This article has been edited by Mansi Bathija and written by Ayushi Yadav, a fourth-year law student from Banasthali Vidhyapith, Rajasthan. In this article, she has discussed the basics of the Indian income tax act of 1961.

Introduction to Income Tax

Tax is the mandatory financial charge demand by the government on pay, product, administrations, exercises or exchange. Taxes are the fundamental modes of income for the government, which are used for the welfare of the general population of the nation through government strategies, arrangements, and practices.

There are references for taxes in ancient writings like Manusmurti and Kautilya Arthashastra. It was initiated in India in 1860 for the first time to defeat the financial crisis of 1857. Accordingly, it is the income tax Act 1961 which is at present operative in India

Constitutional Provisions of Taxes in India

The basis of every legislation in India is rooted in the constitution. As per article 265 of the constitution, no tax must be levied or collected except by the authority of law. There are various other provisions under the constitution that distribute the power.

Entry 82 of List I of Seventh Schedule of the Constitution of India grant power on Parliament to impose taxes on income other than agricultural income. In this way, Income Tax is under the Union list and therefore Central Government is in charge of the collection of income tax.

The Central Government has the authority to collect taxes on income aside from the tax on agricultural income, which is being collected by the State Government. Entry 46 of List II of the Seventh Schedule of the Constitution of India lays down that the State Government has the authority to collect taxes on agricultural income.

Schedule 7

List 1

- Entry 82: Tax on Income other than the agriculture income.

- Entry 83: Duties of customs including the export duties.

- Entry 84: Duties of excise on tobacco and other goods manufactured or produced in India except for alcoholic liquors for human consumption, opium, narcotic drugs, but including medicinal and toilet preparations containing alcoholic liquor, opium or narcotics.

- Entry 85 – Corporation tax

- Entry 92A: Taxes on sale or purchase of goods other than newspapers, where such sale or purchase takes place in the course of interstate trade or commerce.

- Entry 92B – Taxes on consignment of the goods where such consignment takes place during Inter-State trade or commerce.

- Entry 92C – Taxes on services

- Entry 97 – Any other matter which is not included in List II, List III and any tax not mentioned in List II or List III.

List 2

- Entry 46 – Taxes on agricultural income.

- Entry 51 – Excise duty on all alcoholic liquors, opium and narcotics.

- Entry 52 – Tax on entry of the goods into a local area for consumption, use or sale therein (usually termed as Octroi or Entry Tax).

- Entry 54 – Tax on sale or purchase of goods other than newspapers except for tax on interstate sale or purchase.

- Entry 55 – Tax on advertisements except advertisements in newspapers.

- Entry 56 – Tax on goods and passengers that are carried by road transport or inland waterways.

- Entry 59 – Tax on professionals, trades, callings, and employment.

Need for Income Tax in India

Income tax is a tax on the income of an individual or an entity. Income tax is the main source of income for the government to carry out its functions. The jobs of government are not just restricted to defense, law, and order, etc., but it also has to undertake activities like welfare and development under sectors of health, education, rural development, etc. the government also has to pay for its own administration. All of these activities need huge public finance which is raised by the collection of taxes.

Purpose of Taxation

- The money spent on the development of roads, schools, and hospitals, market regulations or legal systems, etc. is raised by the revenue generated by the collection of taxes

- Redistribution of resources by the richer section to the poorer section of the society.

- Taxes are levied on certain products to eliminate externalities such as the taxes on tobacco to discourage smoking

Taxes are broadly divided into two categories- Direct and Indirect taxes.

Income tax is a direct tax imposed on an individual. Estate and wealth tax were also direct taxes, however, these are abolished now

Indirect taxes that were imposed in India are customs duty, central excise duty, service tax, sales tax, and value-added tax.

As of now GST has been implemented and has made all the other indirect taxes obsolete.

Important Terms and Definitions under The Income Tax Act, 1961

Assessment year and previous year

As per Section 2(9) of the Income Tax Act, 1961, states that assessment year means the 12 month period beginning on the 1st day of April every year. The assessee is required to file the income tax return of the previous year in the assessment year. As per S.2(34) of Income Tax Act, 1961, unless the context otherwise requires, the term “previous year” means the previous year as defined in section 3.

As per Section.3 of Income Tax Act, 1961, the term “previous year” means the financial year immediately preceding the assessment year

Say, for example, the year starting from 1st April 2018 and ending on 31st March 2019 is the assessment year 2018-19, the previous year would be 2017-18. The rates of assessment year are taken into consideration.

Who is a person under income tax?

A person is defined under section 2(31) of the act. The term ‘person’ includes –

- An individual.

- A Hindu Undivided Family.

- A Company.

- A Firm.

- An association of persons or body of individuals whether incorporated or not;

- A local authority; and

- Every artificial judicial; person not falling within any of the preceding

Who is an Assessee

Any individual who has income earned or losses incurred, and is liable to pay taxes on these to the government in a particular assessment year, is an assessee.

Categories of the assessee –

1. Normal Assessee

- a person against whom proceedings are going on under the Income Tax Act, despite the fact that any tax or other amount is payable by him or not;

- a person who has undergone loss and filed a return of loss u/s 139(3);

- a person by whom some amount of interest or tax or penalty is payable under the income tax Act;

- any person who is entitled to refund of tax under this Act.

2. Representative Assessee

- A person may not be liable for his own income or loss but he might also be liable for the income or loss of other persons say for example agent of a non-resident, guardian of a minor or a lunatic person, etc. In such cases, the person responsible for the assessment of the income of such a person is called representative assessee. Such a person is deemed to be an assessee.

3. Deemed Assessee

- In the case of a deceased person who has died after writing down his will, the administrators of the property of the deceased are deemed as assessee.

- In case if a person dies intestate (without writing down his will) the eldest son or other legal heirs of the deceased person are deemed as assessee.

- In case a minor, lunatic or an idiot person has income taxable under the Income Tax Act, their guardian is deemed to be an assessee.

- In case a non-resident has income in India, any person acting on his behalf is deemed as an assessee.

4. Assessee-in-default

- A person is deemed as an assessee-in-default if he fails to fulfill his statutory obligations. In case an employer is paying a salary or a person who is paying interest, it is their duty to deduct TDS and deposit the amount of tax so collected in Government treasury. If he fails to deduct TDS or deducts tax but does not deposit it in the treasury, he is known as assessee-in-default.

Concept of income

The Income Tax Act does not define the term Income but section 2 (24) of the Act describes the various receipts which are included under the ambit of income.

- Profits and gains.

- Dividends

- Voluntary contributions received by a charitable trusts

- The value of any perquisite or profit in lieu of salary.

- Any capital gains.

- Any winnings from lotteries,

- Crossword puzzles etc.

Charging section

- Section 4 of the Income-Tax Act, 1961 is the Charging section of the Act

Accordingly, the section provides that :

- The rates are prescribed under the finance act of every assessment year. Income tax for the previous year is to be charged according to the given rates.

- The taxable income is that of the previous year not the assessment year

- The total income, computed according to the provisions of the act, is leviable

- Tds or advance tax wherever applicable is to be charged

Heads of income

Income is classified under 5 main heads under section 14 of the act

- Income from salary

- Income from house property

- Income from capital gains

- Profit and gains from business and profession

- Other sources of income

Agricultural income

Agricultural income is any rent or revenue by means of cash or in-kind, derived from a land, which is used for an agricultural purpose and land should be situated in India.

Income from agricultural should be produced by a cultivator or a rent receiver of that produce in-kind, which can be fit to take that into the market.

The income should be derived from the sale by a cultivator or a rent receiver of that product which is produced or received by him, no process can be performed other than the process to render it fit for the market. You can read more about agricultural income here.

Income deemed to accrue or arise in India

The income of a non-resident person or a foreign company is only taxable to the extent it arose in India. However, under section 9 of the income tax act, other provisions lay down the criteria as to why certain incomes are deemed to accrue in India even though they might actually arise out of India.

Business connections – the term business connections has not been defined in the act but various judgments and circulars have emphasized on the meaning of it.

As per the circular no. 23 of the income tax. Examples of non-resident having business connections in India have been given-

- Branch office in India

- Agent appointed for sale of goods for a non-resident.

- Forming a subsidiary company, of a non-resident parent company, in India

- Establish a factory in India to process the raw materials and the final product is then exported.

- Financial relations between resident and non-resident company

Residential status

The taxation laws classify taxable persons under three categories

- Resident person

- Resident not ordinarily resident

- Non-resident

Resident person –

There are various tests to determine the residential status of a person

Test 1 – If the person is residing in India for 182 days, not necessarily at a stretch, in the preceding previous year, he is said to be a resident of India.

Test 2 – If the person is residing in India for 365 days or more in the previous 4 years and 60 days in the immediately previous year, he is said to be a resident.

Resident not ordinary resident –

An individual is not an ordinary resident if

Test 1 – he has not resided in India for 9 out of the 10 previous years preceding that year

Test 2 – if the individual has not resided for 729 days or more in India in the 7 previous years

Test 3 – a Hindu undivided family whose manager has fulfilled above conditions

Let’s understand this with an example

Question. Mr. John, a foreigner came to India for the first time in 2014 and settled here. He wants to file his income tax return for the assessment year 2015-16 and 2016-17. Determine his residential status for the said two years.

Answer. For the assessment year 2015-16, the previous year is 2014-15

For the previous year 2014-15, he is a resident, because, in the year ending 31st March 2014, he has stayed in India for more than 182 days.

For the previous year 2015-16, he is a resident for he has stayed in India for more than 182 days in the year ending 31st March 2016

For the previous years 2014-15 and 2015-16, he is not an ordinary resident because he is non-resident India for 9 out of 10 previous years preceding previous years and he has not resided in India for 730 or more days during 7 preceding previous years.

Residential status of a company

As per section 6(3) of the income tax act, a company is said to be a resident of India if either of the following conditions is fulfilled-

- If the company is an Indian company, or

- If the place of effective management, for that year, is in India.

Place of effective meaning is the place where all the important key managerial and commercial decisions for the conduct of business are made.

What is Payroll Tax

Payroll taxes are Medicare and social security taxes, employers withhold half of these taxes from employee’s wages. Medicare taxes are a contribution to medical benefits for the person above the age of 65. Social security taxes are for the benefits of the retired person or disabled person or for their dependents. These two taxes are called as FICA tax, i.e., Federal Insurance Contribution Act Tax, which is defined by Internal Revenue Service. These taxes are paid to the Federal or State authority.

If a person is self-employed then he doesn’t need to pay FICA tax, but a Self-employed Tax needs to be pay by him.

FICA Tax rate is equal for employers and employees. Self-employed tax rates are different from FICA tax rates.

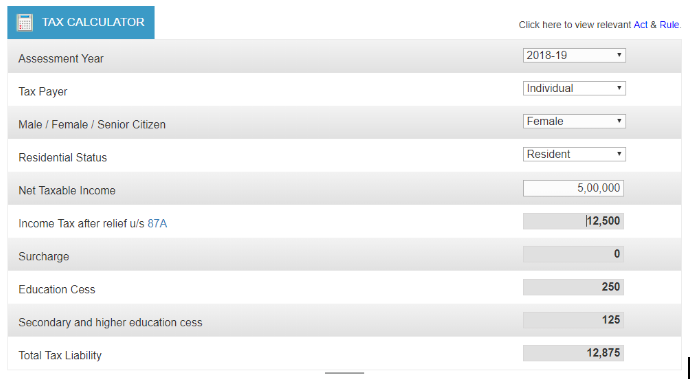

Income Tax Calculator

The income tax calculator is available for quick and easy access to basic tax calculation for the public. It does not assure the taxpayer for an exact payable tax. Some basic details have been provided to the calculator.

In the above image, as per details are given to the calculator total tax liability of a female individual is Rs. 12,875.

Income Tax Form 16

Form 16 is a Tax Deduction at Source Certificate issued by the Income Tax Department for the tax deduction of an employee by the employer on their behalf. It is a mandatory certificate for the taxpayers. This deduction can be reimbursed by the employee later. This form contains details of the transaction between the deductor and the deductee. The certificate must be issued immediately after the Financial Year or before the 15 June of the next year. TDS certificate should be issued every year.

Form 16 contains two parts – Part A and part B.

Part A – Part A of Form 16 contains :

- Name, TAN & PAN and address of the employer;

- Name, PAN card and address of the employee;

- Details of tax deducted and deposited quarterly with the government;

- Assessment Year for which TDS certificate issued;

- The time period of the employment;

- TDS payment acknowledgment number.

If an employee changes his employment during one financial year, then the employer will issue different Part A of Form 16.

Part B – Part B is the annexure of Part A which contains details in regards to the computation of taxable income, this Form will attach along with Part A of Form 16 and if the employer has more than one job in any Financial Year than he has to attach more than one Form. Part B has components:

- Detailed salary and deduction under any scheme or policy;

- Deduction under chapter 6A of the Act;

- Educational cess and surcharge, if any;

- All the financial details of both the jobs.

Income Tax Return Definition

As per the Black Law Dictionary (9th Edition) An Income Tax form on which a person or entity reports income, deductions, and exemptions and on which tax liability is calculated.

Income Tax Return (ITR) is a statement of tax and income, which an individual files to inform the government that how much income he has earned in a financial year. ITR should be filed before the last date, i.e., 31st July. There are different ITR form filed by an individual as per their applicability, and the eligibility of a person is mentioned in the form. There is a total of seven ITR forms which we will discuss one by one.

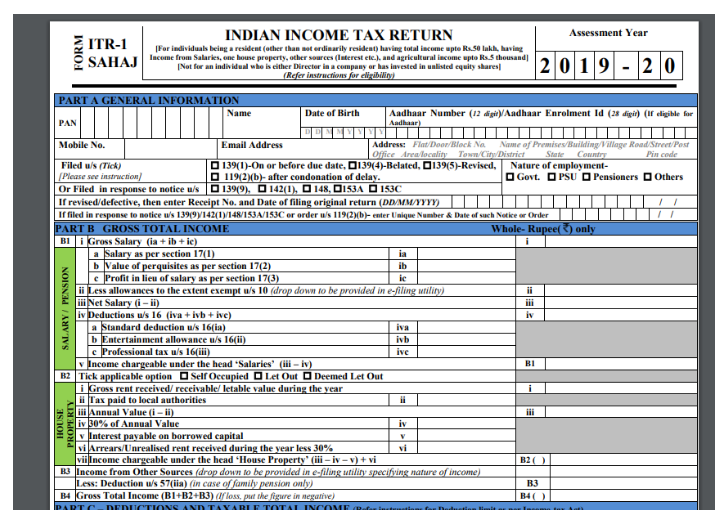

- ITR-1. Any individual or a member of HUF can file this ITR form, where income earned from salary/pension from an ordinarily resident person, income or loss from One House Property, family pension for ordinarily resident people or any other sources.

This form is divided into five parts, i.e., Part -A, Part-B, Part-C, Part-D, and Part-E, which requires some details in terms of income.

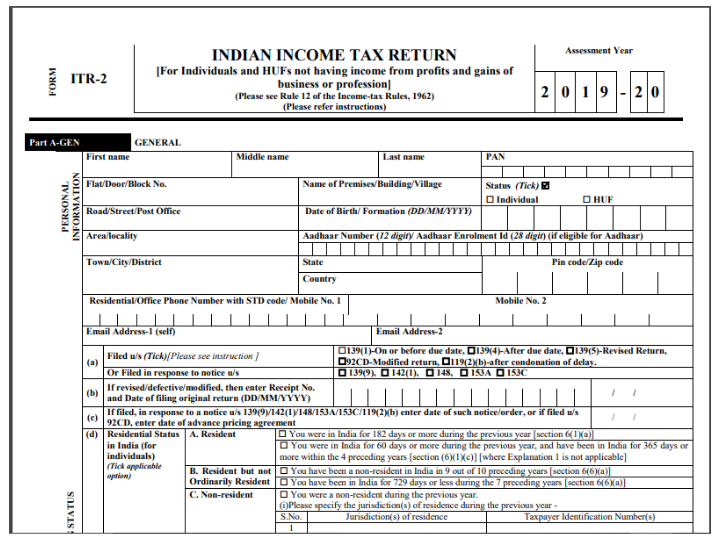

- ITR-2. This form can be filed where income earned from salary/pension whether ordinarily resident or not ordinarily resident and non-resident people, an individual who is the director of any company, income or loss from One House Property or more than One House Property, income from capital gains or loss on the sale of investment or property, unlisted equity shares, family pension whether for ordinarily resident person or not ordinarily person and non-resident people, income from other sources, dividend income taxable under section 115BBDA exceeding Rs. 10 lakh, unexplained income under section 115BBE, person claiming deduction under section 57 under the heads of “other sources”, deduction under Section 80QQB or 80RRB, total income exceeding Rs.50 lakhs, agricultural income exceeding Rs. 5,000, tax under Section 90, 90A, or 91, TDS credit relating to self/other people as per section 5A and income from foreign sources.

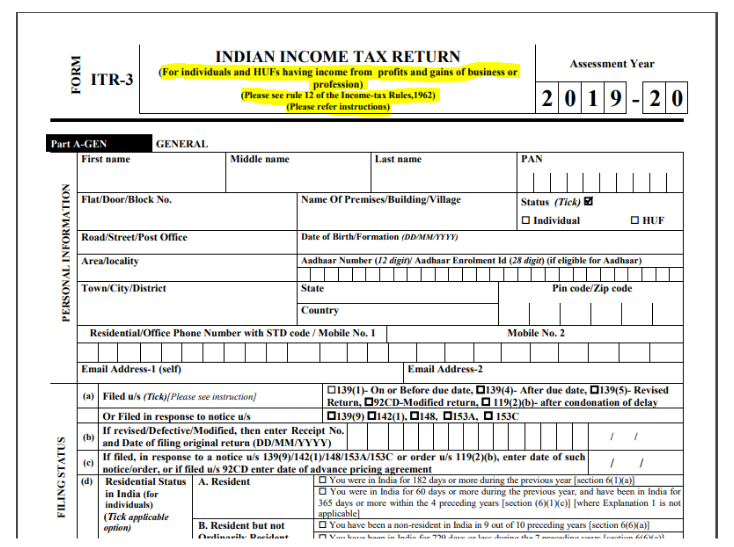

- ITR-3. All the income sources mentioned in ITR-2 including income from business or profession, computation of presumptive income from business or profession covered under Section 44AD, 44ADA, and 44AE from not ordinarily resident and non-resident person, and deduction in respect of units located in Special Economic Zone under Section 10AA.

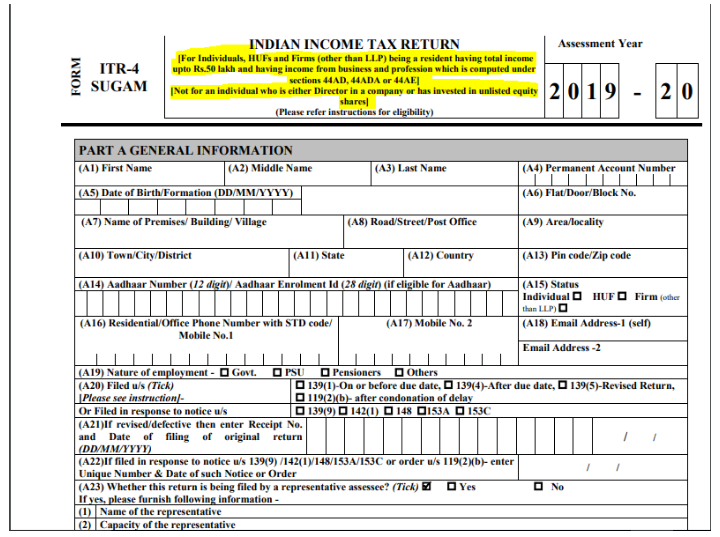

- ITR-4. This form is filed by an individual or HUF and other Assesses. In the case of Individual or HUF, income which is explained under ITR-1 including income under Section 44AD, 44ADA, and 44AE from a person resident in India in respect of presumptive business or profession. In the case of other assessees, firm excluding LLPs computation of income under section 44AD, 44ADA, and 44AE.

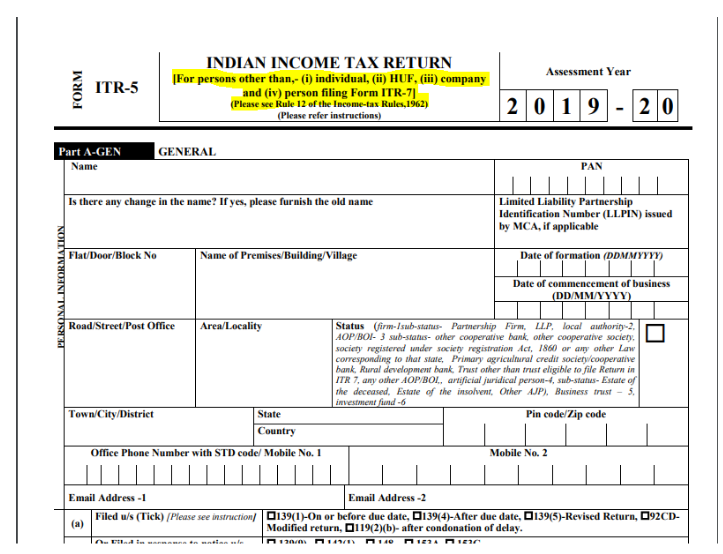

- ITR-5. ITR-5 is filed by other Assesses for firms including LLPs, Association of Persons, Body of Individuals, Local Authority, Artificial Juridical Person, Business trust and investment fund as referred under Sec. 115UB.

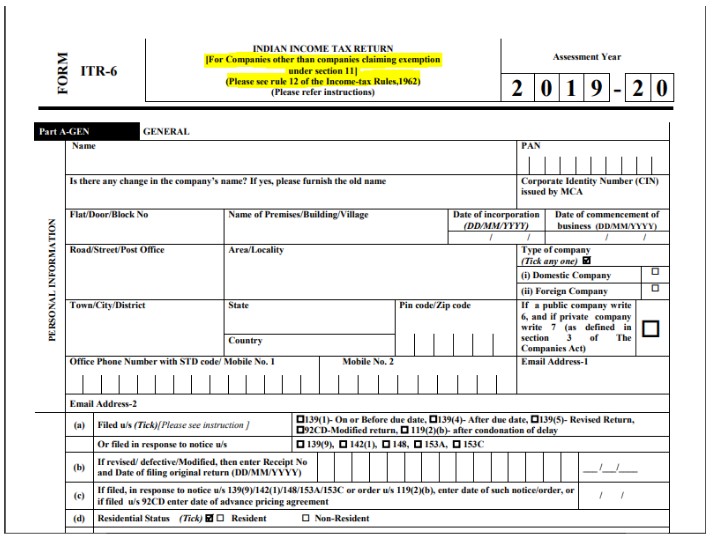

- ITR-6. ITR-6 is for companies other than companies claiming under section 11.

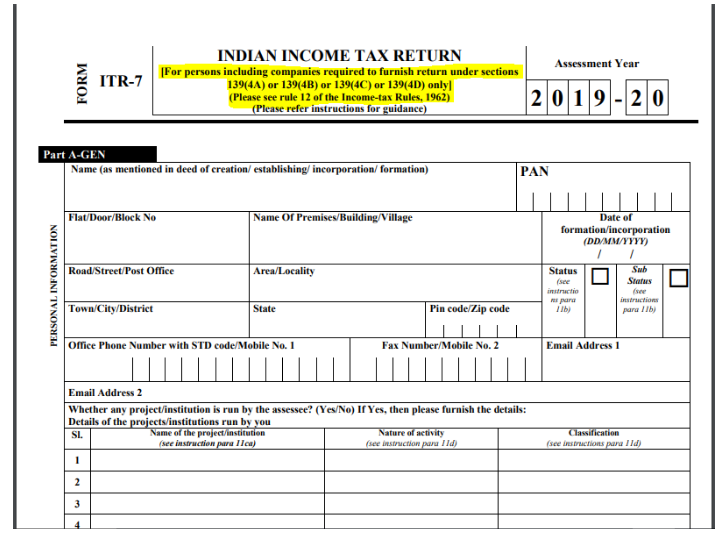

- ITR-7. This form is for persons including companies under section 139(4A), 139(4B), 139(4C), and 139(4D) in respect of furnish return.

Income Tax Slab

Income Tax rates divide into four slabs, i.e., 0%, 5%, 20% and 30%.

|

Age of the individual |

Tax rate Slab applicable |

Limit on Income |

|

Below 60 Years |

NIL 5% 12,500 + 20% of total income 1,12,500 +30% of total income |

Upto rs.2,50,000 2,50,001 to 5,00,000 5,00,001 to 10,00,000 Above rs.10,00,000 |

|

60-80 Years |

NIL 5% 10,000 + 20% of total income 1,10,000 + 30% of total income |

Upto rs.3,00,000 3,00,001 to 5,00,000 5,00,001 to 10,00,000 Above rs.10,00,000 |

|

Above 80 Years |

NIL 20% 1,00,000 + 30% of total income |

Upto rs.5,00,000 5,00,001 to 10,00,000 Above rs.10,00,000 |

As per this slab, an individual is liable to pay taxes or tax deducted from their salary.

Corporate Income Tax

Corporate income tax is levied by the government on the profits of the companies. The tax rate paid by companies varies every year by the Income Tax Department. There are two types of Company explained under the Income Tax, i.e., Domestic Company and Foreign Company.

Domestic Company.- Domestic Companies are those which are registered under the Companies Act of India. A company can be a Public Company or a Private Company. I also include those companies which are situated or registered outside India but having control and management completely in India.

Foreign Company.- Foreign Companies are those which are not registered under the Companies Act of India and having control and management completely outside India.

Now, under Corporate Income Tax these both companies are liable to pay taxes. In the case of Domestic Company, tax is levied on universal income but for Foreign companies, only that income is taxable which is earned within India.

Income earned from the Company included-

- Profit earned by the business;

- Capital gains from sale;

- Income from renting property;

- Income from other sources.

Income Tax Rate of the company depends on the turnover of the company during the Financial Year.

Income Tax Return form file by a company is ITR-6 and ITR-7. As per Income Tax, requirement companies have to audit their accounts and submit it along with ITR form. This audit is known as Tax Audit.

Conclusion

Tax is a mandatory charge levied on a person by the government, as we have discussed what taxes are paid by a person and how he can calculate his payable tax. There are a number of Provisions provided under law for taxpayers as per their requirements. The government has provided various forms to pay income tax whether a person is an individual or HUF or a company or he is an ordinary resident or non-ordinary or non-resident person, as per their applicability they can file income tax.

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Allow notifications

Allow notifications