This article has been written by Avni Sharma, a second-year intern from National Law University Odisha. This article contains provisions of the Minimum Wages Act, 1948 in detail along with the procedures contained in it.

Table of Contents

Introduction

India is a labour-intensive country as we have a great amount of human capital to invest in our industries and other areas of work. Minimum wage is an indispensable part of any such country because there is a huge chunk of population which is dependant on daily wages for their bread and butter.

The concept of minimum wages in India was brought in by Mr K. G. R. Chaudhary in 1920. After the International Labour Conference, 1928, the machinery of wage-fixing was brought into actual policy formulation. The bill regarding the same was brought in 1946 and by the year 1948, the bill was enforced and we had saviour rights for all the blue-collar workers. Blue-Collar Workers refer to those people whose profession requires them to perform manual labour.

The advent of this Act ensured that sweated labour was protected from any type of exploitation and their rights are duly recognized.

Objective of the Act

There were several objectives that this Act needed to ensure:

- Minimum wages need to be ensured to all blue-collar workers in the organized sector.

- Prohibition of exploitation of labour in the workplace.

- The Act would empower the government to fix minimum wages and revise those wages from time to time according to the economic situation of the country.

- To ensure the application of this Act to a maximum number of organized sector employers.

Constitutional Validity of the Act

The Act is constitutionally valid and it can be ascertained from the following pointers:

- The Act does not violate Article 19 of the Constitution: The constitutional validity of the Act was challenged in the cases of U. Unichonoy vs State of Kerala and Gulmuhommad Tarasaheb vs State of Bombay. The parties challenged that this law restricted their Article 19(1)(g), as it puts a restriction on freedom of trade. But, the court held in favour of the Act. It was held that, in the absence of any such Act, the employers will pay wages, arbitrarily.

- The Act does not violate Article 14 of the Constitution: It was contended that the Act violates the ‘equal protection of laws’ clause. However, the court ruled that the Act does not violate Article 14 in the case of Bhikusa Yamasa Kshatriya vs Sangammar Akola Bidi Kamgar Union.

Salient features of the Act

The act has some salient features, let us have a look at them.

- The Act specifies for minimum wages for all government sectors employees, both centre and state.

- The minimum wages include House Rent Allowances. Therefore, Minimum Wages is equals to (=) Minimum Payment + Special Allowances

- There are several kinds of wage-fixing mechanisms:

- Minimum Wage Rate;

- Minimum Piece Rate;

- Guaranteed Time Rate;

- Time Rate or Piece Rate Applicable to Overtime.

- Classes of fixing minimum rates of wages :

(a) different scheduled employments;

(b) different classes of work in the same scheduled employment;

(c) adults, adolescents, children and apprentices; and

(d) different localities (zone-wise).

- There is a standard criteria of fixing minimum wage rate. Standard family consists of four members where it is considered that three consumption units are required on one earner.

- The food requirement must be ascertained by the regular calorie intake by the family.

- It is considered that the family requires clothing of 72 yards.

- The rent is considered to correspond to the minimum area.

- The expenditure is generally considered to be 20% of the minimum wage earned.

- The social expenditure is also considered to be 25% of the total minimum wage.

- The minimum wages must be revised within 5 years and the revised special allowance must be announced every six months.

- The regional labour commission shall be the authority for claiming the remedy under Section 20 of the Act. In Gujarat, Assistant Commissioner of labour shall be the authority.

Application of the Act

The application of the Act can be seen in the provisions. The provisions clearly mention all the procedures and the enactment of the laws laid down. Let us look at them one by one.

Fixation of Minimum Rates of Wages, Working Hours and Determination of Wages and Claims, etc.

Section 3 of the Act mentions all the procedures. Section 3(2) suggests that the appropriate government shall fix the following keeping all the considerations in the formulation of policies:

- Minimum piece rate;

- Minimum time rate;

- Overtime rate; This must be a substitution of the rate which was pre-decided by the employer;

- Guaranteed time rate system.

The government has to revise the minimum rates. In order to do that, the following things need to be kept in mind:

- The rates vary from every locality, Scheduled Employment, apprentices, children, adolescents and adults.

- The rates may be fixed, monthly, weekly, daily or hourly. This time may be fixed for a longer wage period as well.

Fixation of minimum rates of wages

The policy formulation regarding minimum wage happens only after due deliberation on the following:

- The minimum wages must be in compliance with the cost of living index of the employees.

- The basic wage rate with or without the cost of living allowance along with the authorised cash value of concessions pertaining to the supply of essential basic commodities at subsidized rates.

- Comprehensive basic wage rate will include the cash value of the concessions, cost of living and the basic rate.

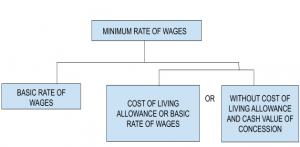

Minimum rates of wages

The minimum rate of wages is clearly defined in the table given below:

Procedure for fixing and revising minimum wages

Section 5 of the Act gives the procedure for fixing and revising the minimum wages. The appropriate government shall appoint committees and subcommittees that may be able to advise on the fixation of minimum wages. The appropriate government is also supposed to publish the minimum wage fixation in the newspapers so as to inform the stakeholders regarding the changes implemented. This publication has to be done at least before two months of the implementation. The stakeholders may also raise issues if any after the publication. The ascertainment of the minimum wage is then published in the Official Gazette. There may also be consultations regarding the revision of wages, with the Advisory Board. One may wonder, what constitutes an Advisory Board. Let us know what is it and its constitution.

Advisory Board

Section 7 of the Act suggests the formation of the Advisory Board. The government requires advise regarding the living cost indices, the requirements etc. An advisory board helps with the same requirements that were mandated under Section 5 of the Act.

Central Advisory Board

The Act also provides for the formation of a Board of Boards, for the management and regulation of all the Advisory Boards of India. This board shall comprise of members elected by the Central Government and the employees of the advisory boards. The formation of this board is given in Section 8 of the Act.

Composition of committees

Section 9 of the Act consists of the composition of the committees. It is mentioned that the committee shall comprise of members, who are elected by the employees of the scheduled employment. This committee will also contain the members from the scheduled employees but that must not exceed one-third of the total number of committee members.

Correction of errors

The appropriate government is provided with the liberty of correcting arithmetic and clerical errors. The correction will be published immediately in the official gazette. The notice will also be provided to the advisory board. The notice will also be up for suggestions.

Wages in kind

Minimum wages in this Act will be paid in cash only. However, if there are any concessions that are provided to the stakeholders by the government, shall be paid in the prescribed manner according to this Act. Section 11 of the Act prescribes the manner.

Payment of minimum rates of wages

The payment shall be made to the employees in order which is prescribed by law under this Act. However, it is also mentioned that nothing in this Act can affect the provisions laid down in the Payment of Wages Act, 1936 (4 of 1936). Section 12 of the Act fixes the payment of minimum wage.

Fixing hours of normal working days

Section 13 provides for the fixing of normal working hours in a working day. The fixation of normal working hours includes:

- The fixed number of working hours will include intervals from time to time.

- The fixed period must also include a day of rest in every seven days.

- The rest day must also be included in the pay, payment for not less than the overtime rate.

There are certain exceptions related to those employees whose work is of nature that is irregular. Such exceptions will be provided only after the consent of the appropriate government.

Overtime

If any employee works for more than prescribed hours then that person is entitled to excess payment for that period. However, it is also mentioned that nothing in this Act must be prejudicial to Section 59 of the Factories Act, 1948. Section 14 of the Act provides for overtime.

Wages for two or more classes of work

When two or more classes of work are performed by a single employee, the minimum wage will be altered according to the time invested in each class of work and remuneration provided in such work. Section 16 of the Act, this practice is mentioned.

Minimum time-rate wages of piece work

The minimum time rate must be given to those who are employed on the piece-rate system. The system must not be a minimum piece rate but only minimum time rate. The minimum time rate is a system, where the wages are paid on the basis of the time worked. Section 17 of the Act provides for this clause.

Maintenance of registers and records

The employers are supposed to maintain a record register in order to ascertain that all the employees are being minimum wages. This register also needs to be exhibited and must be available for perusal at all times. The authorities are supposed to check these registers. Section 18 of the Act provides for this clause.

Inspectors

Inspectors are appointed by the appropriate government in order to make sure that the administration is carried out well. There are certain powers which are given to the inspectors, which are listed below:

- The inspectors may enter any premises in order to carry out investigations regarding the minimum wage remuneration.

- The inspectors may examine or give any information important to the investigation.

- They also have the seize or make copies of any of the documents important to the investigation.

Claims

Claims are heard by the authorities appointed under subsection 1 of Section 20 of the Act. Every authority appointed under sub-section (1) shall have all the powers of a Civil Court under the Code of Civil Procedure, 1908 (5 of 1908). Claims can be made to the appropriate authority so that the appropriate action may be taken as soon as possible.

Single application in respect of the number of employees

The maximum level of compensation provided may not exceed 10 times the total excess of the aggregate. The single application in respect of a number of employees has to comply with Section 21(1) of the Act.

Miscellaneous

Penalties for certain offences

Section 22 of the provides for certain penalties that may be charged if:

- The employers pay less than minimum wage than specified;

- The employer does not comply with the provisions given in Section 13 of the Act

The penalties will also be considered if it can be proved that the offence has been committed by the negligence of the director or secretary or manager of the company.

General provisions for punishment of other offences

Section 22A states that the offenders will have to pay fines and may have to land up in jail if the offences are proved under this Act. The offenders may be granted a jail for a term which can extend to 6 months and/or be imposed with a fine that may extend to 500 rupees.

Cognizance of offences

The courts are not allowed to take cognizance unless there has been an application in front of the appropriate government. The court can also take cognizance when there is a complaint from the inspectors.

Offences by companies

Section 22C states that the penalties will also be considered if it can be proved that the offence has been committed by the negligence of the director or secretary or manager of the company.

Payment of undisbursed amounts due to employees

Section 22D also states about the amount that is due to be paid. The employees may also approach the court for this relief. If the employer does not pay the given amount in due time, then the authorities have the power to disburse the amount to the employees in the prescribed manner.

Protection against attachment of assets of the employer with Government

The employers have to detach their personal property for the security of the employees working. The amount that is kept as security with the government shall be used for the payment of contracts with the employees. This can be done under any decree by any competent court.

Application of Payment of Wages Act, 1936 to scheduled employments

The inspectors are responsible for the application of the Payment of Wages Act, 1936 to scheduled employments. This may be done by the notification in the Official Gazette.

Exemption of employer from liability

The employer may be exempted from liability if he or she is able to satisfy the court regarding the following contentions:

- The person took due diligence before taking the action.

- The action was done without his or her consent or knowledge.

If the employer is discharged from the liability then the person whose fault was that will be held liable.

Bar of suits

The suits shall not be maintained if:

- If the complaint has already been made in the court’s cognizance under Section 20 of the Act.

- The sum has already formed a direction in the plaintiff’s favour.

- Has already been adjudged that the sum will not be awarded in that circumstance.

- Could have been recovered by an application under that section.

Exemptions and exceptions

The appropriate government may impose such conditions on the employers as they deem fit. Such official notification may be granted in the official gazette. The employer does not have to comply with these norms given in the Act if the employee is a family member.

Power of State Government to add to Schedule

The appropriate Government, after giving a notification in the Official Gazette at least three months’ notice before its intention may by notification, add to either Part of the Schedule any employment in respect of which may be minimum rates of wages should be fixed under this Act, and thereupon the Schedule shall in its application to the State be deemed to be amended accordingly. Section 27 of the Act provides for that power to the state.

Power of the Central Government to give directions

The central government has the power to give directions for the smooth functioning of implementation of the minimum wages throughout the country. Section 28 of the Act mentions about this power.

Power of the Central Government to make rules

Along with the power to give directions, the Central government has also got the power to formulate rules in favour of the functioning of the Act. The Central Government may make rules by publishing the news in the official gazette. The rules may be regarding prescribing the term of office of the members, the procedure to be followed in the conduct of business, the method of voting, the manner of filling casual vacancies in membership or the quorum necessary for the transaction of business of the Central Advisory Board.

Power of the appropriate Government to be laid before the Parliament

The Parliament of India has the authority that whenever such a rule is made regarding this Act, the same shall be laid before parliament for approval by the majority. This must happen within a period of 30 days.

Validation of fixation of certain minimum rates of wages

The fixed minimum rates of wages shall be valid until the appropriate government revises this minimum rate of wages. This is provided under Section 31 of the Act. This Act also provides for the maintenance of itself. The rules and regulations are sufficient for its own sustenance.

Conclusion

The Minimum wages Act, 1948 brought about a revolution in the employees’ wage systems because the relief provided in this Act provides for complete protection from exploitation of manual labour at the workplace.

References

Students of Lawsikho courses regularly produce writing assignments and work on practical exercises as a part of their coursework and develop themselves in real-life practical skill.

LawSikho has created a telegram group for exchanging legal knowledge, referrals and various opportunities. You can click on this link and join: https://t.me/joinchat/J_0YrBa4IBSHdpuTfQO_sA

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Allow notifications

Allow notifications

[…] post Elaboration on the Procedures Contained in The Minimum Wages Act, 1948 appeared initially on iPleaders […]