This article is written by Shreya S.K Pandey, a student of Law College Dehradun Faculty of Uttaranchal University. In this article, she discussed the Goods and Services Tax (GST) Valuation Rules, what is the taxable value, how the valuation of supply under GST in done and when valuation rules are applicable.

Table of Contents

Introduction

Goods and Services Tax GST) was introduced to replace all the indirect taxes prevailing in India. The main reason for implementing this scheme was to strengthen the Indian Economy system. It is important to know how much Goods and Services Tax (GST) we pay in everything we buy. To know how much GST is charged for a particular transaction one should know the valuation of Goods and Services. Section 15 of the Central Goods and Services Act, 2017 deals with the valuation of GST in every supply and when Section 15 is not applicable than the remedy is Central Goods and Services Tax (CGST) Valuation Rules, 2017.

What is Goods and Services Tax (GST)?

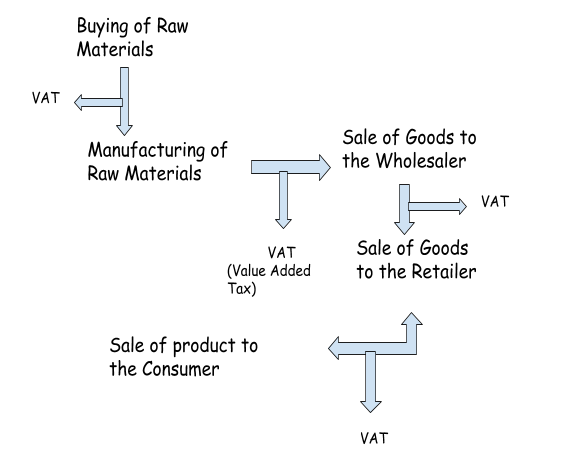

GST or Goods and Service Tax is an “indirect tax” which is payable by the consumer when they buy the product. It is paid to the Government of India by the retailer (someone who sells the goods) who collects it while selling the product. Here, consumers do not pay their taxes directly to the government but it passes through the retailer who ultimately remits the tax to the government.

Goods and Service Tax is imposed upon manufacturing of any goods, sale and utilization of any goods and services in India. The tax is imposed only for the goods and services consumed with the territory of India. It is a domestic tax upon any goods and services. This tax replaces all the indirect taxes prevailing in India.

In 1954, France became the first country to impose the Goods and Service Tax (GST) in there tax system. In 2017, India has enforced a dual GST system in the tax structure of India.

For example:- If a manufacturer makes a cloth for which he gets raw cotton at “Rs. 10” in which tax included was 10%. Then, the had actually bought the raw material at Rs. 9 + 10% tax (which is Rs. 1).

After that, when he manufactures the cloth, the value of cloth came out to be Rs.5 in which the manufacturer adds all previous values. Now, the total rate of the cloth becomes Rs. 5 (actual value of the cloth after manufacturing) + Rs. 10 (the value of raw material) = Rs. 15.

Before supplying the cloth in the market, 10% tax will be imposed on the finished goods i.e. Rs. 1.50. This will take a total of Rs.15 + Rs. 1.50 = Rs. 16.50.

But, under Goods and Service Act (GST), the tax which he had paid additionally i.e. Rs.1.50 will affect the previous tax paid by the manufacturer.

Rs. 1.50 – Rs. 1 = Rs. 0.50

Now, this will be an effective tax to be paid by the manufacturer.

Before, the imposition of Goods and Service Tax (GST) in 2017 in our taxing system. Indian taxing pattern was like the mention below:

One Hundred and First (101st) Constitutional Amendment Act, 2016

Constitution (One Hundred and First Amendment) Act, 2016 received the President’s assent on September 8, 2016. With the introduction of the Goods and Services Tax (GST), a uniform pattern to pay indirect taxes were created. The amendment limits or restricted the power of the Government to some extent to make laws relating to the taxes in their sphere or domain.

101st (One Hundred and First Amendment) Act, 2016 made some significant changes in the Indian Constitution. These changes are:

Article 246A

Article 264A has been inserted in the Indian Constitution through this Amendment. The article gives power to the Parliament and the State Legislature to make law relating to Goods and Services Tax which has been imposed by the Union Government and State Government. Parliament also acquires the power to make laws relating to the supply of goods and services which flows inter-state in trade and commerce.

Article 269A

Article 269A gives power to the Central Government to collect and levy the Goods and Services Tax (GST) on any of the supplies which flow during trade and commerce of inter-state. The tax collected by the Central Government under this Article shall be divided between the State and Union as per the Goods and Services Tax Council’s recommendation.

Article 279A

Article 279A says that a council will be constituted in the name of “ Goods and Services Tax (GST) Council which is authorized under the Constitution to decide any matters dealing with the indirect tax.

Schedule VII

Union List (List I)

Amendment changed the subjects of Entry 84.

|

Sr. No. |

Before Amendment |

After Amendment |

|

1. |

Duties on opium |

High-speed diesel |

|

2. |

Duties on tobacco |

Tobacco and tobacco products |

|

3. |

Duties on Indian Hemp |

Petroleum crude |

|

4. |

Duties on Narcotic Drugs and Narcotics |

Natural Gas |

|

5. |

Duties on Alcoholic Liquors |

Motor spirit (Petrol) |

Entry 84 is kept under the jurisdiction of the Central Government and does not come within the ambit of Goods and Services Tax (GST).

Entry 92

Before Amendment, Entry 92 of the Indian Constitution deals with the taxes on the purchase and sale of the newspapers and on advertisements published. But, after amendment, Entry 92 has been deleted. Now, they come under the Goods and Services Tax.

Entry 92C is repealed from the Union List. Before Amendment, the Entry was about the Service Tax.

State List

Entry 52

In Entry 52 tax relating to the goods which are entered in the particular local area for use, sale or consumption is deleted.

Entry 54

Subjects of Entry 54 has been replaced with new. In the new Entry, it includes taxes on the sale of high-speed diesel, petroleum crude, motor spirit, aviation turbine fuel, natural gas, alcoholic liquor for the consumption of humans.

Entry 55

In Entry 55, taxes on the advertisement has been omitted.

Entry 62

In Entry 62, Taxes on luxuries which includes taxes on amusements, gambling, entertainment, and betting has been omitted and it was replaced by the taxes which can be levied by the Local Government which includes Municipalities, Panchayats, District Council and the Regional Council.

Some other amendments in the Constitution

- Parliament’s residuary power under Article 248k has been shifted to Article 246A.

- Parliament acquires the power to make laws relating to the Goods and Services Tax (GST) in the interest of National if Rajya Sabha (Upper House) pass a resolution with a 2/3rd majority. Such power is given to the Parliament by changing Article 249.

- Under Article 250, now the Parliament of India has the power to make laws relating to Goods and Services Tax (GST) during the time of emergency.

- The amendment is done under Article 268 which omitted the subject matter of State list i.e. Excise duty on toilet medicinal preparation. Now, the subject is included in the Goods and Services Tax (GST).

- Service Tax is included in Goods and Services Tax (GST) by repealing the Article 268A.

- Parliament acquires the power to make laws relating to the Goods and Services Tax (GST) for interstate commerce and trade under Article 269.

What is the Value of Supply?

Value of Supply means the amount which is paid by the receiver or recipient to the person who supplies the Goods as part of the consideration for the supply he had made.

For Example, X goes to a shop that belongs to Z and buys a motorbike. X paid the amount of Rs. 60000 to Z. Now,

- The nature of the Traction between X and Z is the supply of the motorbike to X by the Z.

- In this transaction Z is the supplier.

- In this transaction X is the receiver or recipient.

- Here, the value of supply is Rs. 60000.

- The value of supply flows from the X to Z.

- Amount of Rs. 60000 is the consideration for the supply of motorbike by the Z.

Valuation of supply of Goods and Services under GST

Goods and Services Tax (GST) is an indirect tax. It abolishes all the previous taxes on indirect taxes. The concept of Goods and Services Tax or GST was adopted to bring the taxes in one platform i.e. “One Nation One Tax”.

Value of supply under GST

Before Amendment, taxes were imposed on the value of goods and services. For instance:

|

Sr. No. |

Value of Goods and Services |

Taxes Imposed |

|

1. |

Value of Service Rendered |

Service Tax |

|

2. |

MRP or Transactional Value |

Excise Duty |

|

3. |

Value of Sale |

VAT |

After Amendment, “Transaction value” will be counted under the Goods and Services Tax. There will be no imposition of separate charges. Transactional Value is a “value or price which is paid by the receiver or recipients for the supply of Goods and Services”.

For Example

There is a manufacturer “MSZ”, who sells the mechanical tools. the manufacturer sells a hammer to a wholesaler “XYZ”. The actual price was 3500 but the manufacturer sells it for Rs. 2000.

Before Amendment, the bill will be like:

|

Price of hammer |

Rs. 2000 |

|

Excise on hammer @10.5% |

Rs. 210 |

|

Subtotal |

Rs. 2210 |

|

The VAT on hammer @12.5% |

Rs. 276 |

|

Total Price |

Rs. 2486 |

After Amendment, the bill will be like:

Here, the price of hammer i.e. Rs. 2000 is the transactional value as it is the value of the goods and services which are supplied by the manufacturer. Now, for eg. CGST is 7% and SGST is 7%.

|

Price of hammer |

Rs. 2000 |

|

CGST @9% |

Rs. 180 |

|

SGST @9% |

Rs. 180 |

|

Total |

Rs. 2360 |

Under Section 15(1) of the Central Goods and Services Tax Act, 2017, the basis for the valuation of the supply of Goods and Services under the GST is “Transactional Value”. Goods and Services Tax will be imposed according to the Transactional Value, so first, determination of Transactional Value is important.

Section 15(2) of the Central Goods and Services Tax Act, 2017, deals with the provision relating to the “Inclusions in the Transaction Value for Goods and Services Tax”. the Transactional Value will include the followings:

|

Taxes which are provides in other Statutes |

Transactional Value will include all the taxes, fees, charges or duties which are paid by the receiver as levied in any statute other than the taxes levied in GST Act or IGST Act. |

|

Any Incidental Expenses |

Transactional Value will include all the incidental expenses paid by the receiver of the goods and services and charged by the supplier. Example: Packing |

|

Any late fees and interest |

Transactional Value will include any fees which are paid late, the penalty in delaying the payment of any goods and services, any interest. |

|

Any Subsidies |

Transactional Value will include subsidies that are directly connected to the price. This will not include the subsidies that are imposed by the Central Government and the State Governments. Example: Subsidy in LPG cylinders which is not part of the transactional value as those subsidies are being paid to the poor families through their bank accounts. Reason for not including the LPG subsidy as the transactional value is that the person who is making the supply is not receiving the subsidy. |

Discount

Section 15(3) of the “ Central Goods and Services Act, 2017, talks about the values which will not form part of the Transaction Value. Discount will not be included in the Transactional Value or we can say that the discount given in any supply will not be included in the Value of Supply. The discounts which are not included in the Transactional Values are

- Discount is given when supply is made or before it.

The discounts which are given at the time of the supply or before the supply shall not be counted in the Transactional Value or value of supply if that discount is properly mentioned in the bill or invoice.

Example: A person name “X” sells sarees to Mrs. “S” for Rs. 15,000. Mrs. “S” a receives a discount of Rs. 3000 at the time of supply of “Sarees”. As a discount is given at the time of supply and this was mentioned in the bill or invoice. The GST will be a levy on the value Rs. 12000.

- The discount is given by the supplier after the supply.

The discounts which are given after the supply of goods and services shall not form part of the transactional value, unless-

- That discount is done due to an agreement, which is entered by the recipient or supplier at the time of supply of goods and services or before it and the discount is linked with relevant bills or invoices;

- The input tax credit which is a feature to the discount on the basis of a document has been reversed by the receiver which is issued to him by the supplier.

Example: A corporation “XYZ” sells 100 units of supply to another corporation ABC” for Rs. 2000. Total units sold to corporation “ABC” at the end of the year was 250 unit. There was an agreement between corporation “XYZ” and “ABC” that if the corporation “ABC” will purchase more than 200 unit than corporation “XYZ” will give them a discount of 10%. Let IGST is 12%.

Now, the corporation “XYZ” will give the corporation “ABC” the credit note showing the discount of Rs. 500 and the GST rate on the discount will be Rs. 60.

Valuation of the supply of goods and services when a transaction is not in INR?

Rule 34 of Goods and Service Valuation Rule, 2017, deals with the value of supply when the transaction is not in INR. In a case where a transaction is not in Indian Rupee than RBI Exchange Rate will follow. When a person exports his goods in some other Country, he is likely to get a bill or invoice in the foreign currency. In such a case, the Integrated Goods and Services Tax (IGST) that will be charged will be converted to INR by using the RBI exchange rate.

In case of import of goods when the reverse charge is applicable to the supply which is imported, the RBI rate exchange will convert the bill or invoice in INR.

Valuation of supply made as per Section 15(4) r/w Valuation Rules

Section 15(4) of Central Goods and Service Act, 2017, says that when the value of Goods and Services is not determined in accordance with Section 15(1) then it will be determined in accordance with the manner prescribed for it. In short, the remedy for such circumstances is Valuation Rules. When Value of Goods and Services is not determined in accordance with Section 15(1) then it shall be determined by the valuation rules under Chapter IV of Central Goods and Services Tax (CGST) Rules, 2017.

Rule 27: Determination of Value of Supply of Goods or Services when the consideration is partially in money.

Rule 27 says when there is a supply of Goods and Services and such supply is for the consideration which is partially in money, then in such case value of supply shall be determined by the:

- The Open Market value of that supply.

Example: If the bicycles rate is Rs 20,000 and they were supplied for Rs. 15,000 along with exchange. Then, Rs 20000 will be the open market value of the new bicycles.

2. Now, if the market value of the goods is not known then the value of supply shall be determined by the consideration is paid in money as total sum and if that sum of consideration is paid in a form other than the money then the value of supply will be the amount of money which is equal to the consideration.

Example: In case, one manufacturer sold a new car in exchange for an old car. The Open market value of a new car is not available also the open market value of the old car is not available. A car with like-kind was sold in the market for Rs. 2,00,000. Then the value of Rs. 2,00,000 will be taken as a supply value.

Rule 28: Supply Value of goods and services transferred between a related person or distinct persons

Distinct Person:- Under Section 25(4) of the Central Goods and Services Tax Act, 2017, a Distinct Person is a person who had more than one registration under this, whether in one State or Union territory or a different State or Union Territory.

Under Section 25(5) of the Central Goods and Services Tax Act, 2017, if a person who had registered under the Central Goods and Services Act, 2017, in a state or Union territory has an establishment in another state or Union territory, then for the purpose of the Act, the establishment shall be considered as the establishment of distinct person.

Related Person:- Under the Explanation-I of Section 15(5) of the Central Goods and Services Tax Act, 2017, persons are related persons, If:

- they are directors or officers in anyone’s business.

- they are partners recognized by the law.

- they are an employee and employer relations.

- any one person controls hold or own their voting stock or shares, either directly or indirectly.

- If one person controls the other either directly or indirectly.

- If they are controlled by the third person either directly or indirectly.

- If they control the third person, either directly or indirectly.

- They belong to the same family.

Rule 28 deals with the value of any supply of Goods and Services between a related person or distinct person shall be:-

- The open market value of that supply.

- If there is no open market value available for the supply than the value of supply shall be determined by the goods of a like quantity and kind.

- The value of supply of any goods and services shall be determined in accordance with Rule 30 or Rule 31 of Valuation Rules if the valuation of supply shall not be determined by the above sub-rule (1) and (2).

Example 1: “A” supply hairdryer to “B” who is a related person of “A”. “A” didn’t take any consideration for the supply from “B”. The open market value of the supply i.e. hairdryer is Rs 2000. In this case, the value of supply for Goods and Services Tax will be the open market value of the product i.e. Rs. 2000.

Example 2: “A”, a registered corporation, supply some mechanical tools to “B”, registered corporation. Both are a distinct person. The value of supply of mechanicals tool was Rs. 20,000. But, the open market value of those mechanical tools was Rs. 35,000.

Hence, the value of supply for this purpose of the Goods and Services Tax (GST) will be the open market value i.e. Rs. 35,000.

Rule 29:- When Value of supply of goods or services is received or made through an agent

Agent:– Under Section 2(5) of the Central Goods and Service Tax, 2017, an “agent” is a person who carries on business on behalf of another person for the supply of goods and services. The agent includes broker, commission agent, factor, arhatia, an auctioneer, del credere or any mercantile agent.

Rule 29 deals with the value of supply in case of a supply of goods and services between an agent and his principal:-

- Be the open market of that value or it may be equivalent to 90% of the goods price which is of like kind and quantity at the option of supplier that is charged by the receiver of goods from his customer.

Example: Let a person (principal) “A” supplies the “Apples” to his agent and that agent in subsequently supplies the “Apples” of like kind and quality at the rate of Rs. 200 per kilograms.

On the other side, one independent supplier supplies the “Apples” of like kind and quantity to the same agent at the rate of Rs. 100 per Kilograms.

Now, if the open market value procedure will be used to know the value of supply it shall be Rs. 100 per kilograms or if the 90% procedure will be used when the value of supply shall be:

(200 x 90) /100 = Rs. 180.

2. If the value of the supply is not determined by the sub-rule (1) then it shall be determined by Rule 30 or Rule 31.

Rule 30: When Value of Supply is based upon Cost

Rule 30 says, If the value of supply is not determinable through the provision provided in the previous rules than the value shall be determined by taking 110% of the cost of the manufacturing of the goods, cost of production, or cost of acquisition.

Example: If the actual rate of a product is not known, also the open market value of that product is not available.

The manufacturer “PQR” manufactures that product at Rs. 5000. In such a case, [5000 (manufacturing cost) x 110) / 100 = Rs. 5500

Rs. 5500 will be taken as a value of supply for this purpose of Goods and Services Tax (GST). The Goods and Service Tax (GST) will be paid at the Rs. 5500.

Rule 31: Residual Determination of value of supply using Residual Method.

Residual Method: The residual method to determine the value of supply means to determine the value of supply by using any “reasonable means” which shall be related to the provision of Goods and Services Tax (GST) law when it becomes impossible to determine the tax by the method provided already in the provisions.

According to Rule 31, when the value of supply cannot be determined by the Rules 27 to 30, then it shall be determined by using the residual method or by the provisions of Section 15.

Rule 33: In the case of a pure agent, what is the value of the supply of services?

Pure Agent: A person is said to be “Pure Agent” when

- he enters into a contract with the receiver of supply and act as his pure agent for this purpose of holding the liability of the expenditure or costs in the course of supply.

- that person does not intend to hold and is not holding any goods and services obtain or supply to him as a pure agent.

- a person who does not utilize the goods and services obtained by him for his own interest.

- he receives only the actual sum incurred to obtain the goods and services along with the sum which he had received for supply.

Simply, a “Pure Agent” is a person who works as an intermediary for the supplier and the receiver or recipient. He supplies goods and services to the receiver or recipients. When any liability arises relating to the expenditure or costs on behalf of the client while doing the ancillary services for other suppliers, he may reimburse the same.

Rule 33 says, when supplier who is working as a pure agent incur any expenditure or costs while supplying any goods or services to the receiver or recipients, that expenditure and costs shall not be included in the value of supply, unless-

- The person who is supplying the goods and services i.e. supplier authorizes the supplier to act as a pure agent of the receiver/recipient of the supply.

- Any expenditure or cost which is incurred by the pure agent is separately mentioned in the bill or invoice.

- The supplies which are made by the pure agent is in addition to that service which he has supplied on his own account.

Rule 35: Value of supply where state tax, union territory tax, central tax or integrated tax is included.

Rule 35 talks about the situation when the value of supply includes the integrated tax or state tax, central tax union territory tax, then the tax will be determined in the manner, as prescribed:

Tax amount = (Value inclusive of taxes X tax rate in % of IGST or, as the case may be, CGST, SGST or UTGST) / (100 + sum of tax rates, as applicable, in %)

For Example: If the value of any supply inclusive of tax is Rs 200 and applicable Goods and Services Tax is 13% then the tax amount will be-

(200 x 13) / (200 + 13) = 2600/213= Rs. 12.2

Open market value means a system where there is no tax barrier in any product. There is no tax in the goods or services, no tariffs, no subsidies, no license requirement. There is no control or restriction on the value of goods and services of any product.

Open market value is free from central tax, state tax, integrated tax, Union territory or cess which is payable by the person in a transaction.

Goods and Services of like kind and quality mean goods or services which are substantially or closely resembles because they are made in similar circumstances, or which has the same characteristics, quantity, quality, functional components, etc.

When the provisions of the valuation rules applicable?

The Central Good and Services Tax (CGST) Rules, 2017, i.e. Valuation Rules are applicable in three circumstances, i.e.-

- When the transactional value is declared not suitable or fit.

- When consideration for the supply of goods and services is given partially in money and partially in other forms than money.

- When the parties are related to each other or any category of the supplier.

Is reference to Goods and Services Tax (GST) Valuation Rules,2017, is required in all cases?

Reference to Goods and Services Tax (GST) Valuation Rules, 2017, is required only in those cases where the determination of the value of supply under sub-section (1) of Section 15 of Central Goods and Services Tax Act, 2017, is not possible.

The Relevance of ascertaining the value of supply

The value of Supply is a sum paid by the receiver to the person who supplies the goods and services. It is a consideration for the goods and services paid to the supplier of the product by the person who receives the product.

Taxable Value in certain cases rule 32

Rule 32 of Central Goods and Services Tax (GST) Valuation Rules, 2017, talks about the procedure to determine the tax value of certain supplies, those are:-

- Money Changing and Sales or Purchase of Foreign Currency.

- Tickets booking by an air travel agent for air travel.

- Supply value of second-hand goods

- Value of redeemable vouchers/coupons/stamps/tokens.

- Business on life insurance

- Valuation in case of service relating to Contracts

Money Changing and sale or Purchase of Foreign Currency

- In India, tax is also imposed on the transactions relating to the foreign exchange. After 2017, Goods and Services Tax (GST) is imposed upon all foreign transactions. The Goods and Services Tax (GST) upon the total foreign transactions would range from 0.058% to 0.18%

As per the Goods and Services Tax (GST) on foreign exchange service in 2018, 18% GST will be imposed upon the foreign transaction which comes with “taxable value”.

Taxable value means the sum or value of foreign transaction which is liable for the tax. Taxable value is divided into three slabs:

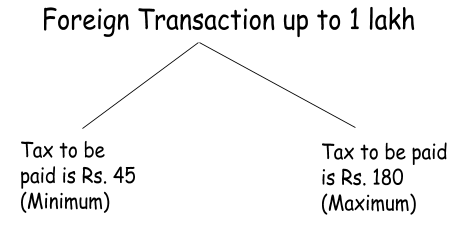

2. Foreign transaction up to Rs. 1 lakh: Slab 1

Foreign transaction’s 1% is considered “taxable value”. Rs. 250 is set as a minimum taxable value.

Rs. 250 is the taxable value of Rs. 25000 according to 1%. So. the GST for foreign transactions up to Rs. 25,000 is 18% of taxable value, i.e.

Rs. 250 x 18%= Rs. 45.

Simultaneously, for Rs. 1,00,000, taxable value is Rs. 1000. GST will be imposed on the taxable value,

Rs. 1000 x 18% =Rs. 180.

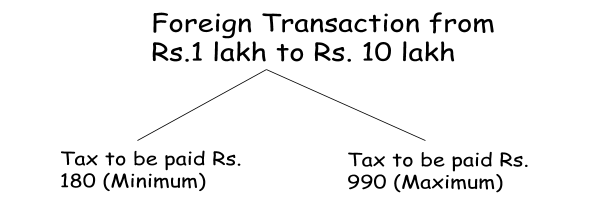

3. Foreign Transaction from Rs. 1 Lakh to Rs. 10 Lakh: Slab 2

In this slab, the taxable value is 1000 + 0.5% of the amount more than 1 lakh. If foreign transaction done by a person is of Rs. 6,00,000. Then, the taxable value will be

1000 + 0.5% of the amount more than 1 lakh

1000 + (0.5% of Rs. 5,00,000) i.e. 2,500 = Rs. 3500

Goods and Services Tax (GST) on foreign transaction of Rs. 6 lakh is:

18% of Rs. 3500 is Rs. 630

The minimum value for GST in slab 2 is

18% of 1000= Rs. 180

Maximum value for GST in slab 2 is:

1000 + 0.5% of 9 lakh = Rs. 5500

18% of Rs. 5500 = Rs. 990

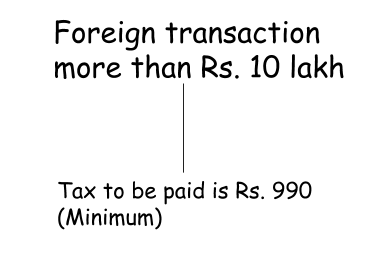

4. Foreign Transaction above Rs. 10 Lakh: Slab 3

In this slab, taxable value is 5500 + 0.1% of the amount more than 10 lakh. If foreign transaction done by a person is of Rs. 23,00,000. Then, taxable value will be:

5500 + 0.1% of amount more than 10 lakh

5500 + 0.1% of 13,00,000= 5500 + 1300 = Rs. 6800

Goods and Services Tax (GST) will be paid @18% rate, i.e.

18% of taxable value (Rs. 6800) = Rs. 1224

The maximum Goods and Services Tax (GST) for Foreign Transaction is capped @ Rs. 60000

Effect of Goods and Service Tax (GST) On Foreign Exchange

|

Foreign Currency Value |

Service Tax |

Goods and Services Tax applicable under Rule 32(2)(b) of Central GST, 2017, and State GST Rule, 2017 |

|

Up to Rs. 1 Lakh |

Subject to a minimum of Rs. 35, Service Tax on foreign exchange was 0.14% of the amount of currency |

Subject to a minimum of Rs. 250, the GST rate on foreign exchange is 1% of the Gross amount. |

|

More than Rs. 1 Lakh but less than 10 Lakh |

If Foreign exchange value exceeds Rs. 1 lakh than service tax on foreign exchange was Rs. 140 + 0.07% of currency. |

If Foreign exchange value is between 1 lakh to 10 lakh then the GST rate applicable will be Rs. 1000 + 0.5% of the total amount more than 1 lakh. |

|

More than Rs. 10 Lakh |

Subject to a maximum of Rs. 6000, If foreign exchange value exceeds 10 lakh than service tax on the foreign exchange will be Rs. 770 + 0.014% of amount of currency. |

Subject to a maximum of Rs. 60000, GST rate for the amount of foreign exchange more than 10 lakh will be Rs. 5000 + 0.10% of the gross amount. |

Tickets booking by an air travel agent for air travel

According to Rule 32(3) of Central Goods and Services Act, 2017, Goods and Services Tax (GST) to be imposed on the tickets booked by the air travel agent shall be calculated at the rate of:

- In the case of domestic booking, 5% of the basic fare.

i.e. 18% on the 5% of basic fare

2. In the case of international bookings, 10% of the basic fare.

i.e. 18% on the 10% of basic fare

Supply value of second-hand goods

When there is a supply of second-hand goods, which are used for a short period of time and without changing its nature, the taxable value will be:

Taxable Value = Purchase Price (without any input tax credit) – Selling Price

(Note: Negative Value to be ignored in this case)

When the input tax credit is availed from the purchase price then in such case the supply will be governed by the normal Goods and Services Tax (GST) valuation.

Value of redeemable vouchers/ coupons/ stamps/ tokens

When a supply of goods and services is done by the redeemable vouchers/ coupons/ stamps (other than the postage stamp)/ tokens, in such case they are considered equal to the money value of goods and services which are redeemable by vouchers/ coupons/ stamps or tokens.

Business on life insurance

Every insurance policy has a different taxable value. It depends upon the nature of the policy.

- When the policy covers double benefits of investment and risk coverage-

In this case, the taxable value will be gross premium which is charged from the policyholder.

2. When a policy is single premium annuity where there is no intimation of savings and allocation for investments to the policyholder-

In this case, the taxable value will be 10% of the single premium which is charged from the policyholder.

3. In all other cases, the taxable value for the first year will be 25% of the premium which is charged from the policyholder. And in the subsequent years, it will be 12.5% of the premium which is charged from the policyholder.

Valuation in case of service relating to Contracts

Valuation of Supply in case of contract service relating to transfer of property in undivided share of land or land shall be equal to the total sum charged for that supply less the undivided share of the land or the value of land and in case of value of supply in an undivided share of land or land it shall be 1/3rd of the total sum or amount charged for that supply.

Conclusion

Goods and Services Tax (GST) emerged as a “One Nation One Tax” scheme. With the emergence of the GST scheme, all the indirect taxes were merged in it. It is an integrated scheme of tax which was introduced in the year 2017 by the Goods and Services Tax Act, 2017. Valuation of any supply is important because Goods and Services Tax (GST) is imposed on the transaction and transaction is dependent upon the value of supply. Each person should know the new scheme of paying indirect taxes. This is to lead India into a new economic development.

Serato DJ Crack 2025Serato DJ PRO Crack

Serato DJ Crack 2025Serato DJ PRO Crack

Allow notifications

Allow notifications