This article is written by Alka, pursuing a Certificate Course in Real Estate Laws from Lawsikho.com.

Table of Contents

Introduction

Buying and owning a house must be on everyone’s wish-list. The same was true for the elderly couple living in our neighbourhood. They bought a house adjacent to ours in 2010 using their life-savings. Soon they moved into the house and since then they were living happily together. Everything was going well, but one day in June 2018 they got a notice from the bank to vacate their house for not paying off the loan of Rs. 65 lacs, which they have never taken. It was clear that they were defrauded by the seller.

They had never thought that their dream home would become their worst nightmare one day, as now they were homeless and penniless. You can imagine the trauma they have faced.

Whatever happened with the elderly couple can happen to you also. Moreover, these types of frauds are very common in the real estate sector. Although, conducting a Title Verification before investing in real estate can guard you from these types of frauds and can save you by millions.

By doing Title Verification you can scrutinize that the transferor is the real owner of the property and has the power to transfer the rightful ownership or title of the property is free from any encumbrances and defects. Additionally, such verification will also help you to alleviate the risk involved in the transaction.

Services of title verification can be availed by hiring a real-estate attorney or a professional title search company and alternatively, you can also do it yourself by using the direction given in the article. So let’s swipe to the nitty-gritty of title verification.

What is title verification

In the context of real estate, the Title basically refers to the rights arising out of lawful ownership of property. A clear title is conclusive proof of ownership. So whenever a real estate transaction takes place a thorough title search is done to ensure clear and marketable title because a defective title may land you in legal and financial trouble.

Title verification is a process of checking and verifying property documents for ascertaining the legal ownership of property and determining any defects in the title of the property. Generally, title verification is conducted by a real-estate attorney or a professional title search company and after that a report called ‘Abstract of Title’ or ‘Title Search Report’ is produced on the basis of verification.

Generally, a title search is conducted for a time period ranging from twelve to thirty years, which can be extended or reduced as per the objective of the party and nature of the transaction.

Extent of title verification

In order to determine the extent of investigation it is necessary to understand the nature of the transaction. It can be divided into –

- Full search

- Limited search

For transactions such as sale and long term lease, a full search is conducted for a period not less than thirty years. For full search, every aspect of the history of the property in question like flow of ownership rights, encumbrances, litigation status is searched and scrutinized in detail.

Whereas in case of transactions like short term leave and license, a limited search restricted to fifteen years is sufficient. Its scope is limited to recent transactional history, encumbrances and disputes only. Because in these transactions title ownership doesn’t hold much importance if any dispute arises afterwards the licensee can directly vacate the property.

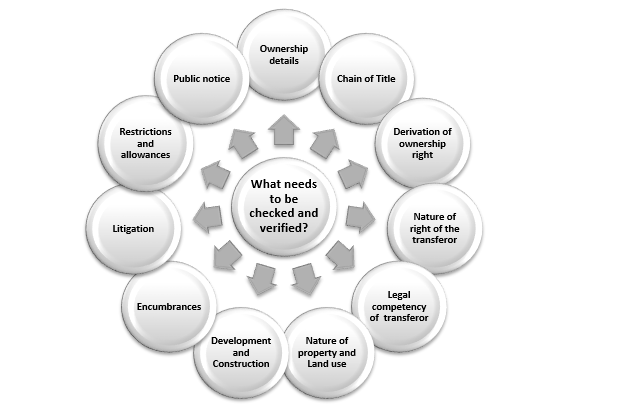

What needs to be checked and verified

- Ownership details

It is absolutely necessary to verify that the transferor is the real owner of the property and has clear and marketable right with respect to the property. This can be ensured by checking the original property-related documents and verifying if they correspond with public records held by the local authorities.

This includes every document evidencing the ownership and transfer of title such as sale deed, conveyance deed, gift deed, will documents, deed of partition etc. and if the sale is made by a person holding power of attorney, such power of attorney must be inspected carefully.

It should also be checked and verified whether these documents are stamped and registered properly.

- Chain of title

It is very usual that a property might be transacted and changed hands multiple times before. Therefore, Title verification not only includes checking and verifying the title of present owner but past owners also. A chain of title means the historical record of title of the property. For that purpose, inspection of the chain starts from the present owner and ends at the original owner of the property. All the documents starting from mother deed to the latest link deed must be scrutinized.

For example – property you are buying from existing owner A is bought from B through general power of attorney. B purchased it from C through a sale deed and property was gifted to C by D.

In this example, property was transferred four times and you need all four property documents for title verification which are called as link documents.

If the chain of title is complete then the clear title will delegate further. But if the continuity link is broken in between, it is a major red flag as there is a cloud on the title and it is not advisable to proceed with the transaction.

Generally, people tend to rely on the documents provided by the seller but it is always advised to get the certified copies of all the link documents and deeds from the Sub-Registrar office to know the legality of documents.

- Derivation of title

It is important to understand in which manner the transferor has derived title with respect to said property. Usually a title is derived by virtue of –

- Sale or purchase

- Gift

- Will or inheritance

- Lease

- Partition

In such cases, all the relevant documents giving effect to transferability of property must be verified for legality and reviewed if they are properly stamped and registered. Such documents include registered sale deed, conveyance deed and title document of present and previous owners, gift deed, will documents, lease deed, deed of partition etc.

- Nature of the right of the transferor

Right of transferor in regard to ownership of property can be absolute or limited. Ownership is said to be absolute when possession, enjoyment and disposal rights are vested in the owner without any restriction otherwise it is said to be limited. In order to execute a valid transfer, absolute right to dispose must be vested in transferor.

So while doing title verification it is pertinent to inspect the nature of the right of the transferor. It helps us to know if the said property is transferable and the transferor has absolute right to transfer the property.

Record of Rights and Mutation records can be a promising source for verification as these documents reflect the nature of the right of the transferor with respect to said property.

- Legal competency of the transferor

While conducting title verification it is necessary to ensure the legal competency of the present owner and former titleholders of such property. They must be major and sound mind in order to execute a binding contract of sale or purchase or any other form of transfer of immovable property such as lease or mortgage.

If not, the transaction will not take place without the prior permission of the competent authority. For example, if the transferor is Hindu then according to the Hindu Minority and Guardianship Act, 1956 permission of guardian as appointed by the competent court is necessary for a valid transfer.

Therefore, it must be checked that the transferor has authority to carry out such transfer and is legally competent to enter into a contract.

- Nature of property and land use

During title verification, it is necessary to ascertain the nature of the property, whether it is government-owned or privately owned. Any property which is under acquisition of government cannot be further transferred or alienated without the prior permission of competent authority otherwise such transfer will be void ab initio.

Further, as per land use property can be divided into two broad categories i.e. agricultural land and non-agricultural land. While conducting title verification it is necessary to determine the land use or status of said property whether it is agricultural land or non-agricultural land. If it is non- agricultural land then it should be further classified as residential or commercial, institutional, industrial etc.

Because knowing the land use pattern will help the buyer to determine the utility of the property. For example- only non-agricultural can be used for residential purposes. If on verification it is found that property in question is classified as agricultural land then you have to apply for the conversion of land with an authorization to use it for residential purposes. If the conversion is permitted, then only it is advisable to proceed with the transaction.

This information, particularly known as Khata Extract, can be derived from the assessment register maintained by the local municipal authorities.

- Development and construction

If the property has some developments or construction, it adds up a few steps to title verification. It must be checked that the construction is in adherence to the building plan and sanction plan in the same manner as prescribed and passed by the municipal authorities.

In addition to this, builders are required to seek various permissions and approvals with respect to infrastructure and utility facilities like water, sewage, electricity, environment compliance etc.

If it is ready to move-in property, you should also check occupancy and completion certificates. Further, you should also check the Khata certificate. As a matter of practice, when a new property is registered a Khata number is allocated and Khata certificate is provided which states that the property ‘xyz’ is in the name of person ‘abc’. Khata certificate is essential for getting water and electricity connection.

Therefore, while conducting title verification it is advised to determine whether all the local construction rules were followed and complied with or not.

Further, if the property is under construction stage it is important to scrutinize following aspects –

- You must ascertain if the developer is the owner of land itself or he has entered into a joint development agreement with the landowner. In case of latter, a power of attorney must be executed between the landowner and developer, which must be scrutinized while conducting title verification.

- It must be ascertained that the builder is complying with all the local construction and safety rules.

- It is also necessary to determine if the builder had sought all the necessary permissions, authorization and approvals.

- You need to ascertain if the construction is in compliance with the sale agreement.

- Encumbrances

Sometimes property can be used as collateral to take loans. It creates an encumbrance charge over the property which means property is subject to lien or mortgage and cannot be transacted further without the prior permission of the lender.

Identification of encumbrances, charges, liens or mortgage is very important because such defects can adversely affect the title of the property. So, while conducting title verification it is advised to get records of property examined at the office of sub-registrar in order to ensure that there are no registered encumbrances, charges and mortgage in favour of any person, bank or financial institution.

It is also important to inspect if there is any lien on the property. For example there can be any loan and tax dues, municipal lien, mechanic’s lien, housing society claims regarding maintenance charges etc. However, presence of these liens doesn’t mean that these agencies can sell the property but they have a charge on the property which means whenever the property will be sold they have a right to be paid with the proceeds.

After examination a no-encumbrances certificate can also be obtained from Sub-Registrar or Tehsildar or other relevant authority.

Also, there can be some unregistered mortgage, so in order to minimize risk original title documents must be inspected carefully.

Similarly, if the property belongs to the company, the examination of encumbrances must be done with the Registrar of companies by inspecting CHG-1 form. Same can also be reviewed by doing a search on the website of the Ministry of Corporate Affairs.

However, with the emergence of digitalization assessment of encumbrances can be done online using the official website of the concerned registration department by entering valid credentials of property. For instance, if the property is in Delhi, link given below can used to check the status of encumbrances charges over the property – https://doris.delhigovt.nic.in/

- Litigation

It is also important to ascertain that there is no pending litigation having the said property as subject matter. It can be determined by conducting a search in civil courts under whose jurisdiction the said property lies.

Seller of the property could also be asked to furnish the information regarding any pending litigation as he is bound to provide so according to Section 55 of the Transfer of Property Act, 1882 which says that the seller is bound to disclose any material defect on the property and he is also liable to answer all such question put to him by the buyer of the property in relation with title of the property.

In order to minimize the risk further a representation can be made in the transaction document asserting that there are no encumbrances and pending disputes, and then imposing a liability on the seller itself in case there are any.

- Restrictions and allowances

- Real covenants on the property – Every housing society has some bye-laws to follow. Such bye-laws enumerate the restrictions and allowances with respect to construction on the property.

For example, bye-laws of the society may not be allowing you to cover the balconies and open spaces or you may be required to follow a specific construction plan or there might be some parking restrictions which are to be considered before investing in property. So, these bye-laws must be scrutinized while conducting title verification.

- Easementary rights – Easement basically means Right to way. It is possible that owner may have provided a right to way to adjacent property or sometimes there can be easements created for utility services like a portion of property may have been reserved for installation and repair of water and sewage pipelines, electrical cables etc. which have to be looked upon while conducting title verification.

- Public notice

Considering the fact that some transactions remain unregistered and remain masked even after due diligence therefore to be discreet it is always suggested to publish a public notice in at least two local newspapers for inviting claims and asking objections with respect to property in question. On so forth, if any dispute arises afterwards such publication will endorse genuine and legitimate title ownership of the buyer in question.

Notice must contain the details of the property and name of both the parties to the transfer, and an appropriate time frame must be given to raise objections.

Other than the points enumerated above, it is always advised to physically survey the property in question, it will provide the ground image of survey plan and also determine the exact location, dimension and area and other particulars of the property and it will also highlight if there are any encroachments over the property. Physical survey will also help you to check if there are any easements which are not reflected in the records.

What is a search report

Following the above mentioned key-points title verification is conducted and on the basis of findings of title verification a Search Report is formulated. Basically, title verification is a process and result of which is concisely inscribed in a Search Report.

Title Search Report contains a historical record of the title of the property and gives accurate legal description of property as to how the property is transacted over a period of time and whether there are any risks involved in the transaction, which may adversely affect the title of property, so that you are sure that you are investing in a legitimate property.

What should it include

A Search Report must cover the following points –

- Firstly, the search report must specify the details and particulars as to location, measurements, area of the property.

- It must elucidate who is the owner of the property whether it is individual, company, trust, or other legal person. It should also include a legal opinion on the issue- how the legal personality of the owner will impact on the title of the property.

- It must include a table of scrutinized records, deeds and documents and the documents which are verified by the authorities must be outlined.

- It must clarify the nature of the right of the transferor, if it is absolute in terms of enjoyment, possession and disposal or not.

- It must specify if there is any charge or dues or lien on the property.

- It should specify if the property in question is subject to mortgage.

- It should inform if there is any kind of encumbrances upon the property for example unpaid tax mortgages, unpaid loans etc.

- Search Report must specify if there is any third party interest on the property.

- It must elucidate if the property is the subject matter of any ongoing litigation or if it is in the process of acquisition by the government.

- At last, it must conclude that if the title of the property is clear and marketable.

- Further, any specific advice, comment or opinion can also be inserted in conclusion.

Who needs a title search report

It is clearly true that Title Search Report is very important for any prudent buyer in order to ascertain if the property is fit to buy or not. But it will be wrong to assume that the usefulness of title search report is limited to an individual in any sale and purchase transaction.

In the modern scenario, real estate transactions are a staple and indispensable part of various realms and so is the need of Title Search Report. So, let’s see who mainly needs a title search report –

- Investors: Real estate sector is very lucrative from the point of view of investment because it provides higher return in the long run. Further, real estate investments are capital intensive therefore, one needs to be extra diligent while entering into such transactions.

And now as per FEMA (Non-Debt instrument) Rules, 2019 NRI/OCIs are also permitted to invest in immovable property in India which includes both residential property as well as commercial property. Since, they are living far away and not aware of ground realities of a property, they are more prone to title frauds.

Therefore it is also advised to conduct a Title Verification before investing in real estate.

- Companies: Many a time companies need to enter into real estate transactions for various purposes. These transactions include – lease, leave and license transactions, or buying an immovable property for a project development etc. Therefore, they also need to conduct a title verification may it be full search or limited search as per the requirement and nature of transaction.

- Banks, financial institutions and other Private lenders: Banks, Financial Institutions and other Private lenders are in a practice of providing loans against the immovable property as collateral. But if the borrower does not hold a marketable title against such property then the purpose of keeping it as security will be defeated. So, it is very important for them to check whether the person seeking loan has a clear title against the property held as collateral before sanctioning and disbursing the loan. Although, they have a reliable robust network to do the same.

Conclusion

A property derives its value from the title itself. A property with a defective title holds no value, only a clear title can set a seal on the fact that you have an explicit right to own the property and sell it further.

So, while investing money into real-estate it becomes crucial to scrutinize whether or not you will have a clear marketable title, which determines that ownership rights are free from any doubts, risks and clear of any kind of claims, encumbrances and defects.

A clear and marketable title can only be acquired when the transferor of the property has a good title to it. So, it is always suggested to conduct a Title Verification before executing any agreement in relation to real estate and immovable property. In order to do so you need to check and verify various records and documents pertaining to property in question. (Here) is the document checklist to assist you in Title Verification.

References

- https://housing.com/news/due-diligence-land-purchase/

- https://www.mondaq.com/india/real-estate/540742/legal-due-diligence-in-real-estate-transactions?type=mondaqai&score=74

- https://www.nitinbhatia.in/real-estate/property-document/

Students of Lawsikho courses regularly produce writing assignments and work on practical exercises as a part of their coursework and develop themselves in real-life practical skill.

LawSikho has created a telegram group for exchanging legal knowledge, referrals and various opportunities. You can click on this link and join:

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Allow notifications

Allow notifications