In this article, Aklovya Panwar of Institute of Law Nirma University discusses Taxation Of Public Charitable Trust.

Introduction

In this modern time, we constantly heard of the term called “Philanthropy”. It is the act of helping others by way of private or voluntarily giving. The term has first entered the English language in the 17th century.[1] Philanthropy serves many social purposes which include religious morality, humanitarianism, charity, etc. India also has a vast history in the concept of Philanthropy. Rig Veda directs to some of the collective social responsibilities in the form of charity as an obligation. It also guides about the conscience of a Human being.[2]Nowadays, there are organisations who are doing these voluntary services like NGOs, Vos, etc. These organizations amalgamate funds for these services. The Government has various taxation laws for these organization to keep a check on them so that they do not misuse that fund for self-purpose. So, the author will highlight certain ingredients of the taxation of these Public Charitable organizations that how these organisations fits in the present tax structure?When they have to pay tax?When they are exempted from the taxation? etc.

What is Charity?

The French word “charité” which was derived from the Latin word “Caritas” give birth to the English word “charity” which naturally means preciousness, dearness and high price. It a voluntary help to the needy.It includes helping in the form of monetary terms or through services. [3]

What is a charitable organisation?

The organization which has an objective of charitable purpose and provides voluntarily help.They are non-profit based organization.It includes Trusts, foundations, unincorporated associations and in some jurisdictions specific types of companies.[4]

The main aim of the Charitable organization is to help the public at large.The policies of these organizations are parallel to general public policies.they raise funds by the way of campaigning and other fund-raising programs.They generally function as a welfare organization.

Charitable purposes

Section 2(15) of the Income Tax Act,1961 defines “Charitable Purpose” which is somehow different from the normal assumption of the meaning of Charitable Purpose.

“It includes relief of the poor,education,medical relief,preservation of environment (including watersheds, forests and wildlife) ,preservation of monuments or places or objects of artistic or historic interest even if it is of the nature of trade, commerce or business[added by the Finance (No.2) Act, 2009] and the advancement of any other object of general public utility.”[5]

According to this section, the above-mentioned points are the charitable purposes. If the organization, directly or indirectly, render any step which is of the nature of trade, commerce or business then it will not be considered under the work of the public charitable organization.They have to pay tax if any act of the nature of trade, commerce or business has been done.This provision was added by the Finance Act, 2008.[6]

But Finance Act, 2010 provided some liberty by allowing the limit up to rupees 10 lac.This means that first provision will not be applied to a person if a number of the receipts from the activities is ten lakh rupees or less in the previous year.The commercial purpose of the trust should not exceed rupees 10 lakhs, if it does the trust ceases to be a charitable trust.[7]

Exemption and application of tax

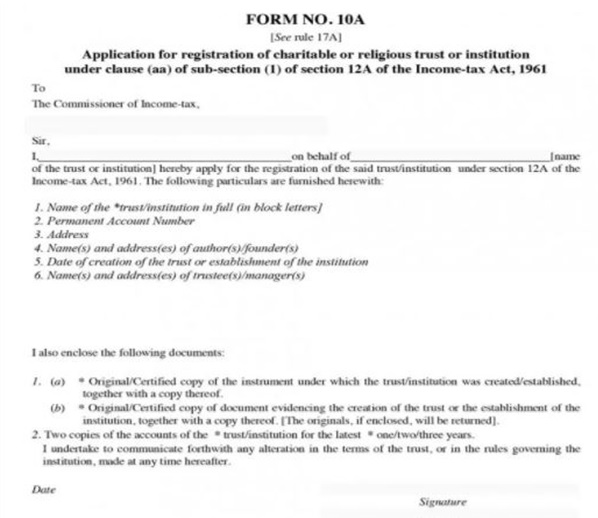

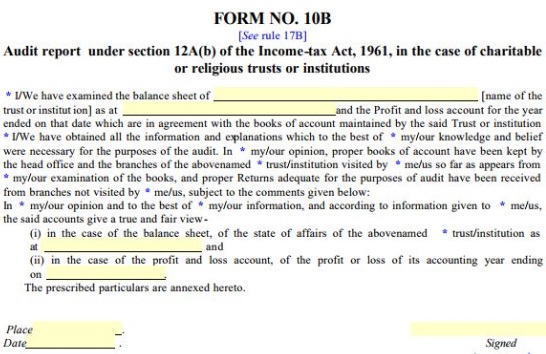

Section 11 of the Income-tax Act provides the aspects in which the property under a trust can be exempted from the tax.The property will be exempted if the trust has a registration with Commissioner of Income Tax by the application Form 10A under section 12AA, which includes the bona fide work for the religious and charitable purpose.Even before claiming the exemptions under section 11 & 12, the exemptions from the tax can be met if the Books are audited by the form 10B and if income exceeds Rs. 1,80,000 which includes corpus donations[U/S 12A(b)].[8]

There is a standard deduction of 15 percent of “such income” derived from property held under trust wholly for charitable purposes. The expression ‘such income’ only means income accruing or arising in favor of the trust – CIT v. P. Krishna Warriar (1964) 53 ITR 176 (SC).[9]

The exemption can be granted if 85 percent of income must be applied towards the approved objects of the Trust, but the corpus donations should be excluded from it.

Before moving further we must know what is “corpus donation” and what is its impact.Corpus donation is the Income generated from voluntary contributions from the donors where they give a particular direction that they shall form part of the corpus of the trust or institution, are generally referred to as “corpus donations”.Section 11(1)(d) of the Act exempt such donations.[10]

Image below shows the Form No. 10A

Image below shows the Form No. 10B

It has to be noted that the words “applied to charitable purposes” includes – Purchase of capital assets – Revenue expenses – Donations to religious/charitable trust registered under section 12AA or section 10(23C) – Repayment of loans taken for purchase of capital assets – Depreciation on capital assets.[11]

In Director of Income-tax (Exemption) vs. Daulat Ram Education Society (2005) 278 ITR 260 (Del) the court held that if the trust has specified some purposes but they haven’t explained the plan of spending on such purposes the Assessing Officer cannot deny the claim of exemption u/s. 11(2).

What conditions are required to be fulfilled by a charitable or religious trust seeking exemption under Section 11?[12]

- The property held under trust or institution has to file a return of income if in some way they have contributed the taxable income during the year without giving effect to Sections 11 and 12.

- There must be a separate account for the business if the trust is involved in some whether it is incidental or not.

- As soon as the trust accumulate Capital gains, it must invest them into another capital asset in order to remain and apply for charitable purposes.There is no period of holding of the asset for availing such exemption by re-investment.Capital gains can be any during the year (whether short or long term).

- Section 11(5) decides the mode of investment and depositing of money.The Income Tax Act provides a list of modes and forms permitted for the investments of the Charitable Trust. This section includes a subclause wherein it is mentioned that “any other form or mode of Investment or Deposit as may be prescribed”. Rule 17C specifies such prescribed other modes of investments.The funds of the trust should be invested or deposited in any one or more of modes or forms mentioned in section 11(5).To remain exempt from the tax u/s 11, this rule must be followed

- The trust should not be created for the benefit of any particular religious community or caste.

NOTE: “a “previous year” is the financial year in question, and the year that follows is the “assessment year”. For example, for the financial year April 2010 to March 2011, the “previous year” is 2010-11, and the “assessment year” is 2011-12. Tax returns are filed in the assessment year, as per tax provisions relevant to the assessment year, for the income earned in the previous year”[13]

Cases in which exemption will be forfeited

- If any trust has both charitable and noncharitable activities and is falling under the proviso of section 2(15) where it is rendering any activity in the nature of trade, commerce, and business, in this case, whole trust will lose exemption u/s 11 & 12 and will be taxed as an unregistered trust in that specific year u/s 13(8) of the act.The tax will equal to the amount of fund collaborated more than the threshold limit.[14]

- If the trust exceeds the monetary limits will fall under the proviso to section 2(15) and the exemption u/s 11 will end. Thus, the proviso puts the stay on the controversies that may emerge from the speculation that profits and gains being incidental to the main object or not. [15]

- If the amount invested by the trust is less than 85 Percent and out of the scope of section 11(5) r/w section 13(1) (d) [the funds of the trust should be invested or deposited in any one or more of mode or form described in this section], then it will be out of the scope of exemption.[16]

- If the funds invested by the trust were before March 1, 1983[other than section 11(5)], in such case they will forfeit exemption. But after that section 11(5) will continue to remain so invested or deposited after November 30, 1983.[17]

Notifications

In this regard, Central Board of Direct Taxes (CBDT) has issued an explanatory circular vide no. 11/2008, dt. 19-12-2008, F.No. 134/34/2008- TPL.

On 27-05-2016,CBDT by circular No-21/2016 has notified that if the public charitable trust,with reference to the proviso of section 2(15) crosses the threshold limit in a specific year then they will have to pay tax in that year.The cancellation of registration is not mandatory as per section 13(8),other requirements have to be met for the cancellation of registration.It has been advised to the field officers to not cancel registration of the trust only on the basis of the proviso to section 2(15) because the introduction of new chapter XII –EB will make the trust liable to tax accreted income by getting hit by section 115TD(3).[18]Cancellation will take place according to the section 12AA (3) and 12AA (4) after examining the applicability of these provisions.

Cases to understand the scenario

Trustees of Dr. Sheths Charitable Trusts v/s Seventh Income Tax Officer (1982) 2 ITD 649 (Mum-Trib), and also clarified by Circular No 72, dated 06-01-1972.

The case held that as per Section 11(1A), the income generated from capital gain is recognized as income derived from property held under trust, as such the provision of accumulation of income applied to capital gains too.As soon as the trust accumulate Capital gains arising u/s. 11(1A), they must invest them into another capital asset in order to remain and apply for charitable purposes.There is no period of holding of the asset for availing such exemption by re-investment.Capital gains can be any during the year (whether short or long term)

Whether entire exemption will be forfeited in case of violation of section 11(5)?

Section 11(5) decides the mode of investment and depositing of money.The Income Tax Act provides a list of modes and forms permitted for the investments of the Charitable Trust.

Whereas Section 13(1)(d) provides the case where the income is invested other than the modes or forms described in Section 11(5) and the sections 11 or 12 will not apply.

But there are various views whether the entire exemption will be forfeited or not in the case of violation of section 11(5).

Gurudayal Berila Charitable Trust v/s ITO, Fifth (1990) 34 ITD 489 (Mum)

ISSUE: Whether the entire exemption has to be forfeited or to the extent of violation committed. The court held that to the extent violated be brought to tax.

Director of IT (Exemptions) v/s sheth Mafatlal Gagalbhai Foundation Trust (2001) 249 ITR 533 (Bom.), it was held that tax will be levied at a maximum marginal rate only to the portion of violation u/s. 13(1) (d).

Director of IT (Exemptions) v/s Sheth Mafatlal Gagalbhai Foundation Trust (2002) 253 ITR 593 (Del), there was a violation of section 11(5) as different mode was used. As soon as the assessee came to know it, he had withdrawn the investment. The decision falls in the favor of assessee and exemption remains with the trust.

Asst. CIT v/s Sri Ramchandra Educational & Health Trust (2010)128 TTJ 408, the investment made was in contravention of section 11(5).It was held that under the circumstances, as the reasons were beyond the control of the assessee as they try to recover the amount but couldn’t able to thus forfeiture will not raise.

References

[1]Rajkumar S. Adukia, HANDBOOK ON LAWS GOVERNING FORMATION AND ADMINISTRATION OF CHARITABLE ORGANISATIONS IN INDIA, 3-6 (2017),http://www.caaa.in/image/hb-charitable_org.pdf.

[2] Id.

[3] Id.

[4] Id.

[5] Id.

[6]TAXATION OF CHARITABLE TRUSTS, 2-6 (2017), http://vipca.net/wp-content/uploads/2015/07/Taxation-of-Charitable-Trusts.pdf (last visited Jul 12, 2017).

[7] Id.

[8] Id.

[9]TAXATION OF CHARITABLE TRUST AND AOP / BOI, 9-13 (2017), https://www.wirc-icai.org/material/TAXATION_CT_AOP_18062016_BirlaFInal.pdf (last visited Jul 12, 2017).

[10]INCOME TAX DEPARTMENT,Assessment of Charitable Trusts and Institutions 47-49 (2017).

[11] Supra 6.

[12] Supra 10.

[13] Supra 6.

[14] Supra 9.

[15] Supra 6.

[16] Supra 6.

[17] Supra 9.

[18] Supra 9.

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Allow notifications

Allow notifications

Nice article. Every ngo required to file Form 10B?