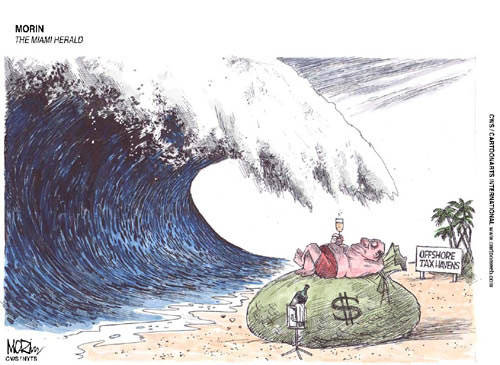

This should not come as something very surprising that Mauritius, a minuscule island, attracts most of the investments from India and that not only Mauritius, even places like British Virgin Island and Cyprus are also not far behind. To the world of investment, these places are like what Switzerland is to banking. More than one-third of a total of around USD 31,000 million, which is invested abroad from India, is destined to end up in many of the well-known tax havens like Channel island [5400Million USD], Mauritius[2600Million USD], Virgin Islands [1008 million USD], Cyprus [1361 million USD] and Cayman islands [104 Million USD] .

The reason behind these huge investments is that these countries have very liberal taxation regimes, so they form one of the hottest destinations for investments.

What are Tax Havens?

Loosely defined, a tax haven may be a place, which has liberal taxation system with regard to foreign investment. A liberal taxation regime is one having a very low rate of taxation or nil taxation. However, every place that has a liberal taxation regime may not be considered as a tax haven. Organization for Economic Cooperation and Development provides three factors to identify whether a place is a tax haven or not:

- 1. It must have low rate of taxation,

2. Lack of transparency,

3. Laws to protect financial information.

What is outbound investment?

Outbound investments are also known as ‘Direct investment outside India’ (in Indian Context). Outbound Investments can be simply defined as those investments which are made outside the country and these investments should only be according to the guidelines as provided by the RBI.

The RBI draws power to frame rules in this regard from Section 6(3)(a) and Section 47 of the Foreign Exchange Management Act, 1999 (FEMA). A direct investment means an investment through:

- 1. Contribution to the capital of the foreign Entity

2. Subscription to the memorandum of association of the foreign entity

3. By purchase of the existing shares of a foreign entity;

As far as modes 1 and 2 are concerned, the Indian party can make a direct investment by any of the following manners:

- 1. Joint venture: When there is a direct investment by a Indian party in a foreign entity formed according to the laws of host country,

2. Wholly owned subsidiary (also called WoS): When the entire capital of such entity is held by Indian Party

In both the above manners, Indian party means a company incorporated in India under the Companies Act, 1956.

As for mode 3, the investment can be made in the following manner:

- a) Market purchase, i.e. purchase of share in an offer in the market, public issue.

b) Private placement, i.e. purchasing the shares when they are offered to a few, selected individuals. It is the opposite of public issue.

c) Stock Exchange

A Direct Investment outside India should be made in the above manner only.

Eligible Entities

The entities eligible to make direct investment outside India are as follows,

- a) Indian Companies or Body Corporate (incorporated according to an act of the parliament)

b) Partnership Firm (registered as per Partnership Act, 1932)

c) Resident Individual

There are limits to the amount of investment that these entities can make, as provided in the regulations of RBI. An Indian Company or Body Corporate can only invest up to 400% of its net worth, a partnership firm can only invest up to 200% of its net worth. However an individual can only invest up to US$ 20,000.

There is also a cap on investment by Indian entities that they cannot invest in Real Estate or Banking Sector

Routes of Investment

Routes of Investments are basically Methods of Investments. There are two kinds of methods:

- 1. Automatic Route

2. Approval Route

If you are making a Direct Investment outside India by way of contribution to the capital, subscription to the memorandum of association or by purchasing existing shares of a foreign entity (keep the limit of 400% for companies and 200% for partnership firm in mind) then you need not require a permission from RBI and may inform the Reserve Bank after the transaction is complete.

However, if the transaction is not by the automatic route, the you need an express permission from the RBI and RBI looks into the transaction taking into consideration factors like viability of the project, benefits that may accrue to India by the project, expertise or experience of the party, financial position or track record of the company. After taking into consideration these factors the RBI may or may not grant the permission. This method is called Approval Route.

How is the Tax Avoided?

The method of tax avoidance by way of outbound invest is very simple. Suppose an Indian company enters into a joint venture with a company registered in the Virgin Islands. The Indian company as per the joint venture provides money for doing business under such a joint venture. In Virgin Islands the rate of capital Gains tax is zero, so essentially there is no tax on the profits earned by such a joint venture. However, these profits would still be taxable in India if they are returned to the parent company. So in order to avoid taxation in India what these companies do, is that they don’t return this money to the parent company but instead they keep deploy the money for overseas expansion. Hence, the result is non-payment of tax.

Most of these companies are only ‘registered’ in tax havens but there actual place of business lies somewhere else.

It is not necessary that all the time these investments are for tax avoidance or are illegal. There can be other reasons for investment in these tax havens especially in Mauritius, which is the single largest contributor of FDI to India (Almost 40% of all FDI is from Mauritius). The reason is that there is a race to capture the new economies of Africa as fast as possible, and to this end, the small island nation of Mauritius comes very handy, since it is geographically located at the Eastern Coast of the African Continent and also it the member of a number of regional trade blocks, including the Common Market of Eastern and Southern Africa (COMESA) and the Southern Africa Development Community(SADC) , it has also signed a wide network of Investment Promotion and Protection Agreements (IPPAs)

So because of these reasons, Mauritius forms the gateway to African markets.

But this is not the only reason for Indian companies to flock to get legal addresses and entities registered in tax haven countries, the other reason is that they are creating an International Holding Company (IHC) in tax havens. These IHCs are nothing but just money routing tools at the hands of Indian Corporations. When money is invested through an IHC it provides many benefits as given below:

- ● It helps in receiving the income with low withholding tax: withholding tax generally mean the tax required to be deducted and paid to the government before making the payment. For example tax deducted before distributing the dividends or interest. Also, income tax treaties reduce the rate of withholding tax.

● It helps is timing of interest, dividends and capital gains in India etc.

These are just a few benefits, there are many others such as:

- ● It can act as an intermediary for borrowing and lending for the parent company : There may be times when the national jurisdiction prohibits the company from raising money or receiving loan for certain projects or purposes. In these circumstances an IHC comes very handy, since it is not subject to the same regulations. It can be used to borrow money on the repute of the parent company and this money is directed to the parent company. Though one must keep in mind that the interest payable on this money is taxable.

● Holding of IPRs and other Property: Having a International Holding Company hold property and IPRs is very beneficial in the sense that it reduces the inheritance tax, capital gains tax. By holding IPRs they may also accumulate royalties.

● Use group funds more efficiently: An IHC helps to use the group funds more efficiently in the sense that it can be used to make high risk investments. It also helps in smooth movement of funds to different subsidiaries.

This is the reason that most of the investment in and outside India is routed through tax havens. Also, only technically 1/3 of the total outbound investment is at the first glance going to tax havens, however in reality, this ends up in reaching too many other countries all over the world.

Conclusion

Current statistics show us that we really need to rethink the laws regarding outbound investment. Corporations have found a really easy way out from paying taxes. Many a times there tax savings are genuine and legal but most of the times the routes they take while making outbound investment leads to tax avoidance. There has to be a law in place that makes them accountable to share holders and governments. Also, we need to assure that IHCs don’t become an international hawala system. There has to be a consensus at the international level to make the present trading mechanism more transparent and investor friendly.

Feel free to drop a mail at info@ipleaders.in in case of any query or doubt.

*Research work done by Suyash Manjul, Vth Yr, Ram Manohar Lohiya National Law University

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Allow notifications

Allow notifications