Introduction

Banking operations are going global these days. With the world becoming a global village, credit has to flow seamlessly. Further, banks should facilitate remittances and payments in all major currencies for commercial purposes. It is for this reason that banks open accounts with other banks to maintain foreign currency deposits and reserves so as to enable easy operations and clearances. In this regard, three types of accounts come into play- Nostro, Vostro, and Loro.

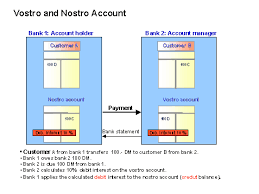

What are Nostro and Vostro Accounts

The word ‘Nostro’ finds its roots in the Italian word ‘Nostro,’ meaning ‘ours.’ Hence, a literal meaning of a Nostro account is- “Our account with you”. Nostro accounts are held in a foreign country (with a foreign bank),  by a domestic bank (from our perspective, our bank). A Nostro account is an account that is opened by a bank with an overseas bank in the currency of the foreign country. The account is opened by a bank so as to facilitate easy clearing of their transactions in the foreign country.

by a domestic bank (from our perspective, our bank). A Nostro account is an account that is opened by a bank with an overseas bank in the currency of the foreign country. The account is opened by a bank so as to facilitate easy clearing of their transactions in the foreign country.

Similarly, ‘Vostro’ is an Italian word which means ‘Your.’ So the ‘Vostro Account’ of the foreign bank with Indian bank in India is said as ‘YOUR Accounts with Us.’ Thus, a similar account opened by a foreign bank in an Indian bank is known as Vostro account. A foreign bank authorized to deal in foreign currency maintains accounts with the Overseas Bank to keep stocks of foreign currencies (home currency of the country in which the overseas branches/correspondents is situated)  for the purpose of putting through the foreign exchange transactions. For example Bank of America maintains an account with a Bank in India in Indian Rupee. Such an account maintained in the foreign currency at the foreign center by a foreign bank is a ‘Vostro Account.’

for the purpose of putting through the foreign exchange transactions. For example Bank of America maintains an account with a Bank in India in Indian Rupee. Such an account maintained in the foreign currency at the foreign center by a foreign bank is a ‘Vostro Account.’

While Nostro and Vostro are used in the bilateral correspondence between the two concerned banks, Loro is the reference which will be used when an account of a bank maintained with other banks is referred to by a third-party. Loro means ‘their account with you.’ For example, If State Bank of India, Mumbai has an account with Citibank, New York denominated in US Dollars then when Bank of Baroda has to refer to this account while corresponding with Citibank, it would refer to it as LORO Account, meaning ‘their account with you.’

Advantages of Nostro and Vostro Accounts

The advantage of these accounts is to minimize the time for transfer of funds. For example, a company in Indi a to receive payment in US dollars can remit funds to India by instructing the bankers abroad to remit the funds to the Nostro Account maintained in that particular currency by the home bank where the current account is maintained. Once the funds are received in the Nostro account abroad, the bank will then credit the same to the account of the company here in India at the prevailing exchange rate.

a to receive payment in US dollars can remit funds to India by instructing the bankers abroad to remit the funds to the Nostro Account maintained in that particular currency by the home bank where the current account is maintained. Once the funds are received in the Nostro account abroad, the bank will then credit the same to the account of the company here in India at the prevailing exchange rate.

RBI has mandated banks to closely monitor their Nostro accounts for better reconciliation. Similarly, for Vostro accounts, RBI has earlier mandated that stipulated that the Exchange Houses handling the transactions shall keep with the Authorised Dealer Category-I bank (under FEMA) a cash deposit in any convertible foreign currency equivalent to three days’ estimated drawings. By way of a circular dated 28.04.2016, RBI has done away with the requirement of maintaining collateral.

Thus, Nostro and Vostro accounts are accounts customary account maintained across the globe by banks to facilitate easy transactions between them in foreign currency.

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Allow notifications

Allow notifications