In this blog post, Mithun Pillai, a Management Trainee at a Textile Company in Mumbai and a student pursuing his Diploma in Entrepreneurship Administration and Business Laws from NUJS, Kolkata, distinguishes between service tax and service charge.

After a sumptuous meal at one’s favorite restaurant, the waiter brings the bill (or ‘check’ for the classy bourgeois) with a sweet yet sinister smile we imagine, and we accept it graciously with a dull sense of foreboding. What happens next is a ritual that most of us are quite familiar with.

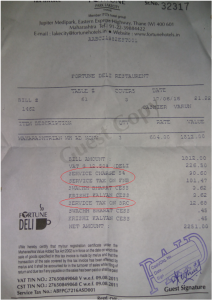

We try to make sense of the drab text on the bill. The name and address of the restaurant seem alright. Confirming the list of food and beverage items ordered feel like a triumph. But then comes the price and tax components. It certainly doesn’t help that the blood has already started to rush away from our brain to shower its attention on our gut. Already light-headed, trying to understand the intricacies of tax components feel like decoding the Da Vinci code if Da Vinci was a Chartered Accountant (in all probability he was; that dude had a famously gifted mind). After a few futile minutes, some of us call it a day, pay up and leave. Others notice that service tax and service charge are charged separately even though they sound similar. They might wonder about it; they may even inquire about it with the staff but in the end, they too have to pay up because it’s not illegal to charge both service tax and service charge at the same time. But the situation is not as simple as that. Some eligibility conditions and compliances have to be taken care of, and I will be elaborating on them further.

Service Tax

Service tax is an indirect tax levied by the Central Government on service providers except some services which are notified as under a negative list and a Mega Exemption list as specified by the government. Specifically, Entry 97 of Schedule VII of Constitution of India empowers Central Government to levy Service Tax through Chapter V of Finance Act, 1994. Indirect tax means that even though the responsibility of paying the tax lies with the service provider, the tax amount itself can be collected from (i.e., tax burden can be shifted to) the service receiver. This tax was introduced in 1994 by the then Finance Minister Dr. Manmohan Singh. Earlier the Service tax was 12.36%. It was then increased to 14% (Education Cess & Higher Secondary Education Cess subsumed) along with Swachh Bharath Cess@ 0.5%. Currently, the incumbent Finance Minister Arun Jaitley while presenting the Budget for 2016-17 proposed Krishi Kalyan Cess@ 0.5% as well. Thus, w.e.f 1st June 2016, all eligible services occurring on or after 1st of June will have to pay 15% as service tax. In general, service tax is collected by the government on the following basis:

Finance Minister Dr. Manmohan Singh. Earlier the Service tax was 12.36%. It was then increased to 14% (Education Cess & Higher Secondary Education Cess subsumed) along with Swachh Bharath Cess@ 0.5%. Currently, the incumbent Finance Minister Arun Jaitley while presenting the Budget for 2016-17 proposed Krishi Kalyan Cess@ 0.5% as well. Thus, w.e.f 1st June 2016, all eligible services occurring on or after 1st of June will have to pay 15% as service tax. In general, service tax is collected by the government on the following basis:

- Cash basis- Liability to pay tax when payment is received.

- Accrual basis- Liability to pay tax when service is provided even though actual payment may happen later (like on credit)

Currently, only individual service providers are allowed to pay tax on a cash basis and further only if their revenue has ever exceeded ten lacs per annum. Company service providers have to pay tax on an accrual basis.

Service Charge

Service charge is not a tax. It is not levied or collected by the Government but by the restaurant itself. The common reasoning provided by eateries are that the amount serves as an alternative compulsory tip which is then equally distributed among the staff right from the transporters who get the raw materials like material through the chefs/cooks who prepare the food and finally to the waiter/host who serves and looks after the customers. Thus the service charge is a bonus for the staff members above their daily wages. Although in reality it is viewed as a less-than-scrupulous means of generating black money among restaurateurs.

In the first image if we go through the price components we notice that service tax, Krishi Kalyan Cess and Swachh Bharath Cess appears to be charged twice. Actually, and charges are on the Service charge collected @5%. Thus even the Service charges collected by the restaurant are further taxed. But it is important to note as a customer that the banks should notify on their menu (second image) all the taxes charged and that includes service charge as well. Generally speaking, service charges range from 5% to 15%.

Restaurants exclusively having Air Conditioning or Central Heating are granted an abatement of Service tax by the government. This is because, they can be considered as a provider of goods and services both and thus are separately charged on both fronts. According to Article 366- 29A- (f) of Constitution of India all food and beverage are deemed outside the scope of service tax because they are viewed as goods and hence on account of the value added by virtue of cooking the final meal (product) they become liable for VAT. And since it’s extremely difficult to calculate and differentiate the portions of the total amount which are taxable as VAT and Service tax government has provided an all-encompassing abatement of 60% in taxable amount for Service tax to minimize the risk of double/extra taxation. Thus, only a restaurant having an Air Conditioning or Central Heating can charge 15% on 40% of the total amount or effectively, 6% of the total amount. This makes it easier to calculate both VAT and Service tax on the same total amount.

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Allow notifications

Allow notifications