This article is written by Ananya Garg, from Chanakya National Law University, and Bhuvan Malhotra, final year student at Jindal Global Law School. It discusses the legal provisions relating to ‘Gifts’ under Chapter VII of the Transfer of Property Act.

Table of Contents

Introduction

A Gift is generally regarded as a transfer of ownership of a property where the sender willingly brings into effect such transfer without any compensation or consideration in monetary value. It may be in the form of moveable or immoveable property and the parties may be two living persons or the transfer may take place only after the death of the transferor. When the transfer takes place between two living people it is called inter vivos, and when it takes place after the death of the transferor it is known as testamentary. Testamentary transfers do not fall under the scope of Section 5 of the Transfer of Property Act, and thus, only inter vivos transfers are referred to as gifts under this Act.

If the essential elements of the gift are not implemented properly it may become revoked or void by law. There are many provisions pertaining to the gifts. All such provisions, for example, types of property which may be gifted, modes of making such gift, competent transferor, suspension and revocation of gift, etc. are discussed in this article.

What may be referred to as a gift

Gift

Section 122 of Transfer of Property Act defines a gift as the transfer of an existing moveable or immovable property. Such transfers must be made voluntarily and without consideration. The transferor is known as the donor and the transferee is called the donee. The gift must be accepted by the donee. This Section defines a gift as a gratuitous transfer of ownership in some property that is already existing. The definition includes the transfer of both immovable and moveable property.

Mt. Brij Devi v. Shiva Nanda Prasad & Ors (1939) : an analysis

One of the few essentials of a Gift is, that in event of a transfer, there must be a transference of all the rights in the property by the donor to the donee; however, it is also permissible to make conditional gifts. Such a clause is governed by Section 126 of the Act.

To delve into the issue, we must refer to the first important pre-independence judgment of the Allahabad High Court, where the subject matter of dispute is the same as our concern. In the case of Mt. Brij Devi v. Shiva Nanda Prasad & Ors (1939) Brij Devi had claimed possession of a land which had formed the focus of a gift deed executed by her ancestors on 11th December 1914, in favor of one Jain Bulaqi Shankar. The gift deed was executed with some conditions attached to it which read as, “The material terms of the gift-deed are as follows: I have made a gift to Pt. Jain Bulaqi Shankar for construction of the temple of Bhaironji, and residence, and removing my possession from the property gifted, I have put the donee in proprietary possession and he will have the right to construct a temple and a quarter… The donee or his successors will have no right to transfer or mortgage it; if he does, the transfer will be invalid, and I and my successors will have a right to get the gift revoked.” As per the gift deed, Jain Bulaqi did not succeed in building the temple or a residential quarter for his own occupation, but subsequently he made a waqf of the property in favour of one Shiva Nanda Prasad in 1927, which means, he transferred the property which had been gifted to him by the plaintiffs’ ancestor. This action of the done was alleged to be in contravention of the conditions of the gift deed itself. They alleged that in circumstances of property being alienated, by virtue of the revocation clause mentioned in the gift deed, they were entitled to declare the transfer done to the defendant as invalid and further have the right to take back the possession of the land as per the gift deed.

The defendants argued that the transfer made by way of gift deed, was an absolute transfer of the land to Jain Bulaqi, and that that transfer in the gift deed had been subject to a condition absolutely restraining the transferee and his successors from parting with or disposing of his interest in the property which is repugnant to the Transfer of Property Act itself. Section 10 of the Transfer of Property act states that, absolute restraint on the transferee by the transferor is void, that is, the condition restraining the alienation is void while the transfer of the property itself is valid. The defendants’ argument was essentially based on the foundation of Section 10 of TPA, they argued that such a restraint on the land was void and the contract must be allowed as if an unequivocal transfer of the land was made to the donee.

Moreover, because the condition was void, the transfers in favor of Shiva Nanda Prasad were valid and could not be set aside, nor were the plaintiffs entitled to revoke the gift deed. The plaintiffs then took the defense of Section 126 of the Transfer of Property Act and contested that the transfer was not void as per the mentioned section. The section essentially means that the donor and donee can agree upon happening of certain conditions, when the condition is not fulfilled, the gift can be revoked. The plaintiffs argued that the right to revoke the gift was contingent upon the alienation by the donee of the land gifted and not upon the will of the donor.

The plaintiffs supported this claim by citing the case of Makund Prasad v. Rajrup Singh (1907), in which the court held that a gift of property made on the condition that the land would be liable to be taken back in the event of its Alienation, was valid and the power of revocation was not repugnant to the original transfer under Section 10.

The court in this case rightfully upheld the defendants claim and ruled that the gift deed cannot be revoked by the successors of the ancestor who had made the gift deed in favour of Jain Bulaqi as the transfer was uncosniable in the first place as it restricted the donee completely to alienate such property. This was the first major judgment which rightfully upheld the donee’s claim and rightfully interpreted the law relating to sections 10 and 126, however the thing to note in this judgment was the lower appellant court had ruled in favour of the plaintiffs and the high court had overturned the decision which is a usual trend which we see in cases relating to the issue of our paper. Even after such a judgment, we see cases relating to the same issue where the lower and high court’s decision is overturned in the Supreme Court. In the case of Sridhar vs N. Revanna (2000), which is a case of February, 2020, out of the many issues in the suit, the same issue, that is, whether a gift deed can be revoked by virtue of Section 126 if such property is alienated had been raised in the Supreme Court once again for which the court had to adjudicate the matter. In this case one Shri Muniswamappa, great grandfather of the plaintiffs and grandfather of defendant No.1, was the absolute owner of the suit schedule property who executed gift deeds in favour of the defendants with the same condition that the property should not be alienated and if such property was to be alienated, then the gift deed stands invalid. The defendants on the other hand had sold the property which they had received as a gift to which the plaintiffs’ alleged that such a transfer was invalid as the gift deed specifically stated that the mentioned property is not to be alienated and the plaintiffs demanded the property to be transferred to them back.

The High Court in this case too decided that the condition of the gift deed was not fulfilled and thus ruled that the sale made by the donee was invalid and the property is to be returned, but the Supreme court in this too cited the ruling held in the case of Mt. Brij Devi v. Shiva Nanda Prasad & Ors (1939) and overturned the High court’s decision and ruled that the gift deed cannot be revoked as at the very inception of the gift deed, the donee was completely restricted to alienate such property which is prohibited by Transfer of Property Act by virtue of section 10.

For an issue that has been a settled law as per the 1939 judgment of the Allahabad High Court, it is important to analyze what is making the courts interpret such laws in different manners and why are the higher courts being time and again invoked to settle such disputes. Firstly we would look at the way Section 126 is drafted in the Transfer of Property Act and also the placement of such a section would be beneficial for an in-depth analysis. Section 126 reads as: “donor and donee may agree that on the happening of any specified event which does not depend on the will of the donor, a gift shall be suspended or revoked; but a gift which the parties agree shall be revocable wholly or in part, at the mere will of the donor, is void wholly or in part, as the case may be.”

The section as it appears has a highly generic wording and allows the donor to make some condition while gifting it to the donee and if such condition is not fulfilled or abided by, the donor can revoke the gift deed not on the basis of his will but subject to the condition that remained unfulfilled or which has not been abided by. This section is type of a conditional clause as the gifts chapter starts from Section 122 of the Transfer of Property Act. Chapter 2 of the Act is a general chapter which puts some restrictions on the property while the gifts form a part of separate chapter, that is, ‘of Gifts’ in the Act. Moreover if we look at the illustrations present in the section, it appears that the law is silent upon such matters, that is, what if there is a complete restriction on the alienation of the property. The courts while adjudicating the matter look at the placement of these conditional clauses, where the presence of section 126, that is, the conditional clause is already present in the chapter, the courts tend to think that the gifts are to be governed only by the set conditions that have been made in the gift deed. Moreover, the courts also interpret that if such conditional clause is present in the chapter ‘of gifts’ hwere parties can make own conditions in the gift deed, there must be a legislative intent behind this structuring and the chapter ‘of gifts’ must be looked at aloof of other chapters, specifically Section 10 (to which our analysis is limited). The illustrations (Section 126), being silent on such conditions, also add to this mis-interpretation of the court. The first illustration provided in the section is contingent upon the death of B and his descendants but in the first place, the donee is not restricted from alienation of the property.

The second illustration provided also does not talk about the alienation issue rather it clarifies that if an amount of 100 is gifted to someone by the donor and with both the donor and donee’s assent, they agree that Rs 10 can be asked back at any time, this shows that the actual gift was of Rs 90 only as the donee has to return back the Rs 10 to the donor back, that is, that amount of Rs 10 is inalienable. The second illustration is somewhat related to the issue at hand but because it is talking about a movable gift, that is, in cash, the courts tend to think that this may be applicable to only movable gifts as we cannot gift land in such a way. Thus, due to the absence of such clarity in the issue, the court thinks that the act is silent in the issue at hand and they tend to give different rationale and rule that the property which forms center of a gift deed can be revoked if the condition of alienation is not abided by the donee.

This interpretation or perception of the courts is wrong as section 10 of the act is part of the chapter 2, that is, ‘of transfers of property by act of Parties’ which is a general section and must apply to all the chapters of the Act as it defines the ‘action’ of the parties per se which is void in the eyes of law. Needless to mention, Parties of any transaction are an essential element for a transaction to take place, thus a specific chapter has been created by the Act which gives some clarity of what all actions of the parties entering into the transaction are good or bad in law. If there was a legislative intent for a gift to be governed only by the conditions of the gift deed, that is, section 126 of the Transfer of Property Act and section 10 would not apple to such conditions, then such an exception would be specifically mentioned in the section 10 of the Act just like mortgage, which has been specifically excluded in the section 10 of the Act. Thus, reading into the issues where the act appears to be silent as section 126 and section 10 are a part of different chapters is the wrong approach that is often followed by the court which leads to wrong judgments time and again. The same logic of free market that is used to defend the creation of section 10 of the Act can also be extended to this issue as well. The main reason for which such a section, that is, section 10 was created was to not allow accumulation of the property. People in India hold a lot of sentimental value towers the land and property they own and subsequently the ancestors do not want their future generations to alienate such property.

To counter such problem, that is, a property does not start limiting to one family lineage; such a section was created and is still needed as exclusion of such a section would pull us back to the zamindari system as was prevalent in India as few years back. Moreover when a gift deed is revoked the government too is not benefitted from this transfer in terms of taxes. A gift deed in the first place when is executed, it does not attract any tax but there is a change in ownership as there is a change in title of the property and when such a gift deed will be revoked, there will be again a change in the title and ownership which would not attract any tax as the property which was owned by the donor at some time is being handed back to him by way of revocation, thus two transfers of title are made and the taxable amount is none on the property which is something not beneficial for a new democracy to progress. Moreover the legal maxim, “alienation rei praefertur juri accrescendi” meaning that Law favours Alienation instead of Accumulation can be extended to the issue at hand and by way of alienation of the gifted property, even the government could benefit from the amount of taxes that would be charged by way of transfer of such property to a third person.

Parties to a gift transfer

Donor

The donor must be a competent person, i.e., he must have the capacity as well as the right to make the gift. If the donor has the capacity to contract then he is deemed to have the capacity to make the gift. This implies that at the time of making a gift, the donor must be of the age of majority and must have a sound mind. Registered societies, firms, and institutions are referred to as juristic persons, and they are also competent to make gifts. Gift by a minor or insane person is void. Besides capacity, the donor must also have the right to make a gift. The right of the donor is determined by his ownership rights in the property at the time of the transfer because gift means the transfer of the ownership.

Donee

Donee does not need to be competent to contract. He may be any person in existence at the date of making the gift. A gift made to an insane person, or a minor, or even to a child existing in the mother’s womb is valid subject to its lawful acceptance by a competent person on his/her behalf. Juristic persons such as firms, institutions, or companies are deemed as competent donee and gift made to them is valid. However, the donee must be an ascertainable person. The gift made to the general public is void. If ascertainable, the donee may be two or more persons.

Essential elements

There are the following five essentials of a valid gift:

- Transfer of ownership

- Existing property

- Transfer without consideration

- Voluntary transfer with free consent

- Acceptance of the gift

Transfer of ownership

The transferor, i.e., the donor must divest himself of absolute interest in the property and vest it in the transferee, i.e., the donee. Transfer of absolute interests implies the transfer of all the rights and liabilities in respect of the property. To be able to effect such a transfer, the donor must have the right to ownership of the said property. Nothing less than ownership may be transferred by way of gift. However, like other transfers, the gift may also be made subject to certain conditions.

Existing property

The property, which is the subject matter of the gift may be of any kind, movable, immovable, tangible, or intangible, but it must be in existence at the time of making a gift, and it must be transferable within the meaning of Section 5 of the Transfer of Property Act.

Gift of any kind of future property is deemed void. And the gift of spes successionis (expectation of succession) or mere chance of inheriting property or mere right to sue, is also void.

Transfer without consideration

A gift must be gratuitous, i.e., the ownership in the property must be transferred without any consideration. Even a negligible property or a very small sum of money given by the transferee in consideration for the transfer of a very big property would make the transaction either a sale or an exchange. Consideration, for the purpose of this section, shall have the same meaning as given in Section 2(d) of the Indian Contract Act. The consideration is pecuniary in nature, i.e., in monetary terms. Mutual love and affection is not pecuniary consideration and thus, property transferred in consideration of love and affection is a transfer without consideration and hence a gift. A transfer of property made in consideration for the ‘services’ rendered by the donee is a gift. But, a property transferred in consideration of donee undertaking the liability of the donor is not gratuitous, therefore, it is not a gift because liabilities evolve pecuniary obligations.

Voluntary transfer with free consent

The donor must make the gift voluntarily, i.e., in the exercise of his own free will and his consent as is a free consent. Free consent is when the donor has the complete freedom to make the gift without any force, fraud coercion, and undue influence. Donor’s will in executing the deed of the gift must be free and independent. Voluntary act on a donor’s part also means that he/she has executed the gift deed in full knowledge of the circumstances and nature of the transaction. The burden of proving that the gift was made voluntarily with the free consent of the donor lies on the donee.

Acceptance of gift

The donee must accept the gift. Property cannot be given to a person, even in gift, against his/her consent. The donee may refuse the gift as in cases of non-beneficial property or onerous gift. Onerous gifts are such where the burden or liability exceeds the actual market value of the subject matter. Thus, acceptance of the gift is necessary. Such acceptance may be either express or implied. Implied acceptance may be inferred from the conduct of the donee and the surrounding circumstances. When the donee takes possession of the property or of the title deeds, there is acceptance of the gift. Where the property is on lease, acceptance may be inferred upon the acceptance of the right to collect rents. However, when the property is jointly enjoyed by the donor and donee, mere possession cannot be treated as evidence of acceptance. When the gift is not onerous, even minimal evidence is sufficient to prove that the gift has been accepted by donee. Mere silence of the donee is indicative of the acceptance provided it can be established that the donee had knowledge of the gift being made in his favour.

Where the deed of gift categorically stated that the property had been handed over to the donee and he had accepted the same and the document is registered, a presumption arises that the executants are aware of what was stated in the deed and also of its correctness. When such presumption is coupled with the recital in the deed that the donee had been put in possession of the property, the onus of disproving the presumption would be on the donor and not the donee.

Where the donee is incompetent to contract, e.g., minor or insane, the gift must be accepted on his behalf by a competent person. The gift may be accepted by a guardian on behalf of his ward or by a parent on behalf of their child. In such a case, the minor, on attaining majority, may reject the gift.

Where the donee is a juristic person, the gift must be accepted by a competent authority representing such legal person. Where the gift is made to a deity, it may be accepted by its agent, i.e., the priest or manager of the temple.

Section 122 provides that the acceptance must be made during the lifetime of the donor and while he is still capable of giving. The acceptance that comes after the death or incompetence of the donor is no acceptance. If the gift is accepted during the life of the donor but the donor dies before the registration and other formalities, the gift is deemed to have been accepted and the gift is valid.

Modes of making a gift

Section 123 of the Transfer of Property Act deals with the formalities necessary for the completion of a gift. The gift is enforceable by law only when these formalities are observed. This Section lays down two modes for effecting a gift depending upon the nature of the property. For the gift of immovable property, registration is necessary. In case the property is movable, it may be transferred by the delivery of possession. Mode of transfer of various types of properties are discussed below:

Immovable properties

In the case of immovable property, registration of the transfer is necessary irrespective of the value of the property. Registration of a document including gift-deed implies that the transaction is in writing, signed by the executant (donor), attested by two competent persons and duly stamped before the registration formalities are officially completed. In the case of Gomtibai v. Mattulal, it was held by the Supreme Court that in the absence of written instrument executed by the donor, attestation by two witnesses, registration of the instrument and acceptance thereof by the donee, the gift of immovable property is incomplete.

The doctrine of part performance is not applicable to gifts, therefore all the conditions must be complied with. A donee who takes possession of the land under unregistered gift-deed cannot defend his possession on being evicted. The following must be kept in mind regarding the requirement of registration:

- Registration of the gift of immovable property is must, however, the gift is not suspended till registration. A gift may be registered and made enforceable by law even after the death of the donor, provided that the essential elements of the gift are all present.

- In case the essential elements of a valid gift are not present, the registration shall not validate the gift.

It has been observed by the courts that under the provisions of the Transfer of Property Act, Section 123, there is no requirement for delivery of possession in case of an immovable gift. The same has been held in the case of Renikuntla Rajamma v. K. Sarwanamma that the mere fact that the donor retained the right to use the property during her lifetime did not affect the transfer of ownership of the property from herself to the donee as the gift was registered and accepted by the donee.

Movable properties

In the case of movable properties, it may be completed by the delivery of possession. Registration in such cases is optional. The gift of a movable property effected by delivery of possession is valid, irrespective of the valuation of the property. The mode of delivering the property depends upon the nature of the property. The only things necessary are the transfer of the title and possession in favour of the donee. Anything which the parties agree to consider as delivery may be done to deliver the goods or which has the effect of putting the property in the possession of the transferee may be considered as a delivery.

Actionable claims

Actionable claims are defined under Section 3 of the Transfer of Property Act. It may be unsecured money debts or right to claim movables not in possession of the claimant. Actionable claims are beneficial interests in movable. They are thus intangible movable properties. Transfer of actionable claims comes under the purview of Section 130 of the Act. Actionable claims may be transferred as gift by an instrument in writing signed by the transferor or his duly authorised agent. Registration and delivery of possession are not necessary.

A gift of future property

Gift of future property is merely a promise which is unenforceable by law. Thus, Section 124 of the Transfer of Property Act renders the gift of future property void. If a gift is made which consists of both present as well as future property, i.e., one of the properties is in existence at the time of making the gift and the other is not, the whole gift is not considered void. Only the part relating to the future property is considered void. Gift of future income of a property before it had accrued would also be void under Section 124.

A gift made to more than one donee

Section 125 of the Act says that in case a property is gifted to more than one donee, one of whom does not accept it, the gift, to the extent of the interest which he would have taken becomes void. Such interest reverts to the transferor and does not go to the other donee.

A gift made to two donees jointly with the right of survivorship is valid, and upon the death of one, the surviving donee takes the whole.

Provisions relating to onerous gifts

Onerous gifts refer to the gifts which are a liability rather than an asset. The word ‘onerous’ means burdened. Thus, where the liabilities on a property exceed the benefits of such property it is known as an onerous property. When the gift of such a property is made it is known as an onerous gift, i.e., a non-beneficial gift. The donee has the right to reject such gifts.

Section 127 provides that if a single gift consisting several properties, one of which is an onerous property, is made to a person then that person does not have the liberty to reject the onerous part and accept the other property. This rule is based upon the principle of “qui sentit commodum sentire debet et onus” which implies that the one who accepts the benefit of a transaction must also accept the burden of it. Thus, when two properties, one onerous and other prosperous, are given in gift to a donee in the same transaction, the donee is put under the duty to elect. He may accept the gift together with the onerous property or reject it totally. If he elects to accept the beneficial part of the gift, he is bound to accept the other which is burdensome. However, an essential element of this Section is a single transfer. Both the onerous and prosperous properties must be transferred in one single transaction only then they require the obligation to be accepted or rejected in a joint manner.

In case the onerous gift is made to a minor and such donee accepts the gift, he retains the right to repudiate the gift on attaining the age of majority. He may accept or reject the gift on attaining majority and the donor cannot reclaim the gift unless the donee rejects it on becoming a major.

Universal donee

The concept of universal donee is not recognised under English law, although universal succession, according to English law is possible in the event of the death or bankruptcy of a person. Hindu law recognises this concept in the form of ‘sanyasi’, a way of life where people renounce all their worldly possessions and take up spiritual life. A universal donee is a person who gets all the properties of the donor under a gift. Such properties include movables as well as immovables. Section 128 lays down in this regard that the donee is liable for all the debts and liabilities of the donor due at the time of the gift. This section incorporates an equitable principle that one who gets certain benefits under a transaction must also bear the burden therein. However, the donee’s liabilities are limited to the extent of the property received by him as a gift. If the liabilities and debts exceed the market value of the whole property, the universal donee is not liable for the excess part of it. This provision protects the interests of the creditor and makes sure that they are able to chase the property of the donor if he owes them.

Suspension or revocation of gifts

Section 126 of the Act provides the legal provisions which must be followed in case of a conditional gift. The donor may make a gift subject to certain conditions of it being suspended or revoked and these conditions must adhere to the provisions of Section 126. This Section lays down two modes of revocation of gifts and a gift may only be revoked on these grounds.

Revocation by mutual agreement

Where the donor and the donee mutually agree that the gift shall be suspended or revoked upon the happening of an event not dependent on the will of the donor, it is called a gift subject to a condition laid down by mutual agreement. It must consist of the following essentials:

- The condition must be expressly laid down

- The condition must be a part of the same transaction, it may be laid down either in the gift-deed itself or in a separate document being a part of the same transaction.

- The condition upon which a gift is to be revoked must not depend solely on the will of the donor.

- Such condition must be valid under the provisions of law given for conditional transfers. For eg. a condition totally prohibiting the alienation of a property is void under Section 10 of the Transfer of Property Act.

- The condition must be mutually agreed upon by the donor and the donee.

- Gift revocable at the will of the donor is void even if such condition is mutually agreed upon.

Revocation by the rescission of the contract

Gift is a transfer, it is thus preceded by a contract for such transfer. This contract may either be express or implied. If the preceding contract is rescinded then there is no question of the subsequent transfer to take place. Thus, under Section 126, a gift can be revoked on any grounds on which its contract may be rescinded. For example, Section 19 of the Indian Contract Act makes a contract voidable at the option of the party whose consent has been obtained forcefully, by coercion, undue influence, misrepresentation, or fraud. Thus, if a gift is not made voluntarily, i.e., the consent of the donor is obtained by fraud, misrepresentation, undue influence, or force, the gift may be rescinded by the donor.

The option of such revocation lies with the donor and cannot be transferred, but the legal heirs of the donor may sue for revocation of such contract after the death of the donor.

The limitation for revoking a gift on the grounds of fraud, misrepresentation, etc, is three years from the date on which such facts come to the knowledge of the plaintiff (donor).

The right to revoke the gift on the abovementioned grounds is lost when the donor ratifies the gift either expressly or by his conduct.

Bonafide purchaser

The last paragraph of Section 126 of the Act protects the right of a bonafide purchaser. A bonafide purchaser is a person who has purchased the gifted property in good faith and with consideration. When such a purchaser is unfamiliar with the condition attached to the property which was a subject of a conditional gift then no provision of revocation or suspension of such gift shall apply.

Exceptions

Section 129 of the Act provides the gifts which are treated as exceptions to the whole chapter of gifts under the Act. These are:

-

Donations mortis causa

These are gifts made in contemplation of death.

-

Muslim-gifts (Hiba)

These are governed by the rules of Muslim Personal Law. The only essential requirements are declaration, acceptance and delivery of possession. Registration is not necessary irrespective of the value of the gift. In case of a gift of immovable property worth more than Rupees 100, Registration under Section 17 of the Indian Registration Act is must, as it is applicable to Muslims as well. For a gift to be Hiba only the donor is required to be Muslim, the religion of the donee is irrelevant.

Conclusion

To constitute a transfer as a gift it must follow the provisions of the Transfer of Property Act. This Act extensively defines the gift itself and the circumstances of the transfer of such a gift. The gift, being a transfer of the ownership rights, must be in possession and ownership of the transferee and must be existing at the time of making the transfer. The transferor must be competent to make such transfer but the transferee may be any person. In case the transferee is incompetent to contract, the acceptance of gift must be ratified by a competent person on his/her behalf. Gift of future property is void. Partial acceptance of prosperous gifts and rejection of onerous gifts is not valid either. The acceptance of a gift entails the acceptance of the benefits as well as the liabilities coupled with such a gift. A gift may be revoked only by a mutual agreement on a condition by the donor and the donee, or by rescinding the contract pertaining to such gift. The Donations mortis causa and Hiba are the only two kinds of gifts which do not follow the provisions of the Transfer of Property Act.

References

- https://www.lawyersnjurists.com/article/discuss-the-concept-of-gift-under-the-transfer-of-property-act/

- https://www.latestlaws.com/articles/all-about-lease-and-gift-under-transfer-of-property-act-1882-by-ayushi-modi/

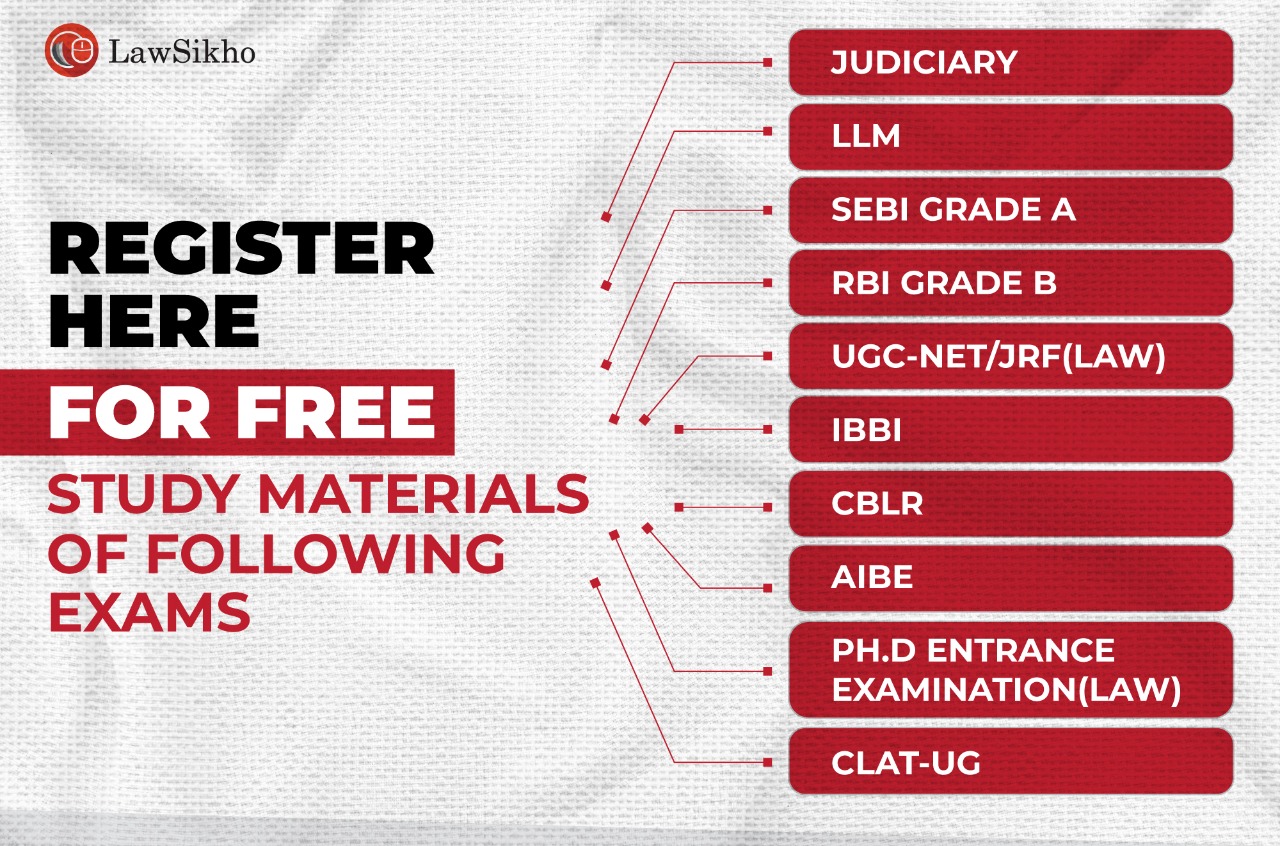

LawSikho has created a telegram group for exchanging legal knowledge, referrals and various opportunities. You can click on this link and join:

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Allow notifications

Allow notifications