This article is written by Srishti Sinha, from the Institute of Law, Nirma University, Ahmedabad. This article deals with the role of privatization laws on business entities and how these laws impact business on a global scale.

Table of Contents

Introduction

The transition of publicly owned or operated means of production to private ownership or operation is known as privatization. Typically, the justification for this transfer is that privately owned businesses are subject to market discipline and hence will be more efficient. A similar argument for privatization is that privately-held businesses are more valuable and well-maintained. Both arguments support the idea that privatization benefits the public. Also, government bureaucracies are notoriously inefficient and wasteful of public cash, therefore privatization is increasingly regarded as a way to enhance efficiency. Privatization allows governments to utilize public funding to establish required public works projects, then contract out the day-to-day management to private firms. Similar to selling off areas formerly held by government buildings or military sites, privatization can apply to transferring government properties to private owners.

Privatization legislation is useful for establishing the legal authority for a country’s privatization programme, the main principles on which it will be founded, and the institutional structures for policy formulation and execution. But how do these privatization laws affect the business sector and the business entities? So, let us understand the role of privatization laws in business entities with the help of this article.

Definitions

Business entities

Business entities are companies or trade organizations that are formed by one or more natural people to assist particular commercial operations or allow their owners to engage in a trade. Business entities must abide by state legislation because they are created at the state level. In most states, a business owner must submit paperwork with a specific state agency, such as the Secretary of State’s office, in order to officially establish their company.

A business entity is administered as per corporate laws like the Companies Act, 2013, Company Secretaries Act, 1980, Competition Act, 2002, Indian Contract Act, 1872, etc.

There are certain types of business entities which are as follows:

Sole Proprietorships

A sole proprietorship, often known as a sole trader or proprietorship, is an unincorporated business with only one owner who pays personal income tax on the business’ profits. Due to a lack of government oversight, a sole proprietorship is the easiest form of business to start or shut down. As a result, these sorts of companies are extremely popular among single proprietors, independent contractors, and consultants. Because a distinct business or trade name isn’t required, many single owners operate under their own identities.

Sole proprietorship businesses in India are not governed by a single legislation to safeguard the interests of individual proprietors and hence this form of company structure is the most straightforward in terms of registration and compliance. The legislature has made a step towards regularising and preserving the interests of entrepreneurs who desire to do business exclusively by introducing the one-person company in the Companies Act, 2013.

Partnerships

A general partnership, also known as a partnership business entity, is a company made up of two or more owners who operate their company according to the provisions of an oral or written partnership agreement. Although an agreement isn’t needed, it’s a good idea to have one in place to ensure that the partnership runs well. Partnership businesses in India are governed and regulated under the Indian Partnership Act, 1932.

Corporations

A corporation is a legal body that exists independently of its shareholders. Under corporate law, corporations of all sizes have independent legal personalities with restricted or unlimited responsibility for their shareholders. Shareholders are represented on the board of directors, which in turn delegate management of the company’s day-to-day operations to a full-time executive. In the case of a liquidation, shareholders’ losses are limited to their interest in the company, and they are not responsible for any outstanding obligations owing to the company’s creditors.

Limited liability companies (LLCs)

A limited liability company (LLC) is a corporate structure in which the owners are not individually responsible for the firm’s debts or obligations. While the limited liability aspect of an LLC is comparable to that of a corporation, flow-through taxes for LLC members is a feature of partnerships (and not an LLC). Limited Liability Company is another category of company registered under the Indian Companies Act, 2013.

Limited liability partnerships

A limited liability partnership (LLP) is a business structure in which some or all of the members (depending on the state) have limited responsibility. As a result, it may display aspects of partnerships and companies. Each partner in an LLP is not accountable or liable for the wrongdoing or carelessness of another partner. The Limited Liability Partnerships Act of 2000 is the principal piece of law that governs limited liability partnerships.

Privatization laws

The Privatization law or Public-Private Partnership (PPP) aims to increase private sector participation in infrastructure projects, support public-private partnerships, provide public services through private enterprise, privatize public services, cut government spending, and develop procedures for implementing PPP and privatization projects. In bidding PPP and privatization contracts, the Privatization Law also aims to foster openness, justice, and honesty.

Some aspects of privatization laws on business sectors

Since the main role of privatization laws is to increase the private sector participation in the projects, these laws affect the business entities in both positive as well as negative ways. Let us have a look over these aspects one by one:

Positive aspects

Increase productivity

The fundamental justification for privatization laws is that private businesses have a financial motive to reduce costs and improve efficiency. Managers who work for a government-run business generally do not get a part of the earnings. A private company, on the other hand, is motivated by profit, so it is more likely to decrease expenses and improve efficiency. For example, prior to 2012, the government regulated and operated liquor sales in the state of Washington. The state was in charge of regulating when and how liquor was sold, as well as collecting the money. The government, on the other hand, privatized liquor sales in 2012. Private companies may sell booze to the general population after privatization.

Further, it is argued that governments are bad economic managers. Political forces drive them rather than solid economic and commercial judgment. A state-owned business, for example, may employ excess workers, which is inefficient. Because of the unfavourable publicity associated with employment losses, the government may be hesitant to fire the workers. As a result, state-owned companies frequently employ an excessive number of people, resulting in inefficiencies.

Also, privatization laws provide a potential to business entities to spur innovation. To keep prices down and retain contracts, private companies are forced to create new, efficient means of supplying goods and services. The public sector, for the most part, lacks these incentives.

Increase flexibility

State officials have more freedom to address programme demands as a result of privatization. If the private business fails to fulfill contract criteria, officials might replace it, reduce service, increase service during peak hours, or shrink as needed.

Quality of product is improved

Another advantage of privatization is that it may result in improved product quality. Because private businesses are constantly up against the strong competition and must operate profitably, they must guarantee that their products are as good as possible in order to remain competitive in the long run. Publicly held firms, on the other hand, may have poorer product quality since they do not have as rigorous profit-maximizing aims and, as a result, may deliver lower product quality. As a result, if we desire the greatest products available, privatization may help us achieve that objective in the long term.

Simple supervision

Many regulating examples exist in private organizations intending to detect illegal activity. They are also supposed to keep an eye on what the board of directors is doing, and if such activities are seen to be damaging to the firm, board members may be replaced within a short period of time.

In publicly traded businesses, however, those governing situations may be considerably less efficient, and as a result, numerous choices that are detrimental to the company may be made. As a result, privatization of public corporations may be a smart idea in order to ensure that the controlling instances inside a company are as sophisticated as feasible.

Less influence of lobbyists

Lobbying is a major issue that leads to many unfavourable policy outcomes. This is especially true in the case of publicly-traded companies. There is a major conflict of interest between politicians’ actions and the aims of public businesses, with many of those decisions favouring publicly held firms over the broader public.

As a result, privatization laws in public enterprises will reduce the lobbying influence, at least to some extent.

Negative aspects

The general public’s interest

Many sectors, such as health care, education, and public transportation, provide vital public services. The profit motive should not be the primary goal of businesses or the industry in these areas. In the case of health care, for example, it is thought that privatizing health care will place a larger emphasis on the business above patient care. Furthermore, in a sector like health care, monetary motivation may not be required to raise standards. If doctors get a bonus, they are unlikely to strive more when treating patients.

Monopoly

While privatization of firms that are subject to strong competition can actually decrease product costs, the reverse may be true for natural monopolies.

For example, if an airport is privatized, the airport would frequently have monopolistic power since many people in a certain region will have to rely on it. As a result, this airport can set pricing, and it’s possible that, as a result of privatization, flight prices would rise considerably over time.

Firms’ short-termism

This is something that private companies may do as well, in addition to the government being motivated by short-term demands. To appease shareholders, they may strive to boost short-term earnings while avoiding long-term investments.

Responsibilities may become unclear

Privatization laws on any firm may cause severe issues, especially in a market with many linkages and interdependencies, because company duties may become unclear. As a result, there might be a lot of disagreements and lawsuits over which firm is accountable for which service. In the worst-case scenario, this may result in significant shortages of critical supplies.

As a result, prior to applying privatization laws on public enterprises, it is critical to ensure that all parties are aware of their obligations in order to avoid unpleasant shocks and confusion.

Impact of privatized business on a global scale

In transition economies, a substantial number of state-owned businesses (SOEs) have been privatized since the 1990s. In addition to extensive free or subsidized issuance of shares in former SOEs, there was a slew of privatizations in Central and Eastern Europe after 1990, with revenues reaching $240 billion between 1990 and 2008. In Africa, the Middle East, and South Asia, privatization revenues have been lower, with total proceeds of less than $50 billion for each. However, when expressed as a percentage of GDP, the outcomes are on par with, if not better than, Europe. The situation in the rest of Asia is somewhat different. While there have been few privatizations in South Asia (particularly India), this was not the case in East Asia, where total privatization revenues accounted for 30% of the global total ($230 billion) from 1988 to 2008. China stands out in particular.

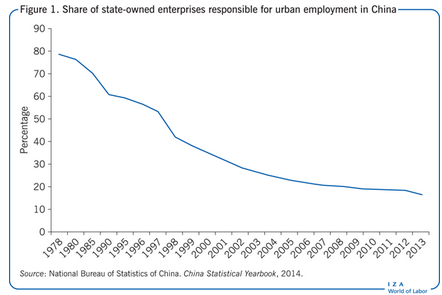

Due to the Chinese government’s worry about its massive debt, SOEs have been gradually privatized since the early 1990s. In 1995, the government adopted the strategy of “grasp the large, let go of the small”, which hastened privatization. A considerable number of small and medium-sized SOEs were privatized as a result of this strategy, but big SOEs remained state-owned, such as the China FAW Group in the car industry and the China Sinopec Group in the petrochemical sector. As a result, the proportion of SOEs responsible for urban employment has plummeted from 78 percent in 1978 to 61 percent in 1990 to barely 17 percent in 2013. According to research, the weighted average Total Factor Productivity (TFP) of surviving state-owned enterprises increased from 55 to 75% when compared to surviving private firms. The percentage of surviving privatised enterprises with a positive TFP improved from 60% to 77%.

Privatization programmes in other nations, such as Nigeria, started successfully but subsequently stopped. Despite the fact that Nigeria’s programme was one of the most effective in Sub- Saharan Africa (SSA) in the 1990s, it was halted in early 1995 in favour of a major “commercialization” campaign. The privatization initiative in Madagascar was similarly halted in mid-1993 owing to significant mismanagement and ensuing unpopularity.

Certain political limitations were eased in the late 1990s, though. First, an increasing number of countries in SSA began to implement substantial economic changes, including privatization, under the auspices of the World Bank and the International Monetary Fund. Reforms and privatization were also gradually embraced by the general public. Finally, the bad financial condition of SOEs in many SSA nations, as well as their increasing deterioration, combined with the state’s economic crises in the 1990s, allowed for the sale of SOEs to boost government income and cut spending.

Impact of privatization on India

Following the 1991 balance of payment crisis, the Indian government enacted a series of measures to boost private industry under the Industrial Policy Resolution of 1991. Partial privatization and strategic sales were the most common methods of privatization. The former, on the other hand, was highly limited, with the government selling only minority stock holdings and not surrendering managerial control until 2000. The creation of a cohesive privatization programme was hampered by political uncertainty. The majority of shares sales and managerial control transfers took place until after the 1999 elections, and even then, the government held an average ownership holding of 82 percent in all SOEs until 2004. Even until 2010 the government-owned more than 80% of shares in the companies. It is now, in the recent budget, that the Indian government is planning to privatize SOEs in the coming years.

In the leading case of Centre for Public Interest Litigation v Union of India & Anr. (2003), a petition was filed by questioning the decision of the government to sell majority of shares in Hindustan Petroleum Corporation Limited (HPCL) and Bharat Petroleum Corporation Limited (BPCL) to private parties without Parliamentary approval or sanction as being contrary to and violative of the provisions of the ESSO (Acquisition of Undertaking in India) Act, 1974, the Burma Shell (Acquisition of Undertaking in India) Act, 1976 and Caltex (Acquisition of Shares of Caltex Oil Refining India Limited and all the Undertakings in India for Caltex India Limited) Act, 1977. The court in this case held that there is no challenge before this Court as to the policy of disinvestment. The only question raised before is whether the method adopted by the Government in exercising its executive powers to disinvest HPCL and BPCL without repealing or amending the law is permissible or not and the court found that in the language of the Act such a course is not permissible at all. In the result, the petitions restraining the Central Government from proceeding with disinvestment resulting in HPCL and BPCL ceasing to be Government companies without appropriately amending the statutes concerned suitably.

It should be noted that the Law Commission of India (2014) recommended repealing some of these laws (including the Esso Act, the Burmah Shell Act, and the Burn Company Act) on the basis that they serve no function in relation to the nationalised corporation. However, it was proposed that before repealing these Acts, a review of all the nationalisation Acts be conducted, and that if required, a savings provision be included in the repealing Act.

Bank privatization in India

During the fiscal years 2021-22, the government has set aside 1.75 lakh crore from stock sales in public sector firms and financial institutions. The finance ministry is debating legal changes to remove two public sector banks (PSBs) from the Banking Companies (Acquisition and Transfer of Undertakings) Act, 1970 and Banking Companies (Acquisition and Transfer of Undertakings) Act, 1980. The PSBs must be transferred from these statutes to the Companies Act before the bank nationalisation laws may be abolished. Before the government sends out an investment invitation for bank privatisation, the goal is to remove the policy-related constraint that caps non-government shareholder voting rights at 10% regardless of holdings.

The NITI Aayog, the Reserve Bank of India (RBI), and the finance ministry’s financial services and economic affairs ministries are all actively engaged in discussions about the first phase of privatisation.

There are currently 12 public sector banks (PSBs) in India, following the merging of ten public sector banks into four in 2020. As part of the privatisation effort, NITI Aayog has targeted four mid-sized PSBs: Bank of Maharashtra (BoM), Bank of India (BoI), Indian Overseas Bank (IOS), and the Central Bank of India (CBI).

While the administration is rashly pushing toward privatization, it may not be the answer to the economy’s problems. Privatization has the potential of becoming politically motivated and pursued for the vested interests of various interest groups or individuals rather than as a cohesive component of stimulating private investment. It may enhance income in the near term, but there are no assurances that the process will result in the creation of competitive marketplaces.

In 1969, Indira Gandhi declared her desire to nationalise the banks after becoming Prime Minister in a paper titled “Stray Thoughts on Bank Nationalization” in order to relieve poverty. The people were overwhelmingly supportive of the paper. Gandhi took steps to nationalize fourteen major commercial banks in 1969. Following bank nationalisation, deposits at public sector banks in India increased by around 800 percent, while advances increased by 11,000 percent. Nationalization also resulted in a considerable increase in bank geographical coverage; the number of bank branches increased from 8,200 to over 62,000, with the majority of them being opened in previously unbanked rural regions. The nationalisation push not only increased family savings, but it also resulted in large investments in the informal sector, small and medium-sized businesses, and agriculture, as well as significant regional growth and expansion of India’s industrial and agricultural base.

Privatization of Insurance sector in India

The government is working on modifications to the General Insurance Business (Nationalisation) Act (GIBNA), 1972, to make privatisation of a public sector general insurance firm easier, and a bill to that effect is expected to be introduced in the upcoming monsoon session. The Act, which took effect in 1972, allowed for the purchase and transfer of shares in Indian insurance firms as well as undertakings of other existing insurers in order to better serve the needs of the economy by ensuring the growth of the general insurance industry.

Amendments to the GIBNA are now being drafted and may be introduced in the future session to facilitate the privatisation of enterprises mentioned in the budget this year. In her Budget 2021-22, Finance Minister Nirmala Sitharaman outlined a big-ticket privatisation programme, including the sale of two public sector banks and one general insurance business.

Railway privatization in India

The Indian Railways, which serves a population of 1.3 billion people, is responsible for the world’s fourth biggest train network. It is also one of the world’s largest employers, employing over 1.54 million people. However, faced with diminishing resources in recent years, the railroads have been considering other revenue streams, including non-fare revenue, leasing out its huge pool of unoccupied land, and, most crucially, opening doors for Public-Private Partnership (PPP) for its trains and stations.

On July 1, 2020, the railway ministry began the legal process of permitting private trains on 109 routes—a procedure that intends to open up one of the government’s most significant companies for the first time. Private trains will be introduced to Indian Railways’ network in stages, with the first dozen expected to begin service in the 2023-24 fiscal year and all 151 by 2027. Bombardier Transportation India, Siemens Limited, and Alstom Transport India Ltd were among the 23 companies who expressed interest in operating private trains in India at the pre-bid conference.

In the first instance, how much money will the railway make from privatisation? Only haulage charges, such as station fees, railway engines, tracks, signals, and overhead electricity, as well as driver pay, would be collected. Private parties will be allowed to offer any price they choose and may use dynamic pricing, as in the airline industry. It’s worth mentioning the case of Reliance Infrastructure, which shut down the Delhi Airport Link Metro in July 2012 after little over a year of service due to a lack of profit.

Conclusion

The transfer of productive assets from the government to the private sector is known as privatization. Because the effectiveness of the process depends on efficient corporate governance of the privatized organization, as well as effective market competition, the data shows that businesses with privatization laws have larger advantages on firm performance in better business settings.

Privatization places significant demands on the state’s capabilities, both in terms of ensuring that the process is not monopolized by local elites and in terms of maintaining an arm’s-length connection between the government and the company after privatization.

References

- https://www.economicshelp.org/blog/501/economics/advantages-of-privatisation/

- https://www.newslaundry.com/2021/03/18/why-privatising-indias-rail-network-is-a-bad-idea

LawSikho has created a telegram group for exchanging legal knowledge, referrals, and various opportunities. You can click on this link and join:

https://t.me/joinchat/J_0YrBa4IBSHdpuTfQO_sA

Follow us on Instagram and subscribe to our YouTube channel for more amazing legal content.

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Allow notifications

Allow notifications