This article has been written by Shreya Kalantri, pursuing the Diploma in M&A, Institutional Finance and Investment Laws (PE and VC transactions) from LawSikho.

Table of Contents

Introduction

A takeover occurs when one company makes a successful bid to assume control of or acquire another. Takeovers can be done by purchasing a majority stake in the target firm. Takeovers are also commonly done through the merger and acquisition process. The purchaser of the company is known as the ‘acquirer’ and the company being purchased is known as the ‘target company’.

A takeover usually occurs when one company makes a bid to take control of or acquire another, often by buying a majority stake in the target company. The company making the bid is called acquirer in the acquisition process. In contrast, the company that it wishes to take ownership of is called the aim.

Facts to know

Difference between Acquisition and Takeover

ACQUISITION- When one company acquires another company with the permission of its board of directors to do so then it is called acquisition. This happens due to various reasons like increasing the market value of the company’s share, providing financial or technical help to the company, etc.

Example: Hindustan Unilever Limited (HUL) acquired GSK Consumer Healthcare of GlaxoSmithKline (GSK).

TAKEOVER- When one company acquires another company without the permission of its board of directors then it is called takeover. Takeovers are generally performed by large companies to either remove competition or to expand.

Example: Larsen and Toubro’s (L&T) takeover Mindtree.

The target company may be a listed or unlisted company. Listed companies are those which are incorporated and exchanged on a particular stock exchange. An unlisted public company is one which is not listed on any stock exchange however can have a limitless number of investors to raise capital for any business adventure.

The takeover of a listed company is governed mainly through SEBI (Substantial Acquisition of Shares and Takeover) Regulations, 2011 and takeover of an unlisted company is mainly governed through section 230(11), 230(12) and 235 of Companies Act, 2013.

How is takeover governed for an unlisted company?

Let us understand the process of acquiring an unlisted company through an imaginary example of two companies P Limited and R Limited.

P Limited is a company engaged in manufacturing of pharmaceutical products. It wants to acquire another company engaged in the supply of raw materials, R Limited. In our example, R Limited is an unlisted company.

Now, let us try to understand the regulatory and substantive bottlenecks that P limited will encounter while taking over R Limited. For instance, for acquiring R Limited, P limited has to make an investment taking into consideration Section 186 of the Companies Act, 2013.

What does Section 186 of Companies Act provide?

Section 186 provides that if a company wants to make an investment in an another company then there are two limits that it needs to follow while investing:

1) 60% (of combined paid-up capital + free reserve + securities premium).

2) 100% (of combined free reserve + securities premium).

whichever is higher.

What if the company is investing less than this threshold limit?

In that case, it can make such an investment just bypassing the board resolution.

What if the company is investing more than the threshold limit?

In this case, they will have to do this through a special resolution in the general meetings of the shareholders.

Now, we have understood that if you are investing more than the threshold limit, you need to pass a special resolution. For passing a special resolution, you need consent from 3/4th of the shareholders.

Let us now assume that P Limited has procured and overseen R Limited by gaining 51% shares that is the majority control. In case, P Limited wants to pass the Special Resolution then it can not do so without approaching R Limited’s 49% shareholders, as in case there should be an occurrence of Special Resolution they need 3/4th of the company’s shareholders that is 75% of the shareholders.

In our example, Once P Limited has 75% of the company’s shares he is eligible to acquire the entire shareholding, i.e; 100% shares of R Limited.

Let us try to understand how the acquiring of remaining shares will be done in our case.

An acquirer owning at least 75% of shareholders can make an offer to the minority through NCLT for acquiring these shares.

Among few provisions of the Companies Act, 2013 yet to be notified were subsections (11) and (12) of section 230. The broader section deals with schemes of arrangement and compromise. These two subsections have come into effect from 3 February 2020.

In order to operationalize these provisions, MCA has also notified rule 3(5) of Companies ( compromises, arrangements and amalgamations) Rules 2016. This rule provides that any shareholder along with others holding at least 3/4th of shares in the company can initiate an arrangement for acquiring the shares of the remaining shareholders of the company.

The offer of acquisition has to be for the remaining portion of shares not held by the potential acquirer (X Ltd). A scheme of arrangement needs to be drafted for the said takeover and an application has to be filed with the National Company Law Tribunal.

This application needs to be submitted with important records including the valuation report given by the registered valuer, most exorbitant cost paid for the portions of the Target Company (Y Ltd) by any individual in the previous year and consideration of the possible pricing parameters (PPP) for arriving at the fair value of the shares. The application will likewise contain the details of the bank account wherein at-least 50% of the total consideration is deposited.

SECTION 230(11) OF COMPANIES ACT, 2013

Since the takeover is a compromise and arrangement falling under section 230, the total arrangement of compliances as needed to be followed under section 230(11) for any standard trade off and course of action is additionally needed to be followed for the application recorded under this subsection which at first sight includes the accompanying:

1) Filing of application with NCLT;

2) Calling of the meeting of the members and creditors by the NCLT;

3) Approval of the scheme by members holding three-fourth in value of the total value of creditors and members;

4) Sending out the copy of the application to the applicable regulatory authorities like the Registrar of Companies, Regional Director, IT Authorities, etc; and

5) Filing an application with NCLT for approval of the scheme of arrangement.

When the application is endorsed, the active investors should take their imperative portion of consideration and transfer their shareholding in the name of the applicant potential acquirer (X Ltd).

SECTION 235 OF COMPANIES ACT, 2013

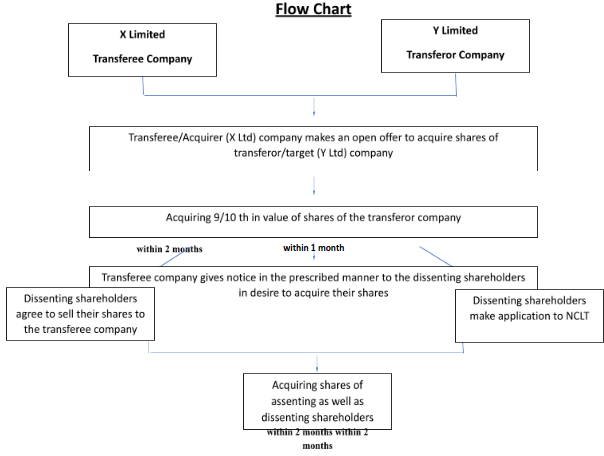

- The acquirer company (X Ltd) makes an offer through a scheme or contract with an intention of acquiring shares of the target company (Y Ltd).

- Within 4 months from the date of offer for acquisition, the shareholders holding 90% of the value of total shares of the Target Company is required to approve the scheme (excluding the shareholding of the proposed acquirer along with the shareholding of its nominees or that of its subsidiary company).

- Once the scheme is affirmed by the requisite majority, the proposed acquirer (X Ltd) shall send notice to acquire shares of the dissenting shareholders in form CAA-14 along with CAA-15 to such shareholders within 2 months from the expiry of the four month.

- Within one month, the dissenting shareholders have two choices either they agree to transfer their shares to the acquirer/transferee company (X Ltd) or make an application to the National Company Law Tribunal (NCLT) and wait for their order. The target/transferor company can approach NCLT through Section 230(12).

- Within one month from the date of which offer was made to the dissenting shareholders or one month from the order of tribunal the acquirer/transferee company has to submit 3 documents to NCLT that is:

- Copy of Notice which contains CAA 14 and CAA 15.

- Share Transfer Instrument.

- Amount/ Consideration.

The acquirer shall send a notice along with an instrument of transfer and pay the amount of consideration to the Target Company who shall deposit such amount in a separate bank account called the ‘Escrow Account’ and make arrangements to disburse the same within 60 days.

Finally the Target Company shall send an intimation to the dissenting shareholder informing them about share transfer registration and receipt of consideration.

Facts to know

If the transferee company along with the person acting in concert (PAC) holds 90% or more shares in the target company then they can offer to buy their shares at a value determined by registered valuer to the remaining shareholders. The transferee company has to keep the money in a separate bank account and pay within 60 days. Consideration has to be paid only when the offer for acquisition has been and the time for delivery of share certificates by the minority has expired. NCLT is not involved at any stage under section 236 of Companies Act. This provision also provides an option to the minority shareholders of a company to offer their shares to the majority, thereby assisting them in exercising their exit rights.

Conclusion

Section 230(11) of Companies Act, 2013 deals with takeover of an unlisted company through an arrangement, Section 235 of Companies Act, 2013 deals with Corporate acquired with majority approval and Section 236 of Companies Act, 2013 deals with takeover through minority squeeze out by the majority shareholders. As studied about the various sections and provisions made or takeover of an unlisted company it’s evident that each of these sections has its own importance. They may seem to have identical provisions but it differs when one looks deep into the language of the same. The only similarity in these provisions is the intent of takeover through an arrangement with the members and paying them a fair price for entering into the same. This not only protects the rights of the investors but also the shareholders and provides transparent and straightforward lawful structure to encourage takeover of unlisted companies.

Students of Lawsikho courses regularly produce writing assignments and work on practical exercises as a part of their coursework and develop themselves in real-life practical skill.

Follow us on Instagram and subscribe to our YouTube channel for more amazing legal content.

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Allow notifications

Allow notifications