In this blog post, Arvind Radhakrishnan, a partner at Synacrity Advisors LLP and a student pursuing a Diploma in Entrepreneurship Administration and Business Laws from NUJS, Kolkata, describes the remittance to be paid by foreign companies and repatriation of dividends.

Play, Play, Play

Consider a playground, full-featured with seesaws, merry-go-rounds, swing sets, a slide or two, jungle gyms, sandboxes, Ferris wheels, mazes and all other manner of joy-enhancing recreational equipment. Of course, in any reasonably safe playground, there is adequate supervision by one or more officials, along with pseudo-official supervision by the older children. Our complicated, adult, geopolitical, socio-economic world is actually not too different from this common playground setting; see the seesaw as our stock markets, the merry-go-round as our business cycles, the sandboxes as our startup environment and you’ll quickly start to draw parallels with every piece of equipment listed above, as well as others not listed. In this adult playground, the governments are our officials and the various regulatory bodies and developed nations are the older children – the ones the younger children (read: developing nations) either look up to or remain defiant of. If these officials and children play well together, happiness (read: international welfare) goes up. If not, squabbles, fights, and general non-cooperation become evident, and everyone goes home unhappy.

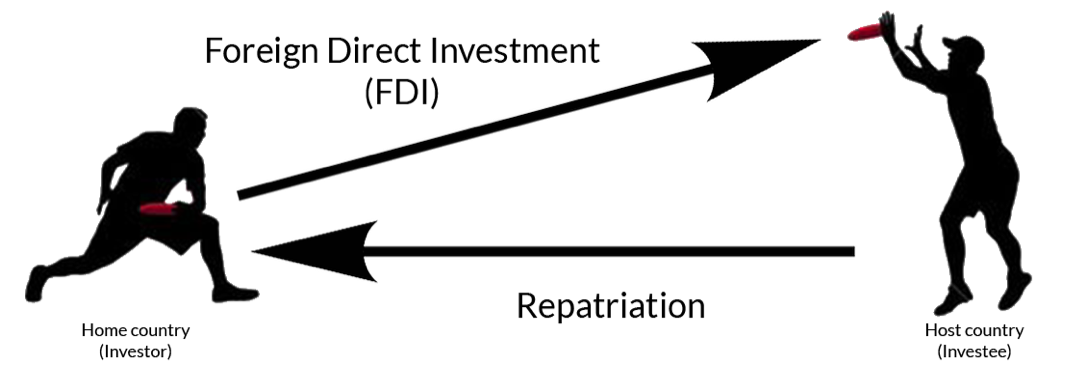

Assuming a utopian playground, this article will focus on the Frisbee areas within the playground, as they closely simulate the dynamics of our Foreign Direct Investment & Repatriation channels (See Figure 1 below).

Figure 1: Give & Take

As long as the Frisbee is thrown from one party to another in a timely and rhythmic way, the game goes on and everyone gains – but if either party stops, or if play becomes aggressive and unpredictable, uncertainty is introduced, either party could be hurt, and the game could end. In very recent history, this has happened to Thailand, Ethiopia, and several developing countries[i], but before recapping those “games”, let’s leave the playground and establish some definitions and context:

Foreign direct investment (FDI) is an investment in the business by an investor from another country for which the foreign investor has control over the company purchased. The Organization for Economic Cooperation and Development (OECD) defines control as owning 10% or more of the business.”[ii] Typically, these large investments or remittances are done by Multi-National Corporations (MNC’s) with the purpose of creating a new company (a greenfield investment) or acquiring all or part of an existing one (a brownfield investment or acquisition) in a country other than where its headquarters are located.

Apart from simply bringing in additional capital to the destination country, however, this foreign investment usually comes with a host of knock-on benefits, such as job creation, technology transfers and wage increases and so it is widely seen as fair for the investor company to want its pound of flesh in return, either in the form of a transfer of dividends back to the host country, or tax incentives and subsidies to remain. However, if this repatriation is allowed to go unchecked, the positive effects of the knock-on benefits can be severely dulled, necessitating the need for balance at both ends. This is the role of policy.

Control Room: The Levers of Policy

India’s FDI & Repatriation policies stem principally from the country’s Foreign Exchange & Management Act (FEMA). A PAN-India Act, FEMA was passed in the winter session of Parliament in 1999, replacing the Foreign Exchange Regulation Act (FERA), which proved incompatible with the post-1991 liberalization policies of the country. After its initial publication, all changes are communicated through an annual publication by the Department of Industrial Policy and Promotion (DIPP) called the Consolidated FDI Policy Circular. An excerpt of the economic levers this policy controls is given below, exclusive of those areas irrelevant for this article. The entire circular can be obtained from either the DIPP or RBI websites.

Key sources for the following table are the Consolidated FDI Policy[iii] and the GOI’s Make in India website[iv]:

| Entry routes for investments in India (Unless specified, all Sectors mentioned allow for 100% FDI as of the 2016 Circular’s date) | Any Indian company receiving FDI under either the automatic route or the government route is required to comply with provisions of the FDI policy including reporting the FDI and issue of shares to the Reserve Bank of India.

AUTOMATIC ROUTE: Under this route, no Central Government permission is required. Sectors that fall into this category include Agriculture, Plantation Sector, Mining of Metals and non-metal ores, Mining – Coal and Lignite, Manufacturing, Food Product Retail Trading, Broadcasting Carriage Services, Broadcasting Content Services, Airports (green- and brownfield), Air transport services (helicopter/seaplane services), ground handling services, maintenance and repair organizations, construction development, industrial parks (new and existing), insurance, petroleum refining (49%) and others. GOVERNMENT ROUTE: · Under this route, applications are considered by the Foreign Investment Promotion Board (FIPB) and in some cases (e.g., FDI in Defense), requires approvals from the Cabinet Committee. All investments involving a quantum of INR 30 billion or more are evaluated by the Cabinet committee on economic affairs. · Sectors that fall into this category include Mining, Defense, Publishing/printing of scientific and technical magazines/specialty journals/ periodicals, Investment by Foreign Airlines (49%), Satellites, FM Radio (49%) Pharmaceuticals (Brownfield), and others. |

| Entry Structures | COMPANIES:

· It can be a private or public limited company and can be either wholly owned or structured as a joint venture (JV). Note that in the case of Private Companies, a minimum of 2 shareholders are required. LIMITED LIABILITY PARTNERSHIPS: · Allowed under the Government route in sectors which has 100% FDI allowed under the automatic route and without any conditions. SOLE PROPRIETORSHIP/PARTNERSHIPS FIRM: · Under RBI approval, in tandem with the Government of India. EXTENSION OF FOREIGN ENTITY: · Liaison office, Branch office (BO) or Project Office (PO). These offices can undertake only the activities specified by the RBI. Approvals are granted after review by both the Government and RBI. The automatic route is available to BO/PO, provided certain criteria and conditions are met. OTHER STRUCTURES: · Foreign investment or contributions in other structures like not for profit companies etc. are also subject to provisions of Foreign Contribution Regulation Act (FCRA). |

| Eligibility for investment in India | · A non-resident entity (be it an individual or business) can invest in India, subject to the then current FDI Policy except in those sectors/activities which are prohibited.

· Citizens of Bangladesh or Pakistan or an entity incorporated in Bangladesh or Pakistan can invest only under the Government route, and Pakistani citizens and entities have the further restriction of not being allowed to invest in sectors other than defense, space, and atomic energy and others prohibited as per the Policy. · NRIs resident in Nepal and Bhutan, as well as citizens of Nepal and Bhutan, are permitted to invest in the capital of Indian companies on repatriation basis, subject to the condition that the amount of consideration for such investment shall be paid only by way of inward remittance in free foreign exchange through normal banking channels. · OCBs have been derecognized as a class of investors in India with effect from September 16, 2003, but erstwhile OCBs can invest subject to RBI approval and certain other compliances · A SEBI registered Foreign Venture Capital Investor (FVCI) may contribute up to 100% of the capital of an Indian company engaged in any activity mentioned in Schedule 6 of Notification No. FEMA 20/2000, including startups irrespective of the sector in which it is engaged, under the automatic route. These entities can also invest in domestic VC funds. The restrictions on FVCIs have been further relaxed in the latest FDI Policy. |

| Types of Investors | INDIVIDUAL:

· FVCI · Pension/Provident Fund · Financial Institutions COMPANY: · Foreign Trust · Sovereign Wealth Funds · NRIs / PIOs FOREIGN INSTITUTIONAL INVESTORS: · Private Equity Funds · Partnership / Proprietorship Firm · Others |

| Type of instruments(For clarity of language, this explanation is an excerpt from the Act itself, and no paraphrasing has been done) | · Indian companies can issue equity shares, fully and mandatorily convertible debentures, fully and mandatorily convertible preference shares and warrants subject to the pricing guidelines / valuation norms and reporting requirements amongst other requirements as prescribed under FEMA Regulations.

· As far as debentures are concerned, only those who are fully and mandatorily convertible into equity, within a specified time, would be reckoned as part of equity under the FDI Policy. · Before December 30, 2013, the issue of other types of preference shares such as non-convertible, optionally convertible or partially convertible, were to be by the guidelines applicable for External Commercial Borrowings (ECBs). On and on December 30, 2013, it has been decided that optionality clauses may henceforth be allowed in equity shares and compulsorily and mandatorily convertible preference shares/debentures to be issued to a person resident outside India under the Foreign Direct Investment (FDI) Scheme. The guiding principle would be that the non-resident investor is not guaranteed any assured exit price at the time of making such investment/agreements and shall exit at the fair price computed as above at the time of exit, subject to lock-in period requirement, as applicable. |

| Prohibited sectors and investment n MSEs | Foreign investment in any form is prohibited in a company or a partnership firm or a proprietary concern or any entity, whether incorporated or not (such as, Trusts) which is engaged or proposes to engage in the following activities:

|

| Repatriation (For clarity of language, this explanation is an excerpt from the Make In India website, and no paraphrasing has been done) | REPATRIATION OF DIVIDEND:

REPATRIATION OF CAPITAL:

REPATRIATION OF INTEREST:

|

| INCENTIVES | CENTRAL GOVERNMENT INCENTIVES: 5 PRESCRIBED INCENTIVES:

STATE GOVERNMENT INCENTIVES are decided at the State Level and could differ from state to state. Also, provisions will vary depending on the amount of investments, project location, employment generation, etc. However, the broad categories of state incentives include: stamp duty exemption for land acquisition, refund or exemption of value added tax, exemption from payment of electricity duty, etc. |

Conclusion – Protect, Grow, Compete

Driven by a need to increase employment and improve India’s infamous Ease of Doing Business score as evaluated by the World Bank Group, the Modi Government has taken a significant number of bold moves as far as FDI Policy reform is concerned. However – and this speaks to the complexity of the Indian Economy – these reforms may actually have adverse socio-economic effects on economic security, the country’s agricultural class, the MSME sector, Domestic R&D and, surprisingly, even Infrastructure, primarily due to the country’s tax repatriation laws allowing all FDI-generated return to being taken out of the country[v]. What’s more worrying, and Turkey is a prime example of this, is that once a country allows such high levels of repatriation, rescinding these allowances later might open the country up to an avalanche of expropriation claims and other lawsuits. A longer-term focus needs to be adopted, with a firm eye fixed on India’s unique ground-level realities. China did this right, and while its protectionist laws have invited healthy doses of criticisms in the recent past, it is now the second largest economy in the world, and it continues to steer the world.

India is a younger child, and given her upbringing, is focused on being a great host to all, even when she’s on the playground. But maybe now is the time to shed her fear of recognizing her true potential, and unapologetically carve out an identity for herself among the older kids.

References:

[i]Beattle, A., 2014, “Foreign Investment is not all good”, Available at http://blogs.ft.com/beyond-brics/2014/10/23/foreign-direct-investment-its-not-all-good/

[ii]Grimsley, S., 2016, “What Is Foreign Direct Investment? – Definition, Advantages & Disadvantages”, Available at: http://study.com/academy/lesson/what-is-foreign-direct-investment-definition-advantages-disadvantages.html

[iii]DIPP, 2016, “Consolidated FDI Policy”, Available at http://dipp.nic.in/English/policies/FDI_Circular_2016.pdf

[iv]Government of India, 2016, “Foreign Direct Investment”, http://www.makeinindia.com/policy/foreign-direct-investment

[v] Pandey, R., 2016, “The Modi Government’s New FDI Policy Will Hurt Indian Interests”, Available at: http://thewire.in/44309/governments-new-fdi-policy-will-hurt-indias-interests/

viUNCTAD, 2016, “World Investment Report”, Available at:http://unctad.org/en/PublicationsLibrary/wir2016_en.pdf

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Allow notifications

Allow notifications