In this article, Rakesh Gupta pursuing M.A, in Business Law from NUJS, Kolkata discusses Valuation of Trademarks.

Introduction

The valuation of trademarks should follow ‘Rules on Appraisal’. However, it is highly likely that valuation may be affected by valuator’s subjective opinion because valuation criteria are not stipulated specifically in the rule. Furthermore, valuation may be made uniformly because various valuation methods are not fully utilized. The purpose of this study is to enhance the expertise and efficiency in trademarks valuation practices by providing evaluators with a basic knowledge and specific criteria in cost approach and income approach.

WHAT IS TRADEMARK?

A Trademark is a word, phrase, symbol, or design, or a combination of these that identifies and distinguishes the source of goods of one party from those of others

WHY TRADEMARKS ARE IMPORTANT?

‘Trademarks are important because if you make a quality product, you want to make sure that customers can quickly identify your product without confusing it with other products, especially other lower quality products. Reputation is important, and trademarks help protect your reputation’.

Trademark Examples

Examples of a trademarked symbol are the Nike Swoosh and McDonald’s Golden Arches.

Pepsi’s designs are an example of a trademarked design.

What is a service mark?

‘A service mark is the same as a trademark, except that it identifies and distinguishes the source of a service, rather than a product’.

Service Mark Examples

Some examples of service marks include: McDonald’s (restaurant services), Wal-Mart (retail business services), and AT&T (telecommunications services).

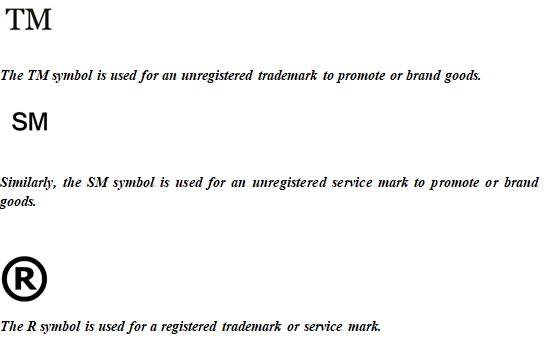

“Trademark” and “Mark”

‘Both of these terms are used to refer to trademarks (goods or products) and service marks (services)’.

Functions of a Trademark

- Indicates the source of origin of goods or services

- Helps guarantee the quality of goods bearing the mark

- Creates and maintains a demand for the product

- Used as a marketing tool to build a brand

- Can have great value to a company

Why Protect a Trademark?

- Trademarks are protected under federal and state law

- Trademarks are earned not born.

- Trademarks come into being through actual use.

- You do not have to register a trademark to have it protected, but there are some advantages to doing so

- A trademark registration provides:

- Constructive notice to the public of the registrant’s claim of ownership of the mark.

- Registrant’s exclusive right to use the mark nationwide on or in connection with the goods and/or services listed in the registration.

- A trademark registration provides:

Policy

Trademark Policy is a marketing function. Normally the marketing personnel of an organization will take care of this trademark policy letter known as ‘ Brand Management

Protection

Trademark protection is a legal function. In small enterprises, one of the tasks of the legal department is to assure the protection of company’s trademarks. In large enterprises there is need to create a specific department known as ‘ Trademarks department’ which will look after the ‘ Trademarks Management

Since trademark protection is a legal function, the trade marks department best assure its role when it is integrated in the legal function of an organization.

The principal duty of the Trademarks Department is to protect and administer the trademark of the company i.e. by getting registration under the relevant laws of a particular country, the country of registration, the list and classes of goods and the services covered, renewals, action against the infringes and dishonest users and so on.

The trademarks department has an additional task in advising the marketing personnel in the choice of new trademarks, their protect ability and their availability, and also in the legal aspects of trademark policy.

The Trademarks Department may also be entrusted with the task to managing the licensing of trademarks, drafting license agreements and permitted user agreement for use of trademarks and also to look after other areas of Intellectual Property such as Patents, Designs, Copyrights and technical knowhow.

Functions of the trademarks department for proper trademarks department for proper trademark management

1) Advise the marketing department with regard to the choice of a new trademark.

2) Legal clearance of a new trade mark by conducting searches in the Trademarks Registry and also in the market places with regard to the availability of identical or similar marks in respect of similar goods and services.

3) Submit trademark applications and advise the company to go for registration in a country where the goods are to be exported or sold.

4) Since there is globalization of industry and trade, it is better to seek International protection of the trademarks and other Intellectual Property.

5) Advise the company for proper use of trademarks after obtaining registration in order to avoid the attack on the registered trademarks on the ground of non-use by business competitors.

6) Initiate legal action against the infringes by filing civil suits or criminal complaint against the infringes and dishonest traders.

7) To conduct search and raid the premises when the infringed or spurious goods are being manufactured or marketed with the help of local police personnel after lodging criminal complaint.

8) To maintain individual files for each and every trademark of the company for easy reference.

9) It is better to computerize the Trademarks Department by creating a software for this kind of ‘ Trademarks Management ‘.

If the creation of trademark department is not economical one of trademark department is not economical one for any type of organization, then it is better to entrust this task to a Trademark Attorney who should be properly instructed to maintain all particulars and papers with regard to trademarks either on retainer or work-to-work basis.

Current Situation

Recent economic and environmental change, depending on the proportion of the corporate intangible assets, such as trademarks greatly increased, the value of these assets reasonably, objectively assess the need is increasing.

Therefore, financing, trading, investment decisions, M and A, litigation, is to assess the value of intangible fixed assets for the purposes of such strategies would reasonably be called the most important part. However, the ability to assess properly the lack of recognition and of intangible assets on despite the importance of these intangible assets are lacking

IFRS to the valuation of trademarks at fair value but with the exception that non-marketable securities, the acquisition cost can be replaced by a well-known professional organizations calculation of the amount of trademarks that the rules are followed. In Article 29, “Rules on Appraisal” but to establish the rules relating to trademarks, including the evaluation of intangible assets has to be determined only by the goodwill of the valuation price evaluation method of revenue reduction, the evaluation criteria does not specify in detail the possibility of intervention is to be the valuator’s subjective situation is very high

Is a trademark of enterprise valuation techniques in order to solve the above problems are situations that require the establishment of valuation criteria that allow you to select a variety of valuation techniques, and get out on the subjective valuation method. In the proposed regulations, specifically with reference to the revenue reduction and valuation methods based on the case analysis and appraisal cost method performs the actual corporate trademarks are the purpose of this study is to propose a practical criterion.

Main Text

Factors affecting the value of corporate trademarks are the factors that are derived from the characteristics that are inherent to the trademark. It can be divided into right and notation, goods and services, markets, sources, etc externalities “Special Education Accounting Standards” intangible assets are exclusively and exclusive right to use a certain period of time. Category is industrial property rights, copyrights, software, software development, etc. Intangible asset has stipulated that the amount plus incidental costs for development costs or purchase value of the asset at cost.

“Municipal Rules on Accounting Standards” has been also defined as intangible assets such as industrial property, with information such as “Special Education Accounting Standards”, specifies the assessment methods for intangible assets.

This assessment has also increased the need for trademark applications in concrete. The “Rules on Appraisal” country stipulates that the evaluation of the trademark line to apply the evaluation method to assess, including goodwill, or goodwill. If this should be the principle evaluated by reduction in revenue, the method may be used to deal case comparison method or cost method if this is not fair.

In “Inheritance and Gift Tax Law” and regulations for the valuation of the trademark as one of the intangible property. The mention of a trademark that directly examine this regulation at least among the “Rules on Appraisal” and “Inheritance and Gift Tax Law”. In “Inheritance and Gift Tax Law” due to trademark and is to assess the value based on the income obtained in the future, it is unclear if that assessment based on the income of the assessment three years ago. This input costs, but it is difficult to apply in future cases if the value is difficult to obtain in the future uncertain income estimates, it has the past three years also represents the future value of income does not matter. Therefore, this case has been commissioned to complement the emotion rating agencies that are accredited by an appropriate amount. This eventually leads to ’Rules on appraisal‘ Article 29 Application of the Provisions of goodwill is connected with problems of its own assessment regulations absence of a trademark. In the case of goodwill is primarily focused on evaluating the benefits exceed its value and property values also exceed profits of the business. However, in addition to the case of a trademark can be accessed from multiple excess benefit side factors such as royalties, input costs in development, the impact of intellectual property as a factor of the nature and value of many other problems. Therefore, the evaluation method of complying with the current regulations of the goodwill that would limit the proper evaluation of its intellectual property, including trademarks that are important recently.

International Valuation Standards Committee as the International Trademark criteria; trademark evaluation of the (International Valuation Standard Committee IVSC) Standards and Assessment Foundation USA (Appraisal Foundation) established a unified professional criterion (Uniform Standard of Professional Appraisal Practice, under USPAP), etc. there. International tendency of trademarks are evaluated in recent years, interest in the trade marks evaluation attempting to simulate the new model evaluation trademarks has been increasingly spread. In utilizing such computer systems address the complexity of the valuation in accordance with the attempt has been made to raise the predictability. However, there is currently a lack of interest in spite of this general agreement with the reference method for the evaluation Trademark yet. According to a survey of UK companies associated with the trademarks valuation made in 2007 and reported that 52% of the required assessment methodology, showed that 57% not sure about the current method. USA also in accordance with GAAP trademarks are the criteria that should be further developed research results have been reported, in the case of China has conducted a study and review of the claim in accordance with the standards and the need for improved assessment and trademark intangible assets associated with the trade office.

In addition, due to the necessity associated with the tax and accounting, as well as require a rating on the company value, corporate interests are also growing increasingly concerned about the trademark in accordance with the higher rating. Since these trends are associated with the reliability of the evaluation results as an opportunity to evaluate Trademarks may be exposed shortcomings, the method and criteria relating to the evaluation is to be improved I have an international consensus has been formed.

Second, as a part of the creative economy has been increasing interest. There are increasingly becoming topics of interest related to the assessment as part of the ‘creative economy’ that has an interest in the importance of economic growth. Accordingly, the OECD has an interest in intangible assets, including trademarks held by related workshops, and the private sector and the government, academia, and that such interest improve.

Third, the valuation trademarks are influenced by changes in technology and the environment. Recently, to save time and money because of the highly-developed computer system and software, while the attention to the complexity that can be performed in model development evaluation.

Therefore, Trademarks valuation is increasingly being adequately achieved immediate, positive rating action appears to have made this tendency rather than a passive, too. This trend has had a profound impact on the assessment as a benefit of the trademarks introduction and development of new technologies. Therefore, appropriate assessment procedures and methods, standards also need to be provided regarding the use of assessment tools based on this technology are also being raised.

Discussion

The trademarks valuation is a trademark of selected functional furniture product “NEO chair” as an example, examine the contents of the marketability and feasibility of such trademarks included in aims to assess its value. “NEO chair” is a May 8, 2014 The B’s intellectual property rights established in Incheon, November 2014 is the current prototype and factory state equipment has been completed. This review is trademark “NEO chair” and assume the same company that developed prior to the relevant domestic and international trademark, by December 1, 2014 criteria to assess the fair value of its trademark.

Valuation Practice by the Cost Method

In this case study the company is committed to the development of the trademark “NEO chair” labor costs, material costs, etc. In addition to seeking the historical cost of the investment in trademark development costs, due to the cost method here on the trademark value plus a percentage of the compensation opportunities estimate.

As using the cost method to estimate the cost spent to develop the intellectual property, trademark first thing you need to evaluate the value of a trademark, it is important that the calculation of the cost of acquisition below.

- Salary and remuneration of those who engage in trademark development.

- Costs of project promotion.

- Common costs for clerical staff and trademark professionals.

- Raw material used in the development process.

- Trademark development costs (fees, etc.).

Our product development costs are trademarks completion of the preparation of the production personnel engaged in trademark development costs incurred to develop (March 2014-October 2014), Labor costs, trademark analysis, advertising, consulting rain, costs such as fees 55.081 million the circle.

The estimated capital investment for an ergonomic chair is “NEO chair” with 50 million won. It is estimated to have been based on the actual cost to register (October 2014) from the trademark applied to 50 million won, the first outturn based on contributions (February 2014), office rent, furniture and the like costs.

Patents relating to intellectual property, such as business opportunity compensation are typically determined in the range of 1 to 10 times. In a recent valuation, but usually three times and evaluation assets. Considering that the same trademark, business opportunities compensation will be calculated at twice the cost of the investment. Thus, the business opportunity is estimated at about 100 million won compensation11.

When assessing the value of the trademark cost method by considering the overall cost is estimated to 205.081 million won,

Valuation Practice by the Income Method

Prerequisites for evaluating the trademark by the income approach are as follows.

- The company has a manufacturing plant was completed in late 2014 began production and sales will start in 2015.

- Sales of the total market size, market share, taking into account the product’s marketability, including one year of primary verbs are presented on the basis of estimated sales plan is assumed to increase by 10% annually (Bank of Korea, Financial Statement Analysis, 2014).

- Estimated Income Statement is prepared based on the projections presented by the company.

- Initial direct development (70,000,000 won) is financed by debt capital.

- Non-operating expenses (financial expenses) are calculated using the average interest burden (10%) of the borrowed capital.

- Head office and factory building is assumed to be a rental, machinery and equipment (useful life: 10 years Residual value: 0) are amortized on a straight-line basis.

- The additional investment is that there is no facility since 2016.

- Increase or decrease in working capital due to the increase or decrease of such inventories, trade receivables, trade payables are assumed not.

- The economic life of the trademark is assumed as five years, no residual value is assumed.

The company is assumed to start selling since 2015, revenues are assumed to increase by 10% per year, based on the first year (2015) sales plan presented by the company. The sales volume and sales is calculated by the three models developed by the company based on market conditions and characteristics (price of product A: 210,000, product B and product sales in the C: 180,000).

The sales costs are applied to 45% of the total turnover on the assumption that the initial cost structure persists.

The selling and administrative expenses consist of salaries and variable costs advertising costs for the operating characteristics of the fixed nature of public relations personnel and development staff. The corporate tax rate of 25% applies.

Trademarks of the economic value of the life and value of a discounted cash flow revenue reduction of five years with five years to see the best of 270,605,000 (discount rate changes and adjustments Technical contributions from the lowest of 248,166,000 (fixed discount rate, and general technical contribution apply) applied) were evaluated in a range of up to. In summary, the results of that appraisal seems trademarks and Table 7.

Conclusion

Trademarks are the same as described for the appraisal also mentioned earlier, because it assumes the previous transaction, it is desirable to assess how fair enough deal to convince the parties. Emotion valuation results have brought a variety of discount rate changes apply one million won to 270, 205 to adjust the contribution of one million won of revenue reduction from cost method. Conservative cost method in terms of trademark holders, on the other hand, can reflect as much as possible the location of the buyer, optimistic revenue reduction may reflect as much as possible the seller’s location. Trademarks and intellectual property assessment revenue reduction generally considered a priority. However, B Company has no past performance, such as appraisal of the first companies to enter the market, there seems to require some conservative perspective. Thus, the final value of the “NEO chair” trademark is evaluated by 250 million fixed discount rate and applying the general contribution of the revenue reduction.

In conclusion, the application of the valuation method proposed to facilitate trademark valuation and assessment related to the relatively examined the measures that can be used on the hands. Through this study, the contents actively respond to the expansion of new business areas that correspond to evaluate the industry is able to enjoy the changing economic environment and look forward to being able to be leveraged by practice, provided that a systematic and consistent.

Reference

- Trademark Act

- IP Act

- Journals

- Internet columns

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Allow notifications

Allow notifications