In this blog post, Krishnendra Joshi, a student at Renaissance Law College and pursuing a Diploma in Entrepreneurship Administration and Business Laws by NUJS, provides an overview on warrants under capital market regulations.

Meaning and Concept of Warrant

Warrants are capital market instruments used for raising funds by companies. Warrants are a type of equity derivative instrument. The value of an equity derivative depends partly on the value of the underlying security. It is an option issued by the company granting the buyer a right to purchase some shares of its equity share capital at a given exercise price during a stipulated period. The warrant holder partly pays the premium for the option which he purchased and partially pays the price for the share that ultimately will get allotted to him if he exercises the option.  The most common types of warrants are detachable and naked. Detachable warrants are issued in connection with other securities (like bonds or preferred stock) and may be traded separately from them. Naked warrants are issued without any accompanying securities. The following basic differences will help to appreciate the nature of share warrants:

The most common types of warrants are detachable and naked. Detachable warrants are issued in connection with other securities (like bonds or preferred stock) and may be traded separately from them. Naked warrants are issued without any accompanying securities. The following basic differences will help to appreciate the nature of share warrants:

Warrants versus Compulsory Convertible Debentures: In the case of compulsorily convertible debentures, there is a mandatory conversion into equity shares at a specified time; it is like a deferred equity whereas warrants the option to exercise lies with the warrant holder. Therefore, a warrant may expire without conversion into shares.

Share Warrants Distinguished from Employee Stock Options: The fundamental distinction between the two lies in the purpose of issuing these two instruments. Employee stock options are means of employee compensation. It forms part of the employee benefits scheme of the company. On the other hand, share warrants are like instruments used by investors to invest in the shares of the company only.

Reason and Purpose of Issuing a Warrant

In a situation where the market is lukewarm for new issues, equity warrants can be used as an added attraction for investors to apply for issues offering equity warrants with their securities. An equity warrant can be used for increasing the marketability of debentures as was done by Ceat Tyres Ltd.; wherein a warrant was issued for every five debentures allotted.

How do Warrants Work?

Warrant defers the issuance of the shares to a future date while at the same time raising funds immediately. Thus, warrants are issued for a longer period which enables the warrant holder to make gains owing to future appreciation in the price of the stock. The warrant holder partly pays the premium for the option which he purchased and partly pays the price for the share that ultimately will get allotted to him if he exercises the option.

Warrants under the Indian capital market regulations are discussed keeping the following regulations under consideration:

- Securities Contract Regulation Act, 1956

- Companies Act, 2013

- SEBI (Issue of Capital And Disclosure Requirements) Regulations, 2009

- FEMA Regulations

Warrants are considered as securities under section 2(h) of the securities contract regulation act, 1956.

As per Section 2(h) of Securities Contract Regulation Act, 1956 “securities” include—

- Shares, scrips, stocks, bonds, debentures, debenture stock or

- other marketable securities of a like nature in or of any incorporated company or another body corporate;

- Rights or interest in securities;

Since the underlying instrument in warrants is equity shares which in turn are marketable securities, it is obvious that warrants will also be marketable in nature.

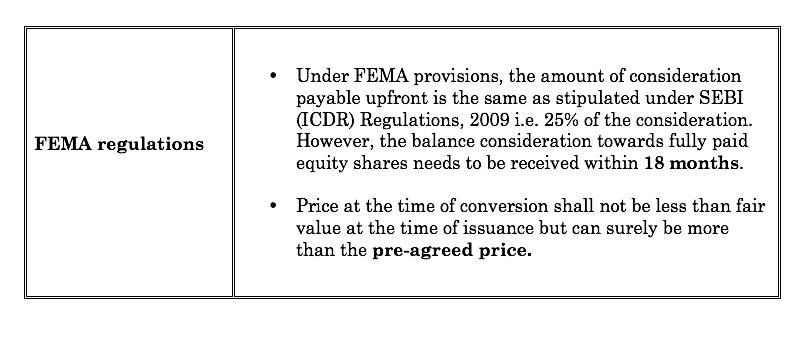

Warrants shall be treated as security within the meaning of Section 2(za) of FEMA as per Notification No. FEMA. 308/2014 issued by Reserve Bank of India in this regard. Further, in the case of warrants being issued to a person resident outside India, compliance under FEMA (Transfer or issue of securities to a person resident outside India) Regulations, 2000 as amended from time to time needs to be ensured.

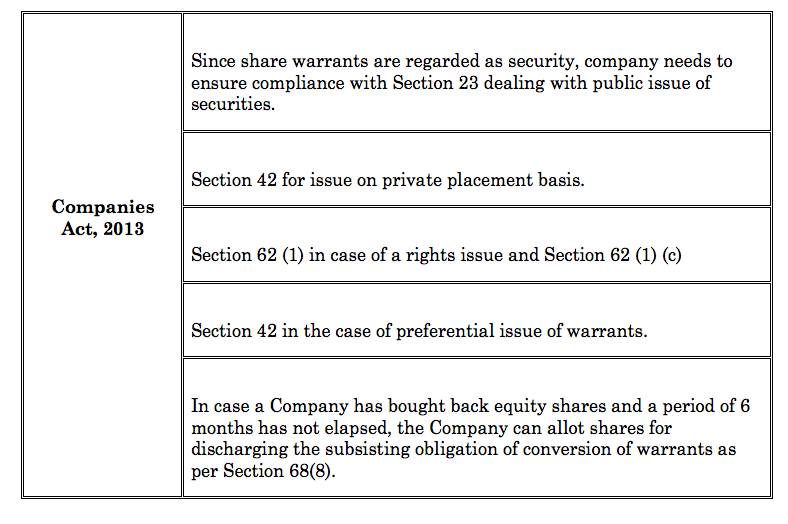

A company whether public or private needs to comply with the following capital market regulations ensure for issue of share warrants:

Right Of Forfeiture

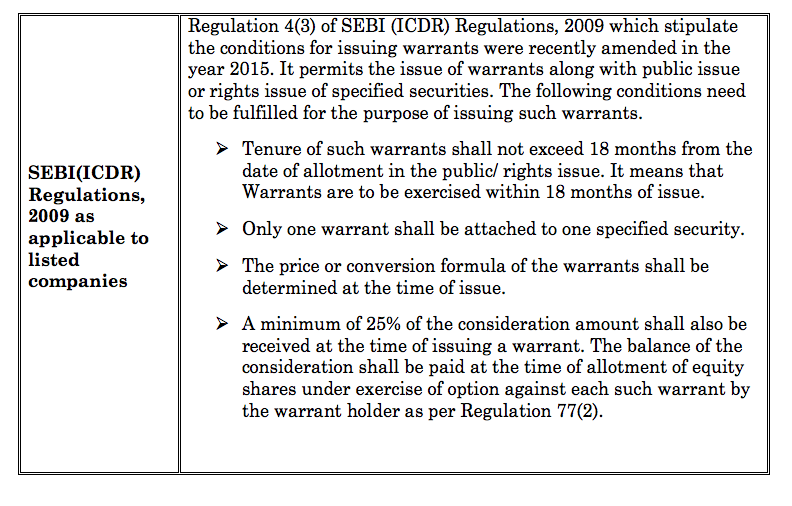

The issuing Company has a right to forfeit the initial premium amount paid in case the warrant holder does not exercise the option to take equity shares against any of the warrants held by him. Regulation 4(3) of (ICDR) regulations, 2015 states that if the option holder does not exercise the option to convert his options, then the entire consideration will be forfeited. However, the provisions of ICDR, 2015 are applicable only to a listed company.

Other companies can decide on their terms under such circumstances. In case the company has received the balance consideration of 75% in tranches, then the terms can allow the option premium to be forfeited.

Regulation in Case of Promoters

If promoters had previously subscribed to warrants of an issuer but failed to exercise the warrants, Regulation 72(3) which prescribes the conditions for preferential issue makes the promoter and promoter group ineligible for issue of specified securities of such issuer on preferential basis for a period of one year from:

- The date of expiry of the tenure of the warrants due to non-exercise of the option to convert, or

- The date of cancellation of the warrants as the case may be.

The rationale for regulating warrants subscribed by promoters and not exercised by them is that otherwise, promoters could take the option of increasing stake in companies at a fixed price by paying just 25 % of the total amount due on full conversion. Such issues give promoters an opportunity to increase their shareholding at an attractively low price. To prevent such abuse, Warrants can be exercised within 18 months of issue. If the promoters don’t exercise warrants by the stipulated date, they cannot purchase any share or warrant for the next 12 months.

Conclusion

Under Companies Act, 1956, sections 114 and 115 dealt with share warrants as bearer instruments. Although there is no specific provision regarding the issue of warrants under Companies Act, 2013, it comes within the purview of the fundraising provisions of the Act due to the wide meaning of the term securities as defined in section 2(h) of the securities contracts Act,1956.

The SEBI (ICDR), Regulations, was amended in the year 2015. It increased the tenure of such warrants from 12 to 18 months from the date of allotment of Public/ Rights issue. The amendment made it clear that the pricing formula should be specified in advance at the time of issue of warrants. The initiative is directed towards ensuring transparency in disclosures. Most importantly the regulations enable the issuer to forfeit the initial consideration in case the warrant holder does not exercise the option to take equity shares against any of the warrants held by him.

The provisions in FEMA regulations aims to facilitate the issue of partly paid up shares and warrants so that the Indian Companies can attract foreign investors. While investing in warrants, the Investors need not make full payment of the entire amount as consideration. The relaxation is aimed to make foreign investment in India relatively easier in certain economic sectors.

References for this article:

http://taxguru.in/company-law/faqs-share-warrants.html

http://www.sebi.gov.in/cms/sebi_data/commondocs/icdrFeb2016_p.pdf

http://indiacorplaw.blogspot.in/2009/07/issue-of-banning-share-warrants-to.html

http://taxguru.in/rbi/rbi-eases-fdi-norms-permits-investment-partly-paid-shares-warrants.html

http://www.investopedia.com/walkthrough/corporate-finance/5/risk-management/warrants.aspx

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Allow notifications

Allow notifications

What is the consequences of forefeited amount. Is is returned to the Investor ?