In this blog post, Abhiraj Thakur, a 1st-year student of NALSAR university of Law writes about the unfair practice of dumping and how does the Indian state deal with it.

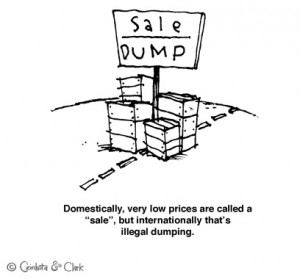

If we take out some time from your busy social lives and pick up a toy with which our young ones play, we will find “Made in China” written on it, not a thing of surprise we all are familiar with this but you’ll get surprised to see the price of the toy, it will be damn cheap. This is just one example we every year get numerous products from different countries at very cheap rates, we might think of it as profitable imports for our country but in fact it is ‘dumping’ of its product by another country on our land.

What is Dumping?

WTO defines dumping as “a firm is said to dump if it sells its product in another country at a price less than the normal value. It does not matter whether a foreign firm sells at a higher or lower price than the domestic ones; as long as the price charged in the domestic country is below that in its own country, the firm can be held dumping.”[1] The Ministry of Commerce and Industry responsible for free and fair trade in India considers dumping to occur ‘When the export price of the goods imported in India is less than the normal value of the like articles sold in the domestic market.’[2]

WTO defines dumping as “a firm is said to dump if it sells its product in another country at a price less than the normal value. It does not matter whether a foreign firm sells at a higher or lower price than the domestic ones; as long as the price charged in the domestic country is below that in its own country, the firm can be held dumping.”[1] The Ministry of Commerce and Industry responsible for free and fair trade in India considers dumping to occur ‘When the export price of the goods imported in India is less than the normal value of the like articles sold in the domestic market.’[2]

Normal Value of a good is the price comparable at which a good is sold in the domestic market of the exporting country or territory. In the above given example, it would be the price of the toy in the Chinese domestic market. The difference between the two prices is called Margin of Dumping. Today, dumping is universally considered an unfair business practice as goods of the same quality ought to be sold at the same price everywhere, exception to legal practices like import tariff and local taxes that may cause variation in the price of the product.

Existing Legal Framework

The current set of laws in India that deal with curbing the practice of dumping are derived from :

International laws: such as Article 6 of GATT (General Agreement on Tariffs and Trade), It lays down certain principles to be followed by member countries for imposition of reliefs such as anti-dumping duties and certain other safeguards.

International laws: such as Article 6 of GATT (General Agreement on Tariffs and Trade), It lays down certain principles to be followed by member countries for imposition of reliefs such as anti-dumping duties and certain other safeguards.

Local laws: Such as Section 9A and 9B of Customs and Tariffs Act, 1975 (Amended 1995) and The Anti-dumping rules such as (Identification, Assessment and Collection of Anti-dumping Duty on Dumped Articles and for Determination of Injury) Rules of 1995, Section 9A of customs and tariffs Act 1975 states:

If any article is exported from any country or territory to India at less than its Normal Value, then, upon the importation of such article into India, the Central Government may by notification in the Official Gazette, impose an anti-dumping duty not exceeding the margin of dumping in relation to such article.[3]

Policy Recommendations: Recommendations by Designated Authority, Ministry of Commerce and Industry, Government of India. Investigative recommendations by Ministry of Finance. Both the ministries have in past recommended changes in Anti-dumping laws such as the 1993 recommendation was incorporated in 1975 act by an amendment.

Who can complain of dumping?

Anti-dumping measures are used in most countries by the state to protect its domestic players in the market. So in India as well a dumping investigation can be initiated on a complaint by a “Domestic Industry.”

Ministry of Commerce and Industry defines Domestic Industry as, Producers of Like Articles as a whole or those producers whose cumulative output constitutes a major chunk of total Indian production.[4] The complaint has to be in the form of written Application by or on behalf of Domestic Industry.

Implementation of Law

For a domestic player to get relief under the current Anti-dumping laws, it must show material injury caused by dumping. The material injury cannot be based on future threats or conjectures. Material injury can be established by when the following gets established :

Step 1 Volume Effect: The authorities examine the increase in the import of dumped materials either in absolute terms or in relation to production or consumption in India and its effect on the domestic players. If the volume is high in either terms than the next step is reached.

Step 2 Price Effect: The vast inflow of material goods in the market leads to decrease in the prices of overall goods (By the law of demand and supply) and further thwart the domestic players from making profits. Once this is established the final stage is of establishing a causal link.

Step 3 Casual Link: A causal link must be there between the material injury suffered and the dumped goods. This step also takes into regard other factors such as general productivity of the domestic player, if the general productivity is itself low then the causal link cannot be said to exist.

When all the three conditions are met, it is ascertained that the domestic industry has faced material injury on account of dumping and is accordingly provided relief.

Reliefs Available

Imposition of Anti-dumping Duties: Anti-dumping duties are the most common form of remedy provided against dumping. These duties are imposed in non-cooperative exporters and are usually at very high rates as being a form of penalty.

Lesser Duty under GATT provisions: By GATT, members cannot impose higher duties than the margin of dumping, some most of the nations impose duties proportion to the injury suffered. The rate is determined at which is adequate to mitigate or remove the injury to the domestic industry.

Lesser Duty under GATT provisions: By GATT, members cannot impose higher duties than the margin of dumping, some most of the nations impose duties proportion to the injury suffered. The rate is determined at which is adequate to mitigate or remove the injury to the domestic industry.

Injury Margin: Injury margin is the difference between the fair selling price due to the domestic industry and landed cost of the product accused of being dumped. Governments can adopt different courses of relief going by the magnitude of injury margin.

De Minimis Margins: These margins are adopted keeping in regard the notions of fair competition and providing adequate opportunities to world players to tap the domestic market keeping aligned with the ethos of globalisation. Under the principle any exporter accused of dumping, if the margin of dumping is less than 2% of the export price of the product in question is immune from Anti-dumping laws even if all the three steps are satisfied.

Further the investigations carried out under the current laws are restricted to those countries whose dumped imports are more than 3% of the total imports of the country. China in most of the cases takes advantage of this principle to defend itself against the accusations of dumping.

Get Undertakings from exporter: If dumping is proved, then government of India among the available measures can ask the exporter concerned to revise the prices to remove dumping. If the exporter agrees to it then under the GATT provisions the investigations against that country need to be suspended.

Why is Anti-dumping Laws Important?

Anti-dumping measures have assumed much more importance today than any time in the past, with the advent of globalisation and Liberalization Foreign trade has been growing exponentially. Every day new players are entering new markets of the world it thus becomes necessary for every nation to protect its domestic players from unfair practices. A majority of the countries today make effective use of Anti-dumping measures. Dumping is a menace to the domestic market and to the economy as a whole for any country. Some of the grave consequences if dumping goes on unchecked are :

Anti-dumping measures have assumed much more importance today than any time in the past, with the advent of globalisation and Liberalization Foreign trade has been growing exponentially. Every day new players are entering new markets of the world it thus becomes necessary for every nation to protect its domestic players from unfair practices. A majority of the countries today make effective use of Anti-dumping measures. Dumping is a menace to the domestic market and to the economy as a whole for any country. Some of the grave consequences if dumping goes on unchecked are :

- Decline in the output of domestic players due to losses faced by the arrival of cheap products in the market. Another consequence being a decline in productivity.

- Loss of Market Share for indigenous Products, which in turn hampers the secondary sector of the economy. Our country suffers worse from this sort of dumping.

- Increasingly reduced returns on investments due to losses in the market.

- Reduced wages for the workers on account of decrease in the overall prices of the goods (Price effect comes into play)

- Adverse effects on cash flow are also observed due to dumping. Further due to the losses faced by domestic producers a market’s ability to raise capital gets severely hampered. In toto, we can say the citizens loose the incentive to enter the market which is detrimental to any economy.

No country in the world today is self-sufficient; in fact, each is dependent on other directly or indirectly. At the same time, it is important to have free and fair trade to ensure equal conditions and opportunities for all countries to prosper. Dumping is one such practice that hampers this prospect. India though has laws in this regard but they are far from being perfect, implementation glitches combined with the laxative approach of government often leads to rampant dumping in few areas of the economy, it needs to curbed as soon as possible or else our cliché of emerging superpower will forever remain such.

[divider]

[1] https://www.wto.org/english/tratop_e/adp_e/adp_info_e.htm

[2] http://commerce.nic.in/traderemedies/ad_casesinindia.asp?id=2

[3] Article 9A Customs and Tariffs Act, 1975.

[4] Supra Note 2

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Allow notifications

Allow notifications