finance-act-2020/

[xii] https://corporate.cyrilamarchandblogs.com/2020/04/update-tax-implications-on-invits-reits-and-its-unitholders-under-finance-act-2020/

[xiii] https://corporate.cyrilamarchandblogs.com/2020/04/update-tax-implications-on-invits-reits-and-its-unitholders-under-finance-act-2020/

Students of Lawsikho courses regularly produce writing assignments and work on practical exercises as a part of their coursework and develop themselves in real-life practical skill.

LawSikho has created a telegram group for exchanging legal knowledge, referrals and various opportunities. You can click on this link and join:

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Allow notifications

Allow notifications