Introduction

Before embarking on a Step-by-Step guide into the nuances of transferring shares in a Private Limited Company, it is imperative to understand and grasp exactly the concept of a Private Limited Company.

A Private Limited Company is a type of privately held business entity that offers limited liability to stakeholders, usually not more than 50, restricted to their shares, but that places certain restrictions on its ownership, as defined in the company’s bylaws or regulations and Articles of Association. The restrictions with regard to ownership that is essential that shareholders cannot sell or transfer their shares without offering them first to other shareholders for purchase and shareholders cannot offer their shares to the general public on a stock exchange are meant to prevent any hostile takeover attempt. Therefore, the ownership of a private limited company is determined by the shareholding of the Company. Induction of new investors or the transferring of any part or full part of the ownership requires the transfer of the movable property of the Company; the shares.

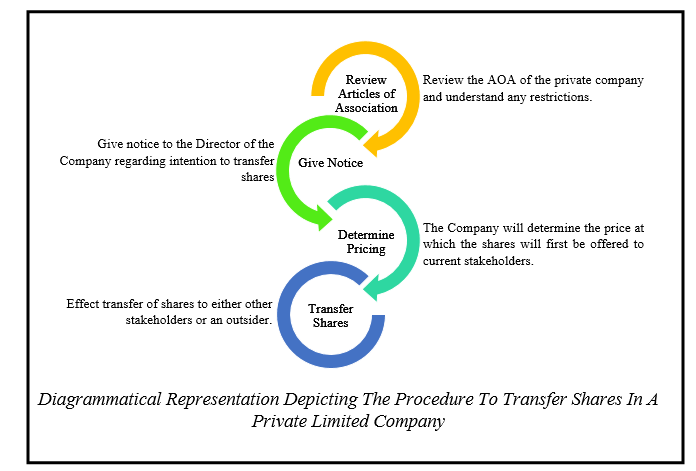

Below is a Step-by-Step Guide to explain the procedure to transfer shares in a Private Limited Company:

Step 1: Review the Articles of Association

The Articles of Association or AOA of the Private Limited Company needs to be reviewed. Before beginning the share transfer procedure, any restrictions that have been placed on them must be first addressed. Being a sort of ‘closed corporation’ of its stakeholders, the AOA contains certain share transfer restrictions. These restrictions that are imposed upon the rights of the shareholders to transfer shares are usually in two forms:

- Rights of Pre-emption: If a shareholder desires to sell some or all of his shares, he/she must first offer such shares to the other existing members of the Private Limited Company. The price at which each share is to be sold is usually determined by the Directors or the Auditor of the Company. The value of the shares may also be determined based on any formula or method prescribed in the Articles of Association if any. It is only if no existing member or shareholder is interested in buying the shares can the shares of the Company be freely transferred to an outsider.

- Powers of Directors to refuse: The Director of the Private Limited Company may have the powers under the Articles of Association to refuse registration of the transfer of shares under prescribed certain circumstances.

It is notable to mention that only restrictions imposed under the Articles of Association have any legal binding. Private agreements between the shareholders are not binding on either the company or on the shareholders. Therefore, simply put, the Articles of Association can only restrict any transfer of shares but the right to transfer shares of a Private Limited Company cannot be completely prohibited or banned.

Step 2: Give Notice

The shareholder that wishes to transfer his or her shares must give notice, in writing, to the Director of the Company expressing his or her intention to do so.

Step 3: Determine Pricing

Following the expression of intent vide a written notice, the price per share has to be determined in accordance with the Articles of Association and the Directors of the Company or the Auditor of the Company. These shares, at the decided price, will first be offered to the present shareholders of the Company.

Step 4: Transfer of Shares

If any of the present shareholders come forward, before the last date to purchase the shares, for buying the shares, at the prescribed price, such shares must be allotted to them. But, if none of the existing shareholders are interested in purchasing the available shares, or if there are excess shares available, the company may transfer the shares to an outsider. The prospective buyer is required to fill up the share transfer deed in Form No- SH.4.

Thus, the final process of transferring the shares of a Private Limited Company goes from obtaining the share transfer deed in the prescribed format, executing the share transfer deed, duly signed by the Transferor and Transferee and stamped as per the Indian Stamp Act and the Stamp Duty Notification in force in the State concerned. A witness is required to sign the share transfer deed with his or her signature, name, and address. Attaching the share certificate or allotment letter with the transfer deed, it needs to be delivered to the Company, which must process the documents and if approved, issue new share certificate in the name of the transferee. The completion of all the formalities and approval will result in handing over the new share certificates.

Conclusion

In my opinion, the procedure elucidated above is sound. Such a procedure allows the Private Limited Company to settle issues within themselves at the first instance before bringing in an outsider into the internal affairs of the Company. This provides the company with more stability and helps the Company grow.

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Allow notifications

Allow notifications