This article is written by Pearl Narang, student of BBA LL.B at Chandigarh University, Mohali. In this article, she has discussed and covered various aspects of Derivative Markets.

Introduction

Globalization has led to tremendous growth in the volume of international trade. This phenomenal growth has increased the magnitude of financial risks involved in different transactions. In order to manage this risk, new instruments have been introduced in financial markets which are known as Derivatives. The importance of derivatives is highlighted by the fact that 25 billion derivative contracts were traded in 2017 alone (see here). But what exactly does the word Derivatives mean? How does it reduce the risk involved in a transaction? How can a person trade in Derivatives? This article aims to answer all these questions.

Meaning of Derivative

Derivatives are essentially contracts whose value is derived from an underlying asset. The underlying asset can be a financial asset or a commodity. The value of the underlying asset keeps changing according to market conditions.

Financial Derivatives: Derivatives derived from financial assets are known as financial derivatives. Financial assets include equity, interest rates, currencies, Index etc. For example, equity is a Derivative whose underlying asset is stock.

Commodity Derivatives: Commodity Derivatives are derived from a physical commodity. Physical commodity means commodities such as Crude Oil, milk etc. For example, if the price of milk increases then there will be an increase in the price of Ice Creams and Butter. In this case, milk is an underlying asset and change in the price of the asset changes the price of things that are derived from it. Similarly, if the price of Crude Oil increases the price of Petrol and Diesel will also increase. Crude Oil is an underlying asset and Petrol and Diesel are things that are derived from it.

Main kinds of Derivatives.

Illustration:

“A” is a wheat farmer, whatever wheat he gets he sells it in the market. In recent years due to untimely rainfall, there have been a lot of fluctuations in the price of wheat in the market. Wheat traders are sick of it as well. “A” to save himself from loss, makes a contract with a trader to sell him 100 kilograms of wheat at 2000 Rupees after 3 months. Irrespective of fluctuations in the price, “A” will sell the wheat at 2000 Rupees. This is an example of a forward contract. The underlying asset in this contract is wheat.

If the price of wheat after 3 months increases from 2000 Rupees, then “A” has to suffer loss. So, “A” decides to insure the contract to minimize his loss. To insure the contract, he pays Rs.200 as premium. The insurance company will only pay “A” if the price of wheat is more than Rs.2000. If the price of wheat becomes 7000 Rupees per 100 kilograms, then insurance company will pay 5000 Rupees to “A”. If the price of wheat decreases to 1500 Rupees, then “A” will not have to pay anything to the insurance company. In this way, “A” has transferred his risk to the insurance company. This is how an option contract works in a derivatives market.

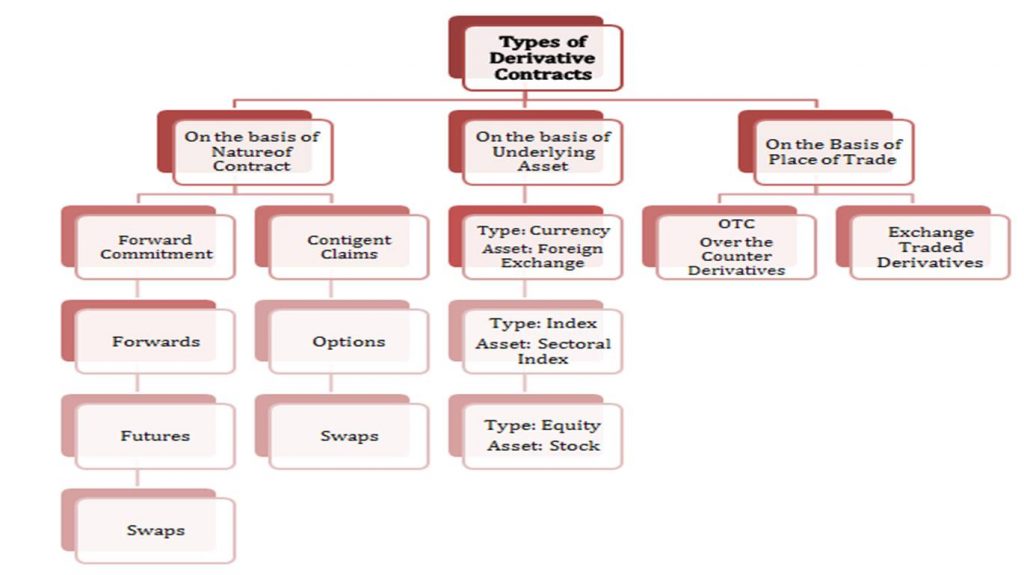

- Forwards: A forward contract is a non-standardized agreement between the parties to buy or sell an asset at a particular date in the future at a specific price. The trade takes place directly between the parties and there is no involvement of stock exchange. They are used to hedge risk in interest rates, commodities, equities etc.

- Futures: A futures contract is a standardized agreement between the parties to buy or sell an asset at a particular date in the future at a specific price. They are traded on a stock exchange. These derivatives are used to hedge risk or speculate on the price movement of an underlying asset.

Example 1: If Rohan makes a contract to buy 20 shares of YesBank at 50 Rupees per share on 5th June 2020. Then on 5th June 2020, whatever the price of the share may be, Rohan will only have to pay 50 Rupees per share.

Example 2: Ronit wants to sell his shares of Amazon. The value of the stock as of today is 1,757 Rupees. Rohit is a speculator. A speculator is a mediator who invests others money in different companies to make them a profit. Ronit says that he will sell 10 shares of Amazon that he owns at Rs.1, 757 per share. He makes a future contract with the speculator to sell shares on 16th June, 2020 at the current price. On 16th June 2020, if the price of Amazon share becomes Rs. 1800 the speculator will be in profit.

Difference between Forwards and Futures.

|

Forwards |

Futures |

|

Forwards are over the counter contracts. |

Futures are exchange traded contracts; in this a person buys a contract through a stock exchange. |

|

There is no middleman in this transaction. |

Middleman is the stock exchange |

|

High risk of non-performance |

Risk of non-performance is on the Stock Exchange. |

|

Forwards are uncontrolled and unregulated. |

Futures are transparent and are regulated by the Securities and Exchange Board of India (SEBI). |

|

Terms are decided by the parties to a contract. |

Terms are decided by the stock exchange. |

- Options: It is equivalent to a Futures contract. It is also entered into through a stock exchange. In this kind of derivative, there is an option whether a party wants to sell or buy. There is no obligation on the party, if the party wants then they can even retain the asset. The transactions are all settled in cash. It provides a right to the buyer but does not impose an obligation. To buy options you have to pay a premium.

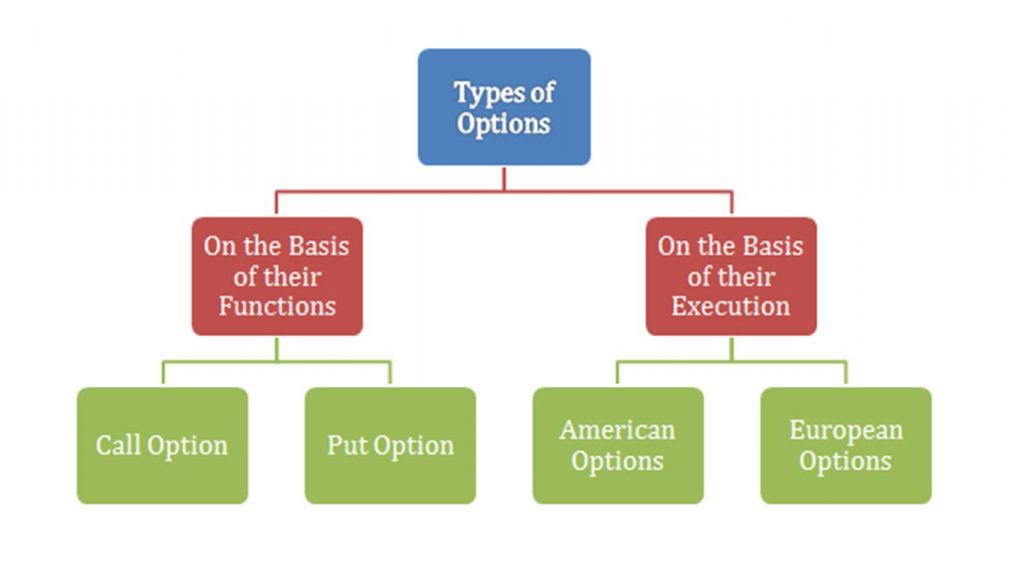

Options are classified on the basis of:

The functions the options perform,

Options are traded through puts and calls.

Call Option: Buyer has right not the obligation i.e. he cannot be forced to buy a given asset at a given price. When you buy a call you are expecting the price to rise.

Put Option: It is the discretion of the buyer to sell the asset or not. When you buy a put option, you are speculating that the price of the asset will fall below the strike price of the instrument before it expires.

Example: A stock is priced at Rs. 200, but Shayam believes that it will fall to Rs. 150. In this case, Shayam will buy the put option. If the stock price goes down then Shayam can sell it for more than he paid for.

The way options are executed,

American Options: They are contracts which can be exercised at any time before the expiry date. Example, individual securities available at NSE.

European Options: They are exercised only on the expiry date. Example, all index options that are traded are European options.

- Swaps: It is an exchange of one security with another. There are,

- Interest rate Swaps

- Commodity Swaps

- Currency Swaps, and

- Credit Default Swaps.

Interest Rate Swap: It is a contract between two parties to trade loan terms. If a person takes a home loan, there are two options for the interest on home loans, one that is flexible i.e. it changes according to the market and the other one is fixed.

Example: “A” takes a loan from State Bank of India at a fixed interest rate and “B” takes a loan from HDFC Bank at variable interest rate. If in the future “A” thinks that to pay less interest he should switch to variable interest rate and “B” thinks that due to uncertainty in the market he should pay a fixed rate of interest. So what will happen in this case is they will swap the interest rates. “A” will pay “B’s” interest rate and vice versa. Provided that, the loan should be of the same category and of approximately the same amount. This is an Interest Rate Swap Agreement. If one party defaults, then the conditions are will switch back.

Commodity Swaps: These allow parties to a contract to exchange cash flows.

Currency Swaps: A trader might sell stock in the United Kingdom and buy it in a foreign currency to hedge currency risk.

Credit default Swaps: These swaps were the main reason for the 2008 financial crisis. They were traded to insure against the default of corporate debts or mortgage backed securities. Thus, when the housing bubble burst and the mortgage backed market collapsed there was not simply enough capital to pay off the swap holders.

Importance of Derivatives

Derivatives are important because,

- They reduce financial risk involved in a transaction by making people commit to prices in the present for future dates.

- They also allow a person to transfer the risk to another person who is willing to take it.

- They are used to manage financial risk by allowing investors to take opposite positions in a single transaction, also known as hedging.

- They are used to speculate on the price of different assets.

- They matter because when a person trades, the more risk he undertakes, the more gains he will have.

- They can be used in both sides of the situation to either reduce risks or to take risks.

Derivative Markets

Markets that trade in financial instruments which are derived from other assets. These instruments are equity, indices, currency, and commodity. Derivative Markets first originated in the United States Commodities Market, then transgressed into currencies and finally into the capital markets with equity.

Derivative Markets Meaning

Financial markets which trade in derivatives are known as derivative markets. The market is divided into two segments.

- Over the Counter Derivatives

- Exchange Traded Derivatives

Over the Counter Derivatives: Privately negotiated contracts are known as over the counter derivatives. The parties set the terms of these contracts themselves.

Features of Over the Counter Derivatives Market,

- The management is decentralized and located within individual institutions

- There are no formal rules for risks involved in the transactions.

- There is no regulatory authority to regulate these contracts.

Exchange Traded Derivatives: These derivatives are traded through stock exchange and are regulated by the Securities and Exchange Board of India.

How are derivative markets different from stock markets?

In stock markets, an investor picks a company and buys and sells its stocks whenever and however he wants whereas in derivative markets, an investor does not directly buys the stocks but future or options which derive their value from stocks.

Let’s understand more about how derivatives function in derivative markets through an example.

“A” is a huge fan of RCB Band; this band was having a concert in Mumbai on 25th October. The price of a single ticket to attend the concert was Rs. 15000. “A” went to purchase the ticket and realized that the tickets were sold out. He got to know that one of his friends “B” is part of the organization team. “A” approached “B” for a ticket. “B” could not give “A” the ticket but he gave “A” a letter and told him that by showing this letter and paying 15000 Rupees, he can buy the ticket.

As the date of the concert was approaching, the price of the ticket increased to 18000 Rupees. But for “A” the price was still 15000 because he had the letter specifying the price and future date. The value of the letter in this case is 3000 Rupees. If “A” neither sells the letter nor buys the ticket, then the value of letter becomes zero because there would be no use of tickets after the concert. In this case the letter is a Derivative, whose value is derived from the underlying asset i. e. the ticket. The expiry date of the contract is 25th October because after this date the ticket would be of no use to anyone.

Derivative Markets in India

The National Stock Exchange (NSE) of India is stock exchange located in Mumbai. It functions in three market sections,

- Capital Market Section

- F&O (The Future and Options Market Section)

- Wholesale market debt Segment

The derivative trading at NSE started on 12th June 2000 with futures trading on Nifty 50 Index. Futures and Options on individual securities are available on 162 securities stipulated by SEBI. In India, derivative markets have shown positive results. According to the latest reports, the total turnover in equity derivatives at NSE and BSE increased by 75% from Rs944 Trillion in 2016-17 to Rs1,650 Trillion in 2017-18 (see here) .

Types of Derivative Markets

- Future Markets: A futures market is an auction market in which participants buy and sell commodities and futures contracts for delivery on a specific future date.

- Option Markets: An options market is a market where traders buy options on a premium.

- Warrant Markets: Stock warrant represents the right of an investor to purchase a derivative at a specific date and time in future. They are directly issued by companies and are typically traded between investors.

- Contract for Difference Markets (CFD): In a contract for difference markets, traders speculate on the rise and fall of fast moving global financial markets or instruments such as shares, index, treasuries.

- Spread Betting: Spread Betting allows an investor to bet on a huge range of financial markets.

Meaning of Derivative Contracts

A derivative contract is a contract between two parties where the value of the derivative is based on the underlying asset. The contract does not have any value on its own, its value is completely based on the underlying asset.

Why Do Investors enter into Derivative Contracts?

Investors enter into derivative contracts for a variety of reasons,

- Derivatives help in risk management.

- Derivatives allow an investor to make profits with high margins.

- Derivatives provide high leverage.

- Derivatives allow investors to transfer the risks.

Types of Derivative Contracts

Accounting for Derivative Contracts

The Institute of Chartered Accountants of India (ICAI) issued a note on accounting for derivatives contracts on 12th May 2015 (see here). This notice was issued to make the practice of accounting uniform for derivative contracts.

Main Accounting Principles

- The derivative contracts should be mentioned on the balance sheet.

- The contracts must be measured at fair value i. e. the price that would be received when transferring an asset or the price that is paid to transfer a liability.

- If hedge accounting is not used by an entity, then it should account for its derivatives at fair value and the changes should be recognised in the profit and loss statement.

- The entity should clearly identify all the aspects related to its risk management objective if it decides to apply hedge accounting.

- If an entity decides to use hedge accounting for certain derivative contracts, then for the contracts not included in the hedge accounting, the entity will,

- Recognize all derivative contracts on the balance sheet and measure them at fair value.

- It will account for the changes in fair value in the statement of profit and loss

- All adequate disclosures should be made in the financial statements.

Applicability of the Guidance Note:

- Foreign exchange forward contracts that are hedges of a profitable forecast transactions and firm commitments; and

- Other foreign currency derivative contracts such as cross currency rate swaps foreign currency futures, options; and

- Other derivative contracts equity index figures, stock futures; and

- Other commodity derivative contracts.

Who participates in Derivative Markets?

There are four main participants in derivative markets:

- Stock Exchange: A stock exchange is a place where derivatives are traded and created.

- Investors: Investors in derivatives could be investors, banks, corporations.

- Regulatory Authorities: They regulate the market and ensure its smooth functioning. Securities and Exchange Board of India regulates the equity derivatives and RBI regulates the interest rate and currency derivative markets.

- Others: The other participants are,

Credit Rating Agencies

Clearing and Settlement Agencies

Different types of Traders in Derivative Contracts

Hedgers: The term hedging means to minimize the risk or loss. An investor who protects his investment from unfavourable price movements is known as a hedger. Hedger always tries to reduce the exposure of his position to price volatility in markets. He will either make opposite investments or will try to minimise his risk paying a premium to buy a put option.

Example: “R” an investor wants to buy 200 shares of Sahara Company, and also want to protect his position form price volatility. To do this, he will take a short position of the same amount of Sahara Company to form a hedge.

Speculators: Driven by the opportunity of making profits. They expect high risks in short time. They buy the stock and expect the price to rise and when it does, they sell it. They need to effectively make predictions so that they position themselves accordingly.

Arbitrageurs: This kind of an investor buys an asset at a lesser price from one market and sells it for a higher price in a different market. They often play a role in increasing market’s liquidity.

Example, if the price of a share of ABC Bank is 100 Rupees in Cash Market and 103 Rupees in Futures Market. An Arbitrageur will buy the stock at 100 Rupees in Cash Market and sell it for 103 in Futures Market.

Margin traders: Margin traders are traders who use borrowed funds from a broker to trade in financial assets.

Different types of Players in Derivative Markets

Banks: Banks play a double role in derivatives trading. They act as intermediaries in over the counter derivative transactions, and earn a commission. They also participate directly by buying and selling derivatives.

Corporations: Corporations issue stocks in a derivatives market.

Commodity Brokers: A firm or an individual who execute orders by their clients to buy or sell commodity contracts.

Traders: A person who trades for his own account is known as a trader.

Advantages and Disadvantages of Derivative Markets

Advantages:

- The contracts are primarily used to reduce risks.

- Hedging risk exposure, in hedging the investor makes two opposite investments to offset the risk.

- Derivative makes future cash flows more predictable.

- They allow companies to forecast their earnings more accurately.

- Derivatives are non-binding contracts. When an investor buys a derivative in the market, he is buying the right to exercise it. There is no obligation on him. This gives an investor a lot of flexibility.

- Derivatives allow underlying asset price determination. Spot derivatives are frequently used to determine the price of an underlying asset.

- Derivative trading has more possibility of higher returns.

Disadvantages:

- Derivatives are highly volatile. They are used as a tool for speculation. The extremely risky nature of derivatives exposes them to huge losses.

- Derivatives are very difficult to value because they have no value by themselves; their value is derived from an underlying asset.

- Derivatives involve a lot of complexity and their pricing is very complex to understand. This is what led to the 2008 crisis; the banks simply did not know how to value the credit default swaps that they held.

- Derivatives are often criticized for being a form of legal gambling.

Different Types of Risks Involved in Derivative Markets

- Since the value of a derivative is based on the value of one or more underlying asset. It is impossible to know the real value of a derivative. They are hard to price.

- The leverage provided by derivatives only requires a trader to pay 2 to 10 percent of the margin amount. If the value of the asset keeps dropping then covering the margin amount can lead to huge losses.

- It is very difficult to predict when the price of an asset will go up or down.

- Derivatives have been a reason for a number of scams.

- The Bernie Madoff Ponzi Scheme, which exploded at the end of 2008 and led to people losing billions of dollars, was based on derivatives.

- Barings Bank Collapse, the United Kingdom based bank collapsed because of one derivative trader, Nick leeson who traded in futures contracts and suffered losses and later managed to hide them for a long time using accounting tricks.

How to Trade in Derivative Markets

Trading in Derivative Markets is governed by two legislations.

- Securities Contracts (Regulation) Act, 1956 (see here)

- Securities and Exchange Board of India Act, 1992 (see here)

Both these acts form the regulatory framework for derivatives trading in India.

Securities Contracts (Regulations) Act, 1956

The Act regulates both, the securities market and derivatives market. The Act has undergone a number of amendments. The last amendment was made in 2017 by the Finance Act.

The amendment increased the scope of the term “securities” by broadening its definition.

Section 2(h) of the Act, defines securities as the term which includes,

- Shares, stocks, bonds, debentures, debenture stock or other marketable securities of a like nature of any incorporated company;

- Derivative;

- Units or any other instrument issued to investors;

- Security Receipt as defined in Section 2 of the Securitisation and Reconstruction of Financial Assets and Enforcement of Securities Interest Act (SARFAESI Act), 2002;

- Any certificate or instrument issued to an investor by an issuer which recognizes beneficial interest of the investor in a debt receivable;

- Government securities;

- Instruments which are declared by Central Government to be securities.

- Rights or interests in securities.

The definition of Derivative given in Section 2[(ac)] of the Act includes,

- A security derived from debt instrument, share, loan whether secured or unsecured, risk instrument or contract for differences in any form of security.

- A contract which derives its value from an underlying asset.

- Commodity derivatives, defined in 2[(bc)] of the Act states that a commodity means,

- A contract for delivery of goods as may be notified by the Central Government

- A contract for differences which derives its value from prices and indices of such underlying goods; and

- Instruments which are declared by Central Government to be derivatives.

Section 18A of the Act states that all derivative contracts will be legal if,

- They are traded on a recognized stock exchange.

- They are settled on a clearing house of a stock exchange, in accordance with the rules and by-laws of such stock exchange.

- The terms of the contract and who will be a party to it are according to the terms specified in the notification by Central Government in the Official Gazette.

Securities and Exchange Board of India Act, 1992

The Securities and Exchange Board of India is established under this Act.

Objectives:

- To protect the interest of investors in securities; and

- To promote development of securities market; and

- To regulate the securities market.

Powers:

SEBI has a lot of powers. These powers include the following:

- Regulate the business in stock exchange and other securities market.

- Regulate the working of stock-brokers, sub-brokers etc.

- Register and regulate the work of credit rating agencies, depositaries etc.

- Prohibit unfair trade practices.

- Prohibit fraudulent practices.

- Prohibit insider trading in securities.

- Regulate acquisition and takeover by companies.

- Promote investors’ education.

- Promotes training of intermediaries in securities markets.

- Promotes and regulates self-regulatory organization.

- Regulates the working of Venture Capital Firms and collective investment schemes such as mutual funds.

SEBI Guidelines for Trading in Derivative Markets.

SEBI set up a 24 member committee to develop rules and regulations for trading in derivative markets.

Guidelines for Stock Exchanges

- Any exchange that fulfils the criteria under section 4 of the Securities Contracts (Regulations) Act, 1956 can apply to the Board and start trading in derivatives.

- The derivative exchange council should have separate governing council.

- Representation of trading members shall be maximum 40% of the total members.

- The exchange has to regulate the sales practices of its members.

- The Minimum members should be 50.

- The members seeking admission in the derivative would have to fulfill the eligibility criteria.

Guidelines for brokers and dealers

- The brokers and dealers are required to seek registration from SEBI.

- The minimum net worth for clearing members of derivatives clearing corporation/house should be 300 Lakh Rupees.

- The net-worth should be calculated according to the equation, net-worth = Capital + Free Reserves.

- The minimum value of contract should not be less than 2 lakhs.

- Every client shall be registered with a derivatives broker.

- The members of the derivative segment are required to make the clients aware of the risk involved in trading derivatives in a Risk Disclosure Document.

Conclusion

Derivative markets have played an important role in the economy by helping people discover the current and future prices. They have increased the volume of trade in markets. They have helped the investors to manage the risk associated with the ever fluctuating prices of the market. However, derivatives are complicated financial instruments; therefore to trade in derivative markets one must have sufficient knowledge and experience.

Students of Lawsikho courses regularly produce writing assignments and work on practical exercises as a part of their coursework and develop themselves in real-life practical skill.

https://t.me/joinchat/J_0YrBa4IBSHdpuTfQO_sA

Follow us on Instagram and subscribe to our YouTube channel for more amazing legal content.

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Allow notifications

Allow notifications