This article is written by Dreamy Jain, pursuing a Certificate Course in Capital Markets, Securities Laws, Insider Trading and SEBI Litigation from Lawsikho.com.

Table of Contents

Introduction

Securities and Exchange Board of India (SEBI) has been formed to protect the interest of investors in securities and regulate the securities market in India. SEBI acts as a watchdog and endeavours to safeguard the interests of investors by continuously regulating the listed companies and other securities in the capital market in India. SEBI also acts as a grievance redressal forum for the investors and for enabling such mechanism it has introduced a full- fledged platform to address the complaints of investors known as the SEBI Complaints Redress System (SCORES) on June 3, 2011. The main objective behind formation of SCORES by SEBI was to redress the grievances of investors which were left unsolved even after directly approaching the respective listed companies or intermediaries registered with SEBI. Being an online platform, SCORES also provides speedy redressal of grievances and since it is regulated by SEBI, the companies and intermediaries are under an obligation to address investor complaints and issues so registered on SCORES.

When do you file a complaint on SCORES?

Whenever an investor has a complaint with regard to the issues which are covered under SEBI Act, Securities Contract Regulation Act, Depositories Act and rules and regulation made thereunder and relevant provisions of Companies Act, 2013, the complaint can be made through SCORES. The complaint can be filed against a Listed entity, or a SEBI registered intermediary. The following are the SEBI registered intermediaries against whom a complaint can be filed on SCORES:

- Stockbroker/Authorized agent and Stock Exchange

- Debenture trustees

- Depository and Depository participant

- Mutual funds

- Registrar to an issue/ share transfer agent

- Banker to an issue

- Merchant bankers

- Portfolio managers

- Collective investment schemes

- Custodian of securities

- KRA registration agency

- Credit rating agency

- Investment Advisers etc.

The following are the type of complaints which do not come under the purview of SEBI’s SCORES:

- Complaint not pertaining to investment in the securities market.

- Anonymous Complaints (except whistleblower complaints).

- Incomplete or un-specific complaints.

- Allegations without supporting documents.

- Suggestions or seeking guidance/explanation.

- Not satisfied with the trading price of the shares of the companies.

- Non-listing of shares of private offer.

- Disputes arising out of private agreement with companies/intermediaries.

- Matter involving fake/forged documents.

- Complaints on matters not in SEBI purview.

- Complaints about any unregistered/ un-regulated activity.

The following are the complaints which shall not be covered by SCORES even though they are related to a listed entity or SEBI registered intermediary:

- Complaints against the companies which are unlisted/delisted, placed on the Dissemination Board of Stock Exchange.

- Complaints against a sick company or a company where a moratorium order is passed in winding up / insolvency proceedings.

- Complaints against the companies where the name of the company is struck off from Registrar of Companies (RoC) or a Vanishing Company as per list published by Ministry of Corporate Affairs (MCA).

- Suspended companies, companies under liquidation, BIFR etc.

- Complaints that are sub-judice i.e. relating to cases which are under consideration by court of law, quasi-judicial proceedings etc.

- Complaints against companies, falling under the purview of other regulatory bodies viz. The Reserve Bank of India (RBI), The Insurance Regulatory and Development Authority of India (IRDAI), the Pension Funds Regulatory and Development Authority (PFRDA), Competition Commission of India (CCI), etc., or under the purview of other ministries viz., MCA, etc.

Who can file a complaint?

Any investor who is aggrieved by a listed company or a SEBI registered intermediary can lodge a complaint against such concern through SCORES or such investor can also file a physical complaint with the investor cell of the concerned stock exchange but such physical complaints will be digitised and will be uploaded on SCORES. With effect from 1st August, 2018, all investors are encouraged to first approach the concerned listed entity or SEBI registered intermediary with their grievances, which are expected to resolve within a reasonable period of time by such concern. The investor can also approach the concerned listed entity or SEBI registered intermediary through SCORES.

How can a complaint be filed?

After 1st August, 2018, an investor is required to mandatorily register on SCORES for filing his complaint. The registration is available on “Investor Corner” appearing on the homepage of SCORES portal and details such as Name, Address, E-mail Address, PAN and Mobile Number are mandatory fields and are required to be filled in by the investor to register. Once registration is completed, the investor has to select the name of the entity, the nature of his complaint and a brief about their complaint along with supporting documents. Once the complaint is submitted, the acknowledgement will be sent to the registered email ID and phone number and the investor will be provided a unique registration number which can be referred by the investor to track their complaints.

It is worthy to note that from 1st August, 2018, if the complainant has not approached the listed entity or SEBI registered intermediary directly before lodging a complaint on SCORES, the complaint will automatically be directed to the concerned entity or intermediary and they will be given 30 days’ period to resolve the issue so raised in the complaint. If the entity or intermediary fails to respond to the complaint, such complaints shall be forwarded to Designated Stock Exchange (DSE) through SCORES and a new SCORES registration number will be provided to the investor. If the investor receives a response but he is not satisfied with the redressal, such investor can indicate the same on SCORES within 15 days and the complaint will be routed to SEBI for redressal. Once the complaint is registered with SEBI, the complaint is then forwarded to the concerned entity with an advice that the investor should be given a written reply and Action Taken Report (ATR) must be filed on SCORES.

It is worthy to note that from 1st August, 2018, if the complainant has not approached the listed entity or SEBI registered intermediary directly before lodging a complaint on SCORES, the complaint will automatically be directed to the concerned entity or intermediary and they will be given 30 days’ period to resolve the issue so raised in the complaint. If the entity or intermediary fails to respond to the complaint, such complaints shall be forwarded to Designated Stock Exchange (DSE) through SCORES and a new SCORES registration number will be provided to the investor. If the investor receives a response but he is not satisfied with the redressal, such investor can indicate the same on SCORES within 15 days and the complaint will be routed to SEBI for redressal. Once the complaint is registered with SEBI, the complaint is then forwarded to the concerned entity with an advice that the investor should be given a written reply and Action Taken Report (ATR) must be filed on SCORES.

Details for lodging a complaint with SCORES:

- Name of the complainant*

- Pan Number*

- Aadhaar Number (Optional)

- CKYC ID (Optional)

- DP id & Client Id

- Postal address for communication*

- Contact number – Mobile*, Landline

- Email id* – For receipt of acknowledgement letter/ updates of complaints on SCORES

- Bank account details – To facilitate direct credit of benefits to investors

- Client id as given by Broker / Stock Exchange

Note: * are mandatory fields.

Documents required for lodging a complaint with SCORES

- Copy of agreements,

- Application forms,

- Bank account statements,

- Contract notes,

- Emails, fax and other correspondences.

Limitation of time for filing Complaint with SEBI

An investor can file a complaint within 3 years from the date of cause of complaint w.e.f. 1st August, 2018 where:

- Investor has approached the concerned listed company or SEBI registered intermediary directly but:

- The listed company or SEBI registered intermediary has rejected the complaint or

- The investor has not received any response from the listed company or SEBI registered intermediary or

- The investor is not satisfied with the response or redressal so given to him.

After the lapse of the above said period of 3 years, if the investor has not lodged a complaint, such investor will nevertheless have a remedy to file the complaint to the concerned entity or may approach the appropriate court of law.

Regulation dealing with SCORES

Pursuant to Regulation 13 of Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015, SEBI on September 02, 2015 has laid down additional provisions for ensuring adequate redressal mechanism in listed entities which is reiterated as below:

“Grievance Redressal Mechanism

- (1) The listed entity shall ensure that adequate steps are taken for expeditious redressal of investor complaints.

(2) The listed entity shall ensure that it is registered on the SCORES platform or such other electronic platform or system of the Board as shall be mandated from time to time, in order to handle investor complaints electronically in the manner specified by the Board.

(3) The listed entity shall file with the recognised stock exchange(s) on a quarterly basis, within twenty-one days from the end of each quarter, a statement giving the number of investor complaints pending at the beginning of the quarter, those received during the quarter, disposed of during the quarter and those remaining unresolved at the end of the quarter.

(4) The statement as specified in sub-regulation (3) shall be placed, on quarterly basis, before the board of directors of the listed entity”.

Timeline for resolving the complaint

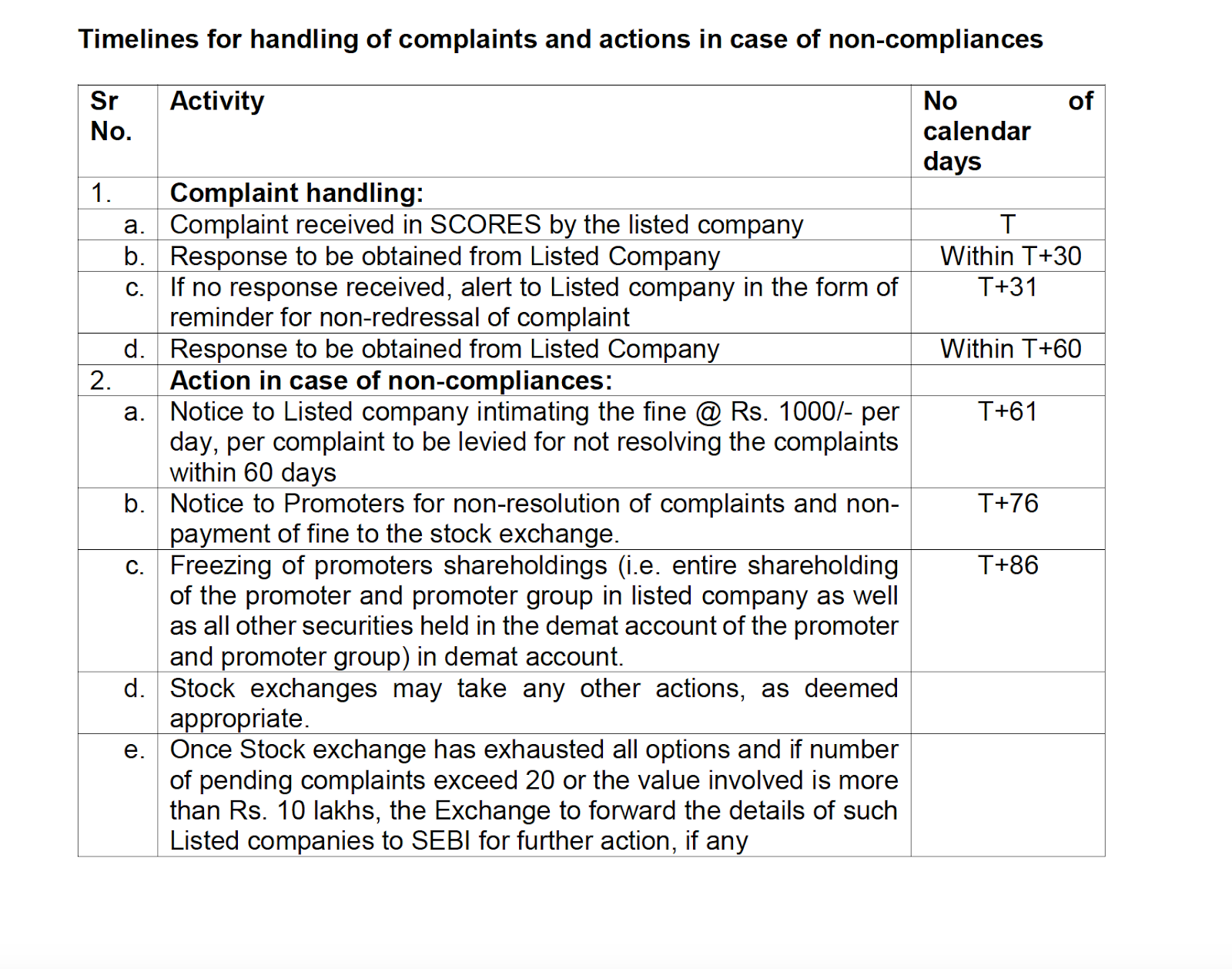

SEBI has passed circulars pertaining to SCORES from time to time and the most recent circular in this regard is dated 13th August, 2020 being circular number SEBI/HO/OIAE/IGRD/CIR/P/2020/152. As per the recent circular, a timeline has been provided by SEBI within which a complaint need to be resolved failing which, penalty of Rs. 1000/- per day shall be levied on the concerned Listed company apart from the freezing of shareholding as mentioned below and appropriate actions which SEBI deems fit.

Once the investor has approached the concerned listed company or registered SEBI intermediary and have not received a reply from such concern, the investor’s complaint will be registered on SCORES and it will be directed to the Designated Stock Exchange who shall be taking up the complaint with the company and will be advised to resolve the grievance and file an Action Taken Report (ATR) within 30 days from the receipt of the complaint. If the complaint is not resolved within 30 days, a reminder shall be given to the company to resolve the complaint. A maximum of 60 days is given to a company to resolve a complaint so registered on SCORES, failing which SEBI shall take action for non compliances as per the above mentioned chart.

Recent changes by SEBI

SEBI has launched SEBI SCORES mobile app in March, 2020 to encourage investors to file complaints online, rather than sending physical complaints to SEBI. The mobile application will facilitate ease of doing business and investors can keep a track of their complaint from their smartphones. The Mobile App SEBI SCORES is available on both iOS and Android platforms.

Conclusion

It will be interesting to note that SEBI has received 40,000 complaints every year since the launch of SCORES on 11th June, 2011 and has resolved 3,75,000 approximately of such complaints through SCORES portal. SEBI as a securities and capital market regulator are trying their best to keep the market regulated and are proactively working towards speedy redressal of grievances to keep the trust of investors intact.

Students of Lawsikho courses regularly produce writing assignments and work on practical exercises as a part of their coursework and develop themselves in real-life practical skill.

LawSikho has created a telegram group for exchanging legal knowledge, referrals and various opportunities. You can click on this link and join:

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Allow notifications

Allow notifications