This article is written by Harshita Gadiya, pursuing an Introductory Course in Legal Writing For Blogging, Paid Internships, Knowledge Management, Research And Editing Jobs from LawSikho.

Table of Contents

Abstract

The paper contemplates the writing survey top to bottom about Whistleblowing in India as a moral idea. A subjective concentrate with optional based examination has been done to comprehend the instrument of informants in India. Purposive examining has been utilized as far as gathering specific scenes of corporate fakes, where whistleblowing was the way to distinguish extortion and look at the part of informants in it. Individuals ought to consider whistleblowing a significant idea for corporate administration. Whistleblowing goes about as a guide to numerous associations or people in the push to distinguish or lessen extortion or misuse. Suggestions of the investigation show that the person’s interests will be accounted for truly, appropriate moves will be made on such cases, insurance to the informants ought to be given as that is the way to urge others to distinguish and report fake movement in any association or individual job. The paper’s significant commitment is towards understanding the idea of whistleblowing act, and what it offers for the corporates. This also talks about the different scenarios of whistleblowing laws in different countries.

Introduction

Nearly 10 years after the biggest budgetary breakdown in Indian corporate history, associations keep on being presented to corporate extortion, unfortunate behaviour, and rebelliousness. In this decade, associations have encountered budgetary misquote, pay off and defilement, huge scope flexibly chain spillages and dim showcasing of items, information robbery because of huge scope hacking, ransomware assaults, and administrative resistance.

The quantum of fakes found over the years in India and the related business as usual keep on presenting challenges towards creating viable against extortion methodologies. While innovation has empowered business measures, has it maybe confounded extortion hazard the board endeavors? Is the present fraudster more encouraged than previously? Can new enactments successfully control fake practices of fraud?

Associations are progressively perceiving that extortion isn’t just a consequence of macroeconomic patterns, for example, reducing moral qualities in the public eye, yet in addition to an inside foundational/social proviso that can be stopped by more grounded controls with restricted abrogates. Resultantly, the effect of speculations made towards building a better enemy of extortion biological system has all the earmarks of being proving to be fruitful, with associations being capable to gauge extortion misfortunes all the more precisely presently than what they have shown in previous overviews.

Without a doubt, innovation is making a difference and better deal with the danger of extortion. Supported by the results they have seen in the course of the most recent two years, associations are presently putting resources into the following degree of antifraud advances that depend on machine learning, man-made consciousness and mechanical measure mechanization stages (that empower utilization of programming robot gadgets). Innovation has additionally maybe made it simple to distinguish and save proof as we see a rising number of associations chasing a legitimate plan of action to extortion.

Corporate frauds in India

Corporate misrepresentation can be grouped in three wide zones:

- Monetary extortion or accounting misrepresentation comprises distorting budgetary data by fudging the books in this way deceptive the financial specialists. The most well-known bookkeeping plans are promoting costs, side arrangements, trade exchanges, channel stuffing, quickened incomes also, conceded costs. This is generally sustained by the board.

- Self-managing by corporate insiders is generally identified with misappropriation of corporate resources by senior heads, for example, advances allowed to senior administration that are never expected to be reimbursed, inability to reveal pardon credits, repaid workforce costs and additional standard faculty costs charged to the organization. Other such cheats are insider exchanging, abuse of corporate property for individual addition, payoffs and individual assessment infringement identified with self-managing.

- Obstructive lead is distorting declarations to controllers, deleting PC records, destroying archives, making or changing records to help illicit lead.

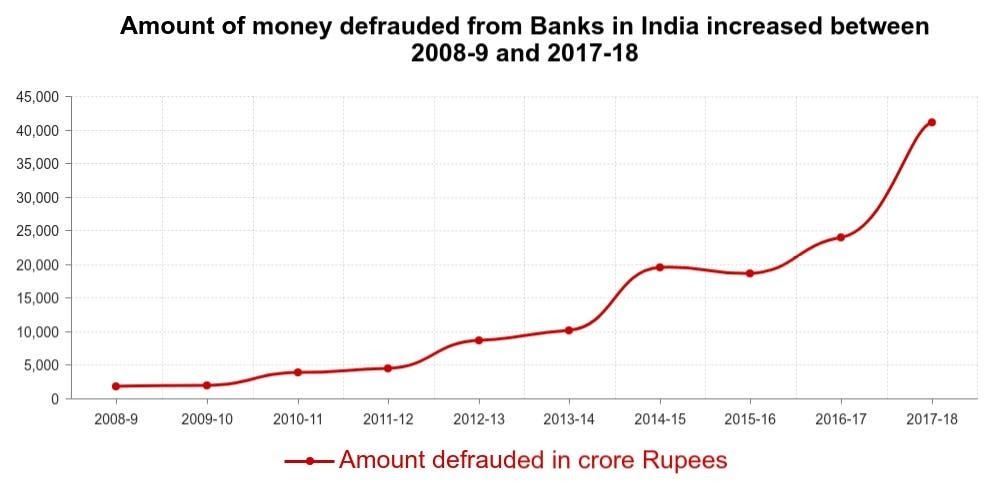

The table shows the distinctive money related fakes which were submitted in India. Unmistakably money related abnormalities can be submitted effectively in the corporate area by their own workers and by their own administration by playing stunts in request to increase illicit advantages. So as to take rigid activities against smart disapproved of corporate monsters there is a need for a legitimate component. An efficient lawful control framework can be accommodating for forestalling monetary fakes inside different companies. Henceforth, the specialist illuminates the working of lawful components in India.

|

Preparator |

Scam |

Amount |

|

Harshad Mehta, broker |

Responsible for the securities scam of 1992 |

Rs 4000 cr |

|

Sohin Daya of Dawood Shoes, Rafique Tejani of Metro Shoes, and Kishore Signapurkar of Milano Shoes |

Multi-crore shoes scam |

$600 million US |

|

CR Bhansali, Founder, CRB capital markets |

Cheated the public of over 1,000 crore and the SBI of 57 crore |

Rs 1200 cr |

|

Abdul Karim Telgi |

The fake stamp racket |

Rs 171.33 cr |

|

Former UTI chairman P S Subramanyam and two executive directors — M Kapur and S K Basu — and a stockbroker Rakesh G Mehta |

UTI Scam |

Rs 32 cr |

|

Sanjay Agarwal |

Home Trade Scam |

Rs 92 cr |

|

Ramalinga Raju, Founder, Satyam Computers |

Satyam Scam |

Rs 8000 cr |

|

Comptroller and Auditor General of India, the coal ministry, many electricity boards and private companies |

Indian Coal Allocation Scam |

Rs 185,591 cr |

|

Nirav Modi and Mehul Choksi |

PNB Fraud |

Rs 11,400 cr |

|

Suresh Kalamadi, Sheila Dixit- the then Chief Minister of the State |

CommonWealth Games Scam |

Rs 70,000 cr |

Increasing trends of corporate frauds in India

Almost 33% of Indian organizations experienced fakes by interior just as outside gatherings over the most recent a year, with information burglary being the top most misrepresentation occasion, says a report.

As per Kroll’s yearly worldwide misrepresentation and danger report, 33 percent of Indian organizations endured reputational harm because of outsiders, while the worldwide figure remained at 29 percent.

The most noteworthy occurrence of extortion was by method of information robbery with almost 41 percent of Indian firms influenced by it over the most recent a year, contrasted with the worldwide normal of only 29 percent.

According to the report, the principal territories of worry for India going ahead will be the developing danger from information robbery (84 percent), reputational harm because of outsider connections (81 percent) and ill-disposed web-based media movement (81 percent).

These are positioned as the main three danger needs that respondents are zeroing in on when building up a danger alleviation technique for their associations.

“We accept that the degree of due constancy done by Indian corporates is improving, yet it is still underneath the essential necessity when thought about all around the world,” said Tarun Bhatia, head of South Asia and overseeing chief in the Business Intelligence and Investigations practice of Kroll.

Bhatia further said there has been a social move as episodes of revelation of cheats by firms have gone up in India.

While this is a much-needed development, it additionally delivers the requirement for maintainable arrangements, better components, more noteworthy implementation and administration design to improve the condition of danger alleviation in the nation,” he said including “organizations likewise need to set up a great deal of balanced governance while enlisting, on boarding merchants, framing associations and so on.”

Kroll’s yearly Global Fraud and Risk Report, with research led by Forrester Consulting, looks at the flow worldwide danger scene, understanding the greatest dangers confronting worldwide organizations and steps being taken to forestall, recognize and react to every day dangers.

Literature review

|

Sr no. |

Name of Author and year |

Title of the study |

Journal /Institute Name |

Findings from the source |

|

1. |

Li Chen 2019 |

A review of research on Whistle blowing |

American Journal of Industrial Business Management, 2019, 9, 295-305 |

The investigation talked about the idea of Whistle Blowing and attempted to recognize the dynamic cycles of whistle blowing conduct and impacting variables of whistle blowing goal. The study showed the Prosocial Hierarchical Behaviour model, Ethics Conduct Model and Social data preparing model in which the elements influencing worker whistle-blowing incorporate individual components, authoritative elements and public elements. The creators proposed a longitudinal report to further explain the steadiness of whistle-blowing practices and the mental changes of journalists. |

|

2. |

Dr. Singam Sunitha, 2018 |

A study on Whistle Blowing Mechanism In corporate India |

IOSR Journal of Business and Management (IOSR JBM) |

The examination demonstrated the significance of Whistle blowing as direct to Corporate Administration and is essential to upgrade the Corporate administration of any association. The investigation stressed Provision 49 of SEBI. The consequence of the study showed that there is a requirement for businesses to end to guarantee that the organization gives a positive benevolent climate for the informants to react and set forward their voices on unlawful practices. |

|

3. |

Ms Monika Makhija & Dr. Shwetha S. Kulshrestha, 2018 |

A Qualitative Study on Impact of Whistle Blowers on Performance of the Organisations |

International Journal of Engineering Sciences & Research Technology |

The investigation centres’ around the effect of whistleblowing on the exhibition of the associations. It likewise talks about the focal points and constraints of Whistleblowing. The examination concluded that the guidelines and guidelines must be applied to secure the government assistance of informants, just as support the way of life of detailing in the work environment. |

|

4. |

Jenny Bartuli Behnud Mir Djawadi Rene Fahr, 2016 |

Business Ethics in Organisations: An Experimental Examination of Whistleblowing & Personality |

Institute of Labour Economics |

The investigation focuses on proposing an inventive test plan all together to examine the idea of whistleblowing in a representative association. The investigation proposed that location must be conceivable when the representative watching the other representative’s bad behaviour blows the whistle and that probably won’t prompt any outcome to the informant. |

|

5. |

Deborshi Chaki |

Whistleblowing in India’s giant corporations |

Thomson Reuters |

The articles talk about the normal debasement in private areas and featuring the counter pay off laws which must be applicable in Indian organizations. |

|

6. |

Gladys Lee Neil FArgher, 2012 |

Companies’ Use of Whistle-Blowing to Detect Fraud: An Examination of Corporate Whistle- Blowing Policies |

Springer |

This examination explores the variety of whistle-blowing exposures. The outcomes of the investigation propose that the degree of whistleblowing divulgences is decidedly connected with the announcing and authoritative help for whistle-passing up the outside chiefs, review councils and the board obligations. |

|

7. |

Nimisha Bhargava, Dr. Mani K. Madala, 2015 |

An Overview of Whistleblowing: Indian Perspective |

International Journal of Innovative Research in Science, Engineering & Technology |

The investigation speaks broadly about Whistle blowing measure, results what’s more, the need to build up a whistleblowing strategy to energize the best practice in India. |

Purpose of whistleblowing policy

- It offers bosses a chance to instruct staff and the board and fortifies the principles expected in their association;

- Workers should make secured divulgences to an appropriately prepared chief who:

- understands the reality of the circumstance;

- can ensure claims are explored as fitting; and

- can find a way to restrict the possible harm to the business.

- An unmistakable whistleblowing strategy can ensure a firm in the occasion a bogus or malignant allegation is made by a current or previous worker. A whistleblowing strategy can clarify the results of when such an allegation is made;

- Having a whistleblowing strategy set up conveys to staff that the business pays attention to any bad behaviour very and is focused on recognizing and curing it;

- A reasonable whistleblowing strategy empowers a culture where bad behaviour can be tended to rapidly and possibly before any administrative activity or harm to notoriety;

- A whistleblowing strategy can likewise strengthen to staff the significance of their obligation of secrecy to their firm and customers.

It is along these lines significant that associations understand the significance of having clear whistleblowing methodology set up and viably imparted to staff at all levels. This is significantly more significant for businesses in the money related administrations area.

Indian laws of whistleblowing policy

Laws identifying with whistleblowing and security of informants are deficient in India. Notwithstanding, the Companies Act, 2013 sets down arrangements for whistleblowing and corporate administration in India and the disposal of misrepresentation by setting up satisfactory vigil systems. Sections 206 to 229 of the Companies Act, 2013 set down laws identifying with Inspection, Inquiry, and Investigation consolidate.

Sec 208 of the Act enables an Inspector to review organization records and outfit any suggestions to lead examinations. Sec 210 states that the Central Government may arrange an examination concerning the undertakings of the organization in the accompanying cases:

- On receipt of a report by the Registrar or Inspector of the organization.

- On insinuation of a Special Resolution passed by an organization that the undertakings of the organization must be explored.

- To maintain the public intrigue.

The Serious Fraud Investigation Office (SFIO), a legal body is made under Section 211 of the Act which has the ability to capture any individual for extortion in the organization. The examiners have the duty to answer to the Central Government on the off chance that they have motivation to accept a misrepresentation submitted or being focused on the organization.

Draft Rule 12.5 of the Companies Act, 2013 and Section 177(9) makes it obligatory for recorded organizations, organizations tolerating stores from public and organizations getting more than Rs. 50 crore from banks or public budgetary foundations to have a whistleblowing strategy and set up a vigil component for chiefs and representatives to report their certified concerns. A vigil advisory group must be set up to guarantee the vigil system in the organization and informant strategy is adequately executed in the organization.

Moreover, the Securities and Exchange Board of India (SEBI) revised the Principles of Corporate Governance in 2003. Condition 49 of the Listing Agreement presently remembers the plan of a Whistle-blower strategy for Indian organizations. An organization may set up an instrument for representatives to report concerns with respect to exploitative conduct, genuine or associated misrepresentation or infringement with the organization’s set of accepted rules or morals strategy. In any case, it is right now not required for organizations to have a whistleblowing strategy set up.

The Whistle-blower Protection Bill, 2011 which supplanted the Government Resolution, 2004 has not come into power yet. The bill expects to adjust the need to shield legitimate authorities from excessive provocation with ensuring people unveiling an intrigue divulgence.

Inadequacies or bad behaviours in an organization may prompt lost the organization’s altruism and capital. It is significant for each organization to have a whistleblowing strategy set up for both the association and workers. To empower workers in raising their voices against bad behaviour and arrive at the proper position, an organization must get a customized whistleblowing strategy through an accomplished corporate attorney.

The whistleblowing strategy must incorporate specifications that will guarantee privacy and secrecy of the source. The strategy should likewise incorporate arrangements for the foundation of an inner council of individuals from each degree of the board to manage possible informants.

Whistleblowing policy in different countries

European Union

By seventeenth December 2021, all EU part nations should fulfil the base guidelines given by the Directive on the protection of persons reporting on breaches of Union law (EU Whistle Blower Protection Directive). There is a lot of work to do, with as of now not exactly 50% of all EU nations having informant security enactment set up. In the equivalent time span, a huge number of associations should set up new, or modify their current, whistleblowing frameworks and approaches.

Current scenario

Every EU Member State currently has the errand of translating the structure gave by the EU Whistle Blower Protection Directive into public laws. However, what is the beginning stage for the various nations?

At present, where informant insurance exists on a public level, it by and large applies to a limited number of areas, for instance money related administrations. Early movers with respect to the codification of informant assurance were the United Kingdom with its Public Interest Disclosure Act 1998, Ireland with the Protected Disclosures Act 2014 and The Netherlands with the Dutch House for Whistle-blowers Act that went into power in mid-2016. Instances of enactment on informant assurance received in later years are France’s Loi Sapin II from mid-2017 and Italy’s Law No. 179/2017 that came into power toward the finish of 2017. In mid-2019, Croatia embraced its Law on the Protection of Persons revealing Irregularities, and Sweden has had its informant security law since 2016.

Albeit a few nations in the EU as of now have informant assurance laws set up, usually, the EU Whistle Blower Protection Directive forces a more extensive degree, expecting changes in accordance with the current laws.

United States

Whistle blowing emerged right around a century back in the False Claims Act of 1863 which was set up to offer motivators to people who revealed organizations or people cheating the legislature. The Act likewise determines that the informant can partake in up to 30% of the returns of the claim. This Act has brought about more than $17 billion dollars of recuperations for the U.S. government since 1986. Monetary prizes to informants can, notwithstanding, make a motivating force to report sham bogus cases. The Act forces financial punishments on fake informants.

At that point came to the Whistle Blower Protection Act, 1989 altered in 1994, under this demonstration government representatives are shielded from working environment reprisal when uncovering waste and misrepresentation. The motivation behind the Act and resulting revisions was to fortify the insurances accessible to government representatives. In 2007 the House of Representative affirmed the Whistle Blower Protection Enhancement Act.

Ensuing to this was the Sarbanes-Oxley (SOX) Act of 2002, in which Congress presented a progression of corporate administration activities into the government protections laws. The government system up to that point consisted basically of exposure necessities instead of considerable corporate administration orders, which were generally left to state corporate law. Government courts had, also, authorized such a perspective on the system’s injuries, by describing endeavours of the Stock Exchanges to expand its area into considerable corporate administration as past its locale. SOX changed this division of power by giving express administrative orders to SEC guidelines of what was recently seen as the states’ select purview.

SOX by accommodating the meaningful corporate administration arrangements attempted to change the demeanor of partnership towards workplace wrongdoings. Unexpectedly Whistle Blowing was incorporated as an authoritative statute of corporate administration standards. sections 806, 301, and 1107 of SOX gave extra direction to whistleblowing.

Sec 806 states that informants who give data or aid an examination of infringement of any government law identifying with misrepresentation against investors or any SEC guideline or guideline are shielded from any type of counter by any official, worker, contract-based worker, subcontractor, or operator of the organization. Workers who are fought back against will be “qualified for all alleviation important to make the representative entire” (SOX sec 806), including compensatory harms of back compensation, reestablishment of legitimate position, and pay for suit costs, master observer charges, and lawyer expenses. SOX likewise requires review boards of trustees to play a function in whistleblowing and lessening corporate misrepresentation. Section 301, revising the Securities Exchange Act of 1934, propels review councils to create revealing instruments for the account, following, and following up on data given by representatives secretly and privately. By ordering strategies and insurance for detailing bad behaviour, the SOX norms go past simply reassuring organizations to be more receptive to representative informants. In SOX Section 1107, the compass of whistleblowing approaches reaches out past open companies. This segment stretches out assurance to any individual who reports to a police officer data identified with an infringement of a government law. These informants are shielded from any reprisal by the guilty party. A violator might be fined and detained for as long as 10 years.

United Kingdom

In the UK, to ensure informants, enactment was sanctioned in the wake of all-around pitched embarrassments and catastrophes that happened in the 1980s and mid-1990s. These incorporated the breakdown of Bank of Credit and Commerce International (BCCI), the suffocating of four youngsters at Lyme Bay, and the Clapham Rail crash.

Public Interest Disclosure Act of 1998

The Public Interest Disclosure Act (PIDA) became compelling on July 2, 1999, in England, Wales and Scotland, as a correction to the Employment Rights Act of 1996. PIDA covers both private and public representatives (aside from cops), and gives that a labourer has the privilege not to be exposed to any disadvantage by any demonstration or any purposeful inability to act, done on the ground that the specialist has made an ensured exposure.” Under the PIDA, informants must utilize recommended directs for causing revelations so as to hold the Act’s insurance the divulgence can be made to the business itself or a suitable power, and denies the divulgence to the media. As is unmistakably clear, the UK’s plan is tangibly unique in relation to that of the United States, which doesn’t expect workers to utilize a specific channel to raise their interests.

Comparative study

Guidelines in India don’t order organizations to set up whistle blowing structure and give insurance to informants who voice concerns in compliance with common decency though in created economies, there are all around characterized guidelines that energize whistle blowing practice to improve corporate straightforwardness. The law in the US regarding this matter may not be ideal (while passing the 2002 Sarbanes-Oxley Act, the Senate Judiciary Council found that informant insurances were subject to the “interwoven and impulses” of differing state resolutions). It is as yet significant that the US began to accommodate security of informants’ path in 1863 under the False Claims Act with regards to misrepresentation by providers to the US Government during the Civil War. The Act secured informants and even guaranteed them a level of the cash recuperated. The 1986 modification presently incorporates a particular assurance arrangement (31 U.S.C. § 3730 (h)) for representatives to shield them from release, downgrade, suspension, dangers, provocation, or segregation. Over the long time, in an enormous number of different zones going from guard temporary workers to protection to private areas to protections, different US States have accommodated laws furthermore, rules to ensure informants.

The Dodd Frank Wall Street Reform what’s more, Consumer Protection Act further upgraded the informant program by paying honors to qualified Whistle Blowers who wilfully give the SEC with unique data about infringement of the government protections law that prompts effective requirement activity in which SEC acquires money related assents adding up to more than 1 million USD. In the UK the Public Interest Disclosure Act 1998 gives the system of lawful insurance for informants from exploitation and excusal.

A little progress

The Public Interest Disclosure and Assurance to Persons making the Exposure Bill, 2010 that has been postponed in Lok Sabha bury alia tries to set up a hardware to enroll grievances on any charges of defilement or tenacious misappropriation of intensity against a community worker, to accommodate the request measure and to give shields against exploitation of the individual who makes such protests. While insurance is imagined for informants there is moreover an arrangement to forestall and punish bogus protests. Not at all like the US and some other global wards this bill does not spread public/privately owned businesses. While debasement and maltreatment of intensity in India has arrived at threatening extents, India actually has far to go to ensure informants. The above bill is a little step toward that path. Despite the transformative cycle of law making, and impulses of execution, allowed us to trust that the public lively residents of India will by the by keep on battling this fight and keep on blowing the whistle without hanging tight for administrative assurance.

Suggestions and recommendations

Albeit an individual’s decision to whistle blows a specific criminal behavior relies on its desire and uprightness, the following proposals can be considered while outlining the strategies:

- A moral and good climate ought to be made accessible in the associations where activities are taken against any bad behavior or wrong practices.

- An individual ought to be motivated to pass on his/her moral fears inside or remotely.

- A worker in an association needs to have faith that his/her objections or issues will be tended to truly and move will be made.

- A representative needs to feel that he/she won’t go through any revenge for their activities. Appropriate security will be given to them.

- A legitimate component of whistle blowing strategy ought to be guided to each representative at the hour of their joining.

- The expression “Exploitation” and “harassing” must be unmistakably characterized in the Whistle Blower Protection Act of India.

- The Behavioural warnings of extortion whenever joined with WHISTLE BLOWING can have a huge commitment to the hierarchical qualities.

Conclusion

A man is but the product of his thoughts what he thinks, he becomes.

-Mahatma Gandhi

Regardless of a huge increment in the mindfulness on the significance of Whistle Blowing Practices in workplace, many stay quiet and decide not to report the bad behaviors Despite this, many commendation informants for heroin and honorable deeds, numerous additionally that representatives ought to have by all appearances obligation of faithfulness to their organization and not to blow whistle as it will discolor the organization’s picture and notoriety, of their bosses. To blow the whistle isn’t a simple errand, it needs fortitude, moral assessment and one needs to put the enthusiasm of the general population ahead than their advantage. censure them as killjoy, instigators and mavericks for uncovering misfeasance and bad behavior of their partners and the executives.

So as to comprehend the adequacy of a whistle blowing component, it is important to evaluate the mindfulness, ease of use and unwavering quality of the complaint revealing frameworks among Indian organizations across different areas.

Students of Lawsikho courses regularly produce writing assignments and work on practical exercises as a part of their coursework and develop themselves in real-life practical skill.

LawSikho has created a telegram group for exchanging legal knowledge, referrals and various opportunities. You can click on this link and join:

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Allow notifications

Allow notifications