This article written by, Shamika Vaidya, pursuing Diploma in M&A, Institutional Finance and Investment Laws (PE and VC transactions) discusses the biggest M&A failures in the history of India.

Introduction

Marriages are made in heaven and M&As in the boardrooms. Some go well and some fall apart. In recent years India had witnessed many successful mergers and acquisitions like Ranbaxy – Daiichi Sankyo, ONGC-Imperial Energy. However, there were few deals which couldn’t get through.

Mergers and Acquisitions

When two entities decide to come together forming a new entity it is called a merger, an acquisition, on the other hand, is when a company gains a controlling interest in share capital or substantially all assets and liability of the other company. Primarily companies Merge or Acquire for;

- Strategic Growth

- Revival of Stressed Assets

Failed M&A

The following deals were foiled by unforeseen circumstances or mere non-diligence.

- HDFC and Max Life

- IDFC-Shriram Finance

- RCOM-Aircel merger

- Flipkart-Snapdeal Merger

- Cross-Border-Apollo-Cooper Merger

HDFC and Max Life

Shareholding Patterns

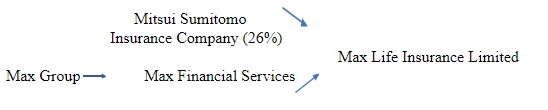

Max life Limited being India’s Fourth largest private insurance company is a Joint Venture between Max Financial Services and Mitsui Sumitomo Insurance Company (26%), a Japanese Insurance Company.

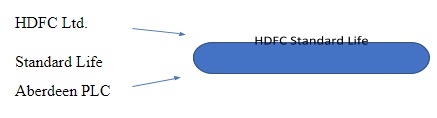

HDFC Standard Life Insurance was a formerly unlisted company and a joint venture between (HDFC) Housing Development Financial Corporation Limited holding 61.5% shares and Standard Life Aberdeen PLC, holding 35% merger of Standard Life and Aberdeen Asset Management rest by others.

Merger Structure and advantage

HDFC was a Private Company and wanted to get listed. The merger would list it automatically without going through the route of cumbersome Initial Public Offering. Not only the merger was an advantage with regards to avoiding the intricacies of an IPO but would cut down the cost appreciably. It was a reverse merger as a listed company was to be merged with non- listed, (HDFC Standard Life was going to merge in Max life Limited). To know more about guidelines in relation to merging of unlisted to non-listed companies (See link here)

As per the scheme, Max Life Limited would first merge with its parent company Max Financial Services, and subsequently, the life insurance business would demerge from Max Financial and merged into HDFC Life. The majority stake in the combined entity was to be held by HDFC Life.

Reason for Failure

The proposed merger was not approved by the sectoral authorities, Insurance Regulatory and Development Board (IRDB). Section 35 of the Insurance Act bars the merger of the insurance company with non-insurance companies.

IDFC and Shriram Finance

The proposed merger pre-determined to get two Non-Banking Financial Company, a bank, and an infrastructure finance company come under a roof.

Shareholding Pattern

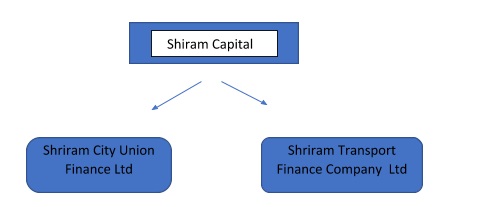

The shareholding pattern of Shriram Limited, a listed entity during the merger time was 33.77% held by the promoters, Domestic Institutional Investor (5.58%) and Foreign Institutional Investor (22.42%). Few of the investors included Dynasty Acquisitions Ltd (FPI), Piramal Enterprise Limited. Shriram Group is an Indian Conglomerate. Shriram Capital is the holding company for two listed companies Shriram City Union Finance Ltd Shriram Transport Finance Company Ltd [1]

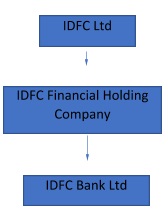

The shareholding Patterns of the IDFC was (43.09%) held by (DII) Domestic Institutional Investor and (29.89%) by (FII) Foreign Institutional Investor and the rest by others. Some of the investors include Sipadan Investments (Mauritius) Limited, Theleme Master Fund Limited, Government Pension Fund Global. IDFC Bank Limited is a subsidiary of IDFC Financial Holding Company which is held by IDFC limited.

Merger Structure

Old Structure

- Shriram Transport Finance would be delisted and become a subsidiary of IDFC Ltd

- Shriram City Union Finance would Merge with IDFC Bank

- Shriram Life and General Insurance would become subsidiaries of IDFC Ltd

Later, a new structure was proposed.

New Structure

- Shriram Transport Finance remains an independent listed entity

- Shriram Capital merge with IDFC Ltd

- Shriram City Union Finance merge with IDFC Bank

In this merger, Shriram holding company and its subsidiaries would be absorbed in IDFC.

Rationale

IDFC had a legacy burden, creating a drag on the financial statements, the Return on Asset (RoA), Return on Equity (RoE) and the Pre-Tax Profit. It was determined to cut the journey of coming out of legacy through inorganic growth and looked forward to diversification.

Failure

Swap Ratio Value destruction

Some of the investors from IDFC demanded 60 percent premium on fear of diminution of their holdings in the swap. IDFC Ltd could not lessen below the 40% shareholding and therefore could not give a good value to Shriram Transport. The shareholders of Shriram feared Holding Company Discount. The structure and valuation were not mutually acceptable to both the parties.

The RBI stance was critical for Piramal Enterprise Limited to hold more than 5% in IDFC whereas it held a reasonable stake in Shriram and its subsidiaries

The reason for calling off the merger was-

- Disagreement in Share swap Ratio

- No value for Shareholders

RCOM and Aircel Merger

Shareholding Pattern

Reliance Communication Ltd is a listed company, 59% was held by the Promoter and Promoter group 10.09% held by Foreign Institutional Investors, 9.84% by Domestic Institutional Investors and 27.07% by others.

Two entities namely, Maxis Communications and Sindhya Securities and investments had around 74% and 26% stake respectively in Aircel.

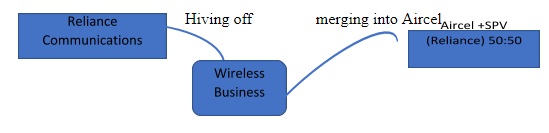

Structure

The Scheme of Arrangement between the Reliance Communication and Aircel was that Reliance Communication will hive off its wireless business into the separate arm in form of Special Purpose Vehicle (SPV) by a slum sale and leave behind its overseas arm and tower. This arm will be merged with Aircel to form a new entity. The new entity formed through the merger will have a 50:50 stake by both the companies.

Purpose

The purpose of the merger was transferring of debt in the new entity by both the companies. Reliance Communication had a debt of 958 crores during the time of the merger. The synergies out of the merger would have been beneficial in cost and debt reduction from both the companies and streamlining their Capex and Opex management. It would help them survive the highly competitive market. It would have helped them to make better use of infrastructure, pooling structure.

Reasons for Failure

- Opposition from Creditors like Ericsson and (CDB) China Development Bank who objected before NCLT.

- The procedure was time-consuming as a lot of permissions had to be sought from courts and authorities like DOT.

- High taxation, the charge levied by the center on the use of spectrum through auction.

The deal was called off mutually by both the parties.

Apollo and Cooper Tire & Rubber Co.

Shareholding Pattern

Cooper Tire and Rubber Co is a US-based listed company and is the second largest tire making company in the US and ranked 11th globally having an annual turnover of $4.2 billion. Cooper main investors are institutes are backed by Black Rock Institutional Trust Co. and Vanguard Group Inc.2

Apollo Ltd is an Indian listed company with headquarters in Haryana and 69% revenues from India, 26% revenues from Europe, 5% from other geographies.3

Click Here

Structure

Apollo Ltd wanted to acquire Cooper Tire & Rubber Co which was three times larger than the acquirer and was to be brought in an all-cash transaction. Apollo had an immense benefit out of the merger. It would gain entry in the international market and there wouldn’t have been immediate equity dilution.

After a few failed attempts Apollo had proposed to buy all the common shares in the company with a premium of almost 40% premium. The capital was raised by various institutions in India.

Reason for failure

Cooper faced two major issues during the ongoing acquisition.

Cooper Chengshan Tire

Cooper failed to provide the latest financial statements of its subsidiary in China. The management and workers stopped working after they were aware of the Apollo-Cooper deal resulting cut in the revenue. One of the main concerns being the surety of success between Indian and Chinese work culture, management being Indian and workers Chinese. The Dispute between Chengshan and Cooper mired in the local courts sending an impression that Cooper had no control over its subsidiaries.

Steelworkers Union

Steel Workers Union had the power to approve the change in ownership. A grievance was filed against Cooper by SteelWorker Union, as they tried to negotiate it for their benefit. Apollo agreed to sign the bargaining agreement with the Union but cleared that it would adjust the same in the price it was paying for Cooper. This was opposed by the later claiming that Apollo was aware of the contract between the Union and Copper and price adjustment was not warranted.

Due to the above-mentioned issues, Apollo was unable to finalize the deal from its end. Further, Cooper sued Apollo to complete the deal, that is to enforce the buyout agreement. The matter was taken up to the Supreme Court after arbitration proceedings by Cooper. However, Apollo didn’t want to move ahead unless Cooper resolved issues with their worker union and Chengshan. The Breakup fee for Apollo was 112 million dollars, whereas for cooper had to pay the termination fee of 50 million dollars. Finally, the deal was called off by Cooper.

Snapdeal and Flipkart

Shareholding Pattern

Incorporated in India some of the investors in Snap deal during the time of merger were Nexus Venture Partners, Soft bank Telecom Corp., Alibaba, Kalaari Capital, Premjiinvest. The stakeholders of the company were of the view that the founders managed to not only to take decisions but also practice mismanagement although equipped with just 6.5% stake in the company. Prior to the merger talks, the company had acquired a lot of other companies like Freecharge and additionally burnout, later sold off to a very less price.

Flipkart is a private limited company based in Bengaluru, India. Some of the key investors are Soft Bank Vision Fund, Naspers, Steadview Capital, and eBay. Softbank was pushing forward the deal and was exploring strategic options.

Reason for failure

- There was no consensus from the founders of Snapchat, Nexus Venture Partner, Premjiinvest and other minority shareholders as there was a differential payout to the investors.

- There was a disappointment amongst the employees.

- Huge Tax liabilities on Snapdeal investors due to a complex structure.

- The non-solicit clause of 5 years by Flipkart, this clause could have been the reason of potential conflict as the investors have investments in many e-commerce companies

Snapdeal called off the deal with Flipkart to go with their Plan B, Snapdeal 2.0

Mergers that Failed after the closing of the deal

Successful deals do not only mean hassle-free transactions. If the core purpose for getting into an arrangement is not served it could mean that the deal is unsuccessful

Tata Steel-Corus

Corus was a merger between British Steel and Koninklijke Hoogovens. Tata Steel acquired Corus for $12billion, 608 pence per share about 30% more than the negotiated price. The acquisition would have created the fifth largest steel producing company in India.

Pursuant to the acquisition, TATA’s manufacturing reduced from 18 mtpa to 10 mtpa. It invested more than 12 thousand crores in Corus post-acquisition. Corus added $6 billion to the debt of TATA4. TATA decided to sell its UK steel business to Liberty house and announced the merger of its Europe Steel business with ThyssenKrupp.

Suzlon Energy Ltd -Servian

Suzlon Energy Ltd had acquired Servian through (FCCB) Foreign Currency Convertible Bonds. It couldn’t repay the debt to the creditors as there was a decrease in the conversion rates of CCB by 70%. Suzlon Ltd. sold Servian to American Private Equity Player Centerbridge Partners LP for 7,200 crores.

SRS (Shree Renuka Sugars) buyout of Brazilian Companies

Shree Renuka Sugars was started by acquiring sick sugar mill Nizam Sugars. Later it acquired (buyout) two Brazilian sugar mills Vale Do Ivai SA Acucar e Alcool and equip for $332 million. However, the company has experienced a downfall since 20145. The debt of SRS rose to about four times that of its equity. One of the prime reasons for the crisis was a drought in Brazil that affected sugarcane production. Later, they had to fire 900 workers at the sugar mill and return the land taken on lease. It tried to sell one of the plants in the auction and the same was restrained by an injunction order from the court.

Bharti Airtel -Zain

Airtel acquired Zain a Kuwait based telecom company’s assets in Africa’s 15 countries. However even after five years, the company suffers from low EBITDA, various reasons like Africa’s economy contributed to the failure. Bharti Airtel lacked in their due diligence and later discovered that Zain had not invested enough in the assets of Africa. Therefore, this acquisition comes under a failed one as Airtel Bharati was not successful in achieving its intention.[6]

Sun Pharma-Taro

Sun Pharma Industries Limited, an Indian Listed Company and Taro entered into a definitive agreement, wherein high stake was purchased by the former when the later had liquidity issues. Later, there was a litigation battle in US and Israeli courts between the two as Taro accused Sun Pharma of certain non-disclosures and lower valuations which lasted for three years. Although, after the court battle Taro continues to be a subsidiary of Sun Pharma and it would not in any way affect the business, the intention of Sun Pharma behind the acquisition was not served as it was looking forward to buyout Taro and delist it from New York Stock Exchange for better dividend payout and cash flows.7

Conclusion

For an M&A to be a successful lot of factors play a vital role. Following are a few reasons that could account for calling-off a M&A deal.

- Post Merger Integration which includes work culture differences.

- Taxation and structuring issues.

- Economy of country

- Permissions from NCLT and sectoral authorities.

- Litigation and Court battles.

- Oppositions by the Stakeholders.

- Prejudicial to the welfare of Shareholders.

- Due-diligence went wrong

- Clauses like Non-solicit and Non-compete being for unreasonable periods.

- Aggressive and high leveraged acquisitions.

References

- https://www.maxfinancialservices.com/about-us/#about-us-2

- https://www.valueresearchonline.com/ads/splash.asp?ref=%2F%3F

- https://www.crunchbase.com/

- https://www.shriramcity.in/index.aspx

- http://www.moneycontrol.com/

- https://rcom.co.in/

- https://dealbook.nytimes.com/2013/12/30/cooper-tire-abandons-merger/?rref=world&module=ArrowsNav&contentCollection=Business%20Day&action=keypress®ion=FixedRight&pgtype=Blogs

- www.economictimes.com/

- www.businessstandard.com/

Endnotes

- https://www.shriramcity.in/About-Shriram-Group.aspx

- https://www.reuters.com/article/us-cooper-apollo-takeover-idUSBRE95B0H820130612 India’s Apollo Tyres to buy Cooper Tire for $2.5 billionBijoy Anandoth Koyitty, Aradhana Aravindan JUNE 12, 2013 / 5:45 PM

- https://en.wikipedia.org/wiki/Apollo_Tyres

4.https://www.bloombergquint.com/business/lessons-tata-steel-learnt-from-its-corus-acquisition-or-not#gs.vPTUZ7c Lessons Tata Steel Learnt from Its Corus Acquisition, Or Not July 04 2018, 4:31 PM

5.https://economictimes.indiatimes.com/news/company/corporate-trends/two-brazilian-acquisitions-have-backfired-for-shree-renuka-but-narendra-murkumbi-confident-of-a-comeback/articleshow/11998297.cms Wed, Oct 18 2017. 10 22 PM IST Shree Renuka Sugars said to have fired 900 workers at its Brazil mills

6.https://www.livemint.com/Companies/5BNrEASu52s5lSKj7WWJMP/5-years-on-Airtels-Africa-business-still-off-target.html Mon, Jun 08 2015. 09 20 AM IST Five Years On Airtel’s Africa Business Still Off Target.

7.https://www.livemint.com/Companies/dZeC8EBg827pU8k6rY49BK/Sun-Pharma-Taro-terminate-merger-plan.html Sun Pharma, Taro calls off planned merger last updated: Sat, Feb 09 2013. 10 25 AM IST

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Allow notifications

Allow notifications