In this blog post, Supallab Chakravorty, who is currently pursuing a Diploma in Entrepreneurship Administration and Business Laws from NUJS, Kolkata, analyzes foreign direct investment in retail trade.

Introduction

With the rampant opening of the market to foreign investors the objective of the FDI policy of maximum governance and minimum government[1] is becoming more and more evident from the actions of the policy makers. The policy has been changed for the year 2016 substantially, and markets have been opened up more than ever before. What has caught the maximum attention among all sectors are the single brand and multi-brand retail sector. Till date, there was a disparity between the demands of the big brand multi-brand retail stores and the opening of the market provided by the policy.

Since India is a signatory to WTO’s General Agreement on Trade in Services, it is under the obligation to open up the retail trade sector (inclusive of wholesale and retailing services) to foreign investment. Initially, the policy structure displayed reservations towards opening up of the retail sector under the fear psychosis of job losses, preferring of the international market over local market, local markets losing competition and loss of local entrepreneurial opportunities. However, the government over a period of time and after a series of policies has finally cleared up the entry to the retail sector.

What is Retail?

The noscitur socii interpretation of the term retail is the simple i.e. sale of goods or commodities in small quantities directly to consumers. The Hon’ble Delhi High Court has also adopted the same definition of the term as connoted to it in common parlance.[2] Retailing is the intermediary interface between producer/wholesaler and final consumer buying for personal consumption.

Why is Retail a lucrative sector for FDI?

India being one of the least competitive and one of the globally saturated economies is an attractive hub for foreign investment.[3] The phase that India is going through in light of increased urbanisation and a consumerism boom provides huge scope for retail expansion.

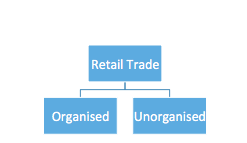

Although the majority of the retail trade in India is managed and controlled by the unorganised sector as much as 97 percent of the business yet the data shows a potential scope for the market to expand and create room for the potential organised sector. The steady and steep growth in the small segment of organised retail sector amongst the whole retail trade sector (consisting of majorly the unorganised sector) is admirable. The data revealed shows a very potential and untapped sector. From USD 290 billion in 2010[4] , USD 395.96 billion in 2011, to a projected growth of USD 200 billion by 2020)[5] In 2012-2016 organised retail is expected to grow at 24 percent or three times the pace of traditional retail (which is expected to expand at 8 percent).[6] Thus the driving force of investment has shifted to investments based on the market of the country investment.

Types of Retail Sectors

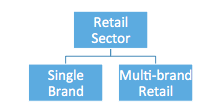

There are two types of retails sectors enlisted in the FDI policy based on the brands that the retailers are selling.

Naturally, the question will come to the picture that what is a brand? Brands could be either differentiated based on a number of products (one and multiple products) or could be differentiated based on manufacturer brands and own-label brands. However, the policy appears to not encourage own-label products and appear to be tilted heavily towards the foreign manufacturer brands. [7]

Single Brand and Multi Brand

The definition of the term of the single brand has not been provided, in common parlance, it simply connotes that the foreign companies would be allowed to sell goods under one particular brand name. It implies that in one particular retail store the investor entity can sell only one brand. However, there is a slight ambiguity in giving a concrete interpretation to the term ‘single brand’ i.e. The FDI policy fails to clearly provide any clarity as to whether retailing of goods with sub-brands. Therefore if a number of sub-bunched brands are being sold under a major parent brand whether the same will be still considered as single-brand and which caps to apply. Similar is the situation for co-branded goods inclusive of goods branded by the manufacturers whether that would qualify as a single brand.

Just like single brand the term multi-brand has not yet been defined. A common meaning if denoted to multi-brand retail it would mean selling of multiple brands under one roof. Department of Industrial Policy and Promotion (DIPP), under the Ministry of Commerce on July 2010, circulated a discussion paper[8] on allowing FDI in multi-brand retail. The paper deliberately does not attempt to set any upper limit on FDI in multi-brand retail otherwise, if a cap is implemented, it will open the economy for huge global retail giants to enter and establish their footprints and kill the competition for unorganised retailers.

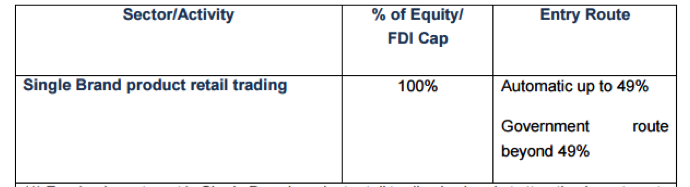

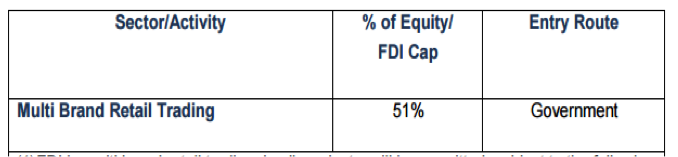

Present Caps

Why FDI in Retail Sector should be allowed?

FDI is a determining factor in the competition running in the retail industry. The prevailing scenario of low competition and bad productivity has called for an opening of the market for foreign investment.

- The main objective of opening the market is to the expenditure of the money spent on goods overseas to be made available in India thereby saving a bulk of flow of foreign currency.

- Pooling in of requests by big brand retailers to enter the Indian market is one more reasons. FDI in single-brand retailing was permitted in 2006, up to 51 percent of ownership. Between then and May 2010, a total of 94 proposals has been received. Of these, 57 proposals have been approved. An FDI inflow of US$196.46 million under the category of single brand retailing was received between April 2006 and September 2010, comprising 0.16 percent of the total FDI inflows during the period.[9]

- Full opening up of the single brand retail sector is for dual benefit of the foreign retailer and the Indian partner. While foreign investors get access to a huge consumer oriented market in India, the Indian entities get an exposure of globally acclaimed management practices (for example Wal-Mart store management technique) , renowned designs and the know-how in terms of technology.

- A partial opening of the sectors was a relief to the government from the pressure of partners in bilateral/ multilateral treaties and clearly displayed India’s intentions in liberalising this sector in a phased manner.[10]

- It will enhance the quality standards and consumer expectations, by pulling up the quality standards and cost-competitiveness among Indian.

- The Indian Council for Research on International Economic Relations (ICRIER), a think tank inquiring into the foreign direct investment in the retail sector, has calculated the worth of the local retail sector to reach $496 billion by 2011-12 and ICRIER has also come to conclusion that investments by large corporates and FDI in the retail sector would in the long run not harm interests of small, traditional, retailers.[11] It will not only result in the substantial growth of the country’s GDP and a subsequent economic development but wouldinter alia also help in integrating the Indian retail market with that of the global retail market in addition to providing not just employment but a better-paying employment than the unorganised sector.

- Industrial and trade unions and commissions like CII, US-India Business Council (USIBC), FICCI, the American Chamber of Commerce in India, The Retail Association of India (RAI) and Shopping Centres’ Association of India all have favoured the making a liberalised FDI policy for retailing sector, and most of them agree with considering a cap of 49-51 percent to start with.

- The international retail players such as Walmart, Carrefour, Metro, IKEA, and TESCO share the same view and insist on a clear path towards 100 per cent opening up in the near future.[12]

Prerequisites before opening up of FDI for retail market

FDI in multi-brand retailing effects large number of country’s population hence must be dealt vigilantly because of its direct impact. Left alone foreign capital will only seek ways through which it can expand its capital for profit, given our unstable socio-economic conditions, may result in the widening of the gap between the rich and the poor. Thus foreign capital must be regulated into multi-brand retailing in such a way that it results in a win-win situation for India. This can be done by integrating into the rules and regulations for FDI in multi-brand retailing certain inbuilt safety norms. For example FDI in multi –brand retailing can be allowed with social safeguards and in a calibrated manner so that the effect of possible labour dislocation can be analysed.

The FDI policy needs to be fixed in such a way that a percent of it should be spent for building up of back-end infrastructure, logistics or agro-processing units to ensure that the foreign investors make a genuine contribution to the development of infrastructure and logistics. To actualize this goal, it can be stipulated that at least 50% of the jobs in the retail outlet should be reserved for rural youth and that a certain amount of farm produce be procured from the poor farmers. Similarly to develop our small and medium enterprise (SME), it can also be stipulated that a minimum percentage of manufactured products be sourced from the SME sector in India. Public Distribution System (PDS) is still in many ways the lifeline of the people living below the poverty line. To ensure that the system is not weakened the government may reserve the right to procure a certain amount of food grains for replenishing the buffer. To protect the interest of small retailers, the government may also put in place an exclusive regulatory framework. It will avoid the retailing giants to resort the predatory pricing or acquire monopolistic dominance. Besides, the government and RBI need to evolve suitable policies to enable the retailers in the unorganised sector to expand and improve their efficiencies. If Government is allowing FDI, it must do it in a cautious and fully synchronised manner because it is politically sensitive and link it with up some caveat from creating some back-end infrastructure.

The FDI policy needs to be fixed in such a way that a percent of it should be spent for building up of back-end infrastructure, logistics or agro-processing units to ensure that the foreign investors make a genuine contribution to the development of infrastructure and logistics. To actualize this goal, it can be stipulated that at least 50% of the jobs in the retail outlet should be reserved for rural youth and that a certain amount of farm produce be procured from the poor farmers. Similarly to develop our small and medium enterprise (SME), it can also be stipulated that a minimum percentage of manufactured products be sourced from the SME sector in India. Public Distribution System (PDS) is still in many ways the lifeline of the people living below the poverty line. To ensure that the system is not weakened the government may reserve the right to procure a certain amount of food grains for replenishing the buffer. To protect the interest of small retailers, the government may also put in place an exclusive regulatory framework. It will avoid the retailing giants to resort the predatory pricing or acquire monopolistic dominance. Besides, the government and RBI need to evolve suitable policies to enable the retailers in the unorganised sector to expand and improve their efficiencies. If Government is allowing FDI, it must do it in a cautious and fully synchronised manner because it is politically sensitive and link it with up some caveat from creating some back-end infrastructure.

Recommendations before further opening of the sector

Various recommendations have been proposed to the government before allowing 100% FDI in the retail sectors both multi-brand and single, they are as follows[13]:-

- Preparing the competition regime (both legal and regulatory) in such a manner that large retailers do not oust small retailers by unfair trade practices and a suitable enforcement mechanism to be devised to help the same.

- Providing institutional credit, at minimal rates, to keep up the efficiency of small retailers; at the same time actively conducting programmes for helping small retailers to upgrade themselves.

- Enactment of a sanctioning act to regulate the entire monetary and social aspects of the entire retail sector.

- The framing of a central legislation to regulate the whole FDI of Retail Sector.

Recent Development

As per the present FDI policy regime provides a way for huge retailers like Walmart and IKEA to sell multi-brand food products only if they are sourced and manufactured in India. Such entities must seek assent from the Foreign Investment Promotion Board (FIPB) i.e. under the permitted sector. This far-reaching reform will benefit farmers, give impetus to domestic food processing industry and create vast employment opportunities at the same time giving a more open window to multi-brand retailers.

Permitting foreign investment in food-based retailing is likely to ensure adequate flow of capital into the country & its productive use, in a manner likely to promote the welfare of all sections of society, particularly farmers and consumers. It would also help bring about improvements in farmer income & agricultural growth and assist in lowering consumer prices inflation.[14]

References:

[1] Clause 1.1.1, FDI Policy Circular, 2015

[2] Association of Traders of Maharashtra v. The Union of India, 2005 (79) DRJ 426

[3] AT Kearney, 2012 Global Retail Development Index, available at http://www.atkearney.com/consumerproducts-retail/global-retail-development-index

[4] Global Retail Report, available at: http://www.researchandmarkets.com/reportinfo.asp?report_ id=1580321&tracker=related.

[5] Federation of Indian Chambers of Commerce and Industry, Retail Sector Profile, available at http:// www.ficci.com/sector/33/Project_docs/Sector-prof

[6] See AT Kearney, The 2006 Global Retail Development Index, available at: www.atkearney.de/content/misc/wrapper.php/ name/file_grdi_2006%5B1%5D_1147072562a95e. pdf

[7] 5.2.15.3, FDI Policy Circular, 2016

[8] Discussion Paper on FDI in Multi Brand Retail Trading, http://dipp.nic.in/DiscussionPapers/DP_FDI_Multi-BrandRetailTrading_06July2010.pdf

1.1 [9] Nabael Mancheri, India’s FDI policies: Paradigm shift, http://www.eastasiaforum.org/2010/12/24/indias-fdi-policies-paradigm-shift/-

[10] Discussion Paper on FDI in Multi Brand Retail Trading, http://dipp.nic.in/DiscussionPapers/DP_FDI_Multi-BrandRetailTrading_06July2010.pdf

[11] ICRIER Annual Report, 2008-09, http://icrier.org/pdf/AnnualReport09.pdf

[12] Nabael Mancheri, India’s FDI policies: Paradigm shift, http://www.eastasiaforum.org/2010/12/24/indias-fdi-policies-paradigm-shift/-

[13] Discussion Paper on FDI in Multi Brand Retail Trading, http://dipp.nic.in/DiscussionPapers/DP_FDI_Multi-BrandRetailTrading_06July2010.pdf

[14] Discussion Paper on FDI in Multi Brand Retail Trading, http://dipp.nic.in/DiscussionPapers/DP_FDI_Multi-BrandRetailTrading_06July2010.pdf

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Allow notifications

Allow notifications