This article is written by Simhadri Bharadwaja, a student from Nalsar Law University, Hyderabad. This article explains the current legal stance on mistake of identity in contracts.

Table of Contents

Introduction

Section 19 of the Indian Contracts Act, 1872, specifies that for a number of purposes, a contract can be voidable which also includes misrepresentation and fraud. The English Contract law also takes a similar stance. Despite the law stating it that way, there have been numerous contradictory judgements in this area of law especially in the mistake of identity concept.

In the opinion of A.L.Goodhart, a renowned jurist and lawyer, mistake in contracts is the most intricate and perplexing part of contract law. Especially the mistake of identity of one of the contracting parties is full of contradictory judgements and has two equally strong arguments. Despite the fact that numerous cases have arisen with this as the central issue, the law of this issue is still uncertain and has not been settled yet.

One of the essential ingredients of a contract is consensus ad idem that is both the parties agreeing to the same thing in the same sense while entering into a contract. But what should be the validity of a contract if one party fraudulently misrepresented himself and induced the other party to give consent. This topic has been very controversial and various courts have given conflicting judgements. In this paper I have shown which parties interest the court should protect but before that, I would like to give an illustration as to how mistake in a contract occurs.

The most common way that mistake of identity occurs is when a person fraudulently misrepresents him to be someone else, especially a famous or a rich person, and convinces the seller to sell him the goods for a cheque. By the time the seller realizes that the cheque is worthless the fraud would have sold the goods to a third party bona fide buyer and have absconded. Then the initial seller would sue the third party bona fide buyer for the good or its value.

The courts are then left with an elusive question of whether the initial contract was void or voidable. The courts are left with a choice of either protecting the interest of the seller who was frauded or the rights of the third party buyer who acted in complete good faith. The court can protect the interest of only one party and the other party is left without a remedy. In this article, I have shown which parties interest the court should protect but before that, I would like to give an illustration as to how mistake in a contract occurs.

If the court holds the initial contract with the fraud to be void then the title of goods never passed to fraud and hence he could not have transferred the right to another person. In this scenario the bona fide buyer is left without a remedy. However, if the court decides to hold the initial contract voidable then the second contract where the bona fide buyer purchases the goods from the fraud will be valid and transfer of tile takes place unless the initial seller voids the contract he entered into with the fraud.

After going through various case laws and giving it a thorough consideration I have come to the conclusion that the contract should be declared void and not voidable. I have properly elucidated this opinion in my research paper with numerous judgements to support my claim.

Cases where mistake of identity was held voidable

In the case of Phillips v. Brooks a fraudster named North entered Mr.Phillips jewellery shop and claimed to be one Sir George Bullough. He selected a few pearls and a ring worth $3000 and paid with a cheque. He requested the seller to allow him to take the ring with him immediately since it was his wife’s birthday the coming day.

He also promised to come back and pay for the pearls once the cheque cleared. He cited the address of Sir George Bullough. Having found that the name matched with the address in the directory the seller departed with the ring even before the cheque cleared. Later on the cheque proved to be worthless. By then the fraudster had sold the ring to a bona fide buyer named Brooks and absconded. The shop owner subsequently sued Mr.Brooks.

The court, in this case, held that despite there being a fraudulent misrepresentation the plaintiff clearly intended to contract with the person present before him. It was held that there was a meeting of the minds, the terms of the sale were agreed upon, the thing sold, the price, time of payment was agreed upon, essentially all the requirements of a valid contract were satisfied and the court, therefore, held the contract to be voidable and not void. The court decided to protect the interests of the bona fide third party who was completely unaware of the fraud. A similar judgement was given in the case of the Citibank N.A, v. Brown Shipley & Co Ltd.

In a similar case of Lewis v. Averay, the complainant Mr. Lewis put his car up for sale. He met with a person who fraudulently misrepresented himself as a famous actor known as Richard Green. Both the parties agreed to a certain price and the fraudster wanted to pay by cheque. Mr. Lewis then requested proof of identity before taking the cheque.

The fraudster then produced a special pass to the Pinewood film studio which had the fraudster’s photograph and the official stamp. This persuaded Mr. Lewis to depart with his car for a cheque. The fraudster sold the car to an innocent third party and absconded. During this time the cheque bounced and Mr. Lewis the initial owner of the car sued the third party innocent buyer Mr. Averay.

The court held that when the parties are face to face the presumption is that the contract is made with the person present even though there is fraudulent impersonation by the buyer. The same approach was taken by dissenting judges in the case of Ingram v. Little. The court also decided that it would be wrong if the third party innocent buyer who knew nothing about how the goods were procured by the fraudster was either asked to return the goods or pay damages and protected his interests.

Cases where mistake of identity was held void

On the other side, there is an equally strong argument as to why a contract which has been entered by mistake of identity is void. Courts have held in several cases where a trickster fraudulently misrepresented himself and made the owner transfer the title that the seller never intended to sell it to the person present in front of them but intended to sell it to the person who the fraudster claimed himself to be.

In Cundy v. Lindsay, the plaintiff-seller received correspondence for the sale of Lenin handkerchiefs from a fraudulent man known as Blenkarn. The correspondence papers showed the address of the firm asking for the order to be ‘Blenkarn & Co,37 Wood Street’. There was a highly reputed firm on the same street known as Blenkiron &Co. Believing the large order to have come from this firm the plaintiffs delivered the handkerchiefs to Blenkarn. Blenkarn the fraud having received the handkerchiefs sold them to a bona fide buyer, Cundy, who was completely unaware of the fraud.

The court, in this case, held that the plaintiff’s intention was to sell the goods to Blenkiron & Co and not to Blenkarn the fraud. Thus no meeting of minds took place which is a crucial element of every contract. Since no contract was formed between the plaintiff and Blenkarn due to lack of meeting of minds there was never a valid transfer of title to Blenkarn and subsequently no valid transfer of title to the defendant Cundy. Thus the court held for the plaintiff and held the contract void and not voidable. Cundy was asked by the court to return the goods.

In Ingram v. Little, The plaintiffs were the joint owners of a car and they put the car up for sale. A fraudster offered to purchase the car with a cheque. As soon as he pulled out the cheque the plaintiffs refused to accept the cheque and took back their offer. The fraudster by using the tricks of his trade persuaded the plaintiffs into believing that he was a successful businessman named Hutchinson and gave an address and a phone number. The plaintiffs verified the given information at a post office which was 2 minutes down the lane and were convinced that he was indeed Mr. Hutchinson. Then they transferred the car to the fraudster for the cheque. The cheque proved to be worthless and by then the fraudster sold the car off to a bona fide third party known as Mr. Little. Subsequently, the plaintiffs sued Mr. Little for the car or its value.

The court in this case held in a similar fashion to that of the court in Cundy v. Lindsay. It was held that the plaintiffs intended to sell the car only to Mr.Hutchinson and not the person in their presence. The plaintiff made the offer only to Mr.Hutchinson and hence could only be accepted by him. As far as the fraudster was concerned no deal was offered to him and subsequently there can be no contract with him. The contract was held to be void for mistake of identity.

The only circumstance in which a mistake of identity can invariably void the contract is when the identity of the party is of paramount importance to the contract. In Said v. Butt, the plaintiff knew very well that due to his harsh criticism of several members of the theatre that he would be refused the purchase of a ticket. So he asked his friends to purchase the ticket without revealing that it was for him. But the managing director of the theatre refused entry on the night of the show. The plaintiff then sued for breach of contract. The court held that the identity of the person was a material element for the contract and hence the non-disclosure of that fact that the ticket was purchased for the plaintiff made the contract void.

In a similar Indian case of Jaggan Nath v. Secretary of State for India, a person named S represented himself as his brother. The government intended to contract only with S’s brother and S was fully aware of this. S deceived the government and procured the contract. Later when challenged the court held that since the identity of S’s brother formed the subject matter of the contract with S could be held voided.

Rise of Caveat Venditor

Caveat Emptor principle best explains the attitude of law towards a buyer until the early twentieth century (1903). Caveat emptor is Latin for “Let the buyer beware”.This doctrine states that a buyer must use his own judgement and skill before purchasing something. The fundamental theory behind this doctrine was that once a buyer is satisfied with the sustainability of the product he will subsequently have no right to refuse the product.

When Caveat Emptor principle came into being it was very stiff and rigid. This is abundantly clear from the English Sale of Goods Act 1893, since the seller had very minimal obligation when it came to the disclosure of information about the product. Buyers examination of the product was deemed to be above and beyond any obligation on the seller to provide information.

When the rule of Caveat Emptor was initially adopted it was present in its absolute form. This was later regarded as counterproductive to the growth of commerce and trade due to the absence of a very important element, which was later adopted through various statutes and case laws, that is the reasonable examination element.

For instance if in a sale transaction when caveat emptor is applied in its absolute form and the seller was fully conscious of the latent defects in the product and yet did not disclose it to the buyer and the buyer could not have possibly detected the latent defect and purchased it, he would be left with no recourse.

This situation occurred in a very old case named Ward v. Hobbes (1878), in this case, the seller sold goods which were defective. The House of Lords held that the principle of caveat emptor did not obligate the seller to disclose the defects yet the principle obligates the seller to use skill and judgement before buying anything.

Another justification that can be argued for the dilution of caveat emptor doctrine other than its narrow scope and rigidity is the need to protect buyers who purchase goods in good faith. For all the aforementioned reasons common law has been gradually moving away from caveat emptor to caveat venditor ever since the judgement of Priest v. Last. In 1935 Lord Wright remarked that the “old rule” of caveat emptor had been superseded by caveat venditor, such change being “rendered necessary by the conditions of modern commerce and trade”.

The caveat venditor principle obligates the seller to provide information about the goods to the buyer for the purpose of providing the buyer a valid reason to purchase the goods. With the gradual rise of the doctrine the obligations of the sellers have been properly provided in various statutes and case laws.

The doctrine of Caveat emptor has also been reduced to reasonable examination only. The courts have also been generous enough to completely negate the duty of reasonable examination on the buyer when the defect cannot be detected in ordinary circumstances through reasonable examination like beer contaminated with arsenic, milk contaminated with typhoid germs, etc.

With such a doctrine at working it is vital that a contract formed due to mistake of identity is voidable and not void. If the contract is considered void then the bona fide third party buyer who knew nothing about the fraud would wrongfully be left without a recourse. It cannot be reasonably expected of a customer to suspect that the article they are purchasing had been fraudulently acquired.

For instance in the case of Phillips v. Brooks, the purchaser even after a reasonable examination of the ring could not have possibly suspected the seller to be selling a ring that has been fraudulently acquired. If the buyer is satisfied with the product it is logical that he would purchase the ring. Any other additional burden on the purchaser would be unreasonable and hence the contract should be voidable and not void.

In Lewis v. Averay, Lord Denning held that subtle intricacies like whether the fraud was committed before or after the contract was completed, or whether the mistake was related to attributes or identity do no good to the law. He held that it would be unfair for an innocent third party who purchased goods in good faith to suffer when he was completely unaware of the fraud especially when the initial seller was the one who let the fraudster have the goods and enabled him to commit the crime.

Conclusion

It has been sufficiently established after the cases of Phillips v. Brooks and Lewis v. Averay that a contract which has been entered into with a party where there is a mistake of identity is voidable and not void. There are very few circumstances in which mistake of identity make the contract void ab initio.

The fact of the matter is that when a person fraudulently convinces the seller to depart with the goods and sells it off to an innocent third party buyer the fraud creates two victims and it is upto the discretion of the courts to decide which parties interest it would protect: the seller who himself handed the goods to the fraud or the innocent third party buyer who was completely unaware of the fraud and purchased the goods in good faith.

Following the principle of Caveat venditor, I believe that the innocent third party buyer should not be punished. It is unfortunate that the courts can protect only one party’s interest and not both. But of the two parties protection of the innocent third parties interest is lesser of the two evils and hence a more reasonable option. Even Section 19 of the Indian Contracts Act, 1872 provides for the same by making the grounds mentioned here ground for making the contract voidable.

Hence, based on all the case laws and reasons aforementioned I conclude that contracts which have been entered into by way of mistake of identity should be held voidable and the courts must protect the innocent third parties interest over the initial buyer.

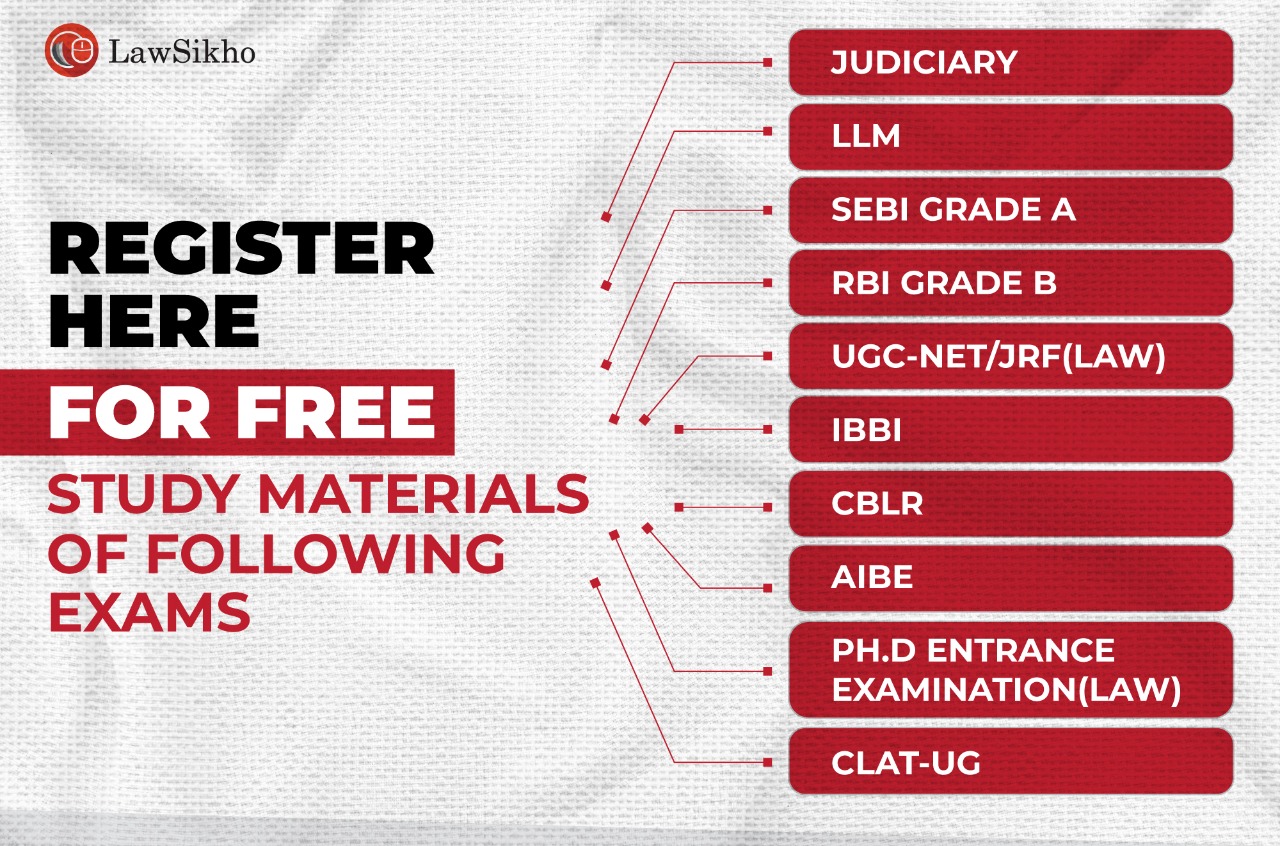

LawSikho has created a telegram group for exchanging legal knowledge, referrals and various opportunities. You can click on this link and join:

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Allow notifications

Allow notifications