This article is written by Nikita Arora, from Trinity Institute of Professional Studies. This article discusses how to conduct a rational valuation of employee stock options.

Table of Contents

Introduction

An employee stock ownership plan (ESOP) is a type of employee benefit plan that gives employees a share of the company’s ownership. ESOPs provide various tax advantages to the sponsoring organization, the selling shareholders, and the participants making them eligible plans. Companies often use ESOPs as a corporate-finance strategy to align the interests of their employees with those of their shareholders.

Background

Stock option schemes have been extremely effective in aligning the needs of employers and shareholders around the world. Many Indian companies also include stock options as a form of remuneration for their employees. When stock options are issued to the employees, they are either an expense to the corporation or a liability that is yet to be resolved from the company’s viewpoint. There are accounting principles that explicitly deal with the accounting of employee stock options around the world, such as IFRS 2 and ASC 718. (US GAAP). On the other hand, the situation in India hasn’t been as obvious. There hasn’t been a detailed accounting standard on accounting principles yet. There are a variety of laws and guidelines that apply differently to various businesses. For example, listed firms are controlled by SEBI guidelines and the ICAI has issued Guidance Note 18 on the subject. However, none of them have the same level of application consistency or the authority of an accounting standard.

Methods of Valuation of ESOP

Depending on the level of accuracy desired and the complexity of the choices, fair value can be calculated using any of the following:

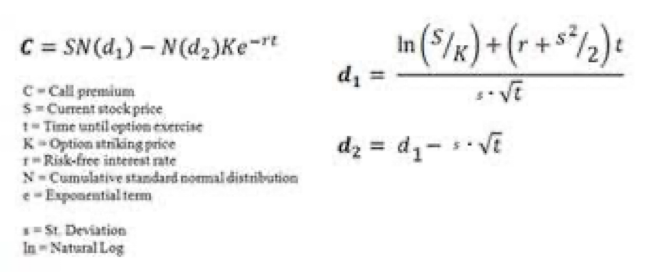

Black Scholes Formula

This is the most commonly used method, and it’s best for small schemes with straightforward rules.

The parameters here are share price (S), exercise price (K), volatility (sigma), duration till exercise (T), and the risk-free rate (r). The simplicity of this method is its primary benefit. The option price can be easily determined once the parameter values are known.

The disadvantage of this approach is that it does not allow for complex features, such as the exercise price varying according to a formula. The method assumes that share prices follow a lognormal distribution, which may not be accurate in certain cases, such as when markets are pressured. In India, Black Scholes Formula is most commonly used to value employee stock options. However, companies are aware of the limitations and ensure that this approach is suitable for their specific circumstances.

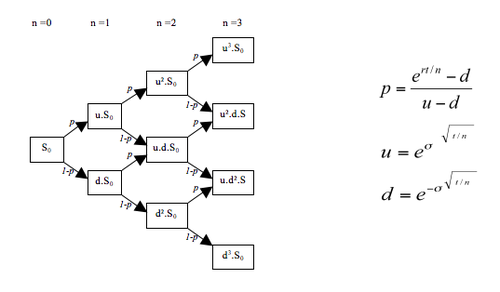

Binomial Method

The binomial model is more complex and requires the application of statistical methods. The share price is projected using ‘up’ and ‘down’ probabilities from the date of grant to the date of exercise in this model.

The odds are calculated based on the assumption of stock price fluctuation. The binomial approach is very reliable, and it can accommodate more complex rules and events during the vesting era (eg. probability of leaving the service). The only drawback is that it often implies that share prices follow a lognormal distribution. The use of the binomial model is very limited in India, although it is simpler and more reliable than the Black Scholes Formula. In my view, even for simpler schemes, the Binomial Method should be the preferred model.

Monte Carlo Method

As with the Binomial Method, this method also involves projecting the share price. On the other hand, the forecasting of a share price is not constrained by predetermined up and down probabilities, the share price is now sampled from the selected share price distribution. The method entails projecting the share price under a variety of scenarios, each of which creates a specific path. Of all options of pricing methods, the Monte Carlo method is the most reliable. It can handle any amount of difficulty in the scheme’s rules and pre-vesting events. It can deal with non-lognormal share price distributions, resulting in more reliable performance. The disadvantage of this method is that it takes time to get results due to the computational complexity. It may also be challenging to understand. In Indian markets, Monte Carlo methods are rarely used.

When ESOP Valuation Required

Income Tax

In terms of taxes, employee stock ownership policies are regarded as perks. On the other hand, employees are taxed on ESOPs in two ways: while exercising and as a requirement. The difference between the Fair Market Value (FMV) on the date of exercise and the exercise price is taxed as perquisite when an employee exercises his choice. When it comes to selling for a profit, there are a few things to keep in mind. After purchasing shares an employee can decide to sell them. He will be subject to capital gains tax if he sold these shares for more than FMV on the exercise date. Capital gains will be taxed based on how long they were kept. This time is estimated from the date of sale. If they hold equity shares that are listed on a registered stock exchange for more than a year, they are called long-term capital. If the shares are sold in less than a year, they are called short-term capital. Long-term capital gains (LTCG) on publicly listed equity securities are now tax-free.

Ind AS

According to IND AS 102 equity-settled share-based payment transactions with the employee must be priced on a fair value basis, with the fair value calculated as of the date of grant of such instruments. The fair value is not re-measured at each reporting date after it is calculated at the time of grant. The costs are recognized as a payment to the income statement (with a subsequent rise in equity) over the vesting period after the fair value of the grants has been calculated. The organization must estimate the amount of ESOPs expected to vest to determine the fee for each period before the end of the vesting period. The charge to the income statement is only for the amount of ESOPs that the company expects to vest ultimately (there is no charge for the instruments that are likely to expire due to early exits. Since the fair value is assessed only at the grant date (and not later) the charge to the income statement over the vesting period in the case of ESOP grants is relatively constant. The only expected deviation is due to a shift in the company’s estimate of the amount of ESOPs that will vest eventually.

Inputs for ESOP Valuation

Fair Value of Underlying

- The fair value of the company’s equity shares is represented by this statistic.

- It is required as of the valuation date, which is typically the grant date.

- If the shares are listed:

- The available market price can be used to determine whether there is enough trading.

- The price from the stock exchange with the largest volume is generally used.

- If the shares are unlisted:

- Valuation of equity shares must be done using commonly accepted metrics such as market multiples, discounted cash flows, etc.

- Care must be taken to ensure that the value is minority level rather than management level.

Exercise Price

- This is usually a fixed number that is included in the ESOP scheme or grant letter.

- In certain cases, companies can opt to keep the exercise price at a low level, such as Rs. 1. In such instances, the option’s value would be higher.

- In some unusual cases, the exercise price may be a variable number linked to share price, efficiency, period, and other factors. In such instances, it may be necessary to build a binomial separately.

Expected Volatility

- This is an indicator of how much the value of equity shares is likely to fluctuate.

- It is calculated using the standard deviation as a starting point.

- If shares are publicly traded, the volatility of shares can be calculated directly.

- If the shares are not publicly traded, the volatility of similar companies’ shares is calculated and used as a proxy.

- Historical volatility analysis is generally done for a period that is close to the future expected option life considered in the option valuation model.

Expected Dividend

- This is the estimated amount of dividends on the company’s equity stock.

- If the firm has a dividend background, the same may be explicitly considered.

- In the absence of dividend history, the dividend history of comparable companies is examined and taken into account.

- Historical dividend analysis is normally done for a period that is close to the future expected option life factored into the option valuation model.

Conclusion

Hence, there are no specific methods of valuation that must be used as per Ind AS, however, the Black Scholes method is widely used. The success of an ESOP scheme is strongly influenced by ESOP valuation. An in-depth analysis is needed to determine each variable used in option pricing models, and if necessary companies can designate an independent value to the value of ESOPs. The value of ESOPs must be expensed over the duration in which the employees’ option would vest.

References

- https://numericaconsulting.com/blog/3-methods-for-valuation-of-employee-stock-options/

- https://ctconline.org/wp-content/uploads/pdf/2019/seminar-presentation/corporate/8-6-2019-Study-Course-Valuation-CA-Devarajan-Krishnan.pdf

- https://cleartax.in/s/esop

LawSikho has created a telegram group for exchanging legal knowledge, referrals and various opportunities. You can click on this link and join:

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Allow notifications

Allow notifications