This article is written by Muddassar Bagadia, a student of Rizvi Law College, on 7/12 extract

INTRODUCTION:

The 7/12 extract, traditionally called as “Saath Baara Utara” (in Marathi language), is an extract from the land register of any district, maintained by the revenue department of the government in the state of Maharashtra.

It is a revenue document showcasing; Ownership, Occupancy, rights, liabilities and other agricultural aspects pertaining to a land, mainly the agricultural land, prepared for each respective village in which property is located. However, Non-agricultural land also has its own extract. Additionally, it is one of the basic documents of title that serves as an evidence of ownership of the agricultural land it represents. Though, not the conclusive proof of ownership and being indicative only. In rural areas, the ownership of a particular plot of land can be established on the basis of the so called extract, known as “Record of Rights” or “Record of Land Rights“. The number seven and twelve of the extract denotes the Village FORM numbers. The upper part of the extract denotes village Form: VII, which refers to record of rights, denoting the names of occupants, owners or mortgagees of the land or assignees of the rent or revenue, government lessees, tenants, the rights and liabilities of holders to pay revenue, other things which can be specified by the state government by making the rule and other details of the land, other than crop details. Whereas, the lower part of the extract, Form: XII refers to, register of crops, denoting the types of crop taken, figures of area under crops and fallow land.

ORIGIN:

The extract is named after, Section-7 (Continuance of requisition) and Section-12 (power to obtain information) of Bombay Land Requisition Act 1948. There are about 16 different Forms’ been maintained in each village revenue system and several other forms recorded as appended to the Maharashtra Land Revenue Record of Rights and Registers (Preparation and maintenance) rules 1971. All records maintained under various village Forms such as VII-XII, VIII-A, VI, VI-C etc.; are land records forming substantial part of land records department, required for maintaining and keeping the revenue accounts relating to a person from whom the land revenue is realizable. Although, Maharashtra Land Revenue Code 1966, does state about maintenance of record of rights under sections 148-159 of the act, however, does not express any provisions relating to such an extract directly. The Form no VII, called as record of rights is maintained in Form no. I, as appended under the said rules thereby. Whereas, on the other side, Form no. XII, which is register of crops, is been maintained in, Form no. XIII, appended under the aforesaid rules framed there in under MLR Code 1966.

CONTENTS:

The extract highlights information of the land by its Survey number and Hissa no, Name of the taluka or tahsil and Village in which the land is located, Name of all the persons (other than tenants) who are holders, Occupants, Owners or Mortgagees of the land or Assignees of the rent or revenue, Names of Government Lessees or Tenants including the tenants within the meaning of the relevant tenancy law, Nature and extent of their respective interest of such persons and the Conditions or Liabilities attached with respect to such land, Area of the land, Type of Tenure.

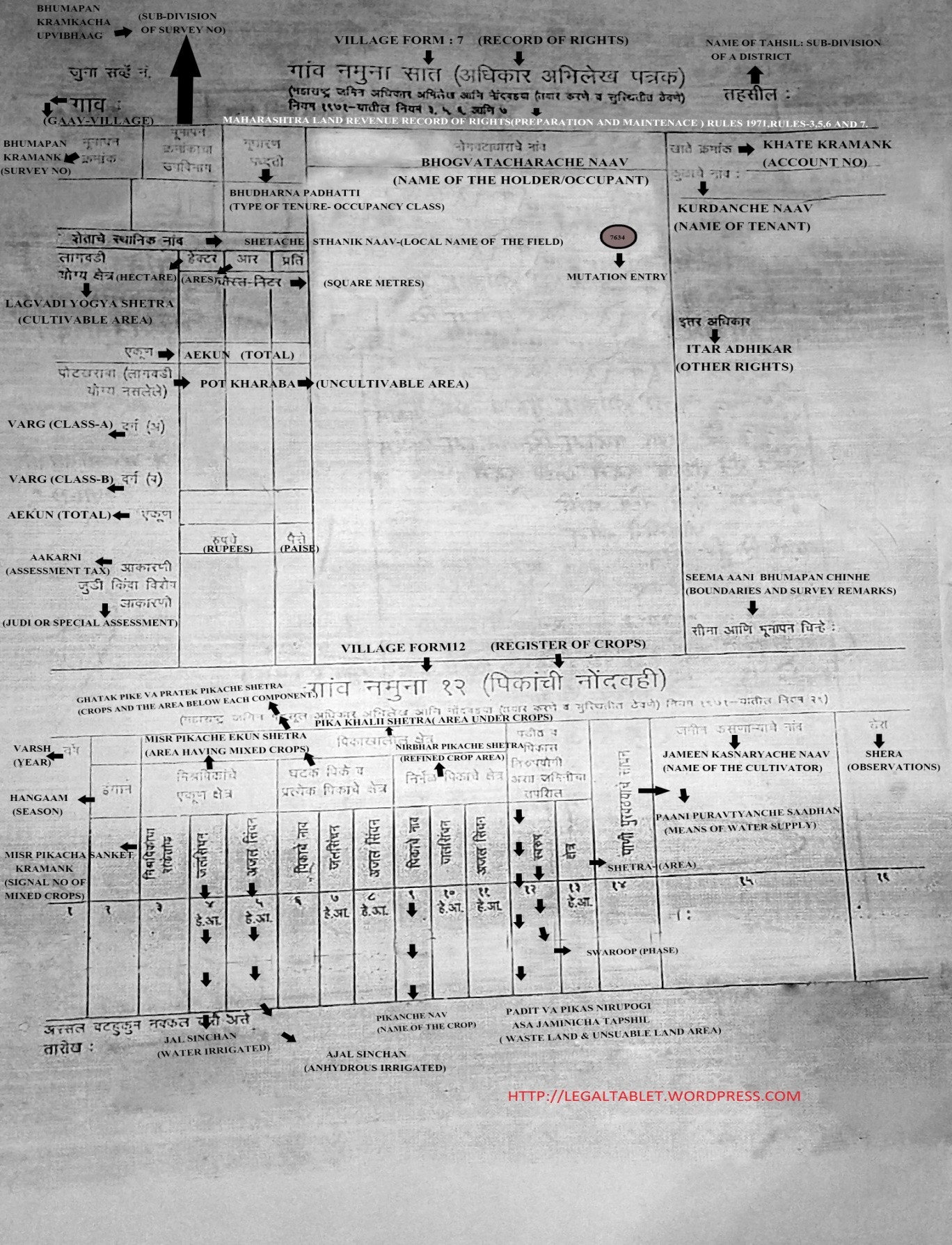

Format of VII-XII

(Whether alienated Land or un-alienated, if un-alienated, whether occupant class-1, class-2 or government lessee), Mutation numbers from the register of mutation, Khate no, Area of land fit for cultivation, Area of uncultivable land, Tax to be paid, Judi to be paid, Boundaries and Survey remarks, Crop Season, Type of crop taken, Type of cultivation – whether irrigated or rain fed, Name of the farmer other than owner if any. It also records loans extended to the land owner given by government agencies, including the purpose – such as loans or subsidies for buying seeds, pesticides or fertilizers, for which the loan was given, the loans could be given to the owner or the cultivator, other rights on the land, such as easement rights, details of charges of attachment and decrees under the order of civil court or revenue authorities, whether land classified as fragment under section 6 of the Bombay preventions of Fragmentation and consolidation on holding act 1947, If right is acquired by heir ship, names of heirs with whom land is not in actual possession and so on.

Furthermore, in the state of Maharashtra, the said extract issued by the revenue authorities reflecting all the above details of land is in the local language of the state i.e. Marathi Language, which makes it difficult for a person not proficient with the language to understand it. Additionally, the details of the land covered and mentioned in the extract are governed by vast range of laws, especially in relation to the ownership of land, Occupant class, whether a piece of land can be transferred or not and if transferable to whom it is transferable, whether prior permissions are required or not before the transfer from competent authorities and so on. Therefore, it is utmost important to understand the terminology and the laws governing to a land in such an extract even before a land is acquired.

ANALYSIS: VII-XII HOW READ?

Now, that we have summarized the above contents of the VII-XII extract, analysis of the each of them is essential in order to understand their respective meaning and how each should be understood in its clear and precise terms in relation to one another. Subsequently, also various laws applicable to a particular piece or the holding of a land and the restrictions on their transfer are to be noted along with its applicable provisions respectively. Analysis of form VII and XII is done in two parts VIZ- Part A and Part B Below: –

- ANALYSIS OF VILLAGE FORM NO: 7 (RECORD OF RIGHTS) (Refer Illustration above)

- GAAV NAMUNA SAATH (ADHIKAR ABHILEKH PATRAK) – Village form 7 (Record of Right) – The heading of the extract denoted by its own name, the rights recorded of the persons in relation to a piece of land. However it also denotes liabilities attached to a particular land.

- GAAV – Name of the village – Showcases the name of the village in which land is situated.

- TAHSIL – Tahsil or Taluka – Is a sub-division of a district in which land is located.

- BHUMAPAN KRAMANK – Survey number/ Gut No – A number put up for the land not less than the minimum area specified in section 82 of MLR code 1966, after a survey conducted by government revenue authorities under sub-rule (1) of rule 3 of Maharashtra Land revenue (Revenue surveys and sub-division of survey number) rules 1969.

- BHUMAPAN KRAMANKANCHA UPBHIVAAG – Sub-division of survey number – A number put up for every holding of which the area is less than the area specified in the section 82 of MLR code 1966, shall be separately measured, calcified and assessed and entered in land records as sub-division of a particular survey number, under sub-rule 2 of rule 3 under Maharashtra Land revenue (Revenue surveys and sub-division of survey number) rules 1969.

- BHUDHARANA PADDHITI – Type of occupancy – Bhudharana means “Occupancy” and Paddhiti means “Type”. This is itself very crucial and important column in the extract and should be carefully noted. Under section 29, of the M.L.R Code 1966, persons are classified into occupant class-1 and class-2. Also, it extends information about the land held by government lessee.

Occupant class- 1, persons classified into this class is free to transfer the agricultural land without the permission of collector in favor of a person who is an agriculturist. Whereas, persons classified under Class- 2 are the persons as tenants who had purchased the land under the provisions of the Bombay tenancy and agricultural lands act 1948, Lands granted by government to the schedule cast, schedule tribes, freedom fighters, members of army forces, ex-service men. This occupant class-2 is allowed to transfer only after the Collector’s permission. However, No sanction from the collector is required when land is to be mortgaged in favor of government.

- BHOGVATACHARACHE NAAV – Name of the holder/occupant – Names of those who are holding the land as holders, joint holders, occupants, government lessees or tenants.

- “To be a land holder” means to be lawfully in a possession of land- whether possession is Actual or not.

- “Occupant” means a holder in actual possession of un-alienated land, other than tenant or government lessee.

- “Joint holders or occupants” means who hold land as co-sharers, whether as co-sharers in a family undivided according to Hindu law or otherwise and whose shares are not divided by metes and bounds and where land is held by joint holder or joint occupants, holder or occupants as the case may be, means all the joint holders or joint occupants.

- “Government lessee” means a person holding land from government under a lease as provided by section 38 M.L.R Code 1966.

- “Tenant” means a lessee, whether holding under in instrument or under an oral agreement and includes a mortgagee of a tenant’s rights with possession but does not include a lessee holding under the state government.

As per section 149,150 and 151 of M.L.R code 1966, persons who have obtained right must inform to the talathi within three months period. However, exemption is been granted to inform talathi if the right is received through collector’s permission or registered documents.

- 7634 – Circled Entry mentioned in the illustration, is called as Mutation entry – Is an entry from the register of mutation (village form – VI), showcasing how a person acquired right’s in a particular piece of land. Whether by – Transactions of purchase or sale, Division (distribution) of land, Mortgage Deed, Tenancy Rights, Hereditary succession Rights, Registered Lease, Gift, Adoption, Merger of Sub-section, Loan, Maintenance, Donations, Administration, Relieving of Rights, compensation etc., By Addition Deletion document, By order of civil or revenue court. Unless the entry in mutation register is certified it should not be recorded in record of rights. Any pencil entry of mutation number in the records of rights is endorsed, that would certainly mean that the entry is not certified as per rule 13 of Maharashtra land revenue record of rights and registers (preparation and maintenance) rules, 1971.

- KHATE KRAMANK – Account No – This is an account number from khate pustika issued under M.L.R Khate – Pustika (Booklet) (Preparation, Issue and Maintenance) Rules, 1971. Wherein the khata no (Account number of the land holder) is mentioned. Also, the village form- VIII A contains details of khatedar’s name (Account holder name) and his Khate number (Account number) and taxes payable by him is entered by talathi. Every land holder is provided with the khate booklet.

- KUDANCHE NAAV – Name of tenant – Law recognizes two classes of tenant i.e. contractual tenant and deemed tenant under the relevant tenancy law.

For instance: Land purchased by a tenant under section 32-M of the Bombay tenancy and agricultural lands act 1948.

- SHETACHE STHANIK NAAV – local Name of the field – Considering shape or location of the field, farmers have given names to their field. For example; Uhalacha Mal (Field where spring water is flowing). Local names are quite useful for finding out the exact location of the land.

- LAGVADI YOGAYA SHETRA – Area fit for cultivation – Area of land fit for cultivation is mentioned underneath this column in Acres, Guntha, Hectares or Ares.

CONVERSION CHART :

| 1 ACRE = | 43,560 SQ.FT | 4046.85 SQ MT | 4840 SQ YARDS | 40 GUNTHA |

| 1 GUNTHA = | 1089 SQ.FT | 101.285 SQ MT | 121 SQ YARDS | 0.0249 Acres |

| 1 HECTARE = | 107639 SQ.FT | 10,000 SQ MT | 11959.8 SQ.YARDS | 2.47 ACRES OR |

100 ARES1 ARES = 1076 SQ FT 100 SQ.MT 0.024 ACRES1 SQ MT = 10.76 SQ FT 1 SQ YARD = 9 SQ FT

- POTKHARABA – LAGVADI YOGAYA NASLELE – Area unfit for cultivation – Area of land unfit for cultivation is mentioned in this column in two categories.

- VARG (A) – Category (a) – under this category consists of that land area which is uncultivable due to rocky area, land under Nala and farm building.

- VARG (B) – Category (b) – under this category consists of that land area which is uncultivable due to land reserved for public purposes i.e. Road, Recognized Foot path and public place for drinking water etc.

- AAKARNI – Assessment – The amount of Assessment tax charged on land is mentioned here.

- JUDI KIVVA VISHESH AAKARNI – JUDI TAX OR SPECIAL ASSESSMENT – Judi means, the revenue paid by the person to whom the land is given by inamdar or government.

- ITAR ADHIKAR – OTHER RIGHTS – Other rights on land is again an important column to be carefully looked for when identifying the extract. It may consists of several other statutory or general obligations on land such as restriction on land transfer or liabilities on the holder or encumbrances on land or other rights attached to the land. Entries in this column can completely make the transaction invalid if overlooked. Thus, it is very essential to look for other claims, restrictions, obligations or rights of third parties on the land before even acquiring it.

Various different entries in this column which must be carefully noted such as below:

- कु. का. क. नौंद – ENTRY OF SECTION 32-G (TENANCY ACT) IN THE OTHER RIGHTS COLUMN: Lands under this category are private lands, which are allotted to kool (Tenant) for cultivation, against payment of yearly rent payable by the said kool to the landlord. Under the provisions of Bombay tenancy (protected) act (kool-kayda) the lands under cultivation by such tenant as on 1-4-1957 (Tillers day), such kool being statutory purchaser automatically becomes the holder of such land, had it been the said tenant has paid appropriate value (Nazarana) to the government and have obtained a Sanad / certificate under section 32 M of the act and thereafter such land can be sold and not otherwise. In some of the cases even today it is seen that encumbrance i.e. 32-G is mentioned by way of mutation entry in the other rights column on 7/12 extract. Which means that the said tenant (even in possession of land) has not paid the appropriate value (Nazarana) to the government and obtained necessary Certificate / Sanad under section 32-M of the act and to that extent the land is encumbered. In such circumstances the holder cannot sale such land unless the appropriate value (Nazarana) is paid to government and necessary permission is obtained.

- कु. का. क. ४३ ला नौंद – ENTRY OF SECTION 43 OF TENANCY ACT IN OTHER RIGHTS COLUMN: Section 43 – Restrictions on transfer of land purchased or sold under Bombay tenancy and agricultural lands act 1948: Lands purchased by tenant under the provision of the act are not allowed to transfer land without the permission of the collector. The collector may grant permission for transfer of land in any of the following circumstances, namely:-

- That the land is require for agricultural purpose by industrial or commercial undertaking in connection with any industrial or commercial operations carried on by such undertaking;

- That the transfer is for the benefit of any educational or charitable institution;

- That the land is required by a co- operative farming society;

- That the land is being sold in execution of a decree of a Civil Court or for the recovery of arrears of land revenue under the provision of the code;

- That the land is being sold bona fide for any non-agricultural purpose;

- That the land is being sold by a land owner on the ground that –

- I. He is permanently giving up the by profession of an agriculturist, or

- II. He is permanently rendered incapable of cultivating the land personally;

- That the land is being gifted in favour of-

- I. The bodies or institution mentioned in section 88A and clauses a & b of section 88B or

- II. A member of land-owners family;

- That the land is being exchanged-

- With the land of equal or nearly equal value owned and cultivated personally by the member of the same family; or

- With the land of equal or nearly equal value situate in the same village owned and cultivated personally by another land owner with a view to forming compact block of his holding or with view to having better management of the land:

Provided that, the total land held and cultivated personally by any of the parties to the exchange whether as an owner or tenant or partly as does not exceed the ceiling area as a result of exchange;

- That the land is being leased by a land owner who is a minor; or a widow or person subject to any physical or mental disability or the member of the armed forces or among the land owners holding the land jointly;

- That the land is being portioned among the heirs or survivors of the deceased land owner; K. That the land is being mortgaged in favour of society registered or deem to be registered under the Maharashtra Co-op Societies Act 1960 for raising a loan for paying the purchase price of such land.

- That the land is being transferred to the person who by reason of acquisition of his land for any development project has been displaced and requires to be resettled.

Where sanctioned for sale of land given in the circumstances specified in the clauses a, b, c, e, or if it shall be subject to the condition of the land owner paying to the State Government a nazrana equal to 40 times assessment of the land. In the case of portioned sanctioned under clause “j” it shall be subjected to the condition that they are allotted to each sharer shall not be less than the unit specified by the State Government under clause c of sub section I of sub-section 27.

However a recent amendment is been made to this section, published in the gazette of government of Maharashtra on 7th Feb 2014 which states for addition of a provision after the existing provision under the said section, the following provision shall be added, namely as – “Provided further that, no such previous sanction shall be necessary for the sale, gift, exchange, mortgage, lease or assignment of the land in respect of which ten years have elapsed from the date of purchase or sale of land under the sections mentions in this sub- section to the conditions that-(a) Before selling the land, the seller shall pay a nazarana equal to forty times the assessment of the land revenue to the government; (b)the purchaser shall be an agriculturist; (c) the purchaser shall not hold the land in excess of the ceiling area permissible under the Maharashtra agricultural lands(ceiling on holdings) Act, 1961. And (d) the provisions of the Bombay prevention of fragmentation and consolidation of holdings act 1947 shall not be violated.

- कलम ३६ व ३६ अ ला अधीन नौंद – ENTRY OF SECTION 36 AND 36-A OF MAHARASHTRA LAND REVENUE CODE 1966 IN OTHER RIGHTS COLUMN: Under the section 36A, the land of a tribal cannot be transferred in favor of any non-tribal without the permission of state government or collector as the case may be. Henceforth, this entry should be carefully noted and permission of the collector or the state government is sought before any such land is transferred in favor of non-tribal. Normally, such extract bears a rubber stamp showing the land as adivasi land holder. But often sometimes talathi forgets to put such a stamp; thus, it should be wise to inquire this aspect as well before purchasing.

- अ. पा. क. नौंद – ENTRY OF MINOR GUARDIAN IN OTHER RIGHTS COLUMN: Guardian cannot sell minor’s share in the property without prior court’s permission under Hindu minority and guardianship act. Such permission must be obtained before buying such a land held by minor guardian. Sale of such property cannot be done without prior permission of the court as held by Supreme Court in Saroj V/s Sunder Singh and others (25.11.2013, S.C).

- हिंदु अविभक्त कुटुंब or प्रमुख नौंद – ENTRY OF HINDU UNDIVIDED FAMILY OR KARTA ENTRY IN OTHER RIGHTS COLUMN OR UNDER OCCUPANT COLUMN: In case of land held by HUF, according to mitakshara School of Hindu law, a karta can sell a property without any family member’s consent only in certain circumstances i.e. in times of distress (apatkale); for the sake or benefit of the family and for pious purposes (dharmarthe), which means “time of distress”, that affects the family. Therefore, it is essential to find out why the property is being sold. It is important to know that Hindu married women born after 1956 have an equal right of inheritance in an ancestral property. Thus while buying such a land it is substantially necessary to check how much each of the members is receiving as their share in the ancestral property. Also further, it is wise and safe enough to obtain No-objection certificate (N.O.C) from all the parties concerned or a copy of resolution passed amongst all the members of Hindu undivided family.

In case of the land held by karta of a Hindu undivided family (HUF), the karta has all the powers to manage the family and its assets, being the head of the family. However, karta is not an absolute, independent, individual owner of the property. Each coparcener has a share, right, title and interest in the ancestral property. Thus it is essential for a buyer to know the individual share of each coparcener before buying such a land if their share is not mentioned in the VII-XII extract. Additionally, it is of utmost importance for a buyer with his diligence to find out whether the property or a land he is buying is ancestral (inherited) or self-acquired. In case of ancestral property, the karta’s identity and the reason for sale has to be enquired and getting in writing from the karta that he holds the consent of all the other coparceners of the family. Many times, coparceners may have received their share of the property but it is possible that they may not be satisfied with their share thus it is again essential to find out from such coparceners whether they are satisfied with their share or not. The eldest male member in three generations Great grandfather, grandfather, father and son – are called as coparceners. They have a definitive right to the ancestral property from the time of conception. After 2005, sons and daughter are also equal coparceners.

- खाजगी वन जमीन नौंद – ENTRY OF PRIVATE FOREST LAND IN OTHER RIGHTS COLUMN: Private forest land is transferable if the word (खाजगी) private is mentioned. Lands covered under sea bed, creeks below high water mark, rivers, nalla’s, lakes, tanks etc. are government lands, if private ownership is not reflected and hence not transferable without permission.

- संरक्षित कुळ महणून इतर हक्क सदरी नौंद – ENTRY OF PROTECTED TENANT IN OTHER RIGHTS COLUMN: A person is a protected tenant, if he is a tenant on some notified dates declared by the government under the law. This step is taken to protect tenant from eviction by landlord. Section 4-A of the Bombay tenancy and agricultural lands act says that, a person lawfully cultivating any land belonging to another person shall deemed to be tenant if such land is not cultivated personally by the owner and if such person is not –

- A. member of the owners family, or B. a servant on wages payable in cash or kind but not in crop share or a hired labourers cultivating the land under the supervision of the owner or any member of the owner’s family, or C. a mortgagee in possession.

Thus necessary permission before sale of such land has to be obtained from the collector or state government as the case may be.

- शासनाचा / बँकाचा / गहाण नौंद – ENTRY OF GOVERNMENT LIEN, BANK LOAN, MORTGAGE IN OTHER RIGHTS COLUMN: Details of the Government lien, bank loan or land under mortgage is mentioned here. All such liabilities must be fulfilled or permission must be obtained by the government authorities or banks by the seller before such land is transferred or sold.

- वहीवतदार देवस्थान ईनाम नौंद – ENTRY OF VAHIVATDAR DEVASTHAN (TEMPLE) INAAM (AWARDS-GIFT) IN OTHER RIGHTS COLUMN: The lands awarded by the state government to religious trusts, temples or to a person for his distinguished services, for their use and occupation are Inami / vatan lands which cannot be transferred by such person or body holding inami / vatan rights without permission of the government. However this category is no more operative as the inami / vatan rights are abolished by law.

There are about two types of devasthan’s (I) Government Devasthan (entries which are recorded in village form. 3 and (II) Private Devasthan (These entries are not recorded in village form.3)

As per the public charity act, the punch committee is appointed on temple / darga. But on the record of VII-XII, only the name of god is recorded. It is not permitted to record the names of the punch committee on the extract. Land alienated register shows which lands in a village are owned by devasthan. Register is available at all tahsils, collector’s office and in the land alienation office.

It is not admissible to transfer or sale of the devasthan lands. However, under exceptional circumstances the land can be transferred with the pre-permission of government and approval of charity commissioner. Tenancy act may be applied to devasthan land but, if the devasthan trust had taken concession as per provision of section 88 , then for such tenant demand for purchase cannot be made under section 32-G of tenancy act. The name of God / Devasthan is usually shown under the occupant column and the name of vice-regent (Vahivatdar) is shown in the other rights column with an underline mark. Name of Pujari, Mahant, Mathadhipat, Trustee, Mutavali and Kazi entered in the other rights column are not considered to be the tenants nor can they file case of adverse possession in civil court. The hereditary rules are applicable to devasthan land but it could not be distributed in heirs nor could it be transferred from one family to another family.

- कोर्ट / लवाद / दावा असलेलली नौंद – ENTRY OF COURT AND ARBITRATION PROCEEDINGS IN OTHER RIGHTS COLUMN: Details of charges of attachment and decrees under the order of civil court or revenue authorities and arbitration proceedings (Pending proceedings- Lis- pendency) is mentioned underneath the other rights column in some extracts. Such land should however be avoided to be purchased before disposal of proceedings and if the transaction is done it would be void.

- कर्ज / तगाई न भऱलेमुळे सरकार जमा / अकारपड नौंद – ENTRY OF SEIZED BY GOVERNMENT DUE TO NON PAYMENT OF LOAN / TAGAYI IN OTHER RIGHTS COLUMN: Tagayi refers to any loan granted by government and recoverable by a talathi under any law for the time being in force. Such kind of entry in 7-12 extract must be considered before buying or purchasing the land. All loans and tayagi must be prepaid by the seller or as understood between the parties to the contract before the transaction is completed.

- पीक पाणी सदरी गवत नौंद / खराबा नौंद / पड जमी / घरपड नौंद – ENTRY OF NON- CULTIVABLE AND WASTE LAND IN OTHER RIGHTS OR FORM 12 (REGISTER OF CROPS): Such land is however not advised to be purchased due to its unproductivity and hence should be avoided although it is transferable.

- सरकारी आऱक्षण / स्थानिक संस्था आऱक्षण / रसता आऱक्षण नौंद – ENTRY OF GOVERNMENT RESERVATION, LOCAL SOCIETY RESERVATION, ROAD RESERVATION ETC IN THE OTHER RIGHTS COLUMN: Entries pertaining to reservation on lands are mentioned in the above form. Before acquiring it is very important to know such reservations and also easement rights on the land if any along with physical inspection of land.

- तुकडा जमीन नौंद – ENTRY OF LAND CLASSIFIED AS “FRAGMENT” – Land Classified As Fragment, should be recorded under section 6 of the Bombay prevention of the fragmentation and consolidation of holdings act, 1947 in other rights column:

Section 7 of the above lays down restrictions on transfer of fragments.

Transfer and lease of fragments – (1) No person shall transfer any fragment in respect of which a notice has been given under sub-section (2) of section 6 except to the owner of a contiguous survey number or recognised sub-division of a survey number. Provided that the holder of such fragment may mortgage or transfer it to the State Government or a land mortgage bank or any other co-operative society as security for any loan advanced to him by the State Government or such bank or society, as the case may be. (2) Notwithstanding anything contained in any law for the time being in force or in any instrument or agreement no such fragment shall be leased to any person other than a person cultivating any land which is contiguous to the fragment.

The above provision must be carefully noted before transferring any fragment land as defined and classified under the act.

- वारस नौंद – ENTRY OF RIGHT ACQUIRED BY HEIRSHIP IN OTHER RIGHTS COLUMN: If right is acquired by heir ship, the names of all the heirs with whom land is not in actual possession is mentioned under this entry. This entry is mentioned from the register of heir ship cases and issued under village for – VI C.

- महाराष्ट्र कृषी जमिनी (होल्डिंग मर्यादा) 1961 नौंद – ENTRY UNDER MAHARASHTRA AGRICULTURAL LAND (CEILING ON HOLDINGS) ACT 1961: Any person or family cannot hold land in excess of ceiling area fixed on 26th Person or family cannot transfer surplus land until the land in excess of the ceiling area is determined under the act.(Section- 8) A person possessing land in excess of ceiling area cannot acquire land by transfer. (Section-9)The land held by individual or the family of the Maharashtra State or the part of India is to be taken into consideration while calculating the ceiling area.

For fixing ceiling areas lands have been classified in five classes as detailed below:

| CLASS OF LAND | CEILING AREA | |

| HECTARES | ACRES | |

| LAND WITH ASSURED SUPPLY OF WATER FOR IRRIGATION AND CAPABLE OF YIELDING AT LEAST TWO CROPS IN A YEAR | 7-28-43 | 18 |

| LAND WHICH HAS ASSURED SUPPLY OF WATER FOR ONLY ONE CROP. | 10-92-65 | 27 |

| LAND WHICH HAS UN-ASSURED SUPPLY OF WATER FOR ONLY ONE CROP. | 14-56-86 | 36 |

| DRY LAND SITUATED IN MUMBAI SUB URBAN DISTRICT AND DISTRICTS OF THANA, RAIGAD, RATANAGIRI, SINDHDURG, BHANDARA, GADCHIROLI, SIRONCHA TALUKAS OF CHANDRAPUR DISTRICT WHICH IS UNDER PADDY CULTIVATION FOR CONTINUOUS PERIOD OF THREE YEARS. | 14-56-86 | 36 |

| DRY CROP LANDS OTHER THAN ALL ABOVE LANDS. | 21-85-29 | 54 |

- नवीन शर्त नौंद – ENTRY OF NAVIN SHARTH IN 7/12 EXTRACT: NAVIN SHARTH Land means ‘Bhogwata (Occupancy class-2) “Juniya Sharti Nusar (As per old conditions) is written I.e. old restrictions which have to be complied to possess or transfer a land. Now the old restrictions are changed and new restrictions are implemented in place so it is “navin shart”(New Conditions), as per the new restrictions to convert the land, you need to pay to the government appropriate tax and obtain permission before the transfer of land.

- खालसा नौंद – ENTRY OF KHALSA LAND IN OTHER RIGHTS COLUMN: The lands of which inami / vatan rights are abolished are known as khalsa lands, even though in private possession. Such holder cannot sale khalsa lands without prior permission of government. The state government can permit sale only after recovering appropriate (Nazarana) from the seller as determined by the collector and not otherwise. It is essential for the purchaser that where the charge of government is mentioned as khalsa in 7/12 extract, he should verify and confirm that the permission of sale and transfer is obtained from the collector and appropriate value (Nazarana) is paid to government prior to transaction.

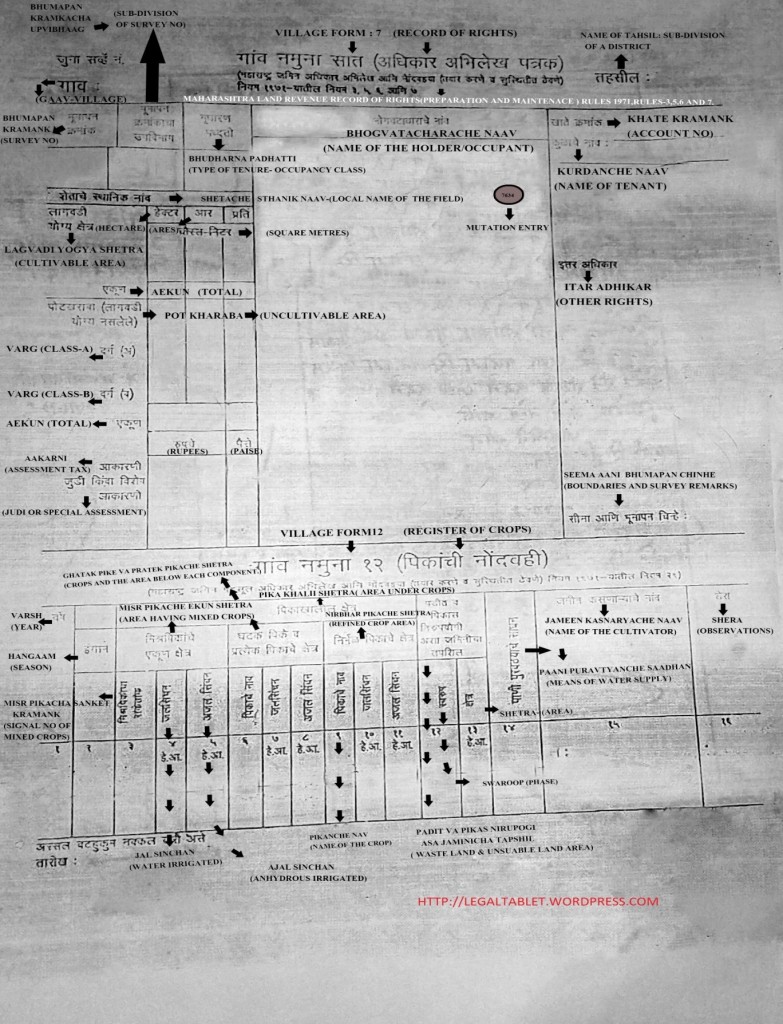

- ANALYSIS OF VILLAGE FORM: 12 (REGISTER OF CROPS)

| MARATHI TERMS FROM THE EXTRACT – XII | ENGLISH CONVERSION OF MARATHI TERM | EXPLANATION (IF ANY) |

| 1. GAAV NAMUNA 12 (PIKANCHI NONDVAHI) | Village Form 12 (Register of crops) | Heading of the lower part of the extract. |

| 2. VARSH | Year | The year in which the crop is or was grown. |

| 3. HANGAAM | Season | The season in which the crop is grown I.E. Whether kharif or Rabi. |

| 4. PIKA KHALIL SHETRA | Area under crops | Total area of land covered by crops is mentioned and subdivided into various categories of crops such as Mishr pike (Mixed crops), Ghatak Pike (Crops and area below each component) and Nirbhar Pike (Refined crops). |

| 5. MISR PIKEACHE EKUN SHETRA | Area covered by mixed crops | Total area of land covered by mixed crops. |

| 6. GHATAK PIKE VA PRATEK PIKANCHE SHETRA | Exclusive crops and area under each crop | Total area of land covered by each exclusive crop. |

| 7. NIRBHAR PIKANCHE SHETRA | Area of Nirbhar crops (Refined Crops) |

Total area of land covered by refined crops8. PADIT VA PIKAS NIRUPYOGI ASA JAMINICHA TAPSHILInformation of unusable Land.

Total area of land waste land and unusable for crop cultivation.9. PAANI PURAVTYACHE SAADHANMeans of water supply.

Instrument for water supply10. JAMIN KASNYARACHE NAAVName of the cultivator.

Name of the cultivator other than farmer if any is mentioned here.11. SHERARemarks, comments or observationsAny other remarks or a particular character of a land is mentioned here.12. JAL SINCHANWater irrigatedWhether a land is water irrigated or rain fed is mentioned beneath this column.13. AJAL SINCHANAnhydrous irrigatedWhether a particular piece of land is cultivated with the help of a substance if it contains no water, for example, salts lacking their water of crystallisation.14. PIKACHE NAAVName of the crop.Names of the crop cultivated.

WHO PREPARES

The 7/12 booklet is been maintained by the talathi at a village level, signed by the tahsildar on each page along with a round seal of tahsildar’s office on each page of the booklet.

GOVERNING LAW

Section 148-159, of Maharashtra Land Revenue Code 1966 lays down the provisions for maintaining the Record of Rights in every village. The extract is also governed by the rules made under (Maharashtra Land Revenue Record of rights and Registers (Preparation and maintenance) Rules 1971, rules – 3, 5,6,7,9 and 29.

HOW TO OBTAIN 7-12 Extract

Any person willing or desiring to obtain the said extract shall make an application to talathi under section-7 of Maharashtra (Inspection, Search and supply of copies of Land Records) Rules, 1970, stating the particulars of the land records and purpose for which the copy is sought for.

On the receipt of application under the above sub- rule, the talathi in charge of the record may grant the request, unless it is rejected under below sub-rule.

If the officer in charge of the record (not being talathi) considers that the record of which a copy is applied for, is of a confidential nature, or that the supply of the copy would be prejudicial to the public interest, he may record an order rejecting the application. Where talathi is in – charge of such record, he shall refer the application for the order of tahsildar.

Cement your knowledge on Real Estate laws by taking this course which is created by iPleaders in association with National University of Juridical Sciences (NUJS), Kolkata which is regularly ranked as one of India’s top three law schools.

LawSikho has created a telegram group for exchanging legal knowledge, referrals and various opportunities. You can click on this link and join:

https://t.me/joinchat/J_

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Allow notifications

Allow notifications

Nice .useful article. However when one farmer buys an agricultural land from another farmer without within the permissible limits in Maharashtra rural area his name is included in 7/12 extract of the original owner . How to get separate 7/12 since farmer who purchase the land has to produce his 7/12 showing his ownership of particular land purchased while availing loan and other official reasons . What is the provision in law ?

Kindly guide

Thanks

Kamalakar Sawant

certainly helpful but i wan also to inform how to calculate total area of land from this extract which shows some guntas as cultivable land and some area as potkarba hene what sud he treated as total area

Very detailed article. Thank you very much. I have a question about the ‘order of the names listed as joint owners in a piece of land’. I observed that in the first 7/12 the order was different and the recent one that I received a week or so earlier, the order was changed. Does this mean anything? or does it have a consequence?

Thank you

What happens to 7/12 when the land becomes part of Urban Land Controlled by Municipal Corporation? Once CTS is allocated does 7/12 still remain valid?

very lucid and informative thanks

Superb article…………. surely very helpful for all

My dad and my uncle had land in their joint name. After death of my dad I have approached Talathi to replace my mother,sisters and my name in place of my dad. But although our name appears in 7/12 extract area shown against our name in 00 also in 8 A extract against this particular gut number area mentioned in 00.

Please guide.

Plz mail me all details exactly ……….i shall help u

Excellent article. Similar article regarding 8A extract will be useful. If there is mismatch in 7/12 extracts and 8A extract, What are possibilities and how to get it rectified?

Thanks !

thank you…

best information…

i want know about my 8 a utara ….i dont understanding what is in 8 a utara .

i have 8 a utara …but dont meaning understand ..plz help me

8007770255

I have purchase agricultural land 39 R outoff 78 R. Said village Talathi send the respective Mutation Extract to circle. The said Circle is rejected the Mutation Extract. What is the next procedure for this matter???

I want to know difference between 3/2 and 4/2 of 7/12. We have agricultural land at Maharashtra. Please reply me at my e-mail id.

I shall be thankful to you. and also explain word ‘boja’

Nicely articulated.

Suggestion if possible take different scenarios of 7/12 extract image and provide explanation.

Ie ( article said about inami land , adivashi land. If you can take those 7/12 extract and showcase it will be more helpful.

Regards

Rahul

i have my ancestral`s lands 7/12 extract but no other document to prove..how can i prove my lands validity ?

Dear,

You have to approach to concern village / city talathi office and obtain the copies of concern property from him with all mutation entries. and from that recoed you can prove your aim.

We have a ancestral house and a plot in gaothan area in a village in maharashtra. When asked for 7/12 extract, the Sarpanch told us that for this house n plot, there is no 7/12 since it is in village gaothan, instead, he can issue a 8a extract. Is is true and OK ?

Kindly advise pl.

Dear,

please approach to village talathi office. Talathi is the person who can issue you the revenue document. Sarpanch and gramsevak are functionary for the concern village purpose only.

Very well written. Thank you!