In this blog post, Sunidhi Pubreja, a student of Rajiv Gandhi National University of Law, Patiala lists out the benefits of changing the age old tax regime in India to GST and its impact on the overall growth and development of the Indian economy.

Goods and Service Tax (GST) is a broad based and single comprehensive tax levied on goods and services consumed in an economy. GST is levied at every stage of the production-distribution chain with applicable set-offs in respect of the tax remitted at a previous stage. It is a tax on final consumption. In simple terms, GST may be defined as a tax on goods and services, in which at the time of sale of goods or providing the services, the seller or service provider may claim the input credit of tax which he has paid while purchasing the goods or procuring the service.[1] As VAT can be applied to goods as well as services, it has been termed as Goods and Services Tax. During the last few decades, VAT has become a significant instrument of indirect taxation in more than 130 countries resulting in one-fifth of the world’s tax revenue. It is a tax on goods and services with a continuous chain of set-off advantage. This will be beneficial for the business as it is transparent with a complete chain of set-off, which will result in increased Tax base and better tax payments.

Opportunities

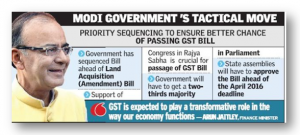

The Goods and Services Tax (GST) aims at simplifying India’s tax structure so as to widen the tax base and create a market that will benefit both corporate and the economy. The implementation of GST would ensure that India provides a tax regime that is almost similar to the rest of the world. Implementation of GST will have following benefits:

- National interest is above all the benefits which anything can provide. The introduction of GST as quoted by Apex Chamber of the Associated Chambers of Commerce and Industry of India (ASSOCHAM) could increase GDP growth rate by 1.4 to 1.7 percent with an annual revenue increase of Rupees 1.2 Lakh Crore at a current level. This will also result in a boost in Tax GDP from 1.5% to 2%.[2]

- There are two kinds of Black money i.e. the one lying outside India and other existing within India. This bill will put an end in the latter category of the black money. In generic terminology, the black money stems from a transaction which has evaded taxes. An example of such black money in the present day is as follows:-

- “When a citizen purchases a brush from a shopkeeper but declines a bill, the shopkeeper tells him that the brush will cost 15% more and he helps the shopkeeper evade taxes and generates the black economy.”[3]The Goods and Service Tax will not support such cash transactions as the shop keeper will lose credit for the taxes paid at the earlier stages of manufacture and distribution if he does not give a bill.

- Poverty reduction has always been the main aim of economic policy making in India. Any policy for poverty reduction must provide at least, food, clothing, shelter, education and health. At present, primary food articles like wheat and rice are liable to tax in many states. However under the GST, all food items covered under the public distribution system are proposed to be exempt from GST i.e. no output tax on the final poor consumer. Similarly, basic health and education services are also intended to be fully exempt. Housing is yet another important need of the poor. The GST provide for including within its scope, the transaction in real estate. Therefore, for a registered real estate builder, all taxes on inputs (including on land) will be set off against the tax payable on the constructed property.[4] This will reduce the cost of housing. At present, there is no mechanism for complete set-off of stamp duty on land and other indirect taxes on inputs. Since food and these services are necessary to meet basic human needs, the tax exemption for these services will enable the poor to have cheaper accessibility.

- A business person will be heavily benefited from the GST regime as it will offer them a uniform and simple taxation regime. Additionally, it will also bring Indian manufacturers an edge over the Chinese manufacturers as the costs of production will be turned down. As per ASSOCHAM, overall cost and thus prices of goods manufactured in India may reduce by 10%.[5]This will bring Indian economy in competition with cheap Chinese markets regarding prices. However, as explained above, the business person will not be able to evade taxes by not providing a bill for the transaction. Hence an illegal source for their tax-free black income will begone.

- The terms of trade can also be expected to improve for agriculture vis-à-vis manufacture goods. The prices of agricultural goods would increase between 0.61 and 1.18% whereas the overall prices of all manufacturing sector would decline between 1.22 and 2.53%. Consequently, the terms of trade will move for agriculture between 1.9 to 3.8%. The increase in agricultural prices would benefit millions of farmers in India. About foods crops, poor would continue to remain safe under PDS. The prices of many other consumer goods like sugar, beverages, wool, textile products, etc. are likely to decline to reduce the burden on the pockets of common masses.

- As the GST provides for a single and low rate of tax, this will significantly reduce evasion of taxes. Therefore, there will be little incentive for producers and distributors to evade turnover. The result will be higher compliance and upsurge in revenue. This will also have an indirect but a positive effect on direct tax revenue.

- The GST envisages a mechanism whereby government at both the levels will cease to have any independent power to make changes in the design and structure once set. Since both levels of government would be similarly placed, this will have no impact on the balance of power.

- The GST will remove the complex system by having a unified code for implementation of State GST in different states. It will not only subsume many indirect taxes but also simplify the classification issues by implementing only one or two rates of tax. It will also solve the problem of tax cascading by input tax credit mechanisms. Under this system, manufacturers, wholesalers and retailers can avail credits for the GST paid on procurement of stock.

- There are a large number of works contracts which involve the supply of goods and services which are available to customers from different suppliers from different parts of India. Such situations arise when there is either gap or overlapping taxation power as service tax cannot be imposed under VAT, and the CENVAT does not have the power to impose a tax on sale within the state. GST is the comprehensive solution in this case.

Conclusion

The introduction of GST will consolidate goods and service taxes for the purpose of set-off relief and lead to increase in revenue through the broadening of the dealer base by including value addition in the distribution chain and increased compliance. In the GST, the limitation of both CENVAT and Service tax are eliminated with set-off, and a continuous chain of set-off from the original producer and service provider to retailer’s level is established which decreases the burden of allcascading effects. Also, with the implementation of GST, burden of Central Sales Tax (CST) will also be eliminated. GST at the state level will be a major improvement in its tax base for future revenue generation as the service sector is growing at much faster pace than manufacturing sector. As per 2011 data on GDP, the service sector contributes about 57% while industrial sector contributes about 28% of GDP of India. This is the true meaning of GST, and this is the reason GST is not simply consolidation VAT and Service tax, but it is an improvement of the previous system of VAT and service tax.

In the end, on the viability of centralized GST, a statement ofSushil Kumar Modi is apt to cite: -“If they can have one currency Euro and common tax regime, then India with 29 States is capable of achieving it.”

Footnotes:

[1] Kishore Kumar Shah, Goods and Services Tax (GST) In India: Challenges and Opportunities, Global Journal of Multidisciplinary Studies, 209 (2014).

[2] ASSOCHAM: Rational GST regime can improve tax revenues by Rs 1.2 lakh crore, available at http://www.commodityonline.com/news/assochamrational-gst-regime-can-improve-tax-revenues-by-rs-12-lakh-crore-41339-3-1.html (19 Dec. 2011).

[3]Gurucharan Das, Answer to black money is to pass GST, available at http://post.jagran.com/answer-to-black-money-is-to- pass-gst-1307886857 (21 Feb 2016).

[4] GST: Impact on the Poor, available at http://www.lawcrux.com/GST%20Impact%20on%20the%20poor.html (21 Feb 2016).

[5] Supra Note 2.

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Allow notifications

Allow notifications