This article is written by Ramanuj Mukherjee, CEO, LawSikho.

As I am writing this, the stock market is in free fall. Well, may not be exactly a free fall yet. It’s just a steady and steep downward slope. It looks more like someone rolling down from a cliff, looking down at an abyss and wondering how far he could fall. Everyone else is wondering about the same thing too.

In the last one week (5 days of trading), this is how things look as far as BSE SENSEX is concerned

Basically, the index was flat for most of the week and then started dropping. Its poised to drop a lot more from the look of things.

There are always different forces at play that pulls things in different directions.

On one hand, there are all the bad signs. The budget was a dampener clearly, which set off the bear market. Then you have projections of a bad monsoon, right after one of the worst droughts India has ever seen. Rural India is reeling from economic impact of all these, and the effects are likely to impact the rest of the financial year.

The government seems to have run out of money for the time being, and firepower to pull the economy out of a slow down seems limited. Private investment is quickly vanishing.

Demand in the economy has slowed down. For instance, sales of two wheelers and cars, a key indicator of growth and prosperity in India, for the first time in a decade, is in negative. It seems that the supply of money in the market is slowing down. Banks are not able to give loans, as they are crippled from non-recovery of loans.

All these factors have been accumulating from at least last 6 months. Add to this further threats of a global slowdown, fuelled by an America – China trade war, and Iran sanctions and increase in crude oil prices after the military of Iran capturing a UK tanker.

Increasing oil price is hitting India hard. A 15% increase in crude oil prices is like a 15% tax on our entire economy. And that’s exactly what has happened since the last general election.

So is it all doom and gloom?

Not really. India’s long term prospects look very strong. Look at the headline in Times of India today.

Everything else is temporary. Crude oil prices will change. We will replace it with other sources of energy that are more sustainable and perhaps even cheaper. Our rural population will urbanize. Dependence on monsoon will reduce thanks to agritech. But this force of the world’s biggest working population aspiring to grow is not going anywhere for the next 37 years.

And that is why the India story is so attractive.

But in the short term, things indeed look quite gloomy.

The stock market is a poor indicator of economic realities. It is still not reflecting the very disturbing realities of our economy. Therefore, it has a lot of room to fall. Especially when triggered by panic of seeing indexes dropping a lot of investors will begin to pull out to avoid losses. That’s the time there will be carnage in the market. We may not be too far from it. There would be enough number of shock events in next 2 years for such Armageddon to get triggered.

However, there is a possibility that it will never happen. Investors can also be influenced by hope and positivity. They may choose to look at the long picture and stay invested.

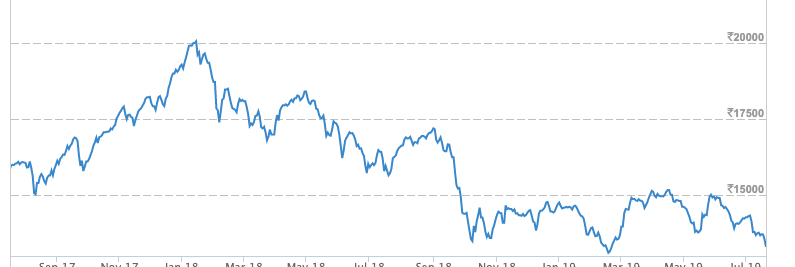

By the way, the movement and reflection of economic realities have been very sharp and stark as far as the small cap index is concerned. This index is less influenced by irrational optimism and more by economic realities.

I am personally not worried about short term fluctuations in the stock market. However, for the first time in many years, my ears are perked up for a recession/ black swan day at the stock market. I have stopped all my SIPs and investments into stocks since last 3 months, and have been eagerly and patiently waiting for major corrections in the stock market, so I can buy good mutual funds at lower valuations.

Reality has to catch up now or later, and we can certainly wait for it.

Also, I have great faith in India’s long term growth story, so I will hold the stocks I buy for the long term. I just want to buy it cheap.

As you can see from the small cap index for the last 2 years, above, the downward pressure on the economy for the last two years is evident from it. Sensex did not look like this though. It kept going up despite all the downward pressure on the economy. And as the headline index, it gets a lot more attention.

Let’s see what actually goes down! I am totally prepared to take advantage of the economic slowdown, on multiple fronts. We have been launching more courses around dispute resolutions and reducing our dependance on courses that are sensitive to market fluctuations. I have held back my investments and waiting for a melt down to make an investment. Here is how I have been preparing myself and my organization for it: https://blog.ipleaders.in/how-to-prepare-for-a-recession-proof-life-and-career/

How have you been preparing for the slow down?

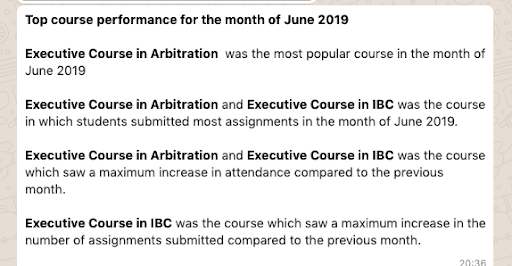

Law firms have slowed down hiring for corporate jobs. However, there is no major impact on disputes hiring, and in fact demand for dispute lawyers and litigators may go up in the near future as new default cases hit the market. Our IBC courses and arbitration courses have really been picking up speed. See this monthly report I got from my team today:

Is it just a coincidence that the market indexes are pointing downwards and that popularity and participation in these two particular courses, related to recovery and disputes, is steadily going up?

Remember that the legal profession is not all that different from the market. There are always market forces influencing things one way or the other. And even in the worst situations and terrible chaos, there are great opportunities. You just have to see it coming, plan for it, prepare for it, and wait for it.

Just like how Warren Buffet made a phenomenal 10 billion dollars from the global financial crisis in 2009. He was waiting for it to happen.

So did John Paulson, who bet against the US housing market and made a cool 2.5 billion dollars! Here are other investors who benefitted from a huge crisis that wiped out most others. What is different about them?

Being at the right place is hard enough, timing it right is even more difficult. One way to make it work is to just be at the right place and wait for long enough so that when the thing happens you are there, waiting to grab the opportunity.

I will give you an example. Indian banks’ recovery problem is an old story. How many lawyers built their expertise and practice around it? How many foresaw insolvency market taking off like it has?

How many wasted too much time trying to become an Insolvency Professional without realising that the fear of the stick will be much bigger and more effective than the stick? How many are realising that a big fintech recovery problem is probably in the offing and are preparing to cater to fintech lending companies, whose requirements will be significantly different than that of banks and NBFCs? How many are building their online and offline professional profile keeping such shifts in the market in mind?

What about infrastructure projects that are likely to get into trouble as government would have less to spend on public infrastructure as tax collection slows down in the short term, and private investors back out? What kind of legal disputes are going to arise out of such situations?

Would the number of contracts breached under market stress go up? Would there be new IPOs in the coming months? Will private equity or venture capital investments pick up, like they do during or right after some slowdowns?

Have you noticed that bitcoin prices are slowly going back to really high levels that we saw around the new year of 2018, from where it came down to really low levels in 2019. What does this mean for fintech and blockchain market? Are we again going to see a lot of new ICOs? Is this bull run sustainable? What opportunities will this open up for investors?

The larger question is, do you have a sense of where your field is headed? Are you clued in? Are you looking at the situation from various perspectives? Is the shift in market forces a part of your plans?

Additionally, I invite you to think about a few things: what are the new skills for the new age lawyering that you are not acquiring?

What are the 3 things you could learn that could significantly increase your income or employability as a lawyer or a professional?

What are unfulfilled or latent demands in the market that you could tap into in order to build a fantastic law practice? For example, here is an Indian lawyer who built a successful practice catering to global ICOs and blockchain companies. He even calls himself a blockchain lawyer. Risky, but the move clearly paid off, or will pay off in years to come.

What is your move?

Here are our online courses that are currently open for enrollment:

Diploma

Diploma in Advanced Contract Drafting, Negotiation and Dispute Resolution

Diploma in M&A, Institutional Finance and Investment Laws (PE and VC transactions)

Diploma in Entrepreneurship Administration and Business Laws

Executive Certificate Courses

Certificate Course in Advanced Corporate Taxation

Certificate Course in Advanced Civil Litigation: Practice, Procedure and Drafting

Test Preparation

Judgment Writing and Drafting Course for Judicial Services

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Allow notifications

Allow notifications