In this blog post, Kaushik Neogi, a student pursuing his LL.B (4th year) from Delhi Metropolitan Education, affiliated to Guru Gobind Singh Indraprastha University and aDiploma in Entrepreneurship Administration and Business Laws from NUJS, Kolkata, discusses the Income Declaration Scheme, 2016 which will give people an opportunity to declare any previously undisclosed income subject to certain taxes, penalties and surcharge.

Introduction

The issue of black money has been a much debated issue in India. After several attempts made by the government over various years to get black money of Indian nationals stashed in offshore accounts, the present government came up with a national policy to get hold of undeclared black money in India.

The Finance Bill, which the Ministry of Finance releases every year with the union budget to keep the economic policies of the country updated and in line with the best interest of the growing Indian economy, saw a few major schemes this year. One such scheme is the Income Declaration Scheme, 2016. Under this scheme, people will now have the opportunity to declare any previously undisclosed income subject to certain taxes, penalties and surcharge.

The Finance Bill, which the Ministry of Finance releases every year with the union budget to keep the economic policies of the country updated and in line with the best interest of the growing Indian economy, saw a few major schemes this year. One such scheme is the Income Declaration Scheme, 2016. Under this scheme, people will now have the opportunity to declare any previously undisclosed income subject to certain taxes, penalties and surcharge.

The Finance Bill for 2016 was proposed on the 29th of February 2016 &, the Bill received the assent of the President of India on the 14th of May 2016 and became the Finance Act, 2016 No. 28 OF 2016.

The provisions of the Act relating to the Income Declaration Scheme

Who can declare:

Section 183 of the Act provides for declaration of undisclosed income. According to 183(1)-

- Subject to the provisions of the income declaration scheme, 2016, any person may make, on or after the date of commencement of the Scheme which is the 1st of June 2016 but before the 30th of September 2016, a declaration in respect of any income chargeable to tax under the Income Tax Act for any assessment year prior to the assessment year beginning on the 1st day of April, 2017—

- for which he has failed to furnish a return under section 139 of the Income-tax Act;

- which he has failed to disclose in a return of income furnished by him under the Income-tax Act before the date of commencement of this Scheme;

- which has escaped assessment by reason of the omission or failure on the part of such person to furnish a return under the Income-tax Act or to disclose fully and truly all material facts necessary for the assessment or otherwise.

As per Section 183(2) where the income chargeable to tax is declared in the form of investment in any asset, the fair market value of such asset as on the date of commencement of this Scheme shall be deemed to be the undisclosed income for the purposes of sub-section (1).

Section 183(3) provides the fair market value of any asset shall be determined in such manner, as may be prescribed which is provided under Rule 3[1] of the Income Declaration Scheme Rules, 2016.

Section 183(4) provides that no deduction in respect of any expenditure or allowance shall be allowed against the income in respect of which declaration under this section is made.

How much tax to be paid:

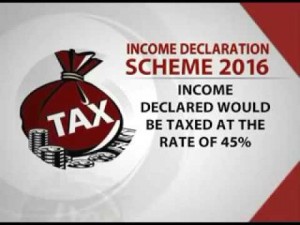

Section 184 provides for the provisions of tax and surcharge. As per Section 184(1)

- Not contrary to the provisions of the Income Tax Act or in any Finance Act, the undisclosed income declared under section 183 shall be chargeable to tax at the rate of 30% of such undisclosed income.

And as per Section 183(2), the amount of tax chargeable under sub-section (1) shall be increased by a surcharge, for the purposes of the Union, to be called the Krishi Kalyan Cess on tax calculated at the rate of 25% of such tax so as to fulfil the commitment of the Government for the welfare of the farmers.

Section 185 of the Act provides for the provision of penalty. Under this Section-

Not contrary to the provisions of the Income Tax Act or in any Finance Act, the person making a declaration of undisclosed income shall, in addition to tax and surcharge under Section 184, be liable to penalty at the rate of 25 % of such tax.

Declaration how to be made:

Section 186 provides for the manner of declaration. As per Section 186(1)

- A declaration under Section 183 shall be made to the Principal Commissioner or the Commissioner and shall be in such form and be verified in such manner, as may be prescribed. The Form released for the purpose of declaration is Form 1.[2] For a better understanding of the procedures related to Form 1, please view the Form manual-[3]

As per Section 183(2) the declaration shall be signed—

| where the declarant is an individual | o by the individual himself;

o where such individual is absent from India, by the individual concerned or by some person duly authorised by him in this behalf; and o where the individual is mentally incapacitated from attending to his affairs, by his guardian or by any other person competent to act on his behalf |

| where the declarant is a Hindu undivided family | o by the Karta, and

o where the Karta is absent from India or is mentally incapacitated from attending to his affairs, by any other adult member of such family |

| where the declarant is a company | o by the managing director thereof, or

o where for any unavoidable reason such managing director is not able to sign the declaration or where there is no managing director, by any director thereof |

| where the declarant is a firm | o by the managing partner thereof, or

o where for any unavoidable reason such managing partner is not able to sign the declaration, or where there is no managing partner as such, by any partner thereof, not being a minor |

| where the declarant is any other association | o by any member of the association or

o the principal officer thereof |

| where the declarant is any other person | o by that person or

o by some other person competent to act on his behalf. |

Section 186(3) provides that any person, who has made a declaration under sub-section (1) of Section 183 in respect of his income or as a representative assessee in respect of the income of any other person, shall not be entitled to make any other declaration, and any such other declaration, if made, shall be void.

Time period for payment:

Section 187 provides for time for payment of tax. As per Section 187(1)-

- The tax and surcharge payable under Section 184 and penalty payable under Section 185 in respect of the undisclosed income, shall be paid on or before a date to be notified by the Central Government in the Official Gazette. Which as notified are –

- the 30th of November, 2016, for an amount not less than 25% of such tax, surcharge and penalty

- the 31st of March, 2017, for an amount not less than 50% of such tax, surcharge and penalty as reduced by the amount paid by 30th of November, 2016.

- the 30th of September, 2017, for the 100% amount payable under section 184 and 185 as reduced by the amounts paid by 30th of November 2016 and 31st of March 2017.

As per Section 187(2) the declarant shall file the proof of payment of tax, surcharge and penalty with the Principal Commissioner or the Commissioner, as the case may be, before whom the declaration under Section 183 was made. This proof of payment shall be in Form 3, which is to be submitted after an acknowledgement is received as Form 2 by the declarant.

As per Section 187(3), if the declarant fails to pay the tax, surcharge and penalty in respect of the declaration made under section 183 on or before the date specified, the declaration filed by him shall be deemed never to have been made under this Scheme.

Declared income not to be total income:

Section 188 provides that the amount of undisclosed income declared in accordance with Section 183 shall not be included in the total income of the declarant for any assessment year under the Income-tax Act, if the declarant makes the payment of tax and surcharge by the dates specified.

Declaration does not affect previous proceedings:

Section 189 provides undisclosed income shall not affect finality of completed assessments. Under this Section-

- A declarant under this Scheme shall not be entitled, in respect of undisclosed income declared or any amount of tax and surcharge paid thereon,

- to re-open any assessment or reassessment made under the Income Tax Act or the Wealth Tax Act, 1957, or

- claim any set off or relief in any appeal, reference or other proceeding in relation to any such assessment or reassessment.

Provisions for declaration relating to benami transactions:

According to Section 190-

- The provisions of the Benami Transactions (Prohibition) Act, 1988 shall not apply in respect of the declaration of undisclosed income made in the form of investment in any asset

- if the asset existing in the name of a benamidar is transferred to the declarant

- being the person who provides the consideration for such asset, or his legal representative, within the period notified by the Central Government.

For the purpose of this section the period notified is the 30th of September 2017.

Tax paid to be non-refundable:

Section 191 of the Act provides that any amount of tax and surcharge paid or penalty paid in pursuance of a declaration made shall not be refundable.

Declaration not be treated as evidence:

Section 192 provides that not contrary to anything contained in any other law for the time being in force-

- nothing contained in any declaration shall be admissible in evidence against the declarant for the purpose of any proceeding relating to imposition of penalty, other than the penalty under section 185, or for the purposes of prosecution under the Income Tax Act or the Wealth Tax Act, 1957.

Which declarations are void:

Section 193 provides that not contrary to anything contained in this Scheme-

- where a declaration has been made by misrepresentation or suppression of facts

- such declaration shall be void and shall be deemed never to have been made under this Scheme.

Certain exemptions under the scheme:

Section 194 provides for exemption from wealth Tax in respect of assets specified in declaration. As per Section 194(1)

- Where the undisclosed income is represented by cash (including bank deposits), bullion, investment in shares or any other assets specified in the declaration made—

- in respect of which the declarant has failed to furnish a return under Section 14 of the Wealth Tax Act, 1957, for the assessment year commencing on or before the 1st day of April, 2015; or

- which have not been shown in the return of net wealth furnished by him for the said assessment year or years; or

- which have been understated in value in the return of net wealth furnished by him for the said assessment year or years,

- then, notwithstanding anything contained in the Wealth Tax Act, 1957, or any rules made thereunder—

- wealth-tax shall not be payable by the declarant in respect of the assets referred to in clause (a) or clause (b) and such assets shall not be included in his net wealth for the said assessment year or years;

- the amount by which the value of the assets referred to in clause (c) has been understated in the return of net wealth for the said assessment year or years, to the extent such amount does not exceed the voluntarily disclosed income utilised for acquiring such assets, shall not be taken into account in computing the net wealth of the declarant for the said assessment year or years.

- Where a declaration is made by a firm, the assets referred to in the point above or, as the case may be, the amount referred to in the point above shall not be taken into account in computing the net wealth of any partner of the firm or, as the case may be, in determining the value of the interest of any partner in the firm.

As per Section 194(2) the provisions of sub-section (1) shall not apply unless the declarant pays the tax and surcharge before the prescribed time and file the proof of payment.

Applicability of certain laws:

Section 195 provides that-

- the provisions of Chapter XV of the Income Tax Act relating to liability in special cases and of Section 119, Section 138 and Section 189 of that Act or

- the provisions of Chapter V of the Wealth Tax Act, 1957 relating to liability in respect of assessment in special cases shall,

- so far as may be, apply in relation to proceedings under this Scheme as they apply in relation to proceedings under the Income-tax Act or, as the case may be, the Wealth Tax Act, 1957.

Persons restricted to apply:

Section 196 provides that the provisions of this Scheme shall not apply—

- to any person in respect of whom an order of detention has been made under the Conservation of Foreign Exchange and Prevention of Smuggling Activities Act, 1974:

Provided that—

- such order of detention, being an order to which the provisions of Section 9 or Section 12A of the said Act do not apply, has not been revoked on the report of the Advisory Board under Section 8 of the said Act or before the receipt of the report of the Advisory Board; or

- such order of detention, being an order to which the provisions of section 9 of the said Act apply, has not been revoked before the expiry of the time for, or on the basis of, the review under sub-section (3) of Section 9, or on the report of the Advisory Board under Section 8, read with sub-section (2) of section 9 of the said Act; or

- such order of detention, being an order to which the provisions of Section 12A of the said Act apply, has not been revoked before the expiry of the time for, or on the basis of, the first review under sub-section (3) of that section, or on the basis of the report of the Advisory Board under Section 8, read with sub-section (6) of Section 12A, of the said Act; or

- such order of detention has not been set aside by a court of competent jurisdiction;

- in relation to prosecution for any offence punishable under Chapter IX or Chapter XVII of the Indian Penal Code, the Narcotic Drugs and Psychotropic Substances Act, 1985, the Unlawful Activities (Prevention) Act, 1967 and the Prevention of Corruption Act, 1988;

- to any person notified under section 3 of the Special Court (Trial of Offences Relating to Transactions in Securities) Act, 1992;

- in relation to any undisclosed foreign income and asset which is chargeable to tax under the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015;

- in relation to any undisclosed income chargeable to tax under the Income-tax Act for any previous year relevant to an assessment year prior to the assessment year beginning on the 1st day of April, 2017—

- where a notice under Section 142 or sub-section (2) of Section 143 or Section 148 or Section 153A or Section 153C of the Income Tax Act has been issued in respect of such assessment year and the proceeding is pending before the Assessing Officer; or

- where a search has been conducted under Section 132 or requisition has been made under Section 132A or a survey has been carried out under Section 133A of the Income Tax Act in a previous year and a notice under sub-section (2) of Section 143 for the assessment year relevant to such previous year or a notice under Section 153A or under Section 153C of the said Act for an assessment year relevant to any previous year prior to such previous year has not been issued and the time for issuance of such notice has not expired; or

- where any information has been received by the competent authority under an agreement entered into by the Central Government under section 90 or section 90A of the Income-tax Act in respect of such undisclosed asset.

Clarification of doubts:

Section 197 provides for the provisions for the removal of doubts.

As per Section 197(a)-

- keeping in mind the provision 183(1), nothing contained in this Scheme shall be construed as conferring any benefit, concession or immunity on any person other than the person making the declaration under this Scheme;

As per Section 197(b)-

- where any declaration has been made under Section 183 but no tax, surcharge and penalty has been paid within the time specified under Section 187,

- the undisclosed income shall be chargeable to tax under the Income Tax Act in the previous year in which such declaration is made;

As per Section 197(c)-

- where any income has accrued, arisen or received or any asset has been acquired out of such income prior to commencement of this Scheme, and no declaration in respect of such income is made under this Scheme—

- such income shall be deemed to have accrued, arisen or received, as the case may be; or

- the value of the asset acquired out of such income shall be deemed to have been acquired or made,

- in the year in which a notice under section 142, sub-section (2) of section 143 or section 148 or section 153A or section 153C of the Income-tax Act is issued by the Assessing Officer, and the provisions of the Income-tax Act shall apply accordingly.

Conclusion

The Income Declaration Scheme, 2016, is a very healthy scheme initiated by the government. The scheme gives a very pleasant opportunity to tax defaulters and evaders to declare previously undisclosed income. The government with this scheme makes an effort to get hold of previous tax dues keeping up to the progress with the GST policy which is aiming to bring down tax evaders in the future.

Footnotes:

[1]http://www.incometaxindia.gov.in/_layouts/15/dit/Pages/viewer.aspx?path=http://www.incometaxindia.gov.in/Documents/IDS-2016/IDSR2016_R1_R4.htm?int=1&grp=&searchFilter=&k=&IsDlg=0

[2]http://www.incometaxindia.gov.in/forms/income%20declaration%20scheme%20rules,%202016/form_66807_1.pdf

[3]http://www.incometaxindia.gov.in/Documents/IDS-2016/Form-1-User-Manual.pdf

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Allow notifications

Allow notifications