This article has been written by Kashish Goel, pursuing the Diploma Programme in M&A, Institutional Finance and Investment Laws from LawSikho.

Table of Contents

Introduction

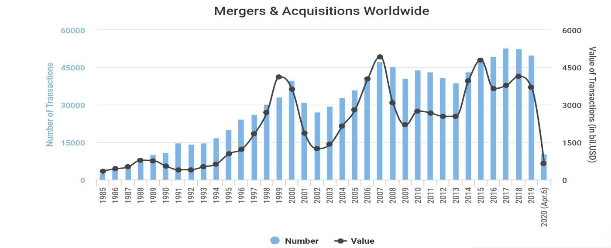

We are living in the digital age so it was about time for the businesses around the globe to move their operations in a virtual form. Virtual Data Rooms, a market that was not existing until 2000, was valued over $1.08 billion in 2018 and growing at a Compound Annual Growth Rate (CAGR) 14.5% and is expected to value $3.66 billion by 2027. Such a rapid rise was in conjecture due to the increase in the Mergers & Acquisitions transaction which had investments of over $5 Trillion dollars in the year 2016.

Online data rooms(ODR) or Virtual Data room (VDR) in simple terms are cloud storage services used by the companies to store and share their data may be confidential or not in a cloud server provided by the vendor. In this way the data can be stored more securely, can be accessed by anyone authorized, potentially saving time on the part of the companies at the time of M&A, during the process of due diligence as all the related data can be instantly accessed by the 3rd Party.

What brought them into existence

As the business is growing in the past decade the efficiency required in the process of merger and acquisition. The number has also increased as more and more companies are being in these transactions. The process needs to be streamlined by building online data rooms. These help in saving time, securing the data, and with the ease of accessing the data with an internet connection creating greater efficiency in the whole process of merger and acquisition.

Purpose of ODR in merger and acquisition

Online Data Rooms is basically an online “warehouse” or “repository” where information is stored and distributed through documents. This method of document sharing and storage solution is designed primarily for legal due diligence, M&A, initial public offerings (IPOs), bankruptcies, corporate restructuring, licensing, intellectual property rights, and other applications involving sensitive information.

Benefits of ODR

Cost Reduction

The physical data room that was formerly used, required higher maintenance as more personnel were required in order to operate them and clean them and keep them secure, all those personnel were required to be paid salaries and wages whereas in an online data room, it requires 1-2 personnel in the repository that saves cost and the room allotted to them can be used for a different purpose. These costs dramatically increase if there is a cross border merger and by using ODR, costs like that of personnel travelling, their meals, the cost relating to the printing can be saved

Efficiency

The whole process of due diligence when using a Physical Data Rooms takes a lot of time as the person has to have permissions in order to have access and view the information then view it or print it or have it Xeroxed, all process is time-consuming and tedious. Whereas when using an ODR all that it takes is a few clicks in order to access the information as the information is much more accessible due to its nature that is digital also the information can be accessed by 2 or more parties simultaneously.

All it takes a few clicks while using ODR in order to access, store or distribute the information as everything is done online with a 24/7 access which is not possible in the case of a physical data room.

Security

The data stored in any kind of data rooms have very sensitive information is ODR are designed keeping in mind this aspect of security. The access is only given to limited personnel by the respective authorities. The data that is accessed by anyone can be tracked and monitored by the ODR software and can set a limit on the time and degree of access to the particular sensitive information

Process Transparency

If needed by the company personnel, he/she can have all the details regarding who logged in for how long, who accessed or downloaded what particular file at what time from which device. This all is possible due to the audit trail feature of ODR. This degree of monitoring is not possible in a physical data room.

Comfort and Convenience

As the saying goes “time is money”, travelling all the way to a physical data room just to retrieve a document seems a task that is not worth the trip but, it can be reduced when using an ODR, as those documents can be accessed from your office or as a matter of fact anywhere as per your convenience as long as you have a system and an internet connection.

Covid-19 is bringing a change in ways in which the world works. There are travel bans to certain places, cancellation of essential business forums and cancellation of conferences have been experienced by the people. In order to create a lower movement of people, the government has insisted on working from home since the economy will shutter if the works stop completely. This means that businesses are moving towards Virtual or Online Data rooms and cloud-based applications so as to make sure that the work is happening even during the pandemic. Following are some of the options available for managing the needs of the business organization.

Best online data room vendors in India

iDeals- Virtual Data Rooms (Rating 5/5)

Started in 2008 the firm has grown to scale having worked with the companies that in Fortune 1000, Top Banks, Legal Corporations, Biotech Organizations are some of the industries that use its services. In order to serve the client’s requirements, the firm provides a free 30-day trial period, this helps the client in order to check whether the firm suits it or not. It also provides 24/7/365 to its clients. When looking for an ODR, iDeal should be on the list. (Website)

Ethos Data- Virtual Data Room Services (Rating 4.5/5)

It is one of the best firms in the ODR providing service in India. The best aspect of the firm is the user-friendly user interface. The whole setup can be set up and running in a few minutes. This company provides the balance of the security and the convenience with customer support of 24/7. (Website)

Intralink India- All About Virtual Data Room Providers (Rating 5/5)

This firm has been in business for over 2 decades. Intralink has involved in many businesses and boasts of a significant client base of over 3.1 Million people with working Professional, Investment Bankers, Real Estate, Energy etc. Considering the developer assists the most demanding customer (e.g., Fortune 100). One of the best features about the firms’ proprietary software is its unbeatable defense system to provide the best encryption to the sensitive information that the clients require to the store. It is among the best and the most experienced in India and will find a common ground with huge organizations and how to assist even small enterprises. It provides 24/7 customer care support. (Website)

Box- Virtual Data Rooms (Rating 5/5)

Box was established in the year 2005 and has grown steadily over the years. The one thing that the client values the most is the simplicity of the user experience and many compared it to the ease of using the ‘DROPBOX’. This firm can be chosen by businesses that are small to medium in size. This is a decent enough firm but the feature set is not up to date with the rest of the competition in the market. In order to meet the demands of the client, this firm offers a 14-day free trial. (Website)

Datasite- Merrill in India (Rating 5/5)

Even before a potential customer reads any data room reviews he may guess what the primary concern and the most evident strength of Merrill DataSite is. It has one of the best defence mechanisms to boast of: Multilevel User Authentication, Dynamic Personally Identifiable Watermarks, Strong Encryption etc. When it comes to the pricing of the plans of this firm, it is not the cheapest but when looking at all the set of features it provides the pricing of the plans seems justifiable. Due to the huge scale of the firm has developed many other products like “Contract Management System” so, by combining the products they can be used to deploy complex answers as an advantage. (Website)

The firms mentioned above have their operations in India and the pricing depends upon the plan you choose by combining the feature set you require. (Detailed Reviews)

Uses of ODR

For many businesses, their user data becomes an important asset and due to the dynamic nature of business and technology, data protection is necessary. Between the hackers and the ever-evolving government privacy regulations regarding online privacy of the users, a company can never be too careful in protecting their data. In this area ODR can help.

The most common use case of ODR:

Mergers and Acquisitions Due Diligence

The process of due diligence in an M&A transaction is a complex one. It requires a large amount of data collection, reviewing it, doing a thorough research and these steps are being followed by all the involved parties as all of them have to do their part in the transaction and this could slow down the process. By using ODR in this phase of the M&A transaction, they make this complex task easier as everyone can access all the needed documents as per their convenience in a systematic and arranged manner.

Legal Document Management

When it comes to managing all the legal documents an ODR can be a very wise choice that can act as a secure location to store data outside the office. There can be many scenarios where the stakes are high and time is of priority and the conclusion of a particular matter depends on a particular document. So, here ODR can come in handy as they can provide access to the documents almost immediately to anyone necessary in a matter of minutes in an organized and a systematic manner.

Capital Raising

Companies looking to raise funds can have an advantage by using ODR service as they require a storage space where all their documents can be housed for as long as they require to. In this case, the sensitive information is viewed by many, from various companies that have a variety of professionals all across. ODR provides this instant access and makes their jobs easy by giving them the previews of the required documents by ensuring they are viewing the exact file that they need to access.

Regulatory Risk Management

In order to run a business, the owners must ensure that business follows all the rules and regulations that a particular business is expected to. The rules and regulations of the government are made to grow the industry and increase their standards and ODR can help both the government and the companies in order to distribute and access the information respectively in a safe and secure manner.

Initial Public Offerings

When the promoters of the company decide to go public there are rules and regulations that are needed to be complied with. The company before getting itself listed has to share the information about the company to the shareholders, public, institutions they need a way to distribute the sensitive information with the help of ODR without the need to worry about its security.

Due to the nature of the business, there are many factors that affect it, such as the current market conditions, the government policies, the natural calamities and many more. But, these factors are not in the hands of the owners so they have to cover all their bases and look for any potential factors that affect the business in a negative way. So following are some documents that are required to be reviewed in a transaction.

What should be in an ODR?

Every information that concerns the particular businesses such as financial statements, key contracts, employee information, intellectual property should be included in the data that goes up in the online data rooms. Mentioned below are some points that may need to be included in an ODR.

Basic Corporate Documents

- Certificate of Incorporation

- Corporate Bylaws and Amendments

- List of Subsidiaries and ownership percentage

- Subsidiary Certificates and Bylaws

- Shareholder Minutes and Consents

- Licenses

- Permits

- Board Committee Minutes and Consents

- List of areas where Company is qualified to do business, owns or leases real property, or is otherwise operating

- Good standing certificate in jurisdiction of incorporation

- Franchise tax board certificate in jurisdiction of incorporation

- List of current officers and managerial people of the company

Capital Stock and Other Securities

- Shareholder List (name, amount, date of issuance, consideration received, common or preferred, etc.)

- Option holder List (name, amount of options, date of grant, vesting schedule)

- Warrant holder List

- Cap Table

- Convertible Note Register

- Stock Purchase Agreements

- Voting Agreements

- Registration Rights Agreements

- Management Rights Agreements

- Stock Option Agreements

- Stockholder Agreements

- Stock Certificates

- Proxies

- Buy-Sell Agreements

- Securities law filings and permits

- Recap and organization documents, including re-incorporations

- Disclosure documents used in private placements of company securities

- Term sheets signed in connection with prior securities issuances

Financial and Tax Matters

- Audited Financial Statements

- Unaudited Financial Statements

- Monthly Financials

- Quarterly Financials

- Letters from Auditors

- Projections and Assumptions/ Operating Plans (current)

- Federal Income Tax Returns

- State Income Tax Returns

- Foreign Income Tax Returns

- Other Tax Returns/Filings

- Reassessment or deficiency or audit notices

- Banking Accounts and Signatories

- Loans and Promissory Notes

- Capital Leases

- Security Agreements

- Accounts Receivable Aging Schedule

- Accounts Payable Schedule

- Description of any changes to accounting methods or principles

- Guarantees

- Bridge Financings

- Inventories: (i) inventory summary by major product as of most recent practicable date; (ii) schedule of consigned inventory; (iii) copies of the Company’s policies for providing for obsolete and slow-moving inventory and summary of obsolescence write-offs and provisions for slow-moving inventory for the last year; and (iv) description of the Company’s methods of inventory control

- Schedule of material prepaid expenses and “other assets” as of most recent practicable date

- Schedule of property, plant and equipment, and accumulated depreciation broken down into category (i.e., land, buildings, equipment, etc.) for the last year (indicating beginning balances, additions (or provisions), retirements, and ending balances

Intellectual Property (IP)

- Summary of Patents and Patent Applications

- Patent Applications

- Patents Issued

- Summary of contracts where Company IP is licensed to a third party, and actual contracts

- Software License Agreements summary

- Software License Agreements

- Employee Non-Disclosure and Proprietary Inventions Assignment Agreements

- Consultant Non-Disclosure and Proprietary Inventions Assignment Agreements

- IP litigation summary

- IP litigation case filings

- Claims or communications against the Company for IP infringement

- Claims or communications against third parties for IP infringement

- List of open source software used

- Trademarks

- Service marks

- Technology license agreements

- IP transfer or sale agreements

- IP escrow agreements

- Third party non-disclosure or confidentiality agreements (consider redaction of names)

- Internal policies to protect IP

- List of registered copyrights

- List of domain names, with expiration dates

- Schedule of mask work registrations and applications

- Clinical trial information (for biotech companies)

Material Agreements

- Summary of Material Agreements

- Summary of agreements needing consent in the event of change in control

- Material Sales Agreements

- Intellectual Property Agreements (see Section 5)

- Distribution Agreements

- Partnership or Joint Venture Agreements

- Leases (see Section 4)

- Non-Competition Agreements

- Employment Agreements

- Change in Control Agreements

- Inter-company agreements

- Agency agreements

- Prior M&A agreements

- Investment Banker engagement letters

- Indemnification Agreements

- Loan or Credit Agreements

- Mortgages

- Privacy Policy

- Terms of Web Site Use Agreement

- Other material agreements

Customers, Sales, and Marketing

- List of customers and key metric information

- Form of Sales Agreement

- Accounts Receivable summary

- Sales Commission Plan

- Sales allowances and return policies

- Reseller information

- Credit and collection policies and processes

- Backlog

- Sales projections and assumptions

- List of products and summary

- Product road maps

- Marketing materials and sales literature

- Product campaigns and launches (summary)

- Industry and analyst reports

Suppliers and Manufacturers

- List of key suppliers and products supplied

- Supplier agreements

- Original Equipment Manufacturer (OEM) agreements

- List of key manufacturers and manufacturing summaries

- Manufacturing agreements

Customer and Product Support

- Customer satisfaction surveys

- Current sales brochures

Regulatory Matters

- Government permits

- Notices of violations from governmental or regulatory bodies

- Government licenses

- OSHA, EPA, ERISA, COBRA, FLSA, EEOC, NLRB, etc., notices

Litigation/Disputes

- Summary of any litigation or arbitration matters

- Copies of all litigation complaints

- Copies of all arbitration filings

- List of all orders, writs, decrees, injunctions, judgments, or rulings by any court or agency

- Documents related to any threatened litigation, arbitration, or governmental action

- Environmental claims and actions

- Copies of lawyers’ letters to auditors

- Past settlement agreements

Insurance

- Summary of all insurance policies

- Copy of directors and officer’s liability insurance (D&O) policies

- Copy of liability policies

- Copy of key person insurance policies

- Copy of workers’ compensation policies

- Other insurance policies

- Insurance claims pending

- Description of any self-insurance programs or captive insurance programs

HR/Employees/Consultants

- List of all employees by title, salary, commission, options, non-cash compensation, bonus, date of hire, severance obligations

- Organization chart

- Employment agreements

- Standard offer letter to employees

- Non-competition and non-solicitation agreements

- Benefit plan summary

- 401(k) plan

- Health and medical plan

- Life insurance plan

- Dental plan

- Retirement plan

- Disability plan

- Vision plan

- Childcare plan

- Other benefit plans

- Employee handbook

- Employee policies not reflected in handbook

- Collective bargaining agreements

- Bonus plans

- Profit-sharing plan

- Incentive plans

- Change in control plans or agreements

- Stock option or restricted stock plan

- Listing of consultants and independent contractors and summary of arrangements

- Consulting and independent contractor agreements

- Severance plans

- Description of any pending or threatened labor or employment disputes or work stoppages during the last three years

Press and PR

- Press releases

- Newspaper articles

- Analyst reviews

What futures hold for online data rooms?

ODR has proven to be a very important tool for the efficient flowing of business over the past decade by serving magnitudes of companies big and large. While the technological world is becoming advanced every day and different sectors find themselves in a tug of war with each other Online Data Room industry is here to stay. As an industry, the market players have also evolved by giving the best feature set to the customers and by the year 2022 the industry is expected to grow to a staggering $1.8 billion.

One needs to stay careful while choosing an ODR by going through 3rd party reviews and negotiating the best prices and plans possible. ODR has so far proved beneficial for their consumers as they save time, cost and space and has improved the efficiency in communication among the parties.

In conclusion, ODR or Online Data Room are cloud computing based more secure servers that can be used by anyone but most importantly used by the likes of the organizations in top 1000 companies and more. They use this service in order to store, access, distribute, download, research the sensitive information about their business that can be shared by them to anyone authorised.

These ODR play an important role in the transactions of Mergers and Acquisition in the phase of Due Diligence as this service significantly cuts down the time involved and the costs by reducing the human element or error and by reducing the personnel involved. There is a healthy amount of competition out there between the vendors but in today’s day and age, we have more data in the digital form that in the print and to make sure that this data does not end up in the wrong hands it is the utmost important responsibility of the corporations to protect it and the vendor’s responsibility to make sure it is secured like fort Knox.

LawSikho has created a telegram group for exchanging legal knowledge, referrals and various opportunities. You can click on this link and join:

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Allow notifications

Allow notifications