This article is written by Kaushiki Brahma who is pursuing a Certificate Course in Insolvency and Bankruptcy Code from LawSikho.

Table of Contents

Introduction

Time is the essence of the corporate insolvency process under the Code. The Bankruptcy Law Reforms Committee provides the rationale as: “Speed is of essence for the working of the bankruptcy code”. One of the main objectives of the Insolvency and Bankruptcy Code is resolve the insolvency process of corporate persons in a time-bound manner for preserving the value of assets of such persons. But as the Insolvency and Bankruptcy Code, 2016 is progressing number of anomalies created obstacles to achieve the objective. As when Insolvency was enacted Insolvency and Bankruptcy Code, 2016 the specified timeline was 180 days. The time, cost and outcome play an important role in corporate insolvency process. Through Insolvency and Bankruptcy Code (Amendment) Act, 2019 timeline has been extended to 330 days as the average time taken to complete the entire procedures including time spent on litigation takes about 350 days in contrast to the previous laws where recovery process took about 4.3 years. To achieve the time-bound manner objective recently Insolvency and Bankruptcy Board of India (Insolvency Resolution Process for Corporate Persons) Regulations, 2016 dated 7 August 2020 has introduced simultaneous voting on resolution plans by creditors.

Simultaneous Voting on Resolution Plan by Creditors

The resolution professional shall present eligible resolution plan to the committee of creditors for its approval which confirm the conditions under Section 30 of the Code. There is no embargo that multiple resolutions plan cannot be placed simultaneously. The simultaneous voting on all resolution plans were adopted in corporate insolvency resolution process of Jaypee Infratech Limited to identify the best plan by preventing delay in insolvency process for maximizing the valuation of assets. Through literal interpretation of section 30(3) indicates that all eligible resolution plans submitted by resolution applicants fulfilling the conditions under sub-section 30(2) can be put to vote simultaneously for approval by creditors. It has been observed that the average time taken was 423 days for completion of the 250 cases ending in approved resolution plans which came down to 380 days excluding the litigation time from the corporate insolvency resolution process. The time, cost, and outcome play an important role in corporate insolvency process.

Position prior to the IBBI (Insolvency Resolution Process for Corporate Persons) (Fourth Amendment) Regulations, 2020

Prior to IBBI (CIRP) Amendment Regulations, 2020 the resolution professional shall submit each resolution plan which conforms the conditions specified under section 30(3) of the Code to the committee of creditors who shall approve a resolution plan by a 66 percent majority of the voting shares. Once the resolution plan is approved by the requisite majority of committee of creditors, it is then presented to the NCLT for its approval. But if the resolution plan is not approved by the committee of creditors, then the next best resolution plan is presented by the resolution professional for approval. This process further delayed the competition of corporate insolvency resolution process. Therefore, to prevent such delay the IBBI introduced amendment in Regulation 39(3) of IBBI (CIRP), 2016 dated for allowing simultaneous voting on all resolution plans. The NCLT permitted simultaneous voting on two resolutions plans in the matter of Jay Prakash Associate Ltd. dated 3rd March, 2020.

It further held that “if two resolution plans are in compliance with section30(2) of the Code, the committee of creditors can vote upon both the plans applying the principle of competitive commercial wisdom. It rejected the objections raised over simultaneous voting being violation of the Code stating that there is no embargo that two plans cannot put for simultaneous voting. Moreover, there is no mandate that if two plans are put to voting, the plan voted in favour to be declared non est in law. Doctrine of severance could be applied by validating the action doable under the law as valid.”

Position after the IBBI (Insolvency Resolution Process for Corporate Persons) (Fourth Amendment) Regulations, 2020

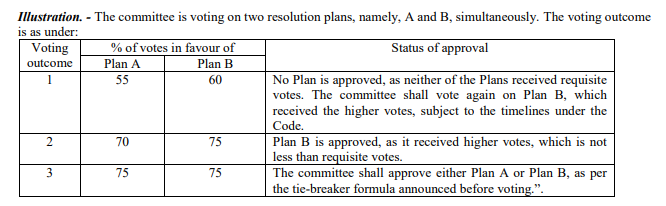

The simultaneous voting on all resolution plans by committee of creditors will help to speedier the insolvency process also preserving the assets of the corporate debtor. As per Regulation 39(3) the committee of creditors are required to evaluate the resolution plans as per the evaluation matrix, record deliberations on the viability and feasibility of each resolution plan and vote on all such resolution plans simultaneously. As per Regulation 39(3A) if there is one resolution plan then such plan will be considered for being approved by requisite votes. As per Regulation 39(3B) if there are two or more resolution plans, then all eligible resolution plans are put to vote simultaneously by committee of creditors. The resolution plan which is approved by the requisite majority of committee of creditors shall be considered as approved. But where two or more resolution plans receives equal requisite votes the committee shall approve anyone based on tie- breaker formula determined prior to voting.

SOURCE: INSOLVENCY AND BANKRUPTCY BOARD OF INDIA NOTIFICATION New Delhi, the 7th August, 2020

In cases where none of the resolution plans gets requisite votes, then the committee of creditors will gain vote on the plan that received highest votes. The above-mentioned illustration helps to understand the purpose of simultaneous voting on all resolution plan and when second round of voting to be considered for approval of resolution plan. Unlike in UK where cross cram down method is applied where a restructuring plan is approved by the Court even if it fails to obtain the requisite 75% of votes from each class of creditors. The cross-class cram down forces a whole class of creditor to accept and be bound by a Plan once it is sanctioned by the court.

Effective representation of Interests of Creditors in a Class by Authorized Representative

In addition to the introduction of simultaneous voting on all resolution plans. The IBBI (Insolvency Resolution Process for Corporate Persons) (Fourth Amendment) Regulations, 2020 also provided for appointment of authorized representative of financial creditors from the geographical location of State or union territory which has the highest number of financial creditors in class as per the records of the corporate debtor. If adequate number of Insolvency Professionals from that particular State or Union Territory, then the Insolvency Professionals having addresses in a nearby state or union territory will be considered for appointment. This will help Authorized Representative to represent the interests of majority of creditors in a class effectively. Creditors like real estate allottees, debenture holders or deposit holders are vast in number and resided across the country. Its exceedingly difficult for them to co-ordinate with the authorized representative. This will help to address the gap in decision making process by authorized representative on behalf of such class of creditors.

Due to confusion arising in the two stage voting process by the authorized representative in a class the IBBI (Insolvency Resolution Process for Corporate Persons) (Fourth Amendment) Regulations, 2020 prescribed under Regulation 16A(9) that the vote of Authorized Representative to be recorded after the circulation of the minutes of the meeting. Such Authorized Representative may seek views of creditors in a class after circulation of agenda for the meeting but before the meeting to have effective participation in the meeting. This will help creditors to have a well-informed information before voting. The creditors shall have at least 24 hours for submitting their views and the time starts when the authorized representation seeks preliminary views on it. The actual voting of Authorized Representative may be based on the voting instructions received a fresh from such creditors after the circulation of the minutes of the meeting.

Conclusion

The parallel voting on all resolution plan will help the creditors to have the best resolution plan based on the principle of comparative commercial wisdom. It will also have better transparency by preventing any informal negotiations between the resolution applicant and the committee of creditors. The detailed comparison in simultaneous voting will help in value maximation of the creditors and all other stakeholders. The simultaneous voting will also save costs in conducting repetitive voting on resolution plans till requisite approval by the committee of creditors. In IDBI Bank Limited v. Mr. Anuj Jain, IRP, Jaypee Infratech Ltd. and Anr. NCLAT it was held that, “We make it clear that if any of the ‘Financial Creditor’ remains absent from voting, their voting percentage should not be counted for the purpose of counting the voting shares, as held by this Appellate Tribunal in ‘Tata Steel Ltd. vs. Liberty House Group Pte. Limited & Ors.” The participation by the majority of creditors will be maximum if all resolutions plans are put simultaneously for voting.

References

- Sahoo MS, Guru A. Indian Insolvency Law. Vikalpa. 2020;45(2):69-78. doi:10.1177/0256090920939809

- Anju Agarwal & Jay Prakash Associate NCLT, New Delhi CA No. 59/2019 decided on 6th March, 2020

- Insolvency and Bankruptcy Board of India 14th February, 2020 Discussion Paper Amendment to Insolvency and Bankruptcy Board of India (Corporate Insolvency Resolution Process) Regulations, 2016

- Insolvency and Bankruptcy Board of India (Insolvency Resolution Process for Corporate Persons) (Fourth Amendment) Regulations, 2020.

- UK Insolvency Act, 2020

LawSikho has created a telegram group for exchanging legal knowledge, referrals and various opportunities. You can click on this link and join:

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Allow notifications

Allow notifications