This article is written by Atif Ahmed, pursuing a Diploma in M&A, Institutional Finance and Investment Laws (PE and VC transactions) from lawsikho.com.

Table of Contents

Introduction

Joint Venture (“JV”) is one of the most interesting kinds of business arrangement, where two or more parties come together and pool their resources in order to accomplish a specific task. A JV could take various forms such as incorporating a completely new entity or merely entering into a contractual arrangement; it could be for a long term or for a limited duration in order to fulfil a strategic purpose. JVs are thus highly flexible and floated structures depending upon the considerations and objectives of the participants.

A JV is a very lucrative arrangement as it offers an enormous amount of benefits by which the parties to the JV could gain. The JV could be a beneficial arrangement in the following ways:

- Leveraging of strength & resources available with both the parties;

- Creating a platform to attain the business goals which are otherwise difficult or uneconomical to achieve independently;

- Access to newer markets or segments;

- Strengthen position in the existing markets;

- Diversify into new businesses;

- Gives competitive advantages;

- Shares the risk or initial losses associated with a new business;

- Allows the business to expand with a smaller amount of capital.

Read this article to understand what are the different ways in which a Joint Venture could possibly be structured, for example a Company, LLP, Partnership Firm, or merely a contractual arrangement in the form of Strategic Alliance, and also learn about the pros and cons associated with each one of them, which would enable you to choose the most optimal structure. The article further discusses all the documents that are required to be drafted for each of such structures for the Joint Venture.

What are the different ways in which a JV could be Structured?

The JVs may be either contractual or structural, or both. They may be broad based or narrowly defined and the main classification of JVs is as corporate JV and contractual JV.

A corporate JV is an arrangement whereby a separate legal entity is created in accordance with the agreement of two or more parties. The parties undertake to provide money or other resources as their contribution to the assets or other capital of that legal entity. This structure is best suited to long-term, broad based JVs.

The contractual JV might be used where the establishment of a separate legal entity is not required or the creation of such a separate legal entity is not feasible. This agreement can be entered into in a short duration project involving a limited activity or where JV is for a limited term.

|

JOINT VENTURES |

|

|

Incorporated |

Company |

|

Limited Liability Partnership (LLP) |

|

|

Unincorporated |

Partnership Firm |

|

Structural Alliance/Cooperation Agreement |

|

Now let us discuss these four most common structures employed to constitute a JV, along with their advantages and disadvantages:

-

Company

Here the parties to the JV would create a joint venture company (“JV Co”), under the Companies Act, 2013 (“Act”) and would hold the shares of such company in an agreed proportion. This arrangement can also be termed as Corporate JV.

Advantages:

- The liability of the parties are limited.

- Procurement of domestic as well as foreign funding is flexible.

- The company will survive as the same entity despite a change in its ownership.

- Business expansion is easier.

Disadvantages:

- Formation is a complex task.

- Annual compliances are way too many.

-

LLP

LLPs are constituted under the Limited Liability Partnership Act, 2008 (“LLP Act”). The LLP has the basic features of a corporation including separate legal identity. The LLP Act permits the conversion of a partnership firm, a private company and an unlisted public company into an LLP, in accordance with specified rules.

Advantages:

- Liability of the partners is limited;

- Flexibility to organise the internal structure;

- Lesser compliance than a corporation.

Disadvantages:

- There are a lot of restrictions on the procurement of funds.

- LLPs with FDI, are not eligible to make any downstream investments.

- Much more compliance than a Partnership Firm.

-

Partnership Firm

A partnership firm is created under the Partnership Act, 1932, and is in many respects simpler than a company in terms of formation and compliances. A partnership represents a relationship between persons who have agreed to share the profits of business carried on by all or any of them acting for all. A partnership JV are unincorporated forms of JV which represent the business relationship between the parties with a profit motive.

Advantages:

- There are certain tax advantages;

- There is hardly any requirement of compliance;

- Its formation is very simple;

- Best suited for smaller projects.

Disadvantages:

- The partners have unlimited liability;

- There is very limited capital;

- There is no separate legal identity.

-

Strategic Alliance

The most simple form of JV is to conclude a purely contractual arrangement like a cooperation agreement or a strategic alliance wherein the parties agree to collaborate as independent companies rather than forming a separate entity.

Strategic Alliance is for the furtherance of a common objective/goal, for a profitable venture, proceeds of which are to be shared in an agreed ratio.

This type of agreement is ideal where the parties intend not to be bound by the formality and permanence of a separate entity. Such alliances allow companies to acquire products, technology & working capital, to increase production capacity and productivity. It provides the companies to penetrate into a new market, wherein it was previously restricted due to shortage of funds, technology or prohibitory regulatory framework.

Advantages:

- There is hardly any compliance required;

- There is no need to form a new entity;

- The parties enjoy independence;

- The documentations required are very less;

- It is significantly cost effective.

Disadvantages:

- There are significant tax issues if it is not structured properly;

- Independence might make some parties less motivated to contribute.

What are the different Documents required for creating a JV?

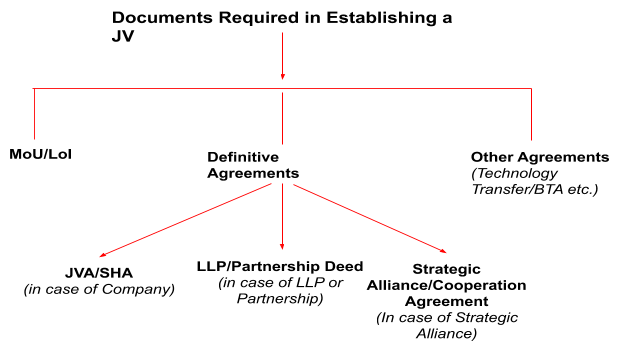

The documents required for creating a JV can broadly be classified into three categories:

- Memorandum of Undertaking (MoU) or Letter of Intent (LoI)

- Definitive Agreements (depending upon the chosen structure)

- Other Agreements (such as Technology transfer agreements/BTA etc.)

Following table shows the different documentaions required under different structures:

Now let us discuss each of the above mentioned documents in detail:

-

Memorandum of Understanding or Letter of Intent

Once a partner is identified, a memorandum of understanding (“MoU”) or a letter of intent (“LoI”) is signed by the parties expressing their intention to enter into definitive agreements.

It is a non-binding document that is used in the early stages of negotiation between the parties, which states their duties and lays down a road map for the future.

The emphasis of MoU lies in the fact that it will be the basis of the further definitive agreements. It is usually drafted by the party that is leading the negotiation.

Usually the MoU/LoI are non-binding agreements, however it contains a few clauses which are made binding.

Following are a few example of such clases:

- Confidentiality Clause

When two parties, especially two big firms join hands for a JV, a lot of confidential information regarding each other and their companies is often involved in the process. Therefore it becomes imperative to include a Confidentiality Clause or sign an NDA before starting the discussions regarding joint venture.

- Exclusivity Clause

Exclusivity clause, also known as lock-out, shut-out or no-shop clause/agreements ensures that the other party negotiates solely with you for a period of time. They give you some protection from another party outbidding him.

- Non-Compete Clause

Non-Compete clause prevents the parties to the JV from competing during the validity of the JV agreement and also for some time after the termination of the JV Agreement. Level and types of restrictions imposed may vary from case to case depending on the negotiations between the parties.

- Non-Solicit Clause

Non-Compete clause prevents the parties to the JV from soliciting the clients/customers of the JV or of the parties to the JV during the tenure of the J.V, and even for some time afterwards.

-

Definitive Areements

Need and Essence

Essentially definitive agreement sets out the mutual rights and obligations of parties in respect to the JV, and it also states the manner in which the parties will conduct themselves in operating and managing the JV. A further purpose is to prescribe, as far as possible, for what will happen if difficulties or deadlocks occur.

The definitive agreements necessarily require incorporation of all the relevant clauses which would specify the mutual understanding arrived at between both parties as to the formation & conduct of the JV, rights and obligations of the parties and dispute resolution mechanism.

The successful implementation and smooth functioning of the JV depends on such definitive agreements and hence it is critical to draft it in a proficient manner without leaving any room for ambiguity.

Different types of Definitive Agreements

The type of agreement you will enter into will depend upon the kind of structure that you choose to go ahead with:

Following table explains the different definite agreements which are required to be entered into as per your chosen structure:

|

TYPE OF DEFINITIVE AGREEMENT REQUIRED FOR DIFFERENT STRUCTURES IN A JV |

|

|

Type of Structure |

Definitive Agreement Required |

|

Company |

|

|

LLP |

Limited Liability Agreement |

|

Partnership |

Partnership Agreement/Deed |

|

Strategic Alliance/Cooperation |

Strategic Alliance Agreement or Cooperation Agreement |

What are the clauses that are included in the definitive agreements?

The following are some of the most significant clauses that are to be required to be carefully incorporated into the definitive agreements:

- What is the object and scope of the JV?

- How would financial arrangements be made?

- Would a partner contribute anything apart from cash?

- How much would be the stake of each partner to the JV?

- What is the composition of the board and management arrangements?

- What are the specific obligations of the parties?

- What are the condition precedent and condition subsequent?

- What is the provision for distribution of profits?

- How would the shares be transferred under different circumstances?

- How would a deadlock be remedied?

- How and circumstances under which the JV would be terminated?

- What is the provision for future issues of capital?

- What are the restrictive covenants on the company and the parties?

- How would the CEO/MD be appointed?

- Equity participation by local and foreign investors;

- Casting vote provisions;

- Change of control/exit clauses;

- Anti-dilution rights;

- Drag Along/ Tag Along rights;

- Anti-compete clauses;

- Confidentiality or NDA clause;

- Indemnity clauses;

- Dispute Resolution clause;

- Applicable law;

- Force Majeure etc.

What is MoA and AoA? And what is its essence?

Meaning

In case the JV is being structured as a separate legal entity in form of a company, then MoA and AoA also become significant documents that , apart from SHA/JV Agreement, that needs to be drafted.

The Companies Act, 2013 requires every company to have a Memorandum of Association (“MoA”) and Articles of Association (“AoA”). The MoA and AoA are the charter documents of the company.

Essence

The SHA/ JV agreement is only between the parties to the JV and it does not bind the JV company, unless its terms are specifically included in the AoA of the JV company and its objects come under the purview of MoA.

Anything contained in any document (including SHA/ JV Agreement) which is inconsistent with the provisions of the Companies Act, 2013 or the MoA or AoA of the company, is ineffective and cannot be enforced.

Therefore it becomes necessary to specifically incorporate the terms of the JVA /SHA into the AoA of the JV company, and to draft the MoA of the company wide enough to cover the business of the JV.

Memorandum of Association:

- The main requirement in the MoA will be to make the main object clause sufficiently wide to cover the company’s proposed activities because the objects specified in MoA, as required by the Act, cannot be overstepped.

- The MoA is in a way a flexible document and can be altered by the shareholders in accordance with the provisions of the Act.

- Any act of the company beyond the scope of MoA will be an ultra vires act, which will have serious consequences. For example, A contract by a company on a matter not included in the Memorandum of Association is ultra vires.

- Therefore, the parties to the JV should ensure that the current main objects of the company are vide enough to cover the proposed activity of the JV Company.

Articles of Association:

- Articles of Association are regulations for internal management of the company. They are the rules or bye-laws for the conduct of Board & Shareholders meetings, issue and transfer of Shares, Powers & duties of Directors, Managing Director etc.

- If the AoA is inconsistent with the provisions of the JV agreement, then the parties will amend the AoA accordingly.

- Some of the points that deserve attention in a JV Company’s Articles are as follows:

- Method of decision in a meeting of Board of Directors – by consensus or majority, with or without casting vote.

- Method of decision in a General Meeting – by consensus or majority, with or without casting vote.

- Powers of the Board of Directors with regard to Notice for General Meeting, Special Resolution, Issue of Shares, Transfer of shares etc.

-

Other Agreements

Other equally important agreements will include the Agreements to effectuate the transfer of whatever the JV partners are contributing to the Joint Venture, for the fulfilment of the objectives of the Joint Venture. This will include Technology Transfer Agreements, Intellectual Property Assignment or licence Agreement, Business Transfer Agreement etc.

Following are some of the Agreements by which the business/assets/IP is transferred:

-

Business Transfer Agreement (BTA)

The partners to the JV may be contributing in terms of some tangible assets like plant, machinery, land, equipment etc (“Asset Sale”), or might even decide to transfer the whole of their business unit to the newly formed JV at a going concern basis along with all the licenses, grants and authorization (“Slump Sale”). This could be achieved by effecting a Business Transfer Agreement (BTA).

|

RECENT CASE STUDY In the recently entered J.V between Mahindra & Mahindra (M&M) and Ford Motors, Ford Motors transferred its entire Indian operations (Ford India Private Ltd.), including its personnel and assembly parts in Chennai and Sanand (Gujrat) to the Joint Venture, by effecting the Business Transfer Agreement (BTA). Click here to see more details. |

-

Transfer of Intellectual Property

In a JV, each of the JV parties contribute something of value to the JV. Such an arrangement allows multiple parties access to pooled capital, technical, management and intellectual property (IP) resources which helps in expanding the business capabilities and attaining rights not available to either party acting alone.

The contribution of IP assets to the joint venture may be in the form of an assignment or a license. Let us understand how:

(i) Assignment Agreement:

An Assignment Agreement is a contractual agreement that assigns/transfers IP rights from the assignor (giving party) to the assignee (receiving party). In Assignment, the assignor transfers all of his rights pertaining to the IP and assigns them to the assignor.

(ii) License Agreement:

A License Agreement is a contractual agreement where the licensor authorizes the licensee to use the rights to a protected IP. Under License Agreement, the licensor maintains his rights and interest in the IP.

Conclusion

From the above discussions on the different structures of the JV, and their associated advantages and disadvantages, we can conclude that there isn’t one single structure which can be designated as the most optimal structure in every situation. Each of the structures mentioned above comes with its own set of pros and cons, and there could be different optimal structures for different parties, depending upon their objectives, requirements and the scale of their proposed business. For example, in case the parties want to enter into a business which would require a lot of domestic as well as foreign capital, then JV Company might be their optimal structure. On the other hand, if the business does not require such investments and is to operate on a much limited scale, then Partnership could be their optimal structure. Having that said, in most cases Company and Strategic Alliance are the most sought after structures. Also, the documentation for each of these structures needs to be carefully drafted and should include all the relevant clauses, which would lead to smooth operation of the business of the JV and would provide for appropriate remedial solutions in dispute and deadlock situations.

References

- Nishith Desai Associates – Joint Ventures in India (May 2013 Edition)

- www.corporate.findlaw.com/corporate-governance/technology-based-joint-ventures.htm

- Anil Chawla Law Associates LLP – Guide to JV in India (April 2020 Edition)

LawSikho has created a telegram group for exchanging legal knowledge, referrals and various opportunities. You can click on this link and join:

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Allow notifications

Allow notifications