This article is written by Ms. Ishita Goel, a student of Symbiosis Law School, NOIDA.

Table of Contents

Introduction

A public or a private company formed through The Companies Act, 2013 is subject to the provisions of the same for effective functioning, good corporate governance and for the benefit of the stakeholders. A Company to run needs directors to manage and administer the functions and these directors becomes the brain of the body that is a company. Directors work in as an agent of the company, on behalf of it and because of that they are entitled to remuneration in lieu of the services rendered by them. They are also provided remuneration as a basis of incentivising the work, to increase motivation and build morale.

There are many types of directors, managing directors, whole-time directors, key personnel manager, independent director, nominated director, women directors, shareholders directors, executive directors among others. These directors are entitled to this remuneration as per the law according to section 197 of The Companies Act and Companies (Amendment) Act, 2017.

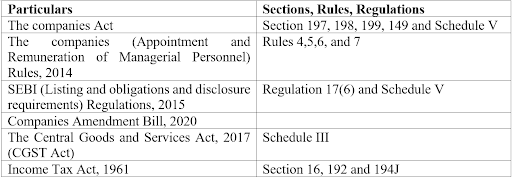

The remuneration to be received by a director if the company has sufficient profits should not go beyond 11% of the net profits of the company and if a company does not have sufficient profits According to Schedule V, the government has provided how much remuneration they are subjected to pay to the directors. The SEBI (LODR) Regulations also provide for the remuneration to the directors. The remuneration received by the directors is also taxable as per Income Tax Act, and Goods and Service Act, that essentially services in an employer-employee relationship are not services as the GST, but non-executive director’s services will be charged. And according to the Income Tax Act, all the remuneration to the directors will be treated as salary and thus will be taxable.

Relevant chapters

Role of Directors

A company is an artificial and juristic body. It is intangible and invisible. The directors act as a brain for the company which acts like the body. The directors have all the knowledge and intention of running the company. These directors, The management and management of a company’s operations are collectively referred to as the board of directors. They act as the company’s agent, working on behalf of the company.

Section 2(34) defines a company’s director as per “The Companies Act, 2013”

According to the “Companies Act 2013” all company must have at least 3 directors if it’s a public limited company, 2 if it’s a private limited company and 1 Companies in the case of a one-person company. A organization may have up to 15 directors, but at the annual general meetings it can select more by adopting a special resolution.

Types of Directors

- Residential Director: a company must have a director that has stayed in India for not less than 182 days in the previous year.

- Independent Director: These directors are part of the non-executive directors and help the company by enhancing the governance standards. These directors have no interests in the affairs of the company and have been only hired for imparting knowledge, skills and diversity to the conclusions of the company.

- Small Shareholders Directors: A company must have a director that represents the voice of small shareholders of the company. Upon A notice shall be named as a Director of at least 1000 or 10% of the total number of shareholders.

- Women Directors: If a company is a listed company with its stock exchange-listed shares or the paid-up capital has a turnover of more than 100 crores, over 300 Crores, than one female director must be a private company or a public company.

- Nominee Directors: These are the directors that have been nominated to represent financial institutions or banks. These institutions nominate this representative for the safeguarding of their interests in the company.

- Managing Director: The managing director has significant powers under the concept of ‘key managerial workers’ as specified in the Company Act of 2013, and a director who has been named by virtue of the articles of association of the enterprise, by contract or resolution adopted at the general meeting or at the executive board.

- Whole-time Director: Section 2(94) prescribes These are the directors who are employed by the company for whole time.

- Part-time Director: These directors take part in the company indirectly. They are not involved with the day-to-day management of the company.

- Executive and Non-Executive Director: The board of meeting comprises of two types of directors, executive and non-executive. The executive directors have an interest in the company and have the job to see that their departments work smoothly. Whereas, non-executive directors participate attend the board meetings and frame policies for the management of the company.

Relevant sections, Rules and Regulations

Managerial remuneration

Directors of the company have a principal and agent relationship as clearly enunciated by the landmark judgement of Ferguson v. Wilson. The directors are mere acting on behalf of the company. Because of the relationship between directors and the company, the company pays remuneration as a form of payment in lieu for their service. This kind of remuneration is called managerial remuneration. According to ICSI, The remuneration is given to the directors for increasing motivation by incentivising. The law to maintain “unnecessary profit squandering” and to provide adequate and reasonable compensation is there.

Remuneration

As per Section 197 of the Companies Act, this has been amended by the Companies (Amendment) Act, 2017, The overall cap for paying the public company’s remuneration to its managing director, entire-time manager and manager has been set. In that fiscal year, the cap is 11% of the Company’s net profit. The organization may also increase the cap of 11 percent at a general meeting, with the approval of the central government. This resolution but must be subject to Schedule V provisions.

Maximum Managerial Remuneration if a company has sufficient profits

The percentages of the remuneration include all the sitting fees payable to directors. If the company defaults in payment of remuneration to the director, prior approval must be taken from the bank or public financial institution, before the approval in the general meeting.

“Managerial Remuneration includes: The remuneration payable to the director shall include the services rendered by the director and not if the director works or has rendered his service in a professional nature, or by way of the Nomination and Remuneration Committee, the company is made under Section 178(1), or the Board of Directors, the director has all the qualification for practicing the profession.”

Sitting Fees: The company may pay the directors a fee for attending the meetings of the board, and this sum must not exceed one lakh per meeting or committee. The women directors and independent director’s sitting fee will not be less than other directors.

Method of Payment: The directors are either paid monthly or at a percentage of the profit, or partly one way and partly other.

“Remuneration not allowed to independent directors”: Any independent directors will only be subject to receive remuneration in the form of sitting fees as per sub-section (5), they are entitled to reimbursement for the expenses for participation in meetings and profit related commissions but not stock options.

“Recovery of remuneration received by the director in contravention of section 197”: If any director receives the sum of remuneration, directly, indirectly, in excess of the maximums provided by the government or as prescribed by the approval, they are subjected to return the advances withing two years or if the company has set a limit with that, whichever is lesser, and the director must use it in trust for the company until he returns it. The company may also waive the recovery by issuing a special resolution.

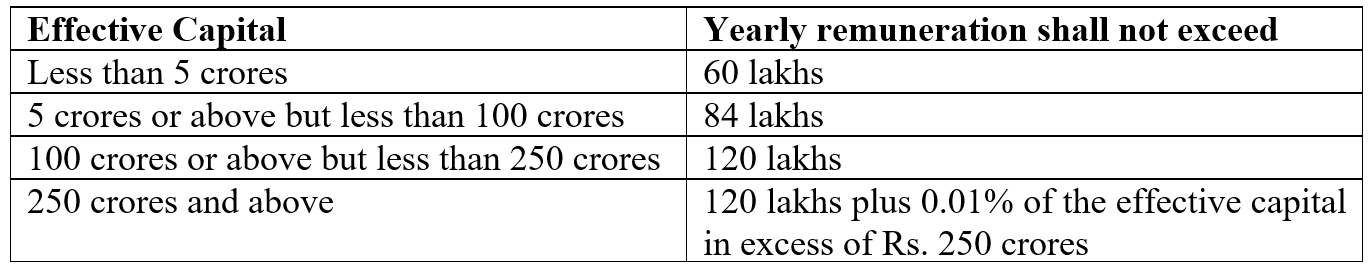

Remuneration by a company having no profit/inadequate: If in the current financial year the company is running in losses and has no profits or the profits are inadequate, they can pay remuneration to their directors according to the tables provided below:

“Provided that the remuneration in excess of above limits may be paid if the resolution passed by the shareholders is a special resolution.”

Section 198: Calculation of Net Profit

This section lays down the process by remuneration is calculated for 16 key managerial personnel for a financial year as per Section 197. Section 198(2) enunciates the sum for credits, section 198(3) sums for which credit will not be given. And Section 198(4) and section 198(5) enunciates the sums which will not be deduced during the calculation of net profits.

SEBI (LODR) Regulations

According to “Regulation 17(6) of the SEBI (LODR) Regulations, 2015”

- The Board of Directors shall, as appropriate, recommend all fees or benefits paid to non-executive directors, including independent directors, including the consent of shareholders in the general assembly.

- A duty to seek the approval of the shareholders at the General Assembly does not apply to the payment to non-Executive director of sitting charges because the payment of sitting fees is made within the limits set out in the Companies Act of 2013 without the approval of the central government.

- The approval of the shareholders referred to in subparagraph (a) shall determine the limits for the maximum number of stock options which may be issued to non-executive directors in any financial year and in total.

- The approval of the shareholders shall be obtained by special resolution, providing the pay of the annual pay of each year in which the annual compensation payable to a single non-Executive Director is greater than fifty percent of the total annual remuneration payable to all non-Executive Directors. There shall be no stock option for independent managers.

- The executive directors who are promoters or members of the promoter party shall be subject to special decision in the general meeting, approving of the shareholders.

- The annual remuneration for such managing directors is more than 5 crore, or 2.5% of the listed company’s net profits, whichever is greater.

- If more than one of those managers occurs, the cumulative annual remuneration to these managers shall exceed 5% of the list entity’s net profits.

- Given that only until the end of such director’s tenure is the approval of the shareholders under this clause valid.

How remuneration is taxed

- GST: it will be taxed as per Schedule III of the “The Central Goods and Services Act, 2017 (CGST Act)” which says that an employer-employee relationship shall not be considered as services. It further says that according to “Companies Act, 2013”, executive directors are Whole-time Directors and as per Section 2(94) they are in full employment. So the non-executive directors will not be the employees of the company. Thus all the services by them will come under Schedule III and will be chargeable to GST under “reverse charge mechanism”.

- Income Tax Act, 1961: According to Section 16 and Section 192 the remuneration given to the directors should be treated as salary. The sitting fees will be treated as professional fees and the company will deduct TDS as per the provisions.

Conclusion

In conclusion, all the directors subjected to remuneration must be provided with according to the provisions prescribed by the law. Since obtaining approval of the Central Government is a time-consuming process and therefore the amendment made under the Amendment Act, 2017 surely seeks to provide relief to the companies. Further, the Companies (Amendment) Act, 2017 will need permission from banks, financial institutions, or non-convertible debenture holders or other secured creditors for making payment of remuneration in excess of the limits specified in sub-section (1), where the company has failed to pay to the non-convertible debenture holders or bank or public financial institution or any other secured creditor.

Now, the central government do not have a say to exceed the payment of remuneration and the companies can obtain the same permission from the shareholders withing one year. On the other hand, the provisions of the law have been amended to include the requirement of obtaining shareholder’s resolution by ordinary or super-majority based on the scales of remuneration. Also, where the company is unable to meet its financial obligations, the need for creditors’ approval seems reasonable. The piece which is still amiss is in case of professional directors, where the need for a special resolution seems superfluous. This is perhaps a product of drafting oversight.

References

- INDIA FILINGS, indiafilings.com (last visited Feb. 15, 2021) Managerial Remuneration – Director’s Salary as per Companies Act.

- TAXGURU, taxguru.in, (last visited Feb. 15, 2021) Maximum Managerial Remuneration under Companies Act, 2013

- TAXGURU, taxguru.in, (last visited Feb. 15, 2021) Overall maximum managerial remuneration under companies act, 2013

- CLEAR TAX, cleartax.in, (last visited Feb. 15, 2021) Managerial Remuneration Under the Companies Act, 2013

- CORPBIZ, corbiz.com, (last visited Feb. 15, 2021) Managerial Remuneration: Amendment 2020

- Managerial Remuneration under Companies Act | Company Suggestion

- ICSI, appointment & Remuneration cover.p65

- TAXSCAN, taxscan.in, (last visited Feb. 15, 2021) Strengthening the Power of Shareholder for approving Managerial Remuneration

LawSikho has created a telegram group for exchanging legal knowledge, referrals, and various opportunities. You can click on this link and join:

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Allow notifications

Allow notifications